Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 21, 2021

Daily Global Market Summary - 21 September 2021

All major European equity indices closed higher, while US and APAC markets were mixed. US government bonds closed lower, while benchmark European bonds closed mixed. CDX-NA closed slightly tighter across IG and high yield, iTraxx-Xover was tighter, and iTraxx-Europe was flat on the day. Oil, silver, gold, and copper closed higher, while the US dollar and natural gas were lower on the day. All eyes will be on tomorrow's 2:00pm ET FOMC meeting statement and press conference to gauge the timing and magnitude of the tapering of QE asset purchases.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Nasdaq/Russell 2000 +0.2%, S&P 500 -0.1%, and DJIA -0.2%.

- 10yr US govt bonds closed +2bps/1.33% yield and 30yr bonds +1bp/1.86% yield.

- CDX-NAIG closed-1bp/53bps and CDX-NAHY -2bps/284bps.

- DXY US dollar index closed -0.1%/93.2.

- Gold closed +0.8%/$1,778 per troy oz, silver +1.8%/$22.61 per troy oz, and copper +0.3%/$4.13 per pound.

- Crude oil closed +0.5%/$70.49 per barrel and natural gas closed -3.6%/$4.81 per mmbtu.

- Global oil supply declined month-on-month in August for the

first time since February and was dealt a further blow in September

from Hurricane Ida, which has removed 28.2 MMbbl of crude from the

balances, with roughly 20% (or 400,000 b/d) still offline - half of

which Shell has announced will stay out of commission for the year.

Oil supply also faces crimps in West Africa and Kazakhstan that are

holding back another ~350,000 b/d from Shell's force majeure on the

Forcados line (which ended Sep. 9) and maintenance work on the

Tengiz field (wrapping up mid-Sept.). Oil markets have taken a

relatively sanguine approach to the near-term outages, with

time-spreads still signaling more softness than earlier in the

summer. Yet a confidence test is fast approaching as traders ride

the flat price up near year-to-date highs, implicitly projecting

that there is a structural element behind some of the short-term

production hitches. (IHS Markit Energy Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst)

- Oil deficits drained off last year's stock accumulation in the OECD and highly visible trading hubs by the end of August, and disruptions add extra momentum to near-term drawdowns. Crude and product tanks in most core OECD markets are now back to pre-pandemic levels. While this is a key milestone on the road back to normal, it remains far from a clear harbinger of future supply crunches. In our view, oil stocks in 2019 were already elevated from the previous cycle of oversupply (2014-2018), and OECD days of forward cover are still well supplied in excess of 60 days, which as a rule of thumb is a good benchmark for gauging tightness. The return to 2019 levels is a natural place to give way to the supply response from OPEC+ to fill the gap while keeping a floor under prices, with the normalization of global spare capacity the third pillar of the structural recovery (along with demand and inventories).

- Inventory drawdowns are also coming from strategic reserves in 4Q2021, with the US selling 20 MMbbl as part of its long-standing Congressionally-mandated sales, while China followed suit for the first time, officially selling roughly 7 MMbbl from tanks (on top of previous unofficial sales reported around 20 MMbbl). These sales fall far short of lifting the September oil deficit of 1.5 MMb/d (down 400,000 b/d from previous expectations of 1.1 MMb/d), but they do run alongside our view on global stocks and ease some of the burden on commercial inventories and spot markets. China still holds far more crude than at the beginning of the pandemic and can further flex some inventory muscle in response to the country's crude import bill, with recent sales unlikely to be the last if prices remain at the upper end of the range.

- The rotating impact of Delta containment measures on oil demand remains a feature of the market particularly in Southeast Asia, although the relative success in stopping the spread in China through aggressive lockdowns has largely shielded global demand from significant downside. Still, the effects of Delta on demand govern a large chunk of oil balances, keeping demand relatively flat over 4Q2021, and pushing a full recovery in jet fuel demand out into 2022.

- In a press release, Laredo Petroleum, Inc. announced the signing of an agreement to acquire Midland Basin assets from Pioneer Natural Resources Company for a total consideration of $229.3 million. The transaction is expected to close by the end of October 2021. Under the deal, Laredo will pay $160 million in cash and will issue 959,691 Laredo common shares valued at $69.2 million based on its closing price on 17 September 2021. The transaction covers 20,000 net acres (80% operated, 98% held by production) in western Glasscock County directly adjacent to its existing western Glasscock leasehold, Laredo said. Current net production from the assets averaged 4,400 boe/d (82% oil and NGLs). (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- FedEx Corp. cut its outlook for annual profit after missing analysts' quarterly earnings estimates because of higher costs and stalled growth in shipments. The shares fell as much as 5% after regular hours. The company said a tight labor market was a key drag on fiscal first-quarter profit, as a dearth of workers drove up wages, reduced network efficiencies and increased the need to hire outside transportation services. Executives estimate this resulted in $450 million in added costs from a year earlier. (Bloomberg)

- Soaring US home prices are shifting demand from the

single-family to the multifamily market. Multi permits soared to a

674,000-unit annual rate in August, the highest monthly reading

since January 1990; multifamily starts climbed to a 539,000 rate,

the second-highest reading since 1987. (IHS Markit Economist Patrick

Newport)

- The single-family permits category, arguably the most important category in the monthly new residential construction report, edged up 0.6% (plus or minus 1.3%; not statistically significant) to a 1.054 million rate. Single-family permits have slipped 17% since January—still, their year-to-date totals are the highest since 2006.

- Housing starts increased 3.9% (plus or minus 11.3%, not statistically significant) in August to a 1.615 million annual rate; single-family starts slipped 2.8% (plus or minus 10.4%, not statistically significant) to a 1.076 million rate.

- New home construction is dropping in all four regions. In the South, though, where activity remains 10% above pre-pandemic levels, the downturn has been mild. Consequently, its share of single-family housing permits has climbed above 60%, up from 56% before the pandemic.

- Demand remains strong. But builders are fighting headwinds: high material costs, labor shortages, and building material supply chain issues—this, on top of the pre-pandemic headwinds of a lack of buildable lots and shortages of skilled labor.

- These headwinds will continue to drag housing down this year. Yet, despite steady declines from January, housing starts and single-family housing starts are on track for having their strongest year since 2006. Multifamily starts will do better than this: they are expected to post their highest totals this year since 1987.

- The US economy is outperforming its trading partners'

economies. That is why US imports have picked up more than US

exports. This largely explains the widened current-account

deficit—to 3.3% of GDP for the second quarter of 2021 from 1.9%

of GDP in the fourth quarter of 2019, the last quarter untouched by

the pandemic. IHS Markit does not expect a further widening of the

current account relative to GDP because economies across the world

are picking up speed. (IHS Markit Economist Patrick

Newport)

- The current-account deficit widened by $0.9 billion to $190.3 billion in the second quarter of 2021.

- The goods and services deficit expanded by $2.3 billion as imports increased more than exports.

- The surplus on primary income edged down by $1.1 billion to $49.1 billion; the deficit on secondary income (transfers) widened by $2.6 billion to $30.1 billion.

- The first quarter's 3.4% reading was the largest since the fourth quarter of 2008.

- The Food Safety and Inspection Service (FSIS) has responded to

petitions filed by a cattle group and a Harvard clinic trying to

shape the labeling policy of cell-based meat products. The agency

told petitioners FSIS is still collecting comments on the best

approach to label these products, while it denied a request by US

Cattlemen's Association to rope in meat terms for plant-based and

other competing products regulated outside the jurisdiction of the

agency. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- Cell-based startups continue to court money in the race to design these novel products, some of which are financed by large meat firms such as Tyson Foods and Cargill, and regulators have been trying to piece together the best way to oversee labeling and safety of these novel food products.

- In February 2018, the US Cattlemen's Association (USCA) started a firestorm by petitioning FSIS to keep the terms "beef" and "meat" exclusively for products derived from the flesh of an animal harvested in the traditional manner. The group envisioned products labeled beef derived from animals born, raised and slaughtered in a traditional manner, not products derived from plants or grown in labs. It also urged FSIS to add these definitions to its Food Standards and Labeling Policy Book.

- Groups such as the Good Food Institute (GFI) blasted the petition in 2018 as protectionism and charged that it asked USDA to move beyond its authority to make rules for plant-based products as well as cell-cultured products.

- General Motors (GM) has announced software and hardware changes that correct the issues with the Chevrolet Bolt and Bolt EUV batteries, which in certain conditions had risk of fire. According to a GM statement, LG battery plants in Holland and Hazel Park (Michigan, US) have resumed production and GM expects replacement battery modules to begin shipping to dealers as soon as October 2021. LG has updated its manufacturing process to address the potential error. The root cause was a "rare circumstance" where two manufacturing defects could be present in the same battery cell. The defects were a torn anode and a folded separator; having only one of these defects present did not create the potential for fire risk. According to GM's statement, "LG has implemented new manufacturing processes and has worked with GM to review and enhance its quality assurance programs to provide confidence in its batteries moving forward. LG will institute these new processes in other facilities that will provide cells to GM in the future." Relative to production of the Ultium batteries at GM and LG joint venture (JV) plants, GM told IHS Markit and other analysts that as a JV plant, GM is more involved in the manufacturing process from the beginning, and manufacturing expertise relative to quality checks and other areas will be directly brought to bear. In addition to the restart of battery production, GM announced that within about 60 days it will launch a new advanced diagnostic software package designed to increase available battery charging parameters over existing software guidance. GM had already announced that it expects the fix to cost the company USD1.8 billion in two recalls, and announced no further costs with these changes. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Aurora has shared the first look of the Toyota Sienna hybrid vehicle integrated with its autonomous platform Aurora Driver, designed for ride-hailing service. This modified vehicle is Toyota's first mass-produced "Sienna Autono-MaaS" (S-AM) prototype, which has interface to work with third party autonomous systems. Aurora said that over the next six months, it will test this initial development fleet in Pittsburgh, Dallas, the Bay Area, and additional locations, with plans to deploy it on ride-hailing networks in late 2024. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- GE Renewable Energy, Fraunhofer IGCV and voxeljet AG have

announced a research partnership to develop the world's largest 3D

printer for offshore wind applications. This partnership aims to

optimize the production of key components of GE's Haliade-X

offshore wind turbine and to reduce the product's carbon footprint

by eliminating the need to transport the large parts from a central

manufacturing location. (IHS Markit Upstream Costs and Technology's

Monish Thakkar)

- The 3D printer which will be capable of producing sand molds for casting the metal parts of different shapes and sizes to make up wind turbine nacelles. The modular 3D printing process, based on voxeljet's core "Binder-Jetting" technology, can be configured to print molds up to 9.5 meters in diameter and more than 60 tons in weight. It is expected to reduce the mold production time from ten weeks down to two for the GE Haliade-X turbine. The Fraunhofer Institute for Casting, Composite and Processing Technology IGCV is responsible for casting and materials technology issues as well as digital process monitoring.

- The partners expect to launch the project during the third quarter of 2021 with initial printer trials starting during the first quarter of 2022. GE's Haliade-X offshore turbine features from 12MW to 14MW capacity, 220m rotor, a 107-meter blade, and digital capabilities.

Europe/Middle East/Africa

- All major European equity indices closed higher; France +1.5%, Germany +1.4%, Italy/Spain +1.2%, and UK +1.1%.

- 10yr European govt bonds closed mixed; Italy/France/Spain -2bps and Germany/UK +1bp.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -4bps/248bps.

- Brent crude closed +0.6%/$74.36 per barrel.

- The UK's Office for National Statistics (ONS) has reported that

the volume of retail sales fell for the second straight month when

falling by 0.9% month on month (m/m) in August. Therefore, retail

sales volumes rose by 0.3% in the three months to August compared

with the three months to May. This implied that they stood 4.6%

higher than their pre-COVID-19 February 2020 levels in July. (IHS

Markit Economist Raj

Badiani)

- In August, food store sales volumes retreated by 1.2% m/m, with the ONS suggesting that the end of restrictions on the hospitality sector encouraged people to spend less time indoors to eat and drink more at restaurants and bars.

- Sales in non-food stores fell for the third straight month in August, by 1.0% m/m in volume terms. The worst performers were falls in department stores (down by 3.7% m/m) and other stores, such as sports equipment and computer stores (down by 1.2% m/m).

- Non-store retailing increased for the second straight month, rising by 2.9% m/m in August. It had declined sharply in June and May when consumers drifted back to physical stores. This implies that its share of overall retail spending stood at 27.7% in August, compared with 27.1% in July and a record 34.7% in March.

- Fuel sales volumes rose by 1.5% m/m in August, rising in four of last five months, reflecting increased greater mobility. Fuel sales remained 1.2% lower than in February 2020.

- Food-grade carbon dioxide (CO2) gas shortage will have a

minimal impact on frozen food supplies, the British Frozen Food

Federation (BFFF) noted. (IHS Markit Food and Agricultural

Commodities' Cristina Nanni)

- Richard Harrow, BFFF chief executive, explained that reports from the press of potential disruption of frozen food deliveries due to a shortage of dry ice are "totally untrue".

- "The CO2 shortage," noted Harrow, "is effecting primary production of many ingredients used by frozen food producers and this may lead to shortages of some frozen food supplies. However, chilled foods producers are much larger consumers of CO2, which is used to extend the shelf life, so chilled food supplies are likely to be hardest hit by the shortage."

- This means that reduced supplies of CO2 might put a strain on the food supply chain which is already experiencing severe labor shortages and freight problems.

- CO2 is a by-product of fertilizer production. A spike in gas prices (+250% since January 2021) had prompted the closure of two fertilizer processing plants in Billingham and Ince, own by CF Industries, resulting in a 60% cut in the UK's carbon dioxide supplies.

- UK charging network company Osprey Charging has announced plans to invest GBP75 million over the next four years to create a network of 150 fast-charging hubs for electric vehicles (EVs) around the country. In a statement, the company said that each site will host up to 12 rapid chargers with a maximum charging power of up to 175kW, and that this will lead to around 1,500 additional chargers nationwide. The first site will open in Wolverhampton in October, which is adjacent to an arterial road and close to the key M6 motorway. It said that this is the first of 10 hubs under construction this year that will be opened on major transport routes in the country. (IHS Markit AutoIntelligence's Ian Fletcher)

- AstraZeneca (UK) has announced an EUR307-million (USD360 million) investment in an advanced small molecules manufacturing facility in Dublin, Ireland, which is part of a business strategy to enhance the resilience of the company's global supply network in the innovative therapeutic market segment. The next-generation active pharmaceutical ingredient (API) manufacturing center is intended to ensure that AstraZeneca's global supply network is "fit for the future" growth outlook, according to the company's press release. The unit will primarily focus on "late-stage development and early commercial supply" of pipeline products. There are no confirmed indications as to which pipeline medicines the company has in mind for manufacturing. However, the facility will probably have capacity to manufacture a wide range of high-value medicines from the site for export mainly to Europe, including "new modalities such as antibody drug conjugates and oligonucleotides". Some of the rare disease portfolio of research and development (R&D) candidates acquired through AstraZeneca's takeover of Alexion (US) could be manufactured from the new facility. (IHS Markit Life Sciences' Eóin Ryan)

- The chief financial officer (CFO) of the BMW Group, Nicolas Peter, has said that the biggest medium- and long-term business challenge the industry faces is trying to achieve profit margin parity from electric cars with their internal combustion engine (ICE) equivalents. In a wide-ranging interview with Automotive News Europe (ANE) Peter discussed the short-term impact of the semiconductor shortage and how this has helped OEMs further hone supply chain efficiency and pricing. However, while the semiconductor shortage remains the most pressing short-term issue for the industry, in the longer term the focus will switch to maintaining profitability and margins as the industry accelerates electrification. Peter said, "From a financial perspective, this is the No.1 challenge we face as an industry. How to get to a sustainable level where margins for EVs and cars with combustion engines are on par. Part of it will be achieved by improving the margin on the product itself. BMW for the last three years has been running a companywide program to improve our cost level, to improve efficiencies." (IHS Markit AutoIntelligence's Tim Urquhart)

- Valeo is said to be preparing to buy out its battery electric vehicle (BEV) component joint venture (JV) with Siemens. Deputy CEO Christophe Perillat told Bloomberg News in an interview that Siemens "entered this joint venture with the plan to eventually sell and we to buy". However, he added, "Whether this happens soon or in 2022 or in 2024, it's not clear." Valeo and Siemens founded the Valeo Siemens eAutomotive JV during 2016. This unit was set up to develop and manufacture a range of components for BEVs, including electric motors, axles and powertrain electronics. (IHS Markit AutoIntelligence's Ian Fletcher)

- Vestas has announced the closure of two of its offshore wind production facilities. The factories in Esbjerg, Denmark, and Viveiro, Spain, will be closed in the first half of 2022, and the end of 2021 respectively. The company has stated that the closures are part of its move to integrate the acquired MHI Vestas business. The Esbjerg facility employs 75 staff for the production of power conversion modules for Vestas' V164 and V174 offshore wind turbines. Vestas has stated that these modules will be delivered from more localized manufacturing facilities outside of Europe, in response to the changing demands. The Viveiro facility employs 115 staff to manufacture generators for its 2 MW onshore platform, as well as control panels for its V164 offshore wind turbines. The closure is in response to a decrease in demand for the onshore platform, and the need to optimize offshore manufacturing. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Romanian Prime Minister Florin Cîțu said on 15 September that

the government is to introduce a compensation scheme, effective

from 1 November, for households' electricity and gas bills, having

also discussed capping natural gas prices. As of 17 September,

European gas prices are nearly four times higher than the average

spot price over the previous four years. In response to the rising

gas prices, other European governments, including Spain and Greece,

have also announced various mitigating measures (IHS Markit Country

Risk's Petya

Barzilska):

- IHS Markit forecasts a significant spike in gas prices in the fourth quarter of 2021, driven by factors such as a rising coal-gas switching range and a limited response to increase pipeline supply to balance lower LNG imports. We expect prices to fall in the first quarter of 2022 because of stronger LNG imports and piped flows, albeit with considerable uncertainty around the forecast, particularly because of weather conditions and other factors. Government responses to mitigate the burden from the rising gas and electricity prices are likely to continue to vary across Europe.

- A coordinated approach at the EU level, as advocated by Spain, such as guidance on building gas reserves, is likely only beyond the one-year outlook. Most measures would probably focus on consumers and small rather than large businesses. They would range from subsidizing households' gas and electricity bills as in Greece, France, Romania, and Ukraine, introducing temporary price caps as in Spain and likely in Romania and Moldova, and cutting associated taxes, excise duties or fees such as in Spain, and likely in Estonia and Italy.

- The measures will probably mitigate the risk of protests across Europe, but demonstrations with varying intensity because of high utility gas and electricity prices are still likely at the end of 2021 and the beginning of 2022 because of the probable slow or sparse introduction of support measures.

- The risk of protests, notably in Romania, Bulgaria, Spain, Ukraine, France, and Italy, and restricting energy consumption in non-key sectors or areas would further increase in case of a shortage of gas reserves in the first quarter of 2022 due to a prolonged and cold winter.

- The Executive Board of Sweden's Riksbank in its September

monetary policy meeting left the key policy interest rate, the repo

rate, unchanged at 0%. The policy rate has been at this level since

December 2019, when it was increased by 25 basis points. (IHS

Markit Economist Marie-Louise Deshaires)

- Similarly, the Riksbank also announced that it will also continue to purchase securities in 2021 in line with earlier decisions. Previous monetary policy decisions mean that the asset purchase program will remain intact within the envelope of SEK700 billion (USD81.6 billion) during the fourth quarter of 2021. Stressing that sustainability is needed in Swedish monetary policy, it noted that it that continues to purchase securities and offer liquidity within all the launched channels. These include bond purchases totaling SEK68.5 billion. The Riksbank expects its holdings of securities to increase to almost SEK930 billion at the end of 2021.

- The central bank also argues that current inflationary pressures are a result of temporary factors, with expansionary monetary policy still required to assist the economic recovery and ensure inflation reach its target (2%) on a sustainable basis over the longer term. The latest inflation data from Statistics Sweden show that the consumer price index with a fixed interest rate (CPIF; CPI with a fixed interest rate) in August rose to 2.4% year on year (y/y), up from 1.7% y/y in July. Higher price growth was driven primarily by rising prices for fuel, and clothing and footwear.

- Turkey's Banking Regulation and Supervision Agency (Bankacılık

Düzenleme ve Denetleme Kurumu: BDDK) will let an expanded

definition of what constitutes a non-performing loan (NPL) expire

at the end of September as planned after consultation with local

banks, the Daily Sabah reported. The regulatory forbearance,

enacted at the beginning of 2020, changed the definition of NPLs

from 90 days past due to 180 days past due and also extended the

time period during which a loan needed to be past due before being

classified as a Stage 2 loan. Separately, the BDDK announced on its

website that it is instituting a maximum 24-month maturity on

consumer loans above TRY50,000 (USD5,780), down from 36 months

previously. (IHS Markit Banking Risk's Alyssa

Grzelak)

- Although still above its 10-year average, Turkey's NPL ratio has been falling steadily since the beginning of 2020, standing at just 3.7% as of June 2021. Very rapid credit growth rates during this period, as well as the regulatory forbearance on NPL reporting mentioned above, contributed to the decline; IHS Markit assesses credit risks in banks' loan books to remain very high in the short term.

- Reporting by large individual banks suggests that NPL ratios could rise between 40 and 80 basis points when reported without forbearance in the fourth quarter. Among the largest banks to have reported such data, Akbank reported a 40-basis-point benefit from the NPL definition change, Ziraat a 45-basis-point improvement, Vakifbank 52 basis points, and Isbank 80 basis points.

Asia-Pacific

- Most major APAC equity markets closed lower, with South Korea and Mainland China markets still closed for a holiday. India +0.9%, Hong Kong +0.5%, Australia +0.4%, and Japan -2.2%.

- SAIC-GM-Wuling, General Motors' joint venture (JV) with SAIC Motor and Wuling Motor, is planning to introduce some of its electric vehicle (EV) models in overseas market in 2022, reports the China Daily, citing statements from a company executive. The executive did not specify the countries to which the models will be exported but they will be built on the global small electric vehicle (GSEV) platform; production of models based on the platform will begin in Indonesia in late 2022. The SAIC-GM-Wuling JV has been successful with its compact sport utility vehicle (SUV) models such as the Hongguang mini EV, which has become extremely popular in the Chinese market. The Hongguang mini-EV is an A-segment vehicle based on the GSEV platform, launched in the Chinese market in June 2020. It performed well in the first year, with sales of 136,822 during 2020, according to IHS Markit's light-vehicle sales data; we expect sales of the model to be around 213,000 units in China this year. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Seajacks Zaratan installed the final foundation and the

transition piece off the Akita Port for the 140MW Akita Noshiro

wind farm offshore Akita Prefecture, Japan. All the 33 monopile

foundations have been installed of which 20 units were installed

off Noshiro Port, and the remaining 13 off Akita Port. The

installation work was started from Akita Port in early May of this

year. The company will also install the 33 Vestas V117-4.2MW wind

turbines, which is scheduled to begin in April 2022. The two wind

farms are scheduled to be operational in 2022. (IHS Markit Upstream

Costs and Technology's Monish Thakkar)

- The Akita Noshiro project is being developed by a consortium led by Marubeni which also includes Obayashi Corporation, Tohoku Sustainable & Renewable Energy, Cosmo Eco Power, The Kansai Electric Power, Chubu Electric Power, The Akita Bank, Ohmori, Sawakigumi Corporation, Kyowa Oil, Katokensetsu, Kanpu, and Sankyo.

- Kajima Corporation is the project's EPCI contractor. The company had contracted Sif to supply the 33 monopiles and 33 transition pieces for the wind farm. Sif manufactured the monopiles while Smulders manufactured the transition pieces.

- Hyundai's premium brand Genesis will roll out its new 'Face Connect' technology, which will enable access using faces to open and close doors without using a smart key, according to a company press release. After identification and syncing, the vehicle can automatically adjust the driver's seat and steering wheel based on the driver's stored preferences. The heads-up display (HUD), side mirrors, and infotainment settings will also be adjusted based on customized settings. The Face Connect system features a near infrared (NIR) camera for high functioning at low light situations. If drivers leave their smart key in the car, the vehicle can be locked using the face recognition system. Face Connect can register up to two faces for each vehicle and add profiles using voice assistant. The profiles can be deleted any time at the driver's convenience. In addition, Genesis will also roll out its over-the-air (OTA) software update to wirelessly update software on major electronic devices including the electric vehicle (EV) integrated control device, suspension, brakes, steering wheel, and airbags. (IHS Markit AutoIntelligence's Jamal Amir)

- Indian biotech Mylab Discovery Solutions has announced the acquisition of a majority stake in Indian healthcare technology company Sanskritech. According to a press release that has been cited by India's LiveMint news, the acquisition will enable Mylab to establish point-of-care testing systems "at doctors' offices, nursing homes, community health centers, airports, etc. through lab partners to enable patients to get test results faster, at a lower cost, and without the need to wait for hours". Sanskritech is the developer of Swayam, an advanced point-of-care testing system with more than 70 test parameters and telemedicine capabilities. It is essentially a portable diagnostic and telemedicine point-of-care system that enables the creation of a small lab in various settings. Mylab will reportedly harness its expertise in diagnostic solutions development, biosensors, robotics, and liquid handling to expand Sanskritech's test menu, and plans to embed artificial intelligence to enable faster diagnosis reporting. The financial terms of the transaction have not been reported, but Mylab will reportedly acquire the majority stake in an all-cash deal and Sanskritech will continue to operate as a separate entity under the aegis of Mylab. (IHS Markit Life Sciences' Sacha Baggili)

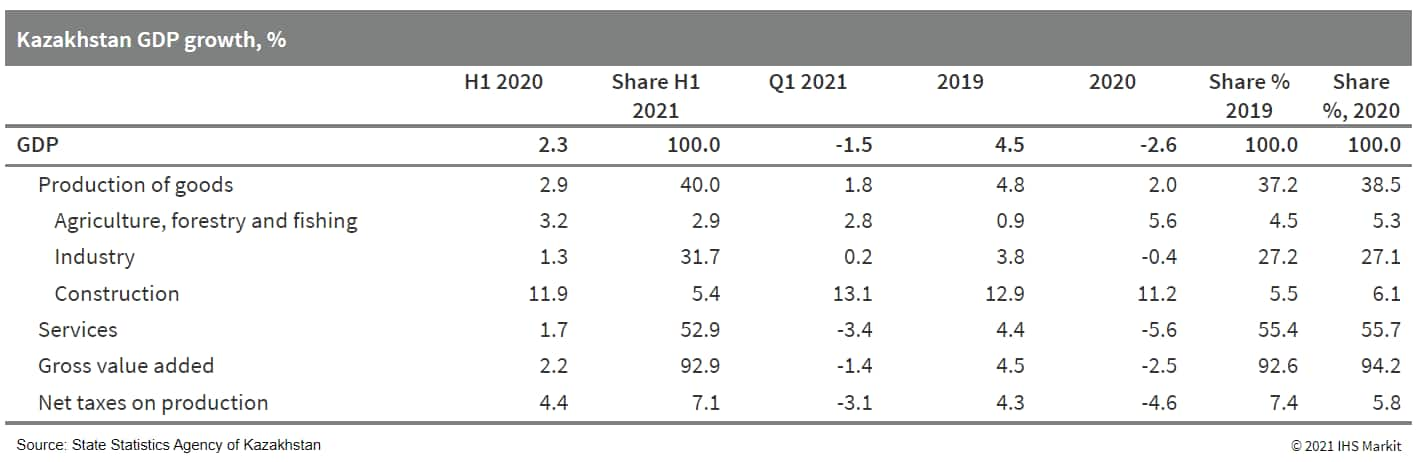

- Kazakhstan's real GDP growth returned to positive territory in

the second quarter of 2021, and the economy in the first half of

the year expanded by 2.3% in annual comparison. The slowly

improving epidemiological conditions and some progress in the

immunization program, combined with the positive OPEC+ output talk

results and reasonably bright export outlook, keep the near-term

growth projections fairly positive, although the pandemic still

marks significant risks. (IHS Markit Economist Venla

Sipilä)

- According to figures published by the State Statistics Agency, the Kazakh economy in the first half of 2021 expanded by 2.3% year on year (y/y) in real terms. This result implies a substantial recovery in the second quarter of the year, given that first quarter data had still shown contraction of 1.5% y/y.

- Real output growth in the second quarter was curtailed by accelerated price gains, as signaled by the growth of the GDP deflator climbing to double digits, to 10.2% y/y from 6.3% y/y in the first quarter.

- Agricultural production expanded at an accelerated rate of 3.2% y/y. Meanwhile, although its expansion eased to below 12% from over 13% y/y in the first quarter, GDP-contribution of construction activity increased from 4.3% in the first quarter to 5.4% in January-June.

- Slowing price gains in the service sector on the whole added

this field to return to growth, and total service supply in the

first half increased by 1.7% y/y, after falling by 3.4% y/y in the

first quarter. Nevertheless, the GDP share of service remained

below 53%.

- Australia's decision to scrap a €56 billion French

diesel-fueled submarine contract after signing the new AUKUS

security pact with the UK and US, is threatening to scupper a

planned free trade agreement (FTA) with the EU, particularly

hitting Australian agricultural exports to the bloc. (IHS Markit

Food and Agricultural Policy's Sara Lewis)

- The European Commission, which is negotiating on behalf of the EU, and the Australian government have so far held 11 rounds of trade talks aimed at clinching the FTA since launching the process in June 2018.

- The next round of talks is scheduled for October 12, with Australia aiming to conclude the deal before the end of this year.

- However, Australia's September 15 decision to cancel the 2016 contract and replace it with nuclear submarines developed using UK and US technology under the tripartite AUKUS (Australia, UK, US) security pact has left Paris furious.

- After recalling France's ambassadors to both Canberra and Washington, the French government is pressing the EU to stall negotiations for the FTA with Australia.

- The Chair of the European Parliament's International Trade

Committee, Bernd Lange, told a September 19 media briefing on

current trade issues that "I guess this will not stop the

negotiations and talks with Australia, but it will be more

complicated to conclude that now."

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2021.html&text=Daily+Global+Market+Summary+-+21+September+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 21 September 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+21+September+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary-21-september-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}