Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 24, 2021

Employment developments in sub-Saharan Africa during the first-half of 2021

- Jobs created in the sub-Saharan African (SSA) region have not been sufficient to absorb new entrants to the job market and make up for the job losses incurred during 2020, at the height of the Coronavirus disease 2019 (COVID-19) pandemic-related lockdown measures and loss in business activity. The subsequent rise in unemployment will increase overall poverty levels and the possibility of more social unrest in the region.

- Fiscal space is limited to provide a social safety net to the most vulnerable in society. Countries in SSA are not only grappling with rising debt-servicing burdens but also continuing to face healthcare spending pressures, including the procurement of COVID-19 vaccines and managing the availability of healthcare facilities as more contagious COVID-19 variants, such as Delta, spread across the continent.

- The recent approval of a general allocation of International Monetary Fund (IMF) special drawing rights (SDRs), equivalent to USD650 billion, is timely and should be used prudently to address some of these near-term challenges COVID-19 vaccine procurement, enhancement of healthcare facilities, and the alleviation of poverty should be prioritized, in IHS Markit's view. Countries with low foreign reserves should build their foreign-exchange buffers. SDRs can also be exchanged for hard currency to meet debt commitments to the IMF and other lenders. Ultimately, the IMF SDR allocation could ease near-term external liquidity and fiscal pressures, but more structural adjustments will be needed to place the SSA region on a higher growth path.

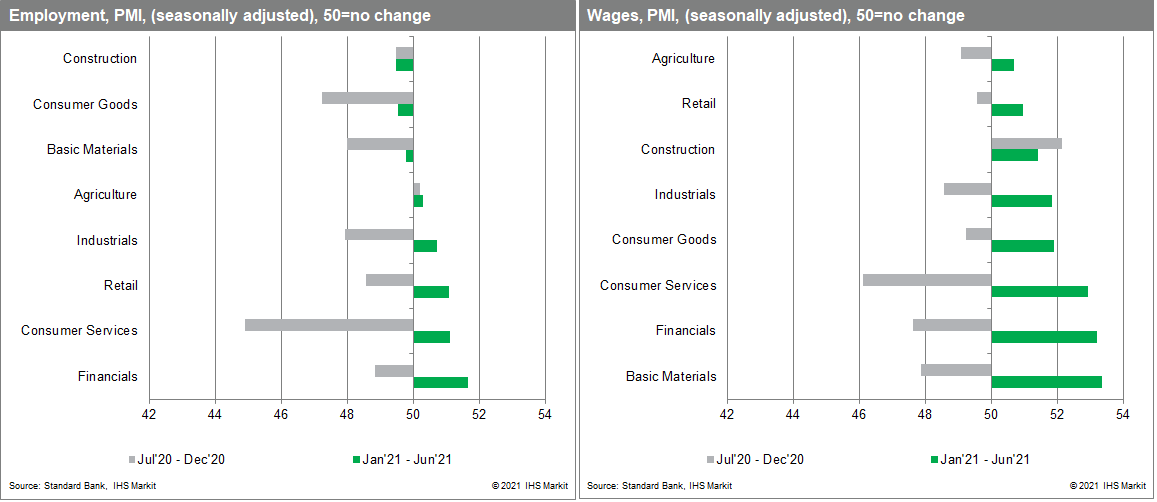

Employment in almost all sectors of the economy picked up during January-June 2021 in the SSA region, the latest statistics in the Standard Bank and IHS Markit purchasing managers' indices (PMIs) show. Using monthly PMI survey information, IHS Markit compiled an aggregate weighted employment PMI for SSA. A similar PMI for wages was compiled. Countries included in the analysis were Ghana, Kenya, Mozambique, Nigeria, South Africa, Uganda, and Zambia.

The aggregate SSA employment PMI shows that the recovery was the strongest in the financial sector (banks, real estate, and insurance), followed by the consumer services sector (media, retail, and hotels and restaurants). Of this group, retail employment showed the biggest gains. Employment conditions in the basic metals (chemicals and resources), consumer goods (automotive, household products, beverages, and food), and construction sectors were less favorable, with the aggregate SSA employment PMI reading for these sectors remaining below the 50-neutral level during the first half of 2021.

Wage increases accelerated during the first half of 2021, the aggregate wage PMI for SSA shows. The basic metals sector reported the strongest recovery in wages, followed by financial services and consumer services. The consumer services sector reported the biggest fall in wages over July-December 2020. However, the jobs created in the sub-Saharan Africa region were not enough to bring overall unemployment down to pre-coronavirus disease 2019 (COVID-19) pandemic levels. Initial indicators show that Nigeria's unemployment rate remained at 33.3% in the fourth quarter of 2020, from 27.1% in the second quarter of 2020. South Africa's unemployment rate shot up to 32.6% in the second quarter of 2021, from 27.6% in the second quarter of 2019. Angola's unemployment rate averaged 30.5% in the first quarter of 2021, from 29.0% in the third quarter of 2019. Of the smaller economies, Rwanda's unemployment rate also increased, to average 17.0% in the first quarter of 2021, from 15.0% in the second quarter of 2019.

More detailed unemployment data in South Africa show that the poorest in society - namely informal sector workers - have been severely impacted. Informal sector employment fell by 14.3% year on year (y/y) during the second quarter of 2021, compared with a 6.3% y/y fall in formal sector employment. Those countries that have the fiscal capacity have extended their social support programs. South Africa's basic income grant (BIG) for the unemployed - introduced in 2020 - has been extended until March 2022 and amounts to ZAR350/month (USD23/month), below the food poverty line of ZAR560/month. The additional government spending will be financed through a mining tax windfall in fiscal year 2021/22. In the future, it will be significantly more difficult to uphold this spending commitment. The slow rollout of the COVID-19 vaccine program will leave the SSA region vulnerable to the resurgence of new COVID-19 cases and increases the risk of exposure to new COVID-19 variants amid an ill-prepared healthcare system. The recovery in the tourism, aviation, entertainment, and hotel industries will be delayed as a result.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-developments-ssa-firsthalf-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-developments-ssa-firsthalf-2021.html&text=Employment+developments+in+sub-Saharan+Africa+during+the+first-half+of+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-developments-ssa-firsthalf-2021.html","enabled":true},{"name":"email","url":"?subject=Employment developments in sub-Saharan Africa during the first-half of 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-developments-ssa-firsthalf-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Employment+developments+in+sub-Saharan+Africa+during+the+first-half+of+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femployment-developments-ssa-firsthalf-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}