Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

COMMENTARY

Mar 24, 2023

Eurozone flash PMI signals faster than expected growth in March

Eurozone economic growth accelerated to a ten-month high in March according to the latest flash PMI survey data, adding to signs that the economy is reviving after falling into decline late last year. Inflationary pressures have meanwhile continued to moderate, with input prices even falling sharply in manufacturing. Jobs growth has also accelerated and business confidence in the outlook has remained resilient despite concerns stemming from recent banking sector stress and higher borrowing costs.

However, the overall rate of growth remains modest and driven solely by the service sector, with manufacturing suffering a further loss of new orders, meaning current output is only being sustained via backlogs of previously placed orders. Furthermore, despite easing further, overall input cost and selling price inflation rates remain elevated by historical standards. In fact, charges again rose at a pace unseen prior to the pandemic.

Upturn gathers momentum

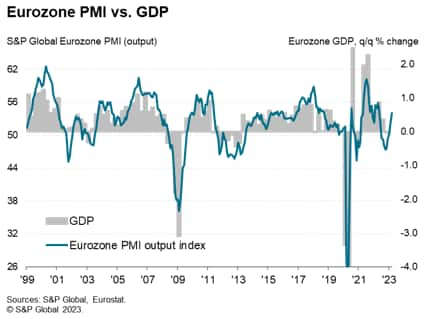

The seasonally adjusted S&P Global 'flash' Eurozone PMI® Composite Output Index, based on approximately 85% of usual survey responses, rose for a fifth consecutive month in March, up from 52.0 in February to a ten-month high of 54.1. The latest reading indicated a third successive month of growth with the rate of expansion having accelerated throughout the year to date. The latest reading was also higher than even the most optimistic forecast tracked by Refinitiv in a poll of 32 economists.

The survey is consistent with GDP growth of 0.3% in the first quarter, accelerating to an equivalent rate of 0.5% in March alone.

Services powers growth revival

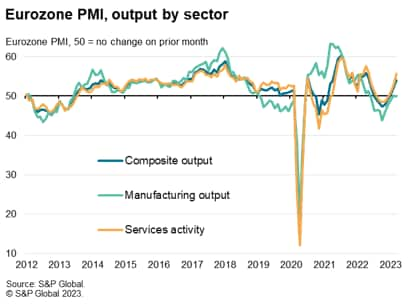

Growth was again powered by the service sector, where business activity rose for a third straight month, the services activity index up from 52.7 in February to 55.6 in March to register the strongest expansion since last May and beating expectations by more than three points.

A key development was the further revival of growth in financial services, with a notable turnaround in real estate activity compared to late last year despite recent concerns regarding banking sector stability and the impact of higher interest rates. Consumer services activity also continued to revive from the downturn seen late last year, notably in respect to travel and tourism. Growth was also recorded in industrial services, IT and healthcare.

Manufacturing output, on the other hand, broadly stagnated for a second consecutive month in March, the factory output index dipping from 50.1 to 49.9. The flat picture nevertheless represents an improvement on the solid declines seen throughout the second half of last year. The autos sector in particular reported a stronger performance, linked in part to improved supply chains.

Fastest growth seen outside of France and Germany

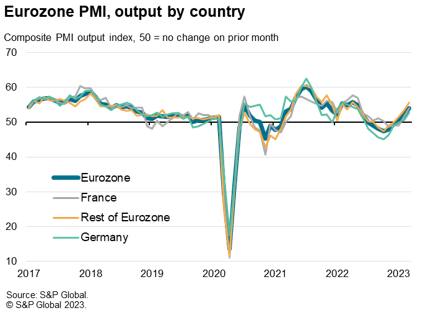

Within the euro area, output rose for a second straight month in both France and Germany, the former reporting the faster pace of expansion as its composite output index rose from 51.7 to 54.0, its highest since last May. Stronger French service sector growth offset a sustained steep manufacturing decline. The composite PMI for Germany meanwhile rose from 50.7 to 52.6, likewise registering the fastest expansion since last May with solid service sector growth accompanied by a marginal increase in factory output.

However, it was the rest of the eurozone that again reported the strongest performance, the composite index up from 53.4 to an 11-month high of 55.5. Services activity surged higher at a rate not seen since November 2021 and manufacturers reported a modest upturn in production for a second successive month.

Diverging demand conditions

The acceleration of growth of output across the eurozone as a whole was fueled in part by rising volumes of new business, albeit limited to the service sector. Measured across both sectors, new orders rose for a second month in a row and at the steepest rate since last May. However, an increased rate of growth of new business in the service sector contrasted with a steeper rate of decline of new orders in manufacturing, which has now seen order inflows fall for 11 successive months.

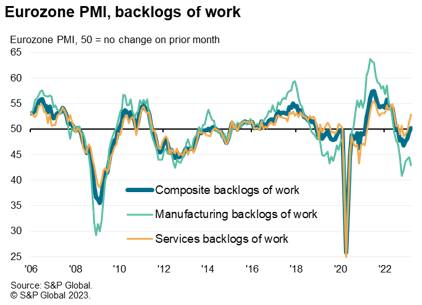

The divergence in demand conditions across manufacturing and services signalled by the varying inflows of new business was also reflected in changes in backlogs of work. Whereas the rise in new business led to backlogs of work accumulating in the service sector at the steepest rate since last May, falling orders in manufacturing led to the steepest drop in backlogs for four months.

The backlogs data therefore suggest that rising levels of outstanding work will help support further service sector growth in coming months, but in manufacturing, existing output is only being sustained by eating into previously-placed orders, posing downside risks to future output.

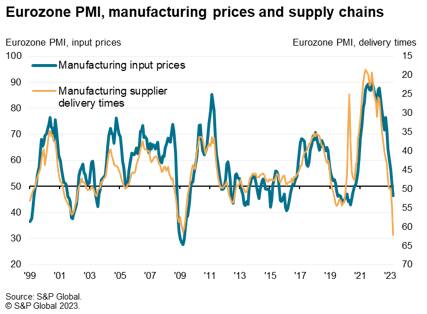

Record improvement in supply chains

In manufacturing, factories also benefitted from fewer supply delays and input shortages. Average supplier delivery times shortened for a second consecutive month and to the greatest extent since data were first available in 1997, led by an unprecedented improvement in Germany.

The record easing of supply constraints marks a major reversal from the record delays seen during the pandemic and reflected not only an improvement in supply logistics, such as reduced port congestion and fewer container shortages, but also lower demand for inputs - which fell sharply again in March - and further efforts by companies to unwind high inventory levels. Stocks of purchases fell for a second month running in March, having risen strongly throughout most of 2022.

Falling industrial prices contrast with further service sector inflation pressures

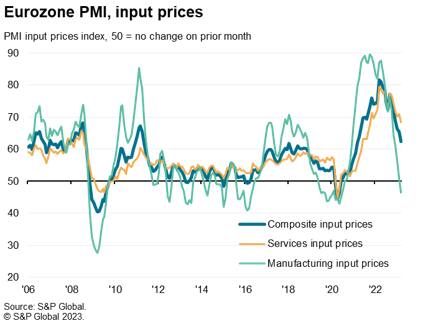

Supply chain improvements, combined with falling demand, also

took further pressure off industrial input prices, which fell for

the first time since July 2020. In contrast, service sector firms

reported a further steep rise in average input costs, often

associated with high wages, though even here the rate of inflation

here eased to its lowest since October 2021. Measured overall,

input costs rose at the slowest rate since March 2021, yet with the

rate of increase remaining well above the survey's long-run

average.

Average prices charged for goods and services meanwhile continued to rise sharply, the rate of increase falling further from the peak seen last year to the lowest since May 2021, though remaining higher than any time in the survey's history prior to the pandemic.

Especially elevated output price inflation was seen in services, albeit down to a 13-month low, while prices charged for goods leaving the factory gate rose at the slowest rate since January 2021.

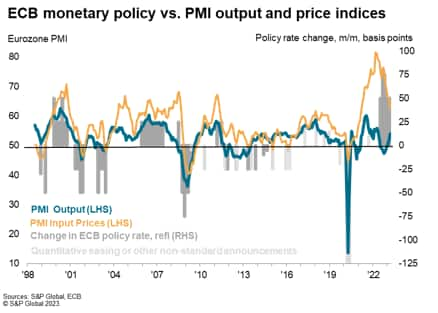

Policy tightening

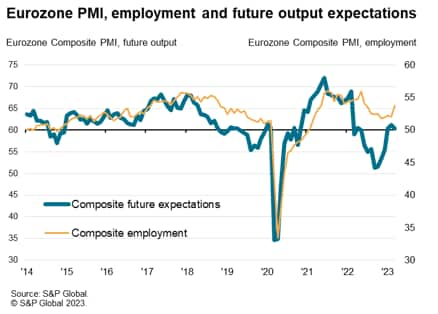

Employment growth meanwhile picked up to reach a nine-month high in March, accelerating notably in services to reach the highest for ten months as firms sought to keep pace with rising demand, but holding steady in manufacturing at a relatively slower pace that was among the lowest seen over the past two years.

Finally, optimism about the year ahead dipped from February's 12-month high but remained among the highest seen over the past year, running well above the levels seen late last year and broadly in line with the long-run average of just over 60.0. Sentiment slipped lower in both manufacturing and services, though in both cases remained far above the levels seen late last year heading into the winter.

Future sentiment has improved considerably in both manufacturing and services since late last year, attributed by survey respondents to lower recession risks, falling inflation pressures, improved global supply chains and reduced energy concerns, as well as signs of improved demand and confidence. The dip in sentiment in March could be in part traced to concerns over uncertainty caused by recent banking sector stress and the potential impact of further interest rate hikes.

Outlook

Growth has been buoyed since the lows of late last year as recession fears and energy market worries fade, inflationary pressures ease and the unprecedented supply chain delays seen during the pandemic are replaced with record improvements to supplier delivery times. Business confidence is also so far showing encouraging resilience in the face of further interest rate hikes and the uncertainty caused by recent banking sector stress.

However, although inflationary pressures continue to moderate, the rate at which prices charged for goods and services are rising remains higher than anything seen in the survey history prior to the pandemic. Such stubborn inflationary pressures, fueled primarily by the service sector and rising wage costs, will be a concern to policymakers and suggests that more work may be needed in terms of bringing inflation down to target.

Growth is also very unbalanced, driven almost solely by the service sector with manufacturing largely stalled and struggling to sustain production in the face of falling demand.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-faster-than-expected-growth-Mar23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-faster-than-expected-growth-Mar23.html&text=Eurozone+flash+PMI+signals+faster+than+expected+growth+in+March++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-faster-than-expected-growth-Mar23.html","enabled":true},{"name":"email","url":"?subject=Eurozone flash PMI signals faster than expected growth in March | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-faster-than-expected-growth-Mar23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+flash+PMI+signals+faster+than+expected+growth+in+March++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-flash-pmi-signals-faster-than-expected-growth-Mar23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}