Daily Global Market Summary - 15 July 2020

Most global equity markets closed higher, with the exception of China, as COVID-19 vaccine trials continue to show positive initial results and periodically drive market optimism. iTraxx and CDX indices were tighter across IG/high yield and both Brent/WTI closed over 2% higher on the day. Tomorrow's US initial claims for US unemployment insurance will be watched closely to determine if the recent re-closures across several states is creating a second wave of job losses.

Americas

- US equity markets closed higher; Russell 2000 +3.5%, DJIA/S&P 500 +0.9%, and Nasdaq +0.6%.

- 10yr US govt bonds closed flat/0.63% yield and 30yr bonds +3bps/1.34% yield.

- CDX-NAIG closed -2bp/72bps and CDX-NAHY -25bps/478bps.

- Crude oil closed +2.3%/$41.20 per barrel.

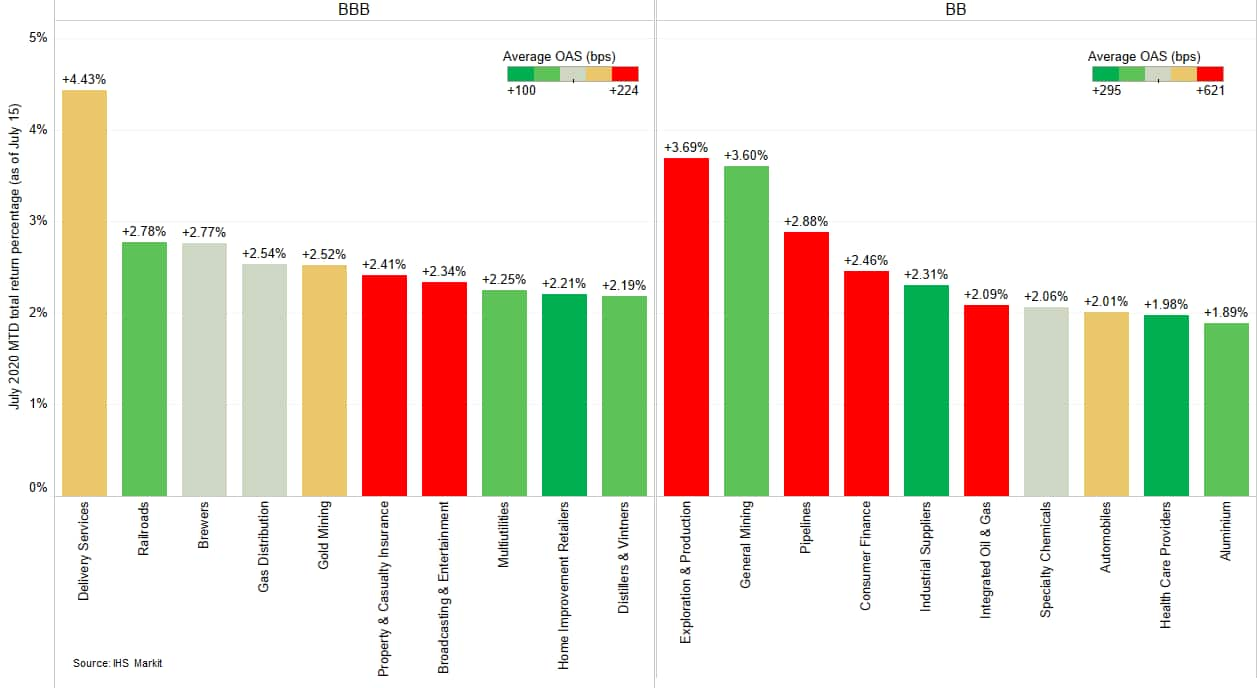

- The below charts shows that the top performing BBB rated

subsector in the IHS Markit iBoxx USD Investment Grade Index this

month is delivery services at +4.43% MTD (as of July 15) and the

top BB rated sector in the IHS Markit iBoxx High Yield Index is oil

and gas exploration and production (E&P) at +3.69%.

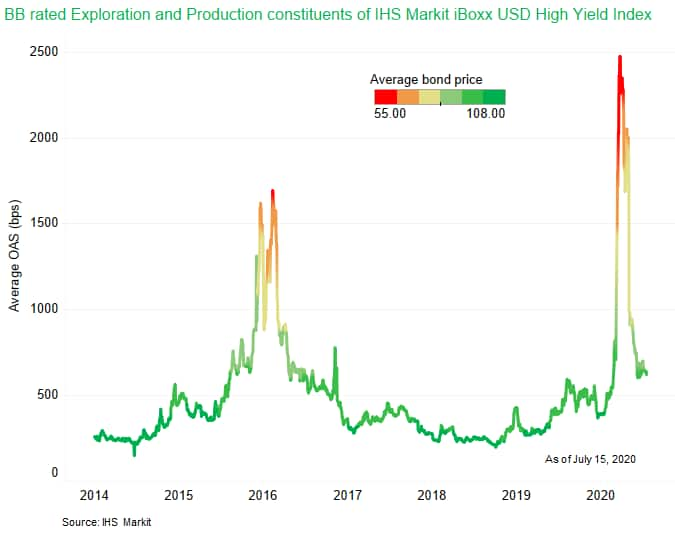

- The chart below shows the magnitude of tightening of BB rated

E&P USD corporate bond option adjusted credit spreads (OAS) and

the improvements in bond prices (indicated by the color of the

line) since the sector's multi-year lows on March 23, 2020:

- Moderna (US) has published detailed interim results from the

National Institute of Allergy and Infectious Diseases' (NIAID)

open-label Phase I trial investigating the safety and

immunogenicity of its investigational COVID-19 vaccine, mRNA-1273,

in The New England Journal of Medicine (NEJM). (IHS Markit Life

Science's Margaret Labban)

- The interim analysis included 45 healthy participants (aged 18-55 years) that received one of three dose levels (25, 100, or 250 µg) of mRNA-1273 twice (prime and boost) 28 days apart.

- Prime-boost vaccination with mRNA-1273 led to "rapid and strong immune responses" against the virus in all participants, with geometric mean titers and neutralizing antibody titers at day 57 exceeding those of convalescent sera obtained from 38 individuals with confirmed COVID-19 diagnosis (including 15% with severe symptoms, 22% with moderate symptoms, and 63% with mild symptoms).

- Neutralization activity was assessed with a live SARS-CoV-2 plaque-reduction neutralization test (PRNT) that demonstrated geometric mean titer (GMT) levels for the 100 ug prime-boost group of 654.3 - 4.1-fold above those seen in convalescent sera (n=3) at day 43 - as well as a pseudovirus neutralization assay (PsVNA) with the 100 ug group demonstrating GMTs of 231.8, which was 2.1-fold higher than convalescent sera (n=38) at day 57.

- Moderna also reported that the vaccine elicited Th1-biased CD4 T-cell responses without significant elevation of Th2-biased CD4 T-cell responses, suggesting a reduced risk of vaccine-associated enhanced respiratory disease.

- Assessment of durability of the immune response is ongoing. However, based on the GMTs for binding antibodies and neutralizing antibodies, participants started experiencing notable declines in in titers by day 57. For the 100 ug group, GMTs of neutralizing antibodies declined from 343.8 at day 43 to 231.8 by day 57 - an almost 33% drop.

- Regarding safety and tolerability, adverse events were dose-dependent, mostly transient, and mild or moderate, and no serious adverse events were reported through day 57.

- Solicited systemic adverse events were reported commonly after the second vaccination in 54% of the 25 ug group, and in 100% of the 100 ug and 250 ug groups, including fatigue, chills, headache, and myalgia.

- Moderna's vaccine is part of Operation Warp Speed (OWS) and remains on track to potentially deliver 500 million doses per year, and up to 1 billion per year as of 2021. The full NEJM article is available here.

- The significantly high neutralizing antibody GMTs reported for Moderna's vaccine strongly support the candidate's continued development and confirm the company's selection of 100 ug as the optimal dose for the randomized, placebo-controlled Phase III COVE trial, which is due to begin on 27 July.

- Total US industrial production (IP) rose 5.4% in June, beating

our estimate and the consensus expectation. The gains were broadly

based. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The details in this report that bear on our GDP tracking combined with updated vehicle production schedules for the third quarter left our estimate of second-quarter GDP growth unrevised at a 35.5% annualized rate of decline and raised our forecast of third-quarter GDP growth by 0.3 percentage point to an 18.0% annualized rate of increase.

- Manufacturing IP rose 7.2% in June, reflecting gains in every major industry. Of note was a large increase in motor-vehicle assemblies that contributed to a 105% increase in IP of motor vehicles and parts. Outside of this industry, manufacturing IP rose 3.9%.

- Even with the healthy increase of IP in June, its level was still 10.9% below the pre-pandemic (February) level, and the second-quarter average of IP was 42.6% below the first-quarter average at an annual rate.

- Furthermore, while the momentum in IP heading into the third quarter is good, further gains will be hampered by the rising trend in new infections of COVID-19. California has already reversed its reopening and other states could follow suite. Furthermore, a reemergence of widespread caution on the part of consumers could negatively feed back into production.

- Mining output declined 2.9% in June, continuing a slide that began in February. The June reading reflected declines in oil-and-gas extraction (1.7%), other mining (3.9%), and support activities for mining (17.6%).

- IP of electric and gas utilities rose 4.2% in June reflecting increases in both electric power (4.6%) and natural gas (2.1%).

- The index of US import prices increased 1.4% month on month

(m/m) in June following a 0.8% rise in May, marking the largest

monthly increase since March 2012. The index's 12-month growth rate

rose 2.4 percentage points to -3.8%. (IHS Markit Economist Gordon

Greer)

- The index of nonfuel import prices increased 0.3% m/m in June, while its 12-month growth rate came in flat.

- Fuel import price growth continued to rise after tumbling down from January to April. The index of prices for imported fuel jumped 21.9% m/m in June after a 15.4% May increase. This was the largest monthly change on record. The cost of imported fuel was down 36.4% versus June in the prior year.

- Export prices rose 1.4% m/m in June, with the 12-month growth rate rising 1.8 percentage points to -4.4%. The increase was driven by prices for agricultural and nonagricultural exports.

- American Airlines said in a letter to employees Wednesday that it expects to have 20,000 more employees than it needs this fall. The Fort Worth, Texas-based carrier sent notices for potential furlough to 25,000 of its employees as stipulated by federal labor laws. The figure includes airport and technical operations workers who could be shifted to other locations, the airline said. (WSJ)

- UnitedHealth Group Inc. UNH saw profits rise sharply because of savings from surgeries, hospital stays and doctor visits canceled amid the coronavirus pandemic, but the company said that health care returned to near-normal levels in recent weeks. (WSJ)

- Fisker has announced a deal with Spartan Energy, a special purpose acquisition company, to enable the electric vehicle (EV) startup to become a publicly traded company. Separately, reports indicate that Fisker is in talks with Volkswagen (VW) to gain access to VW's MEB platform. In the announcement, the Spartan deal is referred to as a "business combination" and it will result in Fisker becoming a publicly listed company. Under the deal, Fisker has a USD2.9-billion pro-forma equity value, at USD10.00 per share PIPE (private investment in public equity) price. The proposed transaction is due to be closed in the fourth quarter of 2020 and will give the new company more than USD1 billion in gross proceeds, including USD500 million in the common stock PIPE. The intention is to use the proceeds to fully fund the development of the Fisker Ocean EV. The combined company's board of directors will comprise existing Fisker board members and one designee of Apollo Global Management, which sponsors Spartan Energy. Spartan's board reportedly unanimously approved the deal on 15 July. Separately, Bloomberg reports that Fisker is in talks with VW about the possibility of using elements of VW's MEB EV platform for its upcoming sport utility vehicle (SUV). The proposed deal with Spartan has a similar structure to a transaction that Nikola completed earlier this year, which resulted in the hydrogen and EV commercial truck startup being traded on the NASDAQ stock exchange. (IHS Markit AutoIntelligence's Stephanie Brinley)

- A group of 15 US states have announced a joint memorandum of understanding (MoU) to increase the use of electric medium- and heavy-duty commercial vehicles (MHCV) and phase out diesel engines by 2050. The voluntary initiative requires manufacturers to sell increasing numbers of zero-emission MHCVs starting in 2024, and for nearly all large trucks to be electrified by 2045. According to a Reuters report, the vehicles include large pick-up trucks and vans, delivery trucks, box trucks, school and transit buses and long-haul delivery trucks. The target is for all new MHCVs sold in 2050 to be zero-emission and 30% of sales by 2030. California, Colorado, Connecticut, Massachusetts, Hawaii, New Jersey, New York, North Carolina, Oregon, Pennsylvania, Washington and Vermont are among the states participating. These states are in the initial stages, at this point agreeing to develop a plan within six months to identify barriers and propose new solutions to support widespread electrification. The plan could include incentives and ways to boost electric vehicle (EV) infrastructure, according to Reuters. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In the July Monetary Policy Report the Bank of Canada provided

a central scenario, not a baseline estimate, for Canada's real GDP

in which real GDP declines 7.8% this year and grows 5.1% in 2021

and 3.7% in 2022. The central scenario annual inflation outlook has

consumer prices gradually increasing but staying below 2% through

2022. (IHS Markit Economist Arlene Kish)

- There were no interest rate changes by the Bank of Canada, as expected.

- The Bank of Canada has committed to the large-scale asset-purchase program, purchasing at least $5 billion of Government of Canada bonds per week.

- The greater transparency provided by the Bank in terms of the economic and inflation outlook aligns closely with the IHS Markit view that the rebound in 2021 will be subdued and that monetary policy points to interest rates remaining unchanged until 2023. The next policy announcement is scheduled on 9 September.

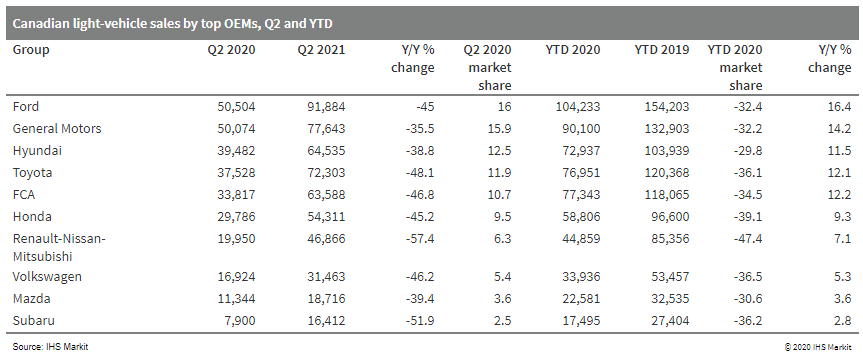

- Canadian light-vehicle sales were impacted by the COVID-19

pandemic more strongly in the second quarter than the first

quarter, as expected, declining 44.7% year on year (y/y) to 314,838

units during April to June. Passenger car sales dropped 56.8% y/y

and light commercial vehicle (LCV) sales fell 39.9% y/y in the

second quarter.

- Regardless of the impact of COVID-19, Canada continues to be a truck-heavy market, with the Ford F-Series easily being the best-selling product, followed by the Ram 1500, GMC Sierra, and Chevrolet Silverado. Those four products accounted for a combined 21.4% of sales in the second quarter of 2020, compared with 17.7% in second quarter of 2019.

- The traditional market dominance of D-segment vehicles (large cars) in Canada has been tested since 2017, and in 2019, C-segment (medium sized cars) sales ended the year with a 22,215-unit lead.

- In 2020, however, D-segment vehicle sales have pulled ahead, both in the second quarter and in the year to date (YTD). In second quarter, D-segment sales were ahead by about 14,600 units.

- The source of the change is the popularity of the C-sport utility vehicle (SUV) segment and strong performances of D-pick-up (PUP) sales in supporting the D segment's lead in 2020.

- Pick-up sales easily represent the largest proportion of D-segment sales and the D-PUP segment is the second largest segment overall, with an 18.6% market share in 2019, despite a 1.1% y/y decline in volume.

- In the second quarter of 2020, the D-PUP segment's market share increased to 23.2%, from 19% in the second quarter of 2019. In the YTD in 2020, the D-PUP segment's market share is 22.3%. D-PUP sales declined 32.9% y/y in the second quarter and 22.7% y/y in the YTD.

- In the second quarter, D-PUP sales were higher than C-SUV sales by about 4,700 units. C-SUV sales dropped 47.9% y/y in the second quarter and 37.6% y/y in the YTD.

- In the YTD, the C-SUV segment's market share of 22.5% is barely

ahead of that of the D-PUP. In the YTD, C-SUV sales are less than

1,300 units ahead of D-PUP sales.

- Argentina's Minister of Public Works Gabriel Katopodis said on 12 July that the government is preparing a plan to relaunch public works in 2021 to reactivate the economy once the coronavirus disease 2019 (COVID-19)-virus outbreak abates. A detailed plan will be submitted to Congress with next year's budget in September and will be financed by unexecuted loans that multilateral entities extended to the previous government of Mauricio Macri. Public works have been virtually paralyzed since Macri suspended a public-private partnership (PPP) scheme in 2018 amid Argentina's growing financial and economic stress and the country's lack of access to financing. The government's public works plan is unlikely to use PPPs and, instead, is likely to be based on state-financed concessions, as under pre-Macri governments. Major infrastructure projects, such as new highways, are unlikely given Argentina's poor financial situation and lack of access to financing, with the country remaining in technical default while negotiating with bondholders; IHS Markit forecasts a GDP contraction of 12.4% in 2020 and 1.5% in 2021. (IHS Markit Country Risk's Carla Selman)

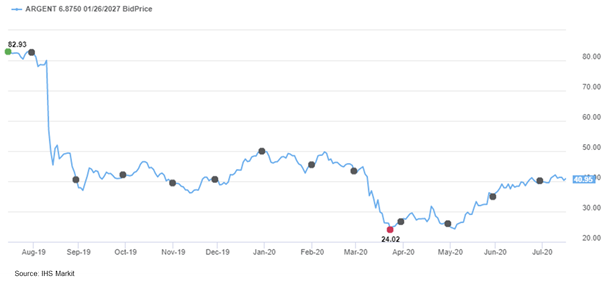

- The below Price Viewer screen shows the one year price history

for the Argentine Republic's 6.875% 1/2027 bond issue:

Europe/Middle East/ Africa

- Most European equity markets closed higher; Italy/France +2.0% and Germany/Spain/UK +1.8%.

- 10yr European govt bonds closed mixed; UK/Spain +2bps, Germany/France flat, and Italy -1bp.

- iTraxx-Europe closed -1bp/61bps and iTraxx-Xover -8bps/368bps.

- Brent crude closed +2.1%/$43.79 per barrel.

- According to the Office for National Statistics (ONS), UK

consumer price inflation edged up to 0.6% in June, the first

increase since January. It had fallen to 0.5% in May 2020, its

lowest level since June 2016, to sit well below the Bank of England

(BoE)'s inflation target of 2.0%. (IHS Markit Economist Raj

Badiani)

- Falling automotive fuel prices were again a major drag on the overall inflation rate in June 2020. Specifically, fuel and lubricant prices dropped by 16.4% year on year (y/y) after a 16.7% y/y fall in May. The lever was tumbling crude oil prices, with Dated Brent falling for a fifth successive month, plunging by 37.4% y/y to average USD40.27 per barrel (pb) in June.

- Clothing and footwear prices continued to evolve weakly, down by 2.2% y/y in June. Overall, these prices have fallen in 13 of the past 18 months, which illustrates continued pressure on some retailers to price generously to attract absent consumers.

- Furniture, household equipment, and maintenance price inflation remained negative. Specifically, the annual rate of change decelerated for the sixth straight month, standing at -0.5% in June. This illustrates the already-difficult retail trading conditions made more precarious by the closure of non-essential retail premises in April and May to combat the spread of the coronavirus disease 2019 (COVID-19) virus.

- The ONS reported that games, toys, and hobbies, particularly computer games and computer games consoles, were the largest contributors to the slight pick-up in the inflation rate in June.

- All-services price inflation was at 1.8% in June (down from 1.9% in May), and -0.5% (up from -0.9% in May) for all goods.

- Core inflation, excluding energy, food, alcoholic beverages, and tobacco prices, rose to 1.4% after falling in the previous three months.

- A group of companies in the United Kingdom have called on the government to pull forward its commitment to end the sales of non-zero-emission light vehicles to 2030. In a statement, the UK Electric Fleets Coalition, run by The Climate Group, has asked for this to take place as part of a package of wider measures. As well as making the push for 100% of new car and van sales to be fully electric by 2030 (with exceptions for the small number of vehicles where this may not be possible), it has also suggested a mandate to require vehicle manufacturers to produce an annually increasing percentage of zero-emission vehicles. Furthermore, to stimulate demand in the near term, the group has said that the government should extend grants for battery electric vehicles (BEVs) and charging points until at least 2022, when BEVs are expected to start competing on price with conventional vehicles. It has is also looking to the government to increase the roll-out of public charge-points across the UK for use by any payment system. (IHS Markit AutoIntelligence's Ian Fletcher)

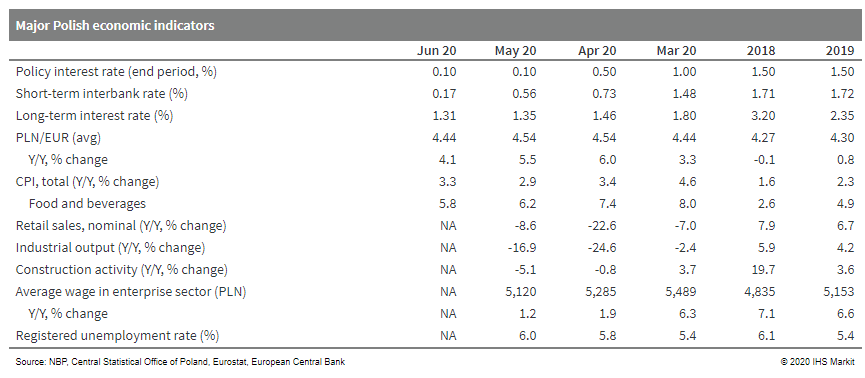

- As expected, Poland's Monetary Policy Council (MPC) kept the

policy interest rate stable at a historical low of 0.1% during its

session on 14 July, while committing to a continuation of the

quantitative easing (QE) program that was launched in March to

support recovery from the COVID-19 virus crisis. The country's QE

program includes the purchase of government securities and

government-guaranteed debt securities on the secondary market, and

the timing and scale of the operations are being determined by

market conditions. (IHS Markit Economist Sharon Fisher)

- The National Bank of Poland (NBP) is also offering discount credits to refinance commercial bank loans granted to enterprises, similar to the European Central Bank's targeted long-term refinancing operations (TLTRO).

- Interest rates remain unchanged despite an upswing in inflation, which jumped 3.3% year on year (y/y) and 0.7% month on month (m/m) in June, despite a slight drop in the food and beverages category. NBP's new quarterly forecast projects that price growth will fall below 2% in 2021-22 (after rising 3.3% in 2020), signalling that inflation is not viewed as a problem.

- The new forecast is surprisingly pessimistic about Poland's 2020 GDP growth outlook, projecting a 5.7% decline (versus +3.2% in the March projection). The new forecast is below the June Consensus figure (at -4.2%) and the latest IHS Markit projection (at -4.7%).

- The MPC assesses that the zloty's lack of adjustment following the recent monetary measures (including deep interest rate cuts and extensive QE) may be slowing the economic revival. After weakening at the start of the pandemic, the currency has since strengthened, reaching an average of PLN4.44/EUR1.00 in June.

- Despite a steep drop in exports, Poland's external balances show few signs of strain, as imports have also fallen. Data for the first five months of 2020 indicate that the country's current-account surplus is surging this year, benefitting from improving balances on the goods and income accounts.

- Although the Polish economy appears to be on the path towards

recovery, near-term risks remain elevated, especially if the

country experiences a second wave of the pandemic this autumn.

Poland has already been struggling to bring down daily numbers,

having experienced outbreaks in several regions.

- Multimodal shared mobility firm GoTo Global has raised USD19 million in a Series B funding round, reports TechCrunch. Adam Neumann, former chief executive (CEO) of WeWork, has invested USD10 million as part of the round and in return has received a 33% equity stake in GoTo Global. The company will use the fresh capital to expand its services into Europe, beginning with Madrid (Spain). Gil Laser, GoTo Global's CEO, said, "Shared mobility, and transportation in general, was one of industries hit hard by the economy lock-downs as people were required to self-isolate. But we are the ones who made the come-back fastest, we are +12% back to pre-lockdown baseline." (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Most APAC equity markets closed higher except for China -1.6%; Australia +1.9%, Japan +1.6%, South Korea +0.8%, India +0.1%, and Hong Kong flat.

- The Bank of Japan (BoJ) left its monetary policy unchanged at

its 14 and 15 July monetary policy meeting. The BoJ will continue

quantitative and qualitative monetary easing (QQE) with yield curve

control. The bank also maintained the pace of its asset purchasing

and special lending program to support financing in response to the

COVID-19 virus pandemic. (IHS Markit Economist Harumi Taguchi)

- The decision reflected stability in financial markets and improved economic activity following the lifting of the state of emergency, although business conditions remain severe. Despite a downward revision to the forecast range for real GDP in fiscal year (FY) 2020, the BoJ expects Japan's economy to improve gradually. However, the pace is expected to be only moderate because of the ongoing global negative effects of the pandemic.

- While the BoJ expects inflation to turn positive and increase gradually once the negative effects of the pandemic and the past decline in crude oil prices ease, the median of consumer price forecast ranges (all items less fresh food; year-on-year changes) remained modest at 0.7% even in FY 2022, below the bank's inflation target of 2.0%.

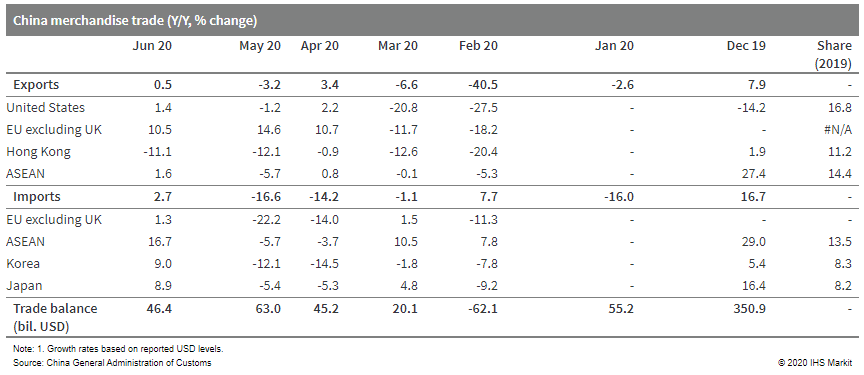

- China's merchandise exports rose 0.5% year on year (y/y) in

June in USD terms, following a contraction of 3.2% in May and

returning to the full-year level in 2019, according to the General

Administration of Customs (GAC). (IHS Markit Economist Yating Xu)

- Merchandise imports increased by 2.7% y/y in USD, jumping up from a 16.6% y/y contraction in May and the first expansion since the beginning of this year.

- China's strong exports of pandemic prevention supplies remained the main driver for June exports, contributing to 5 percentage points of headline growth.

- Exports of textiles (including facemasks) rose by 56.7% y/y in June, slowing from a 77.3% y/y expansion in May; the growth in medical equipment exports accelerated for a third consecutive months to 100% in June from May's 88.5% y/y increase.

- The exports of electronic products improved from 2.3% y/y contraction in May to 1.6% y/y expansion and high-tech product exports remained in expansion.

- Benefited from eased restrictions abroad, exports of labor-intensive consumption goods, such as clothes and furniture contracted at a slower pace.

- By country, business recovery in the US led its purchase to rise by 1.4% y/y, exports to ASEAN improved to 1.6% y/y and exports to the EU (excluding UK) grew 10.5% y/y. However, exports to Japan and Korea declined by 10.5% and 3.9% y/y respectively.

- Besides low-base effect, continuous recovery in domestic economy, strong rebound of imports from the US and price rise contributed to import recovery in June.

- Imports from the US rose by 11.3% y/y in June, up 24.9 percentage points from May. Particularly, the quantity of soybean imports grew 71.4% y/y. Meanwhile, commodities, such as crude oil, iron ore, and copper imports all registered sharp y/y increase in volume and m/m rise in price.

- Strong recovery of imports led trade surplus declining to USD46.4 billion in June compared to USD63 billion in May. The trade surplus rose 49% y/y in the second quarter, compared to an 82% y/y contraction in the first quarter.

- Exports in the first half declined by 6.2% y/y, imports

contracted by 7.1% y/y.

- ChemChina (Beijing), owner of recently launched, enlarged Syngenta Group (Basel, Switzerland), is in talks with potential investors including China Investment Corp. for a stake in Syngenta before an initial public offering (IPO) of Syngenta shares, according to Bloomberg citing people familiar with the matter. Bloomberg says ChemChina has also approached Silk Road Fund (Beijing) to invest in Syngenta. ChemChina aims to complete Syngenta's pre-IPO financing before the end of this year, followed by a listing on Shanghai's Star board for high-technology companies next year, Bloomberg says. Syngenta says it is focused on being ready for an IPO by mid-2022. ChemChina bought Syngenta in 2017 for $43 billion, making it China's biggest foreign takeover to date. The main aim was to use Syngenta's crop protection and seeds technologies to improve domestic agricultural output. ChemChina last month officially launched the new Syngenta Group, which combined Syngenta AG, headquartered in Switzerland; Adama, based in Israel; and the agricultural businesses of Sinochem, based in China. The new entity has 48,000 employees in more than 100 countries and had sales of $22.58 billion in 2019. The crop protection business had sales of $10.499 billion; Adama, $3.997 billion; Syngenta seeds, $3.084 billion; and Syngenta Group China, $4.996 billion. Syngenta is the global market leader in crop protection products, the global number three in seeds, the market leader in fertilizer in China, and the leading agriculture services provider in China. It operates 15 key production sites. Meanwhile, the previously announced megamerger, which was to combine ChemChina with Sinochem to create one of the world's largest chemical conglomerates, last year hit difficulties and the two companies reportedly abandoned those plans.

- Chinese electric vehicle (EV) startup Lixiang, formally registered as Li Auto, is planning an initial public offering (IPO) in the United States, reports Reuters, citing a filing with the US Securities and Exchange Commission (SEC). The startup intends to list its shares on the NASDAQ stock exchange under the symbol 'LI'. The company has yet to announce the price range of the IPO. Currently, Li Xiang, founder and chairman of Li Auto, holds 25.1% of the company's shares and is its biggest shareholder. Wang Xing, co-founder and CEO of Meituan Dianping, one of the largest e-commerce platforms in China, holds 23.5% of Li Auto's shares and is its second largest shareholder. Li Auto intends to take forward its plan to list in the US at a time when local EV startups face sluggish sales in the Chinese market. Li Auto began deliveries of its first model, the Li One, in the fourth quarter of 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- National Applied Research Laboratories (NARLabs) has teamed up with TUV Rheinland to ensure that autonomous vehicles (AVs) in Taiwan meet international standards. Taiwan CAR (Connected, Autonomous, Road-test) Lab of the NARLabs will provide a closed facility in Tainan (Taiwan) for AV companies to test in a mixed traffic real-time environment on a closed course. TUV Rheinland will design safety standards and certification requirements for AVs. Wallace Pan, general manager, new business development of mobility division at TÜV Rheinland, said, "In the future, cars will be like a mobile phone on wheels. The increasing maturity of Internet-of-Vehicles technology means most cars will be able to connect to the Internet. At the moment there are two main types of connectivity technologies: DRSC and C-V2X. Since C-V2X is compatible with 5G, we expect it to replace DRSC one day. Autonomous vehicles need to go through a series of tests before they can touch the road". Significance: Introduction of international standards will boost Taiwan's AV industry. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Automotive Research & Testing Center (ARTC) has developed Taiwan's first autonomous electric minibus, the WinBus, in collaboration with more than 20 industry groups. WinBus has Level 4 autonomous driving capabilities and is deployed with three positioning systems. The bus will conduct a public trial along a 7.5 km route in country's Changhua Coastal Industrial Park, reports the Taipei Times. Following this trial, more autonomous vehicles (AVs) will be tested on the route, which is expected to expand to 12.6 km. The WinBus project received a grant of TWD40 million (USD1.26 million) from the Department of Industrial Technology (DOIT) of the Ministry of Economic Affairs (MOEA). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hyundai Motor Group aims to capture 10% of the global electric vehicle (EV) market by selling 1 million EVs in 2025, reports Yonhap News Agency, citing the automotive group executive vice chairman Chung Euisun. In a bid to achieve its aim, the automaker aims to invest more in future mobility and introducing more EV models. "The year 2021 will be the first year of Hyundai Motor Group's leapfrog to become a leader in the EV markets. Next year, a next-generation EV model equipped with an EV-only platform will be launched," said Euisun. The latest announcement was part of the South Korean President Moon Jae-in's 'Green New Deal' aimed at reducing country's heavy reliance on fossil fuels. A Reuters report highlights that the South Korean government aims to have 1.13 million EVs and 200,000 fuel-cell electric vehicles (FCEVs) on the country's road by 2025, up from 91,000 EVs and 5,000 FCEVs at the end of 2019. (IHS Markit AutoIntelligence's Jamal Amir)

- Reliance Industries says that due to unforeseen circumstances in the energy market as well as COVID-19, its talks with Saudi Aramco to form an oil-to-chemicals (O2C) partnership have not progressed according to the original timeline. Mukesh Ambani, chairman and managing director of Reliance, said during the company's annual shareholders' meeting on Wednesday that Reliance would approach the National Company Law Tribunal (Delhi, India) with a proposal to spin off its O2C business into a separate subsidiary to facilitate a partnership with Aramco. Ambani said he expects the spin-off to be completed by early 2021 but did not provide a date for the partnership with Aramco, which was originally due to be completed in March 2020. Ambani said that Reliance remains "committed to a long-term partnership" with Aramco. However, he did not say whether this would involve Aramco buying a stake in the O2C business, as previously announced. Aramco had been planning to buy a 20% stake in the O2C division for $15 billion, according to a nonbinding agreement reached in August 2019. However, the collapse in crude oil prices this year has complicated asset valuations and caused analysts to question whether the deal will go ahead, analysts say. Press reports in India say the deal is frozen.

- A 50/50 joint venture between Saipem and Clough has been selected as the preferred EPC contractor for Perdaman Industries' urea plant on Western Australia's Burrup Peninsula. Final investment decisions will be taken in 2021. The scope of work includes engineering, construction, pre-commissioning, and commissioning of an ammonia and urea plant, including engineering, procurement, and construction for all site civils, process plant, utilities, urea handling, storage and loadout, storage facilities, and site buildings. The facility will consist of the urea fertilizer plant and related facilities, with a capacity of 2 million metric tons of urea per annum. The facility includes a water treatment plant, a 100 MW power plant, urea storage, and loading and unloading facilities. A closed conveyer will transport the urea 7 km directly to the Pilbara Ports Authority for shipping to local and offshore markets, with 50-100 shiploads expected per year. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- In a press release, Woodside Petroleum reported second quarter 2020 production of 25.9 MMboe, up 50% from the year-ago period and up 7% from the last quarter. The increase was primarily due to strong LNG and liquids production, partially offset by weak domestic gas and LPG production, the company said. Second quarter 2020 sales revenue was $768 million, down 29% from $1,076 million in the prior quarter and down 8% from $838 million in the year-ago period. Capex totaled $340 million in three months ended June 2020, compared with $299 million a year ago. On 14 July 2020, Woodside announced $3.92 billion ($2.76 billion for oil and gas properties and $1.16 billion for exploration and evaluation assets) of post-tax impairment losses in the first half of 2020. About 80% of the oil and gas properties impairment losses were primarily due to the significant and immediate reduction in oil and gas prices assumed up to 2025, the company said. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.