Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 07, 2021

Daily Global Market Summary - 7 May 2021

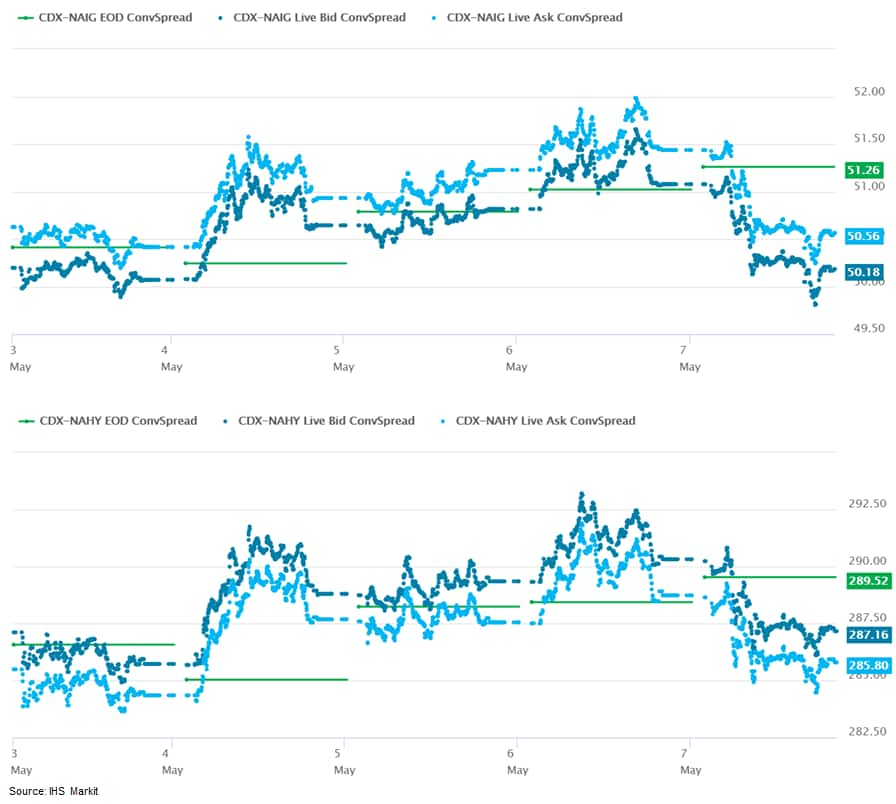

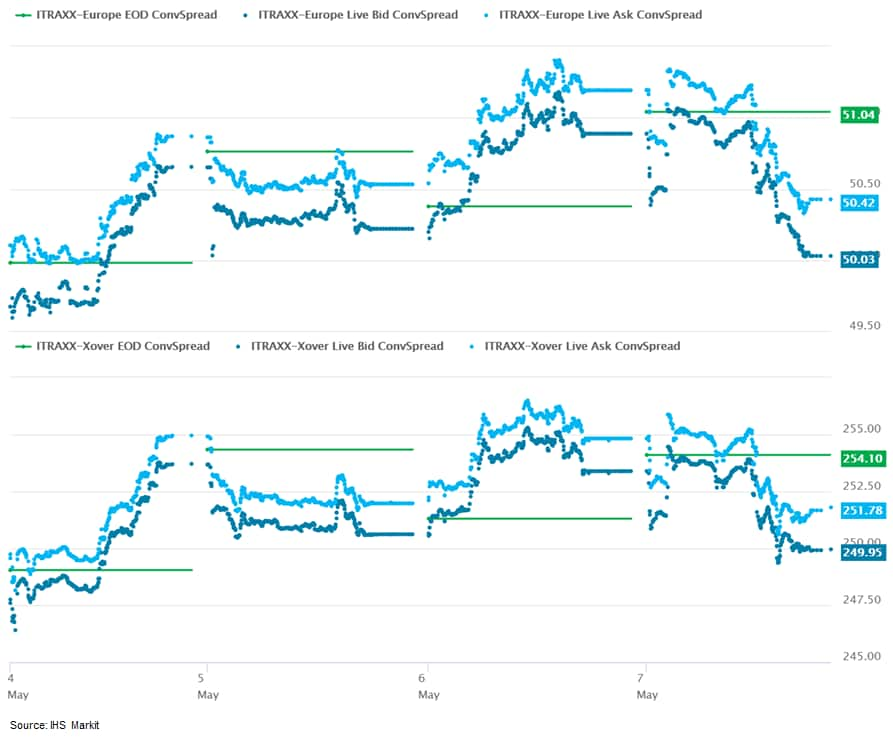

Today's US non-farm payroll report reported its largest miss versus consensus in over 20 years, coming in at a net add of 266 thousand jobs versus one million expected, which temporarily sent US government bonds sharply higher and also drove equity markets higher by alleviating some concerns that the Fed will act quickly to raise rates. All major European and US equity indices closed higher, while APAC markets closed mixed. US and most benchmark European government bonds closed lower. European iTraxx and CDX-NA closed slight tighter across IG and high yield. The US dollar closed lower, silver flat, and oil, natural gas, gold, silver, and copper closed higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher with the S&P 500 +0.7% and DJIA +0.7% closing at record highs; Russell 2000 +1.4% and Nasdaq +0.9%.

- US govt bonds closed lower despite 10s rallying 8bps and 30s 6bps on the much lower than expected 8:30am ET US employment report; 10yr govt bonds closed +1bp/1.58% yield and 30yr bonds +4bps/2.28% yield.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY closed -3bps/286bps,

which is flat for both indices week-over-week.

- DXY US dollar index sold off 0.2% on the US employment report to close at -0.8%/90.23.

- Gold closed +0.9%/$1,831 per troy oz, silver 0%/$27.48 per troy oz, and copper +3.2% to a new record high close of $4.75 per pound.

- Crude oil closed +0.3%/$64.90 per barrel and natural gas closed +1.0%/$2.96 per mmbtu.

- US nonfarm payroll employment rose 266,000 in April, and the

unemployment rate rose 0.1 point to 6.1%. Expectations were for a

larger gain in payrolls and a decline in the unemployment rate.

Still, there were several positive aspects of the report (IHS

Markit Economist Ben

Herzon and Michael

Konidaris):

- First, the increase in the unemployment rate was not for a lack of jobs (civilian employment rose), but rather for an increase in labor-force participation, which could reflect firming optimism on the part of households and a rising comfort level associated with re-engaging in the workforce as vaccination becomes widely available.

- Second, average hourly earnings (AHE) rose 0.7%, well above expectations. As lower-wage jobs that were lost to the pandemic come back, their rising prevalence puts downward pressure on average wages. A large increase in AHE against this backdrop is all the more impressive.

- Third, the average workweek rose in April. The same story applies here: as shorter-workweek jobs come back, this puts downward pressure on the average workweek. It could be that the difficulty of firms finding employees is putting upward pressure on the weekly hours of existing employees.

- Difficulty finding employees, moreover, could help account for the soft headline jobs figure and the solid gain in AHE.

- Finally, with respect to aggregate private wages and salaries, the unexpected weakness in job gains was more than offset by the unexpected strength in AHE and the workweek, raising our estimate for April private wages and salaries above our prior estimate.

- Outstanding US nonmortgage consumer credit rose $26 billion to

$4.24 trillion in March after a comparable increase in February.

The 12-month change in outstanding consumer credit rose by 0.9

percentage point from a flat (0.0%) reading. (IHS Markit Economist

David

Deull)

- Revolving credit rose by $6 billion but the main driver of the gain was a $19 billion increase in the nonrevolving category.

- The 12-month change in outstanding revolving credit was still deeply negative at -9.0%, but for nonrevolving debts, it was 4.3%. The latter category includes student and auto loans, and the growth of these types of obligations has been robust.

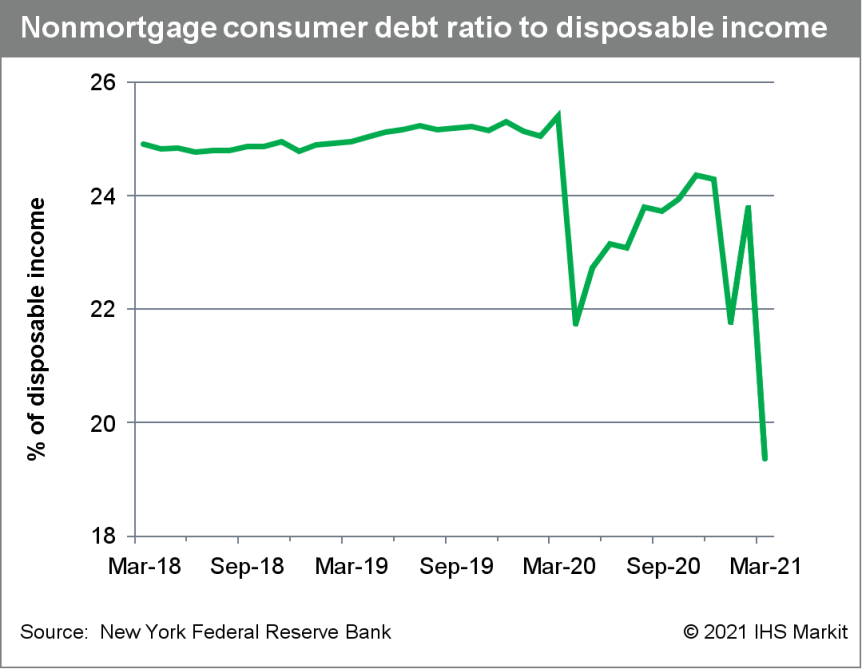

- The ratio of nonmortgage consumer credit to disposable personal

income plunged, as expected, falling 4.4 percentage points to

19.4%—the lowest since 1995. This was a function of the

stimulus checks that arrived in March and boosted personal income

by more than 20%. The ratio will return to a more normal range in

the coming months.

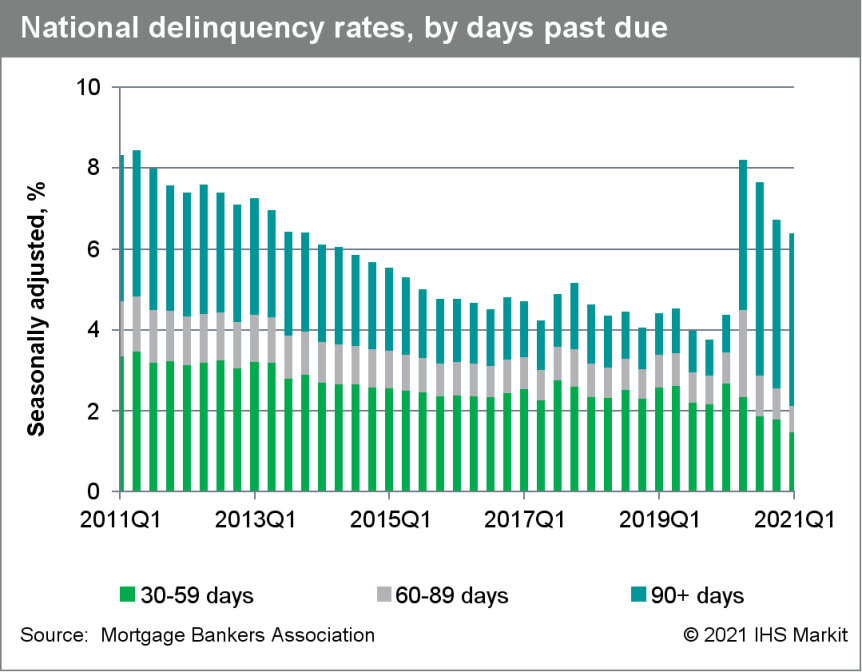

- The seasonally adjusted US mortgage delinquency rate fell 35

basis points from the end of the fourth quarter to 6.38% at the end

of the first quarter; it was up 202 basis points from a year

earlier. (IHS Markit Economist Patrick

Newport)

- The serious delinquency rate—loans more than 90 days delinquent or in foreclosure—was 4.70%, 303 basis points higher than a year earlier.

- The percentage of loans in the foreclosure process was 0.46%, down 19 basis points from a year earlier and the lowest reading since the first quarter of 1982.

- The 30-day delinquency rate plunged to a record low of 1.34%, down 103 basis points from a year earlier; "early stage" delinquencies, the rate for 30-day and 60-day delinquencies combined, also set a record low.

- The seasonally adjusted rate on new foreclosures remained at a

survey low 0.03%—almost zero.

- Exports of dairy products from the US have reached a new

milestone, led by a rebound in Mexican demand and the ever-growing

appetite for powders in Asian countries. (IHS Markit Food and

Agricultural Commodities' Jana Sutenko)

- According to customs data, the US' total dairy exports volumes totaled 195,800 tons in March, up 16% m/m and 27% y/y. In milk solids equivalent, exports were 215,600 tons, which is a new record, according to the US Dairy Export Council (USDEC).

- Those volumes equated to an estimated 19% of production exported for the month of March - the second highest month of all-time. Value grew alongside volume with USD688 million worth of dairy products shipped overseas in the period, the highest since 2014.

- Cadillac has confirmed development of the Lyriq electric vehicle (EV) continues to progress faster than expected when the program started and that production is due to begin in the first quarter of 2022. The brand is to start taking reservations for the model in September 2021 and it is due to be available to customers in the first half of 2022. The confirmation that the start of production is due in the first quarter of 2022 was part of a surprise announcement in a press statement; however, Cadillac vice-president Rory Harvey reportedly confirmed a date of March 2022 specifically when speaking to a media group. The program, along with other new battery electric vehicles under development, has made extensive use of virtual development and validation. Virtual testing has included elements such as cabin comfort for all passengers in hot and cold environments; advanced aerodynamics; aeroacoustics and active road-noise cancellation; driver assistance and active safety features; and protection of the Ultium battery in a wide variety of collision scenarios. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canada's Ivey Purchasing Managers' Index (PMI) lost its entire

gain from the previous month, falling 12.3 points to 60.6 in April.

(IHS Markit Economist Chul-Woo

Hong)

- Reversing last month's pattern, all sub-indexes fell except for the prices index.

- Given the continued strict regional containment measures, the overall real GDP growth pace will be very modest in the coming months.

- The employment index declined the most, down 4.7 points to 58.0, indicating a modest increase in employment, contrasting April's significant Labour Force Survey decline in net employment across most industries.

- After advancing for three consecutive months, the inventories index slightly decreased, down 2.3 points to 59.4.

- Purchasing managers seem to focus on building inventories to mitigate supply disruption risks from the third wave of the COVID-19 pandemic. The supplier deliveries index, which dropped 1.8 points to 37.8, continued to show further delay in delivery time.

- The prices index solidly jumped, up 4.9 points to 80 after falling for two successive months. The prices index has stayed at an average of 80, a near-record high, since December 2020, consistent with rising commodity input costs and supply-chain scarcity issues seen around the world.

- Canada's net employment was slashed by 207,100 positions in

April, exceeding market expectations, but coming in below the IHS

Markit forecast. Ontario's province-wide shutdown led the overall

decline with jobs down 152,700, followed by British Columbia's

(down 43,100) and Quebec's (down 13,300) regional measures. (IHS

Markit Economist Arlene

Kish)

- Losses were broad-based with hefty decreases in private sector and full-time employment. Given the nature of the restrictions it was not surprising that services-producing industries suffered the biggest setback.

- The decline in the labor force pulled the participation rate down 0.3 percentage point to 64.9% and pushed the unemployment rate up 0.6 percentage point to 8.1%.

- Total average hourly wages advanced throughout the month but declined 1.8% from a year earlier relative to the high base-year comparison. Part-time employment plateaued in April 2020, removing those wages from the overall calculation.

- Total hours worked declined 2.7% over the month, which was the first significant decrease since a year earlier.

- Mitsubishi has launched a subscription service in Brazil, called Mit Assinatura, available for all the brand's models offered in the market, reports Automotive Business Brazil. According to the report, the subscription plans are offered for 12 to 24 months and are available on the Eclipse Cross, Outlander Sport, Outlander, L200, and Pajero Sport. The pricing starts at BRL3,455 per month for the Eclipse Cross GLS. Included in the price is insurance and 24-hour technical assistance, as well as the right to reserve a car in case of an accident. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed higher for a third consecutive day; Germany +1.3%, Spain +0.9%, UK +0.8%, Italy +0.5%, and France +0.5%.

- Most 10yr European govt bonds closed lower except for UK -2bps; Italy +5bps, France/Spain +3bps, and Germany +1bp.

- iTraxx-Europe closed -1bp/50bps and iTraxx-Xover -3bps/251bps,

which is flat and +2bps week-over-week, respectively.

- Brent crude closed +0.3%/$68.28 per barrel.

- The Bank of England's Monetary Policy Committee (MPC) voted

unanimously to maintain the Bank Rate at 0.1% at its meeting that

ended on 5 May. (IHS Markit Economist Raj

Badiani)

- The MPC also voted unanimously for the Bank to maintain the stock of sterling non-financial investment-grade corporate bond purchases at GBP20 billion (USD28 billion), financed by the issuance of central bank reserves.

- However, the MPC voted by a majority of 8-1 for the Bank of England to continue with its existing program of UK government bond purchases, financed by the issuance of central bank reserves, maintaining the target for the stock of these government bond purchases at GBP875 billion and hence the total target stock of asset purchases at GBP895 billion.

- The gradual rollback of pandemic restrictions and the roadmap

out of lockdown led to a flurry of hiring activity across the UK at

the start of the second quarter, according to the latest UK Report

on Jobs data compiled by IHS Markit on behalf of KPMG and REC. (IHS

Markit Economist Annabel Fiddes)

- However, the latest survey, which monitors over 400 recruitment consultancies across the UK, also pointed to a renewed decline in total candidate availability after a period of rapid redundancy-related expansion, which has pushed up rates of starting pay.

- Recruiters signaled the second-steepest increase in permanent

staff appointments since data collection began 23-and-a-half-years

ago (surpassed only by that seen in October 1997) during April. At

the same time, temp billings growth softened only slightly from

March's 40-month record

- UK-based EV startup Arrival has partnered with Uber Technologies to build an electric car that will be "purpose-built" for ride-hailing services. The "Arrival Car" will go into production in the fourth quarter of 2023. Arrival will invite Uber drivers to join the design process over the coming months to ensure the Arrival Car meets the needs of professional drivers and their passengers. Given the massive benefits offered by EVs, mobility firms are also turning to EVs as solutions to transport problems. In the booming mobility service market, EVs are deemed as a natural fit. This partnership will support Uber's aim for 100% of its ride-hailing fleet globally to be zero-emission vehicles by 2040 and support Arrival in providing multi-modal zero-emission transportation ecosystems in cities. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Eurozone retail sales volumes rose by 2.7% month on month (m/m)

in March, following an upwardly revised 4.2% m/m increase in

February (initially 3.0% m/m). (IHS Markit Economist Ken

Wattret)

- For the second month in a row, the m/m increase surpassed the market consensus expectation (of 1.5% in March, according to Reuters' survey) by some distance.

- Following the exceptionally strong back-to-back increases in February and March, retail sales are now 1.3% above their pre-pandemic level back in February 2020 (compared with a peak cumulative decline of over 20% in April 2020).

- The introduction of an EU-wide 'Digital Green Certificate'

(DGC) ahead of the tourist season in June is increasingly likely as

member states (MSs) seek to revive non-essential travel from

overseas. (IHS Markit Country Risk's Dijedon

Imeri)

- Several national solutions to the challenge of resuming cross-border travel have emerged in recent weeks across the EU. In France, national authorities plan to buttress the TousAntiCovid contact tracing app with verified vaccination or COVID-19 virus test results to enable international travel. Germany, Estonia, and Denmark are also developing their own national solutions.

- However, a mosaic of national systems that are not sublated into an EU-wide solution risks undermining the resumption of international travel within the EU. To address this issue, the European Commission in May launched a pilot test in partnership with Deutsche Telekom, SAP, and five MSs.

- The proposed system would connect national databases to an EU gateway, allowing holders of national vaccination certificates, COVID-19 test certificates, or proof of recovery from COVID-19 to obtain a DGC. The DGC certificates would then serve as a 'passport', allowing its holders to travel freely within the EU as well as Norway, Switzerland, Iceland, and Liechtenstein, which are likely to be included in the scheme.

- The EU is set to ban the food additive titanium dioxide (E 171) after the European Food Safety Authority (EFSA) concluded in an opinion published on 6 May that the substance, used as a whitening, thickening and anti-caking agent, could "no longer be considered as safe" since genotoxicity could not be ruled out. The 2016 opinion, produced as part of the EU's rolling review program for additives on the market on 20 January 2009, when the 2008 additives regulation (1333/2008) took effect, found research was needed to fill data gaps on titanium dioxide, which is used in a wide range of foods including cakes, ice cream and confectionary. That opinion recommended new studies should be carried out to look at possible effects on the reproductive system, which could enable EFSA to set an acceptable daily intake (ADI), the amount that people could consume every day for a lifetime without ill effects. It also highlighted uncertainty around the characterization of the material used as the food additive (E 171), particularly with respect to particle size and particle size distribution. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Seasonally and calendar-adjusted German industrial production

excluding construction increased by 0.8% month on month (m/m) in

March, recouping only one-third of the January-February interim

correction. In contrast, construction surged by 10.8%, offsetting

most of its weather-induced slump during the first two months of

2021, therefore total production increased more strongly at 2.5%

m/m. (IHS Markit Economist Timo

Klein)

- Within manufacturing, the rebound in March was mostly driven by consumer goods for a change, presumably reflecting the partial (and temporary) opening of shops for non-essential goods.

- A different split according to industrial branches reveals that the largest upward impulse came from food/beverages/tobacco (5.2% m/m), followed by chemicals/pharmaceuticals (2.1%), whereas the other key sectors (automotive, machinery/equipment, metals, electrical and electronic equipment) posted little change during March.

- Automobile production remained constrained by supply-chain problems (the shortage of computer chips and shipping capacity).

- X1 Wind has deployed its X30 scale prototype floating platform in open ocean waters at the PLOCAN test site off the Canary Islands. The X30 is based on the PivotBuoy design which started in April 2019. Manufacturing was completed in Novembr 2020 by DEGIMA in Santander, and the platform was then shipped in nine parts to Las Palmas, Canary Islands, for assembly at Hidramar's shipyard. The one-third scale prototype is installed in water depth of 30 meters and features a single point mooring system foundation. The wind turbine installed is a Vestas V29 downwind turbine. X1 Wind is leading a consortium consisting of oil and gas, naval and offshore wind companies, including DNV-GL, Intecsea, Technical University of Denmark (DTU), EDP CNET, WavEC, and DEGIMA. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Einride, a Swedish transportation company focusing on autonomous electric trucks, has raised USD110 million in a Series B funding round, according to a company statement. New investors Temasek, Soros Fund Management LLC, Northzone, and Maersk Growth, along with existing investors EQT Ventures, Plum Alley, Norrsken VC, Ericsson and NordicNinja VC participated in the round. The company plans to use the infused capital to scale up deployments in Europe and the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Monetary Policy Committee of the Central Bank of the

Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) kept

its main policy rate, the one-week repo rate, steady at 19.0% at

its scheduled 6 May rate-setting meeting. The other major policy

rates - the late liquidity policy rate and the overnight rates -

also remained unchanged. (IHS Markit Economist Andrew

Birch)

- The TCMB raised the repo rate three times between November 2020 and February 2021 by a total of 875 basis points. The last increase contributed to the ouster of then TCMB governor Naci Aǧbal, to be replaced with current governor Şahap Kavcioǧlu.

- The current governor is closely aligned with President Erdoǧan's economic policies, which are vehemently opposed to elevated interest rates.

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.6%, India +0.5%, Australia +0.3%, Japan +0.1%, Hong Kong -0.1%, and Mainland China -0.7%.

- Mainland China's merchandise exports rose 32.3% year on year

(y/y) in April in US dollar terms, edging up from 30.6% y/y in

March, according to the General Administration of Customs (GAC).

Compared with the same period in 2019, the 2020-21 average growth

surged to 16.8% y/y from 10.3% y/y in March. Merchandise imports

growth continued to accelerate to 43.1% y/y in April, while the

2020-2021 average growth compared with April 2019 moderated to

10.7% y/y. (IHS Markit Economist Yating

Xu)

- By product, exports of pandemic-prevention supplies increased by 28% compared with the 2019 level, up 22 percentage points from the March growth rate, thanks to the resurgence of COVID-19 cases in Southeast Asian countries.

- Exports of labor-intensive products, such as clothes and bags, continued to accelerate.

- Exports of supply-chain products broadly accelerated; auto exports increased by 137% from the 2019 level, and exports of mechanical products, high-tech products, and agricultural production all registered notable rebounds.

- Mainland China's trade surplus expanded to USD42.9 billion in

April from USD13.9 billion in March.

- Chinese electric vehicle (EV) maker NIO has announced its plans to expand to Europe by making an entry into the Norwegian market. According to a company press release, the automaker plans to establish a full-fledged ecosystem encompassing cars, services, and digital experience, with the ES8 sport utility vehicle (SUV) being the first model to be introduced in Norway this year followed by the ET7 in 2022. Pre-orders for the ES8 will begin from July, while sales are expected to start from September. NIO's first sales and service center will be set up in Oslo and will open in September this year. This will be followed by the opening of NIO Spaces in Bergen, Stavanger, Trondheim, and Kristiansand by 2022. The company will also introduce its Power Swap technology, which enables vehicle batteries to be automatically replaced within three minutes. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan's monthly average nominal cash earnings rose by 0.2% year

on year (y/y) in March 2021, the first y/y increase since March

2020, although the seasonally adjusted level remained below the

pre-pandemic level. The improvement was thanks largely to a 0.8%

y/y rise in scheduled earnings, while the contraction of

non-scheduled earnings softened in line with increases in hours

worked, reflecting the lifting of the second state of emergency.

(IHS Markit Economist Harumi

Taguchi)

- The increase in nominal cash earnings also reflected rises in the share of full-time employees. The number of full-time employees rose by 1.7% y/y, while the number of part-timers continued to decline, moving down by 1.1%.

- Although the number of employees continued to decrease in manufacturing, life-related services and leisure, and some other industry groupings, a rise in full-time employees largely reflected moves to shift part-timers to the status of full-time employees, particularly in wholesale and retail sales.

- HHI, together with nine other entities, will build and operate a 1.2GW green hydrogen plant powered by a floating offshore wind farm in the East Sea by 2025. HHI will be responsible for developing the plant to produce hydrogen from sea water using electricity powered by a floating offshore wind farm. This is in line with HHI's growth plan to establish a hydrogen value chain. The South Korea government aims to produce 6.2 million hydrogen-fueled cars by 2040 and build up to 1,200 hydrogen refilling stations by 2040. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Lotte Chemical (Seoul, South Korea) reports first-quarter net

profit of 538 billion South Korean won ($478.7 million), swinging

from a net loss of W90 billion in the same period of the previous

year. The company also recorded an operating profit of W624 billion

versus an operating loss of W86 billion a year earlier. Sales were

W4.1 trillion, jumping 27.3% year on year (YOY). (IHS Markit

Chemical Advisory)

- The company says its olefin segment's operating profit was W313 billion in the first quarter compared with an operating loss of W12 billion in the year-ago quarter. Revenue leapt 20.1% YOY to W1.9 trillion.

- Lotte Chemical's aromatics division swung to an operating profit of W40 billion, versus an operating loss of W41 billion a year earlier. Sales were up 20.5% YOY, to W528 billion. The business returned to profit on higher demand for polyethylene terephthalate (PET) and purified isophthalic acid (PIA). The para-xylene (p-xylene) and purified terephthalic acid (PTA) businesses were solid, Lotte Chemical says.

- Operating profit for the advanced materials business more than doubled to W116 billion from W41 billion a year earlier. Sales for this unit grew by 28.6% YOY to W1.0 trillion. Higher profit was realized because of strong demand for home appliances, game consoles, and televisions. Selling prices for acrylonitrile-butadiene-styrene (ABS) were strong and prices of polycarbonate increased due to tight supply for bisphenol A (BPA) in northeast Asia.

- Operating profit at the company's Lotte Chemical USA unit grew threefold to W49 billion from W14 billion a year earlier, on sales of W152 billion, up 14% YOY. The company says that the business recorded its highest-ever profitability due to stabilized raw material prices and tight supply. It expects robust profitability to continue due to strong feedstock competitiveness in the US, although ethylene glycol capacity additions are forecast to have a negative impact on the industry, the company adds.

- According to a Reuters reports, Mongolia's state-owned coal

producer Erdenes Tavan Tolgoi is seeking international bond finance

to build rail infrastructure to improve its delivery capacity to

China. (IHS Markit Economist Brian

Lawson)

- On 23 April, Reuters reported that an initial tranche of debt sold in late March had obtained some USD200 million of two-year debt divided between US dollar and local currency debt, priced at 6.8% and 10%, respectively, underwritten by two domestic banks.

- The report stated that the project needs USD3.4 billion of funding between 2021 and 2025, with projects including a 450-MW power plant to supply the Oyu Tolgoi copper project and coal washing and water infrastructure facilities, although the company suggested that some 70% of this can be funded from its own cash flow.

- EVLOMO and Rojana Industrial Park Public Co., Ltd. have announced plans to set up an 8-GWh lithium-ion (Li-ion) battery plant in Thailand's Eastern Economic Corridor (EEC), according to EVLOMO's press release. The companies will together invest up to USD1.06 billion through a new joint venture (JV). In this new JV, Rojana would own 55% shares and the remaining 45% would be owned by EVLOMO. The battery plant will be located on a greenfield manufacturing site at Nong Yai, Chonburi (Thailand), and will create more than 3,000 new jobs. The companies plan to set up a 1-GWh plant with an investment of USD143 million in 18-24 months in the first stage of the project, with breaking ground expected to take place this year. They will manufacture batteries for electric four-wheelers, buses, heavy vehicles, and two-wheelers and offer energy storage solutions for Thailand as well as overseas markets. (IHS Markit AutoIntelligence's Jamal Amir)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2021.html&text=Daily+Global+Market+Summary+-+7+May+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 7 May 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+7+May+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-7-may-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}