Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 13, 2021

Ethiopian latest fiscal plan targets improved revenue mobilization

- Ethiopia's budget for fiscal year (FY) 2021/22, commencing 8 July, was approved by parliament earlier this month and represents an 18% increase on the FY 2020/21 budget amounting to ETB561.7 billion (USD12.7 billion)

- The growth boost envisaged by the latest budget is to be underpinned by implementing ongoing economic reforms and particularly increased participation of the private sector in the economy. The finishing of infrastructure mega-projects has been restated as a priority expenditure target.

- The 2021/22 budget is largely targeted to be financed (65.7% of the total budget) through domestic channels, including tax revenue of ETB334 billion, while non-tax revenue is targeted at ETB34.7 billion.

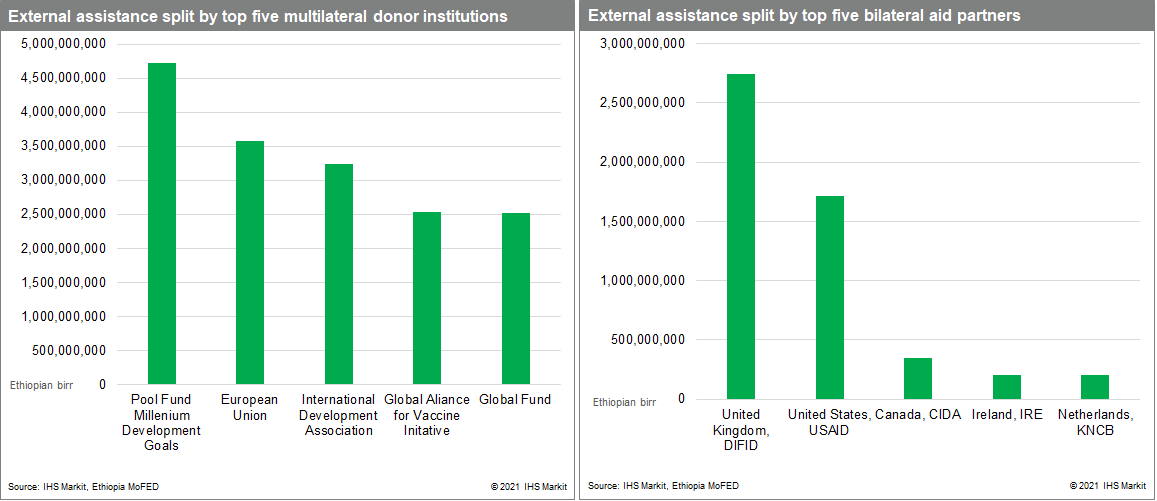

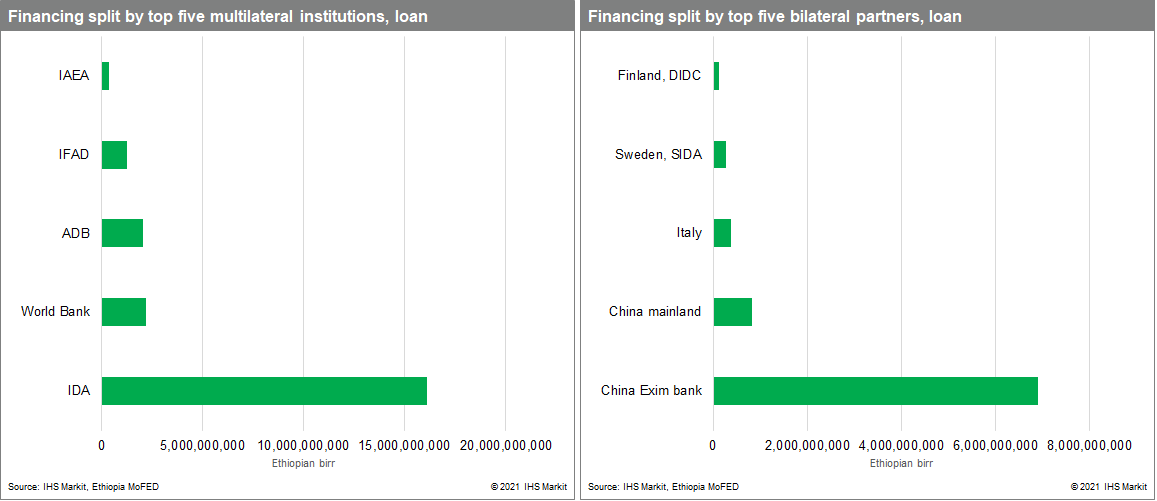

- External assistance is planned to finance 11.9% of the total budget, while external loans are scheduled at 5.6%, coming predominately from multilateral institutions.

Ethiopia is currently under International Monetary Fund (IMF) Extended Credit Facility and extended Fund Facility arrangements, which we expect to help guide economic policies further towards fiscal consolidation despite the increase of the latest budget to address additional financing needs during the coronavirus disease 2019 pandemic.

Achieving envisaged multilateral support as outlined in the latest budget is expected to depend on IMF program observance. IHS Markit has previously raised concerns that the additional suspension of foreign budgetary support, and/or the IMF and the World Bank withholding funding over the situation in Tigray, could be likely if tensions escalate in the region and this would support a sovereign debt downgrade from our side. However, the Ethiopian government announced on 28 June a ceasefire in the Tigray region, which credibly de-escalates the conflict. If the conflict re-escalates after the rainy season ends in September, when large offensives are more possible, the likelihood of economic sanctions will rise sharply according to our Country Risk experts.

Notably, in the budget, the Ethiopian government puts emphasis on improving revenue mobilization. Tax financing of the budget is set to go up by ETB109.2 billion during FY 2021/21 compared with FY 2020/21. To align with IMF program requirements, we expect to see greater prudence in borrowing by state-owned enterprises. Furthermore, in the latest budget, the increase in domestic financing and lower foreign borrowing compared with the previous year, as well as continued reform progress on liberalizing the telecommunications sector, could also provide fiscal space. Additionally, we expect that Ethiopia's debt ratios are less likely to increase with a given increase in the fiscal deficit, which should have a growth-enhancing outcome for the economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopian-fiscal-plan-targets-improved-revenue-mobilization.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopian-fiscal-plan-targets-improved-revenue-mobilization.html&text=Ethiopian+latest+fiscal+plan+targets+improved+revenue+mobilization+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopian-fiscal-plan-targets-improved-revenue-mobilization.html","enabled":true},{"name":"email","url":"?subject=Ethiopian latest fiscal plan targets improved revenue mobilization | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopian-fiscal-plan-targets-improved-revenue-mobilization.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ethiopian+latest+fiscal+plan+targets+improved+revenue+mobilization+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fethiopian-fiscal-plan-targets-improved-revenue-mobilization.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}