Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 18, 2024

Europe's chemicals sector braces for new policy impact

The European chemicals sector has faced sharply fluctuating demand conditions and changing policy initiatives since the pandemic, with further disruptions likely in the future. In particular, many chemical producers are poised for change as policy developments - including the impending per- and polyfluoroalkyl substance (PFAS) ban - are anticipated to cause disruption. Opportunities, however, are expected to arise from the energy transition.

As an example of an impacted sector, the outlook for semiconductors continues to be unsettled given their reliance on PFAS, with heightened relevance to the chemicals sector given that semiconductors are a requirement for many green technologies.

In this paper we look at how PMI survey data can help track the changing business situation in the chemicals sector with an additional focus on semiconductors to demonstrate the power of the data in helping assess trends.

Chemicals sector showing tentative signs of recovery

Business conditions across the European chemicals sector remained tough in the opening months of 2024, with the S&P Global Chemicals PMI for Europe signalling a continued trend of decline which began over two years ago. The sector has been particularly hard-hit since Russia's invasion of Ukraine, which led to a surge in energy prices that in turn led to a marked deterioration in the international competitiveness of many of Europe's energy-intensive companies. Output of the chemicals industry fell at a pace not seen since the global financial crisis in the early stages of the Ukraine war (excluding early pandemic lockdowns). However, while the latest data for March 2024 signalled contractions across both output and new orders, alongside ongoing reductions in backlogs of work and further cuts to selling prices, the latest decline in output signalled was the joint-weakest seen for 22 months. New orders meanwhile fell only marginally in March, dropping at the slowest rate for just over two years.

Although demand conditions remain generally subdued across Europe, S&P Global's Comparative Industry Service anticipates that chemicals output will continue to recover over 2024. The trend of chemicals destocking will eventually bottom-out once inventories are depleted, and firms are likely to begin to re-build stocks.

The MSCI Europe Chemicals Index which covers 20 of Europe's largest securities classified in the chemicals industry across 15 developed markets saw a generally improving trend for investor sentiment during the last 6 months of 2023. This tracks closely new orders PMI data, which in general has been trending towards the neutral 50.0 mark that separates growth from contraction. Although remaining in negative territory, the rate of decline in new business signalled by the PMI data was close to neutral in March and the least pronounced in over two years.

Shifting policy landscape expected to disturb chemicals sector

Amid ongoing policy development, the chemicals sector is readying for change. The implementation of the Chemicals Strategy for Sustainability in 2020 solidified plans to protect both people and the environment and also encourage safe and sustainable chemical innovation. Alongside this, the European Green Deal indicated a push towards climate neutrality by 2050. Furthermore, the European Commission announced their REPowerEU proposal in response to the Russian invasion of Ukraine; a plan which promotes the transition to cleaner energy and encourages the diversification of energy supply, therefore reducing dependency on Russian energy sources.

The shift in the landscape poses opportunities for the European Chemicals sector given that the movement towards greener technologies leans on the advanced chemical materials used during the production of wind turbines, solar panels and also electric vehicles, for example. Anecdotal evidence from the S&P Global Business Outlook Survey has seen an increase in the number of European companies citing the energy transition or the movement towards greener technology as an opportunity for business growth in recent survey periods.

On the other hand, one potential barrier to output growth includes the potential phasing-out and ban of harmful per- and polyfluoroalkyl substances (PFAS) or 'forever chemicals' due to their slow and only partial degradation process and toxicity. Covering over 10,000 substances, the ban, which is expected to be implemented in 2026, influences a range of industries, namely electronics, cosmetics, and medical devices. Given the lack of alternatives, the impact of the EU's biggest chemicals ban is anticipated to be far-reaching. PFAS are a crucial component required for the manufacture of semiconductors, therefore the ban is expected to impact the production of wind turbines, solar panels, trains, and electric vehicles, and is therefore highly likely to influence the progression of the energy transition.

Anecdotal evidence from the S&P Global Business Outlook Survey suggests that both the looming PFAS ban, and increased regulation are of growing concern for firms across the private sector, posing a threat to future output levels, particularly in the Chemicals & Plastics sector itself.

Ongoing supply chain disruption leaves firms hesitant

Supply chains have faced several headwinds over the past three years, a consequence of pandemic lockdowns and more recent geopolitical tensions. The pandemic saw purchasing trends change among the major chemical clients. Firstly, demand for chemicals needed to produce personal protective equipment (PPE), disinfectants and plastic packaging was boosted, while demand for chemicals used in manufacture of autos and within the construction industry slumped.

Amid periods of COVID-19 related supply chain uncertainty, firms built up safety stocks of chemicals. De-stocking has since been firmly on the agenda as businesses seek to cut costs. According to PMI data for new orders, the European chemicals sector recovered quickly from its pandemic low in April 2020 and demand remained in growth territory for around a year-and-a-half post-pandemic. However, more recently the data has shown that demand conditions across the sector have been subdued for some time, falling in each month for just over two years.

These fluctuations in demand for chemicals are closely linked to the purchasing activity of chemical customers, many of which are manufacturers of autos, technology, and household goods. Furthermore, unfavourable economic conditions including recession across the euro area, high inflation and the disappointing post-pandemic economic rebound in mainland China have all been factors weighing on demand for chemicals during the tail-end of 2023 and into the opening months of 2024.

Focus on semiconductors

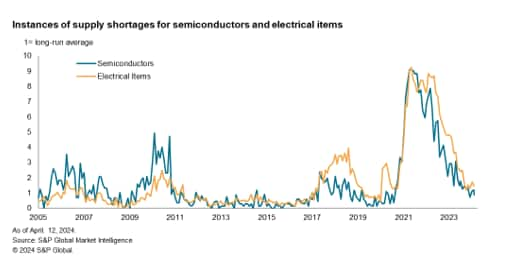

Semiconductor data, complied by S&P Global helps to shed some light on the extent of supply chain disruptions over time, which have in turn helped explain some of the marked changes in demand for associated chemicals used as inputs by semiconductor manufacturers. As well as muted global demand, chip scarcity was one of the most notable trends seen during the height of the pandemic. At their worst during 2021, semiconductor shortages were over nine times greater than the long-run average. This was an example of the 'bullwhip effect', whereby small changes in final demand can led to greater impacts on semiconductor production via inventory changes through the supply chain. However, with sluggish demand conditions for electronics, a supply glut developed. Supply shortage indicators from S&P Global Market Intelligence's PMI surveys show that by the end of 2023 there were fewer mentions of chip shortages compared to the long-run average for the first time since August 2020.

The Philadelphia Semiconductor Index (PHLX) has generally been trending upwards since the late 2022 nadir, recording year-on-year growth for the first time in over a year in May 2023. Recent spikes in semiconductor stock prices have also been linked to the announcement of the first grant under the CHIPS and Science Act 2022 in the US, designed to re-shore chip production. However, the improvement in the index (which covers the 30 largest US companies involved in various stages of chip production) has also been commonly attributed to the projected growth of artificial intelligence (AI). Hence the future projected earnings growth from AI has led stock prices to diverge from underlying current demand, which remains subdued, as demonstrated via the S&P Global Electronics PMI New Orders Index.

Eleanor Dennison, Economist, S&P Global Market Intelligence

Tel: +44 134 432 8197

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropes-chemicals-sector-braces-for-new-policy-impact-Apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropes-chemicals-sector-braces-for-new-policy-impact-Apr24.html&text=Europe%27s+chemicals+sector+braces+for+new+policy+impact+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropes-chemicals-sector-braces-for-new-policy-impact-Apr24.html","enabled":true},{"name":"email","url":"?subject=Europe's chemicals sector braces for new policy impact | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropes-chemicals-sector-braces-for-new-policy-impact-Apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe%27s+chemicals+sector+braces+for+new+policy+impact+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feuropes-chemicals-sector-braces-for-new-policy-impact-Apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}