Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 04, 2024

Floods in Brazil’s Rio Grande do Sul state disrupt supply chain

Learn more about our Supply Chain Console

Floods caused by record heavy rains in May have severely impacted Brazil's state of Rio Grande do Sul, an agribusiness and industrial powerhouse. Hundreds of people have died and hundreds of thousands have been displaced. The floods and subsequent clean-up will have a major impact on domestic industry, both in terms of ongoing operations, sourcing materials, and sales to export markets and within Brazil.

We explore the consequences of these floods for Brazil's supply chain, including the disruption to logistics, the impact on key industries, and the potential effects on the national economy.

Logistics disruptions

Rio Grande do Sul depends on land (truck and rail) as well as maritime for its international supply chain connectivity. The floods caused significant disruptions to these networks. Roads and highways were blocked, railway operations were suspended, and major seaports were facing significant delays in receiving goods. The longevity of the disruptions, and their potential recurrence, will be key in determining whether firms choose to either build alternative shipping networks or simply relocate manufacturing in, or supplies to, the state.

The nature of Brazil's geography and extent of flood damage means a rapid, agile recovery will prove challenging. Shipping to other maritime ports and then transiting by road or rail can prove prohibitively time consuming, while air freight alternatives are partly unsuitable (e.g. agricultural commodities, vehicles) or overly expensive (e.g. automotive components).

Trade with Uruguay may prove particularly difficult, with road transport accounting for 67% of Brazil's exports to Uruguay, including nearly all exports from Rio Grande do Sul. Road traffic from other states to Uruguay also has to transit Rio Grande do Sul, including 79% of the exports from Sao Paolo, equivalent to 27% of all exports from Brazil to Uruguay. Shipments from Brazil to Uruguay are led by products including autos, food (principally meat), refined oil products and capital goods including construction machinery.

Sign up for our Supply Chain Essentials newsletter

Impact on key industries

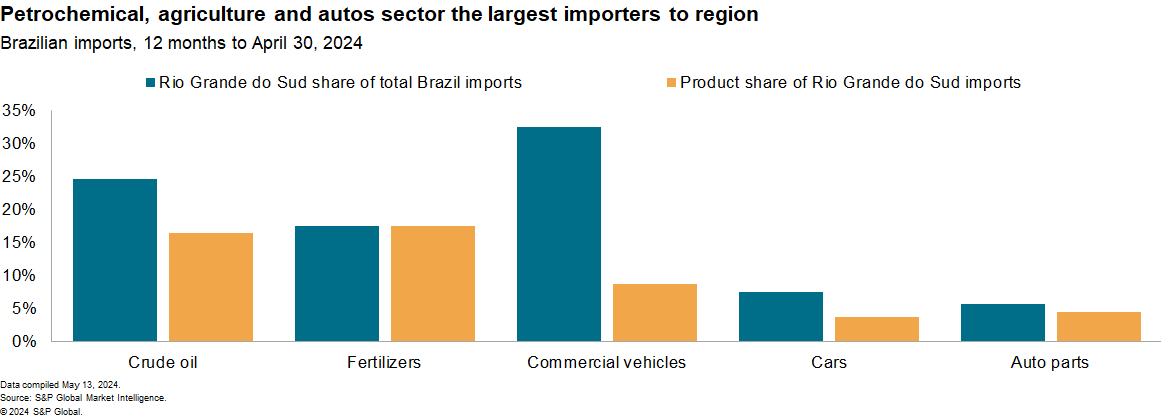

For globally connected supply chains in Rio Grande do Sul, the impact of reduced imports and distribution of goods will be felt most notably in the petrochemicals and transport equipment industries. The state accounted for a significant portion of Brazil's imports of crude oil, which is crucial for petrochemical refineries. The disruption in the delivery of crude oil and the operations of these facilities have had a significant impact on the production of ethylene and propylene derivatives, which are vital exports for Brazil.

The region also accounted for 17.6% of Brazil's imports of fertilizers - both potassic and nitrogenous - which also support key agricultural export sectors. The need for imports will be reduced depending on crop area damage.

The transportation equipment sector will face dual impacts from reduced imports of vehicles as well as parts. Rio Grande do Sul accounted for about one-third of Brazilian imports of commercial vehicles and a more modest 7.6% of total vehicle imports. The vehicles are predominantly shipped from Argentina via Uruguay. The state also plays a crucial role in the manufacturing of transport equipment, including auto parts and agricultural machinery. The floods have disrupted production and distribution, affecting exports and causing supply chain restrictions.

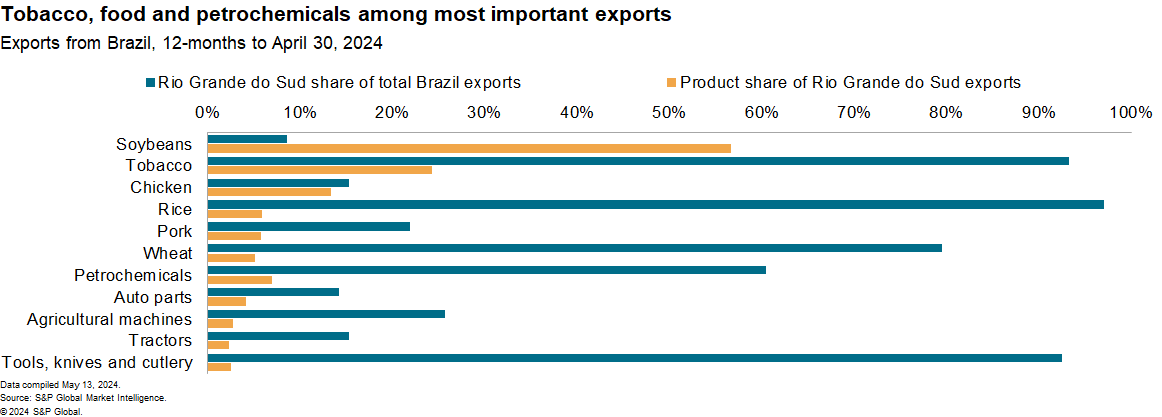

Rio Grande do Sul is a major exporter of agricultural products including soybeans and tobacco. The disruptions in agricultural activity have led to reduced exports of these products, impacting both domestic and international markets. For example, the state's soybean exports have been significantly affected, leading to a two-year high in soybean prices, according to S&P Global Commodity Insights.

The exposure of the tobacco industry is much higher, with state exports accounting for 93.2% of all Brazilian tobacco exports. Among food products there was a similarly high ratio for rice and wheat, though those products each represented less than 6% of total exports from the state.

The meat sector faces the dual challenges of distribution and ongoing animal care. The state accounted for 22.0% of Brazil's pork exports and 15.3% of its chicken in the past 12 months. Reduced agricultural activity, both for human food and animal feed, will cut the need for fertilizer imports, reducing some pressure on the upstream bulk commodity sector.

Economic and fiscal implications

The devastating floods in Brazil are not only causing immediate supply chain disruptions but also have significant implications for the national economy. The damage to infrastructure and human capital has severely constrained economic activity across sectors. Preliminary estimates suggest a decline of 0.3% in GDP due to the floods. Reconstruction efforts are expected to partially offset this decline.

Fiscal accounts are also likely to be impacted as the government will bear the brunt of the reconstruction efforts. The government has already announced a $12 billion package for reconstruction, and the debt owed by the state will be suspended for three years. The long-term impact on business sentiment and the overall economy will depend on the government's commitment to fiscal consolidation and its ability to send strong signals of fiscal prudence.

Learn more about our array of data and insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffloods-in-brazils-rio-grande-do-sul-state-disrupt-supply-chain-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffloods-in-brazils-rio-grande-do-sul-state-disrupt-supply-chain-.html&text=Floods+in+Brazil%e2%80%99s+Rio+Grande+do+Sul+state+disrupt+supply+chain++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffloods-in-brazils-rio-grande-do-sul-state-disrupt-supply-chain-.html","enabled":true},{"name":"email","url":"?subject=Floods in Brazil’s Rio Grande do Sul state disrupt supply chain | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffloods-in-brazils-rio-grande-do-sul-state-disrupt-supply-chain-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Floods+in+Brazil%e2%80%99s+Rio+Grande+do+Sul+state+disrupt+supply+chain++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ffloods-in-brazils-rio-grande-do-sul-state-disrupt-supply-chain-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}