Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 11, 2021

The geopolitical implications of vaccine rollout programs across Asia-Pacific

Domestic innovation and production capacity of coronavirus disease 2019 (COVID-19) vaccines have uniquely positioned China and India to be pivotal suppliers of vaccines within the Asia-Pacific region, and elsewhere. The development and production of COVID-19 vaccines are key political priorities for both countries, driven by geopolitical considerations and made possible by domestic manufacturing capabilities. Beijing is seeking diplomatic advantage in an increasingly adversarial external environment by providing vaccines to other countries. Sinovac Biotech has confirmed advanced purchase agreements (APAs) with Brazil, Chile, Indonesia, Malaysia, Mexico, the Philippines, Turkey, and Ukraine, while fellow Chinese company Sinopharm has agreements with Egypt, Morocco, Pakistan, Peru, and the United Arab Emirates. China's external push, however, will likely be marred by concerns about the reportedly low efficacy of its vaccines and poor transparency in declaring results of testing regimes. Reports of increasing domestic COVID-19 cases - notably in the provinces of Hebei and Heilongjiang - will probably also oblige China to prioritise local distribution ahead of exports.

China's domestic constraints are likely to give an advantage to India's vaccine diplomacy program, known as 'Vaccine Maitri'. India has the benefit of both extensive manufacturing capability - production of Covishield is expected to reach 100 million monthly doses by February 2021 - and higher reported vaccine efficacy. (Covishield is a licensed version of the Oxford-AstraZeneca vaccine manufactured locally by the Serum Institute of India, the world's largest vaccine manufacturer before COVID-19.) India has already sought to counter growing Chinese influence in the region by donating millions of Covishield doses to nine Indian Ocean countries, including Bangladesh, Mauritius, Nepal, Seychelles, and Sri Lanka. Additional non-regional, commercial deliveries have also been scheduled for Brazil, Morocco, Saudi Arabia, and South Africa.

Logistical and healthcare limitations will protract rollout completion

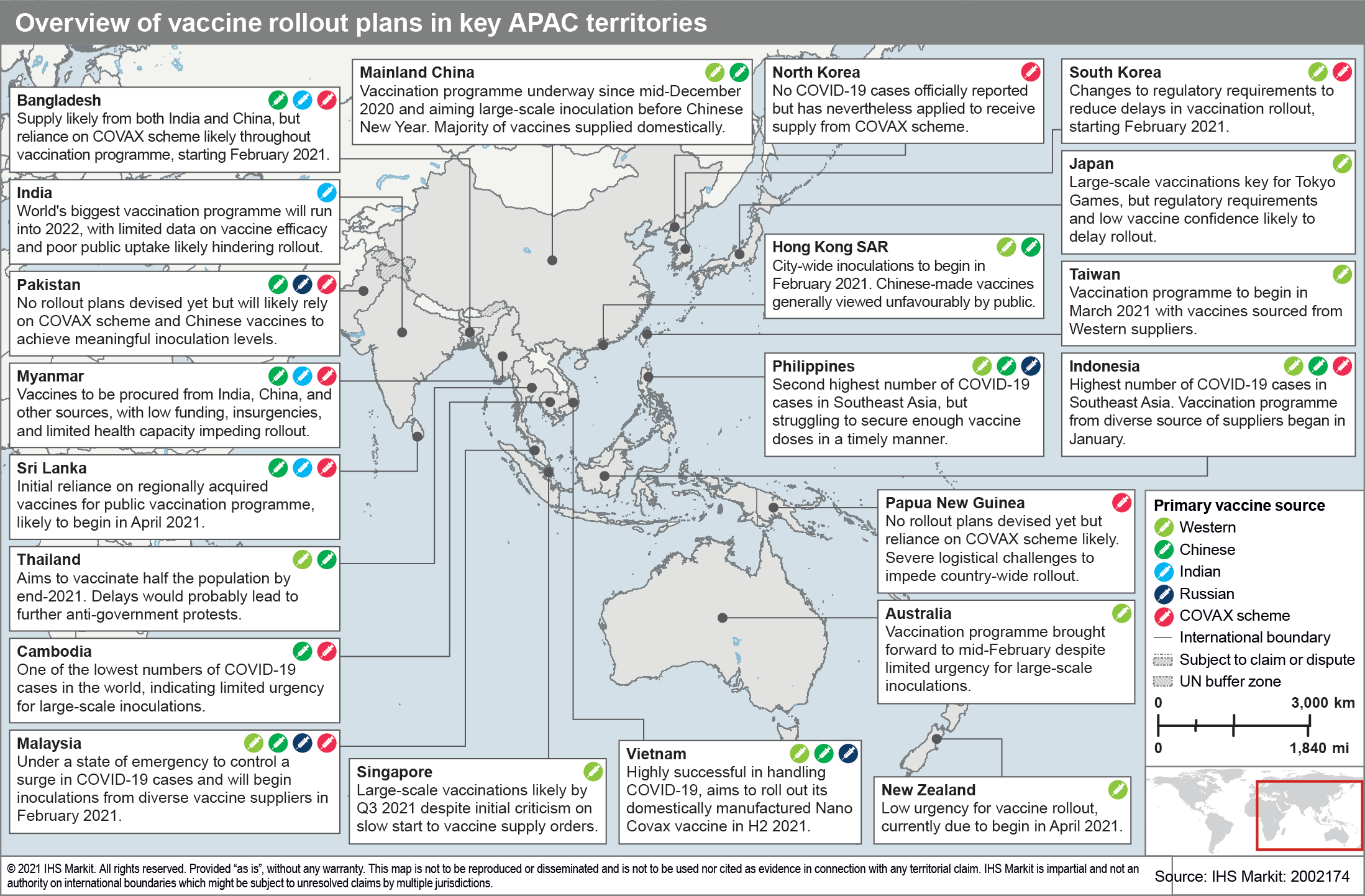

Major Asia-Pacific economies have already started - or aim to start - vaccination programs in the first quarter of 2021, with almost all countries prioritizing healthcare and frontline workers. A risk-positive development is the rapid development of cold chain infrastructure in advanced and emerging Asia-Pacific countries, involving private-sector efforts to complement state capacity. This will assist vaccine rollout, whose progression will likely enhance business confidence and reduce the need for national lockdowns.

However, rollouts in most countries faces a high likelihood of being extended into at least 2022. Large disparities in road infrastructure and healthcare provision are widespread within the region, potentially causing the most significant delays in countries with a high density of rural populations. Challenges facing these countries in supplying peripherals - such as syringes and personal protective equipment (PPE) - will further complicate rollouts. Consequently, the risk of localized lockdowns will persist throughout 2021 in specific regions with outbreaks. For instance, business and movement restrictions will likely be loosened in India, Indonesia, Malaysia, and the Philippines, whereas delays in rollout and new outbreaks would trigger region-specific lockdowns in Australia, Myanmar, Pakistan, and Sri Lanka. Throughout 2021, Hong Kong SAR, Taiwan, and Thailand will probably continue to have limited movement restrictions, whereas stringent lockdowns are most likely to be imposed in mainland China (around the Chinese New Year in February) and in Japan (in the run-up to the postponed Tokyo Games in July).

Successful vaccine rollout key to economic recovery

A successful rollout of vaccination programs will be critical, particularly in major economies in which consumer and business demands are key growth drivers. IHS Markit estimates real GDP growth for the Asia Pacific at 5.7% for 2021 - the strongest regional expansion since 2010. The sharp rebound in economic activity, however, will primarily be due to favorable base effects after a weak 2020. Moreover, given that GDP growth reached 7.1% in 2010, this recovery is not especially robust, considering the magnitude of the contraction in 2020.

A meaningful recovery for most countries is unlikely until they

return to their pre-pandemic levels of real GDP output in 2021-22.

This is underpinned by the importance of expanding private

consumption and fixed investment in several countries where these

account for 70-80% of GDP (except for outliers like the Philippines

and Singapore). Achieving high demand-driven growth is very

dependent on successful vaccine rollouts, with the highest risk

facing geographically remote and dispersed economies. Furthermore,

many governments are likely to start unwinding pandemic-related

fiscal stimulus measures in 2021, which will almost certainly drag

on growth. They are also likely to reprioritize other spending

towards vaccination campaigns, although that would not offset

broader budget trimming efforts.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgeopolitical-implications-vaccine-rollout-asia-pacific.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgeopolitical-implications-vaccine-rollout-asia-pacific.html&text=The+geopolitical+implications+of+vaccine+rollout+programs+across+Asia-Pacific+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgeopolitical-implications-vaccine-rollout-asia-pacific.html","enabled":true},{"name":"email","url":"?subject=The geopolitical implications of vaccine rollout programs across Asia-Pacific | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgeopolitical-implications-vaccine-rollout-asia-pacific.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+geopolitical+implications+of+vaccine+rollout+programs+across+Asia-Pacific+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgeopolitical-implications-vaccine-rollout-asia-pacific.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}