Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 21, 2023

ETF flows, the winners and losers in volatile markets

ETF flows, the winners and losers in volatile markets

The recent volatility in financial markets is pushing ETF flows into higher quality assets

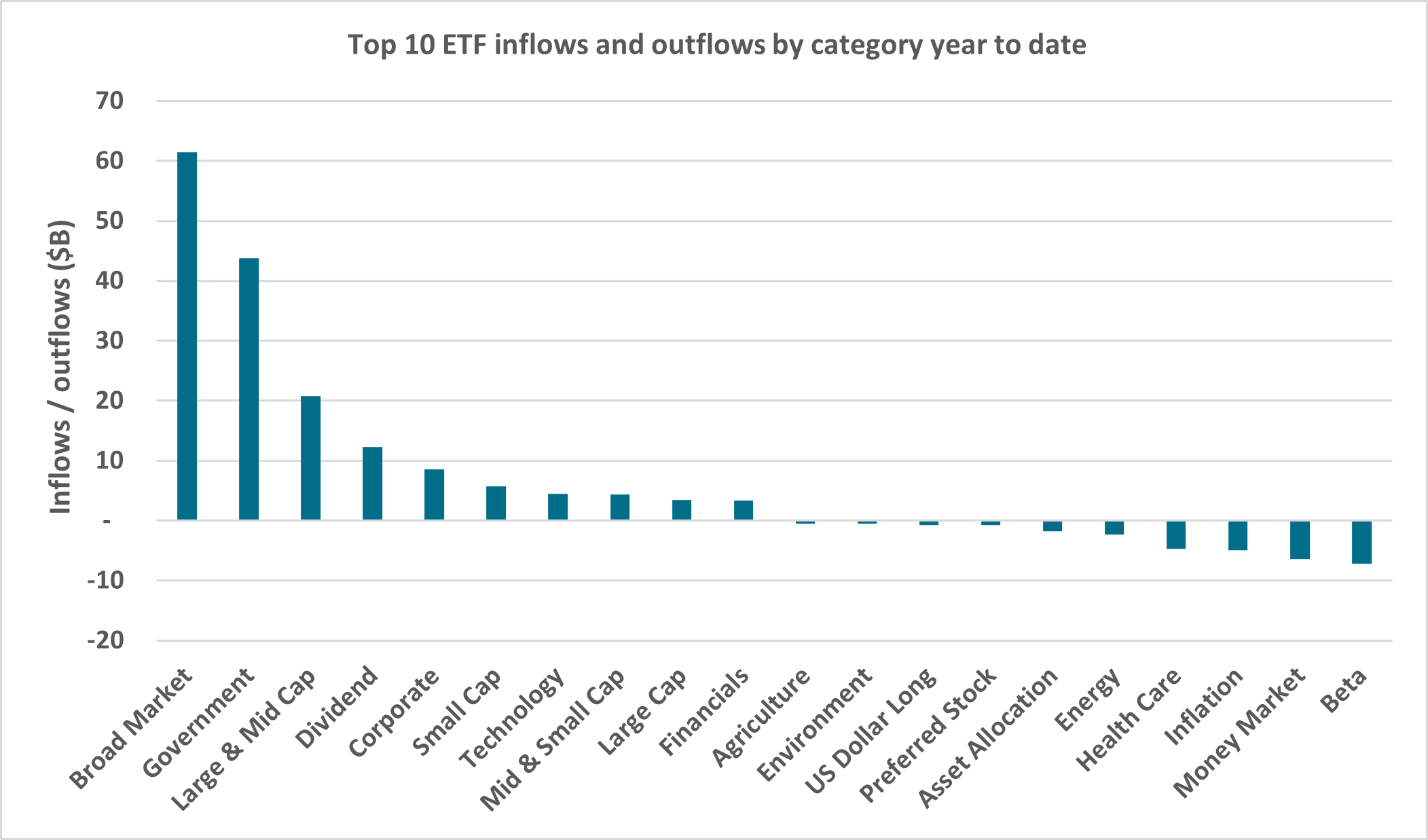

During 2023, managing market volatility has been at the forefront of investor strategy. Recent uncertainty, instigated by the issues seen across the financial sector, has led to a change in investment flows seen across exchange traded funds. When examining the top inflows and outflows during 2023 so far (1st Jan - 16th March), the largest investor inflows can be seen across both broad market and government investments whilst the largest outflows have been from beta and money market funds.

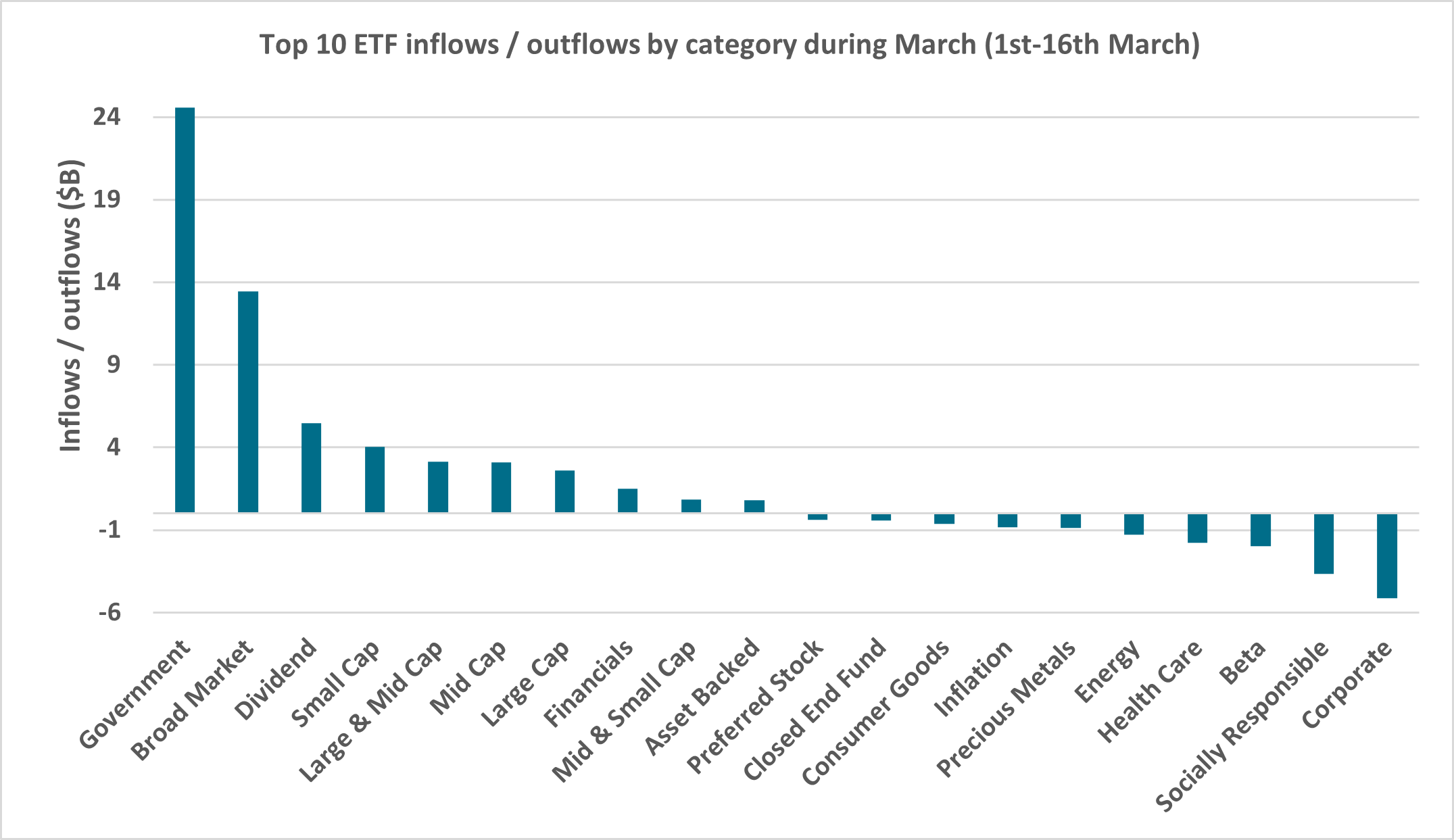

A change in investment flows can be seen over the month of March as equity market volatility has increased. To 16th March 2023, ETF flows were recorded moving into the safety of high quality, short-dated treasury funds whilst moving out of high yield and corporate bond funds. Due to the issues in the banking sector and the ongoing uncertainty surrounding inflation and interest rates, a move towards lower duration, higher quality assets can be seen. Investment flows across money market funds have also turned positive (+$596M) over the month.

When looking across some of the most popular U.S. banking ETFs, over the past week, flows have been resilient. Investment into U.S. regional banking ETFs has been positive. Combined flows into the SPDR S&P regional Banking ETF (KRE), iShares U.S. regional Banks ETF (IAT) and the Invesco KBW Regional Banking ETF (KBWR) have topped $2.27B.

All data has been provided by the S&P Global Market Intelligence Eclipse web-based GUI.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fetf-flows-the-winners-and-losers-in-volatile-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fetf-flows-the-winners-and-losers-in-volatile-markets.html&text=ETF+flows%2c+the+winners+and++losers+in+volatile+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fetf-flows-the-winners-and-losers-in-volatile-markets.html","enabled":true},{"name":"email","url":"?subject=ETF flows, the winners and losers in volatile markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fetf-flows-the-winners-and-losers-in-volatile-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=ETF+flows%2c+the+winners+and++losers+in+volatile+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fetf-flows-the-winners-and-losers-in-volatile-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}