Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

OUTLOOK

Aug 05, 2021

Dry bulk market briefing summary: Vaccine, a double-edged sword

We expect dry bulk market demand and supply balance will be stable in the coming years. However, our data-driven forecasting models predict freight rates will face correction and decline by 30% in the coming quarters as vaccines become more widely available and reduce COVID-19 impact.

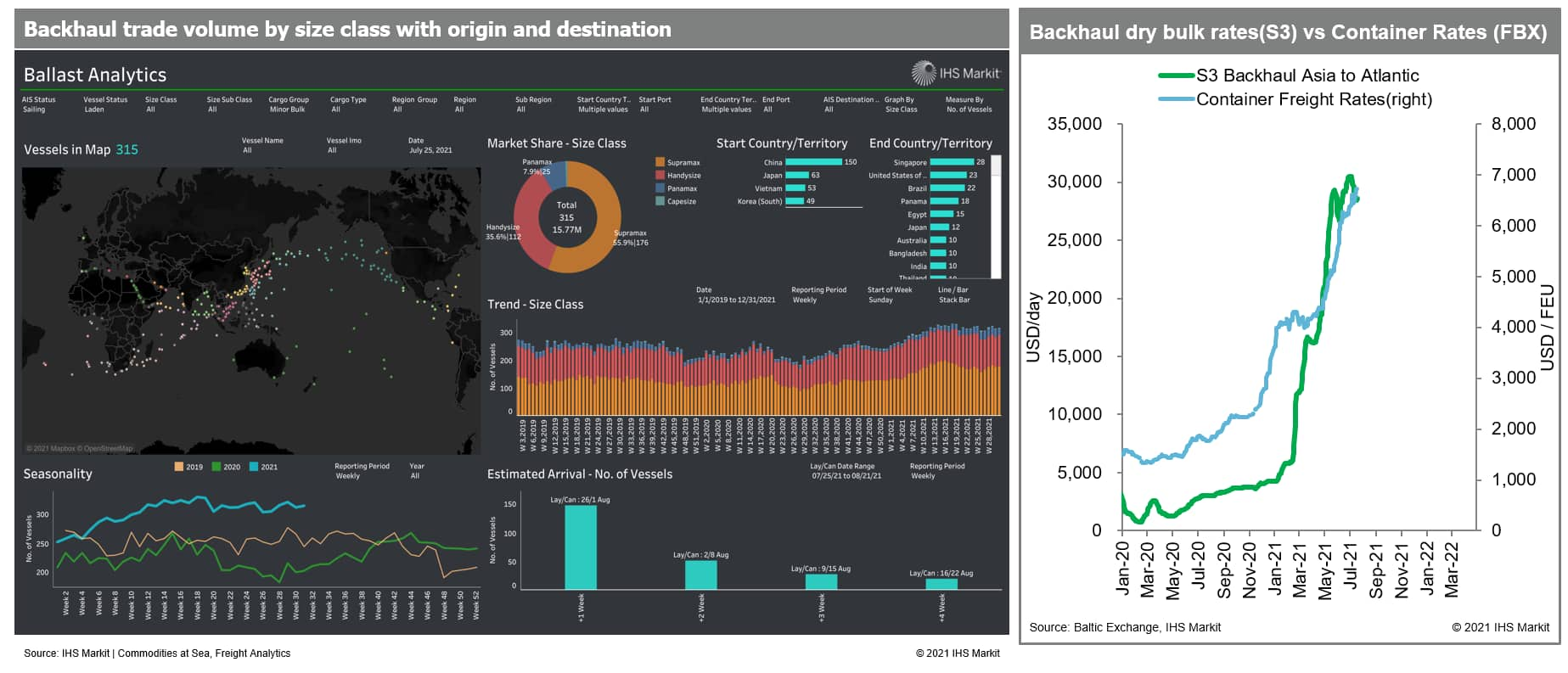

Chart: An influx of container-related minor bulk cargoes has boosted the geared bulker's backhaul rates higher

In the freight rate forecast demand and supply outlook, IHS Markit predicts that the global dry bulk trade will increase by 3.2% in 2021 mainly driven by coal (4.4%) and minor bulk trade (8.0%). It will continue to grow by 5.8 % in 2022 and 2.7% in 2023 largely supported by global economic recovery-related industrial materials and agricultural goods while bulk fleet growth will remain 2-3% in the next three years.

For fleet supply, even though some shipowners have exercised options for existing newbuilding contracts placed in the previous years with much cheaper prices, we observed that total orderbook contract has been limited so far this year compared with historical level. Especially uncertainty over several environment regulations including carbon dioxide (CO2) emission control it became difficult to have newbuilding order in the coming months.

For steel, mainland China's electric arc furnace capacity is expected to increase from about 10% in 2020 to about 15-20% of the total steel production capacity in mainland China by 2025 to reduce carbon emissions with its ongoing supply-side reform to limit the overall crude steel production volume. At the same time blast furnace steel production with iron ore is projected to increase very marginally or potentially decline in the coming years. However, in our view iron ore will remain as a main source for steel production in the coming years despite mainland China increasing consumption of steel scrap for steelmaking. Specifically, we expect Brazilian iron ore exports to grow by 13.2% in 2022 once the pandemic and license-related supply constraints issue have been resolved.

Agricultural shipments are also expected to grow in the coming years. Soybean trade has been slow in 2021 mainly owing to limited end-stock but trade growth will continue from 2022 to 2023 as mainland China will increase its meat consumption with continued urbanization. Corn trade is also expected to increase during 2021-23 mainly from the United States and mainland China routes with the trade deal earlier last year. Global wheat feeding could increase owing to a lower availability and high prices of corn and soybean in major origins.

Download the full report for deeper analysis covering steel, iron ore, coal, grain, and freight

On the contrary we believe that the peak coal trade had ended in 2019. With the recovery in energy demand and high gas prices thermal coal demand is expected to remain strong in the next two years but will decline eventually thereafter in line with the global energy mix shift. Environmental policies that favor renewables and gas over thermal coal and also favor scrap over coking coal and iron ore will lead to more widely available coal demand to be down. Metallurgical coal trade will recover from its 2020 levels and grow in 2021 and 2022 by 5-7% every year but annual growth will start to slow once it becomes near its 2019 level.

We observed a significant increase in the congestion and very high volume of minor bulk shipments. We believe this is the main cause of current status of market. Minor bulk trade growth is set to be the best-performing commodity in 2021 with a strong 8% growth.

Traditionally dry bulk freight rates have been supported from the top down Capesize supporting Panamax and Panamax supporting Supra/Handy sizes. However, unlike in the previous years this strong performance in the minor bulk trade has resulted in supporting the larger vessel classes from the bottom to top. This is a very interesting development because with general cargo vessels especially from east Asia including mainland China, South Korea, Japan, and Vietnam the vessels have moved to container market now, especially convertible breakbulk cargoes from the container sector including cement, fertilizers, chemicals, minerals, and steel products. Recently, general cargo ships and geared smaller bulkers picked up those container-related cargoes.

There has been very high market on these traditional bulkers backhaul rates as backhaul dry bulk rates became almost identical with container rates. Therefore, the key assumptions for dry bulk freight rates outlook also need to be based on container related backhaul routes for geared bulkers. This route will hugely depend on the pandemic and vaccination rate.

We expect vaccines will reduce COVID-19 impact. As global economy recovers, overall consumption and energy demand will also increase. But this could be countered by decreasing port waiting times and also service-sector consumption will recover and reduce physical consumption including online shopping. This may reduce actual physical container trade and backhaul dry bulk trade demand.

A lack of stimulus from mainland China and the returning focus to environmental policies that favor gas renewables and scrap over coal and iron ore would also be a major downside risk once vaccines become more widely available in the world. Therefore, we are more bearish with vaccine impact in the freight rate market. And also in the medium and long term vaccines will reduce COVID-19 impact, which will also reduce freight rates in the long term. However, in the same context in the short term the ongoing pandemic and record high backlog would become a major upside risk on freight in the fourth quarter and early 2022.

Download the full complimentary report to learn more: Freight Rate Forecast - Dry Bulk Market Briefing 2021

English | Chinese | Japanese | Korean

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-market-briefing-summary-vaccine-a-double-edged-sword.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-market-briefing-summary-vaccine-a-double-edged-sword.html&text=Dry+bulk+market+briefing+summary%3a+Vaccine%2c+a+double-edged+sword+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-market-briefing-summary-vaccine-a-double-edged-sword.html","enabled":true},{"name":"email","url":"?subject=Dry bulk market briefing summary: Vaccine, a double-edged sword | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-market-briefing-summary-vaccine-a-double-edged-sword.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dry+bulk+market+briefing+summary%3a+Vaccine%2c+a+double-edged+sword+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdry-bulk-market-briefing-summary-vaccine-a-double-edged-sword.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}