Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 11, 2021

Daily Global Market Summary - 11 June 2021

All major European and most US equity indices closed higher, while APAC was mixed on Friday. US government bonds closed slightly lower and benchmark European bonds were sharply higher. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar, oil, natural gas, silver, and copper closed higher, while gold was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

1. Most major US equity indices closed higher except DJIA closing

flat; Russell 2000 +1.1%, Nasdaq +0.4%, and S&P 500 +0.2%.

2. 10yr US govt bonds closed +1bp/1.45% yield and 30yr bonds

+1bp/2.14% yield.

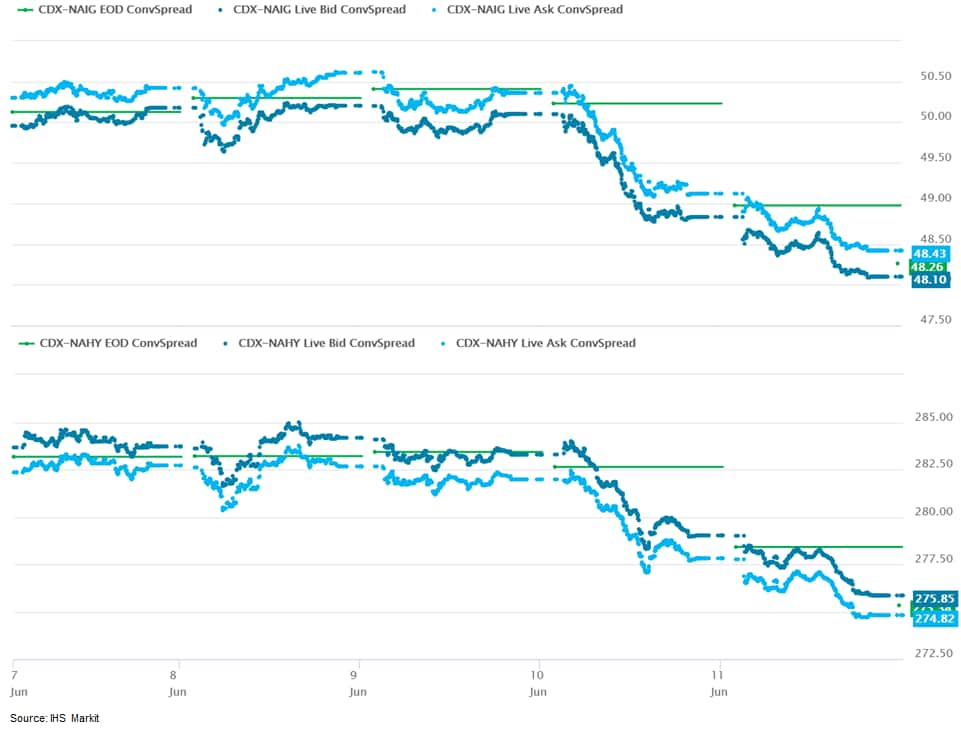

3. CDX-NAIG closed -1bp/48bps and CDX-NAHY -3bps/275bps, which is

-2bps and -8bps week-over-week, respectively.

4. DXY US dollar index closed +0.5%/90.56.

5. Gold closed -0.9%/$1,880 per troy oz, silver +0.4%/$28.15 per

troy oz, and copper +1.2%/$4.54 per pound.

6. Crude oil closed +0.9%/$70.91 per barrel and natural gas closed

+4.7%/$3.30 per mmbtu.

7. The US University of Michigan Consumer Sentiment Index rose 3.5

points (4.2%) to 86.4 in the preliminary June reading, erasing a

portion of a 5.4-point decrease in May. The reading suggests that

consumers have not lost confidence in the recovery despite rising

prices, and is consistent with our expectation for robust consumer

spending growth in the second quarter. (IHS Markit Economists David

Deull and James

Bohnaker)

a. The June increase in consumer sentiment was driven mainly by

expectations, the index for which rose 5.0 points to 83.8, a new

pandemic-era high. The index measuring views on the present

situation rose 1.2 points to 90.6.

b. Supporting the increase in expectations was a record high in the

proportion of respondents expecting a further decline in the

unemployment rate. The mean expected probability of an increase in

respondents' personal income rose to 54%, just short of its

pandemic-era high.

c. The expected one-year inflation rate stepped back to 4.0% from a

reading of 4.6% the prior month. The expected 5-to-10-year

inflation rate fell 0.2 percentage point to 2.8%. Despite this

moderation, prices remain highly salient to consumers; the measure

of net negative references to prices of homes, autos, and durable

goods was the most pronounced since 1974.

d. The increase in consumer sentiment was expressed entirely by

upper-income households. The index of sentiment for households

earning more than $75,000 a year rose 5.9 points to 92.8, while

sentiment for households earning less fell by 1.1 points to 78.2,

the lowest since February.

e. Views on buying conditions for big-ticket items worsened to

multidecade lows in June. The index of buying conditions for large

household durable goods rose 5 points to 116, but that of vehicles

fell 11 points to 89, while that of homes dove 16 points to 74.

Both were the lowest since 1982.

f. Price pressures remain concerning for consumers, especially

those with low incomes, but tight labor markets and equity markets

scraping record highs are supporting expectations for continued

recovery.

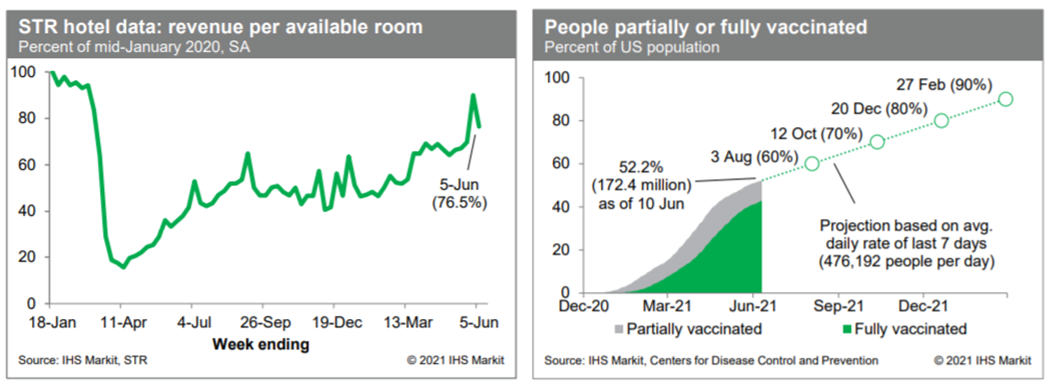

8. Revenues at US hotels last week, after seasonal adjustment, were

about 76.5% of the mid-January 2020 level (our estimate based on

weekly data from STR). This is down from the prior week, likely

reflecting volatility due to the timing of the Memorial Day

weekend. Still, averaged over the last two weeks, hotel activity is

up considerably from earlier in the spring. Meanwhile, averaged

over the last seven days, about 476,000 people per day received a

first (or only) dose of a COVID-19 vaccination, down somewhat from

an average daily rate of about 482,000 per day over the prior week.

As of yesterday, 172.4 million US residents, or about 52% of the

population, were at least partially vaccinated against COVID-19. At

the current rate, the US would achieve widespread vaccination

(70-80%) by this fall. (IHS Markit Economists Ben

Herzon and Joel

Prakken)

9. Three members of the US FDA's Peripheral and Central Nervous

System Drugs Advisory Committee have now resigned in protest at the

agency's decision to approve US firm Biogen's Aduhelm

(aducanumab-avwa) for Alzheimer's disease (AD). The first member to

resign was Dr Joel Perlmutter, a neurologist from the Washington

University School of Medicine in St. Louis. His resignation was

shortly followed by those of Dr David Knopman, who is a clinical

neurologist from the Mayo Clinic, and Dr Aaron Kesselheim, who is a

professor of medicine at Harvard Medical School. According to CNBC,

Kesselheim's resignation letter described Aduhelm's approval as

"probably the worst drug approval decision in recent US history".

The resignation letter also claimed that the FDA is not "presently

capable of adequately integrating the Committee's scientific

recommendations into its approval decisions", and that Aduhelm's

approval "will undermine the care of [AD] patients, public trust in

the FDA, the pursuit of therapeutic innovation, and the

affordability of the health care system". (IHS Markit Life

Sciences' Milena

Izmirlieva)

10. US almond shipments in the first 10 months of the 2020-21 crop

year (August 2020-May 31 2021) reached a record level of 2.448

billion pounds, more than has been shipped in any year in 12

months. (IHS Markit Food and Agricultural Commodities' Julian

Gale)

a. In his monthly letter to industry members, Richard Waycott,

president and chief executive of the ABC, remarked: "All regions of

the world performed well during the month. Increases in western

Europe were led by Spain, Italy and the Netherlands. In the Middle

East, the UAE, Turkey and Saudi Arabia experienced strong demand.

Asian shipments were boosted by higher imports in China, Vietnam,

Japan and a more modest increase in India. Morocco continued to

amaze importing over 11 million pounds in the month, up from 2.3

million pounds last year."

b. The May position report from the Almond Board of California

(ABC) showed that domestic shipments last month were at 69.89

million pounds versus 57.15 million pounds in May 2020.

c. This brought domestic shipments for the 10-month period to

671.94 million pounds, 3.7% up from the 647.6 million pounds

reached in the August 2019-May 31 2020 period.

d. Export volumes reached 149.51 million pounds this May compared

with 96.73 million pounds in the same month a year ago, bringing

the seasonal export total to 1.77 billion pounds from 1.37 billion

pounds in the first 10 months of 2019-20 - an increase of

29.7%.

e. The total shipments of 2.448 billion pounds were 21.4% up from

2.016 billion pounds achieved in August 2019-May 31, 2020.

11. Beep, in partnership with Local Motors, has launched autonomous

shuttle trials at Yellowstone National Park in the United States,

according to a company statement. These trials form part of an

autonomous shuttle program, called T.E.D.D.Y (The Electric

Driverless Demonstration in Yellowstone), to test the feasibility

and sustainability of autonomous mobility. The autonomous shuttle

Olli, developed by Local Motors, will travel on two routes until 31

August, gathering important information such as ridership, route

optimization, and overall vehicle operations. (IHS Markit

Automotive Mobility's Surabhi Rajpal)

12. Waymo has partnered with transportation logistics company J.B.

Hunt to launch an autonomous truck pilot in Texas, United States,

according to a company statement. Under this partnership, Waymo

Via, the company's trucking and cargo transportation service, will

be autonomously hauling freight on the I-45 corridor between

facilities in Houston and Fort Worth for one of JB Hunt's

customers. The trucks will be powered by the Waymo Driver

autonomous platform, although a commercially licensed driver and a

software technician will be on-board to monitor operations. (IHS

Markit Automotive Mobility's Surabhi Rajpal)

Europe/Middle East/Africa

1. Most major European equity indices closed higher; France +0.8%,

Germany +0.8%, Spain +0.8%, UK +0.7%, and Italy +0.3%.

2. 10yr European govt bonds closed higher; Italy -5bps, UK -4bps,

France/Spain -3bps, and Germany -2bps.

3. iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -5bps/231bps,

which is -2bps and -13bps week-over-week, respectively.

4. Brent crude closed +0.2%/$72.69 per barrel.

5. Bank for International Settlements (BIS) Thursday (10 June)

started a consultation regarding capital treatment for banking

sector exposures to crypto-currency assets, proposing the maximum

1,250% capital weighting for unregulated mechanisms. The BIS's

proposals, open for consultation until 10 September, suggest two

categories for crypto-assets. Those in Group 1 must meet four

conditions (IHS Markit Economist Brian

Lawson):

a. First, they must be either a tokenized traditional asset or be

permanently linked within narrow boundaries to a traditional

asset.

b. Second, they must be subject to a clearly defined and

enforceable legal framework within a specified jurisdiction.

c. Third, they must be designed and operated in a way to "manage

any material risks", including the provision of "robust risk

governance and risk control policies" in areas such as anti-money

laundering (AML)/combating the financing of terrorism (CFT) and

fraud, alongside operational risk and credit, market, and liquidity

controls.

d. Fourth, entities that operate the crypto-asset must be subject

to official regulation and supervision.

6. The Office for National Statistics (ONS) reports that the UK

economy grew by 2.3% month on month (m/m) in April, after a 2.1%

m/m gain in March. (IHS Markit Economist Raj

Badiani)

a. GDP shrank by 1.5% quarter on quarter (q/q) in the first three

months of 2021.

b. GDP was still 3.8% below the level before the first

COVID-19-related lockdown in February 2020.

c. The figure for April this year was marginally below the market

consensus, which had predicted a 2.4% m/m gain during the

month.

d. A breakdown by type of output reveals that the services sector

increased by 3.4% m/m in April but was still 4.1% lower than the

February 2020 level.

e. Consumer-facing services grew by 12.7% m/m as COVID-19-related

restrictions eased throughout April, returning to a level last seen

during their initial recovery peak in October 2020.

f. Retail sales volumes grew by 9.2% m/m in April, lifted by the

reopening of all non-essential retail from 12 April in England and

Wales and from 26 April in Scotland.

g. Meanwhile, accommodation and food and beverages service

activities grew by 68.6% m/m and 39.0% m/m, respectively. A key

change was that pubs, restaurants, and cafés were able to serve

customers in outdoor seating areas from 12 April. Other personal

service activities (including hairdressing) grew by 63.5% m/m in

April as hairdressing reopened in England on the same day.

h. The ONS reports that consumer-facing services were 5.9% below

their pre-pandemic levels (February 2020), while all other services

were 3.7% below their pre-pandemic levels.

7. Daimler AG, BASF, Fairphone, and Volkswagen Group have created a

partnership, the German Society for International Cooperation

(Deutsche Gesellschaft fur Internationale Zusammenarbeit: GIZ), to

bring together stakeholders to ensure responsible lithium mining in

Chile's Sala de Atacama watershed. According to a joint press

statement, the partnership "intends to foster a dialogue among

local stakeholders, generating and synthesizing scientific facts

and seeking solutions in a participatory manner". According to the

statement, the world's largest lithium reserves and a large part of

lithium production are in this area of Chile, but the region's

ecosystem is fragile. The group states that there is a lack of

consensus on the impacts and risks of lithium mining and economic

activity in the region, with particular concern over shifts in the

water and brine tables. (IHS Markit AutoIntelligence's Stephanie

Brinley)

8. French payroll employment rose by 89,000, or 0.3% quarter on

quarter (q/q), during the first quarter of 2021, according to

figures released by the National Institute of Statistics and

Economic Studies (Institut national de la statistique et des études

économiques: INSEE). This followed a decline of 0.1% during the

final three months of 2020. (IHS Markit Economist Diego

Iscaro)

a. Employment was driven by the private sector, which added nearly

89,000 new jobs during the first quarter (+0.5% q/q).

b. The construction sector added around 20,000 new jobs (+1.4%

q/q), while employment in the manufacturing sector was stable.

Employment in the service sector rose by 48,000 (+0.4% q/q).

c. Despite the first-quarter rise, employment in the private sector

remains 243,400 below its level during the fourth quarter of 2019.

Only employment in the construction sector is higher than before

the pandemic. On the other hand, employment in the public sector

declined by 2,700. Public-sector employment has still increased by

33,600 since the start of the pandemic.

9. The Italian government is spearheading a program that will

commit EUR1 billion (USD1.22 billion) of funding to the

construction of a 'Gigafactory' to make battery cells for battery

electric vehicles (BEVs), according to a Reuters report. As part of

this initiative, the Italian government has sent a proposal to the

European Union (EU) to access EUR600 million from its EU Recovery

Funds aimed at boosting economic growth across the bloc in the

post-COVID-19 environment. However, according to Italian government

sources, the state is looking to bolster this figure to over EUR1

billion through private investment, with Stellantis being at the

center of these plans. (IHS Markit AutoIntelligence's Tim

Urquhart)

10. CBD of Denver, listed on the US OTC exchange, has started to

build a factory in its Swiss headquarters, focused on warehousing

its products for the European markets. The plant will have a

processing capacity of 24 tons of hemp annually, producing CBD

products with European hemp. "We were dependent on external

partners and with this expansion we are improving our service," the

sales manager of CBD of Denver, Pascal Siegenthaler, said. The

company produces and commercializes CBD products with its Rockflowr

and BlackPearlCBD brands. Its revenues totaled USD30 million, 22%

more year-on-year, from June 2020-May 2021. (IHS Markit Food and

Agricultural Commodities' Jose Gutierrez)

Asia-Pacific

1. Major APAC equity markets closed mixed; South Korea +0.8%, Hong

Kong +0.4%, India +0.3%, Australia +0.1%, Japan 0%, and Mainland

China -0.6%.

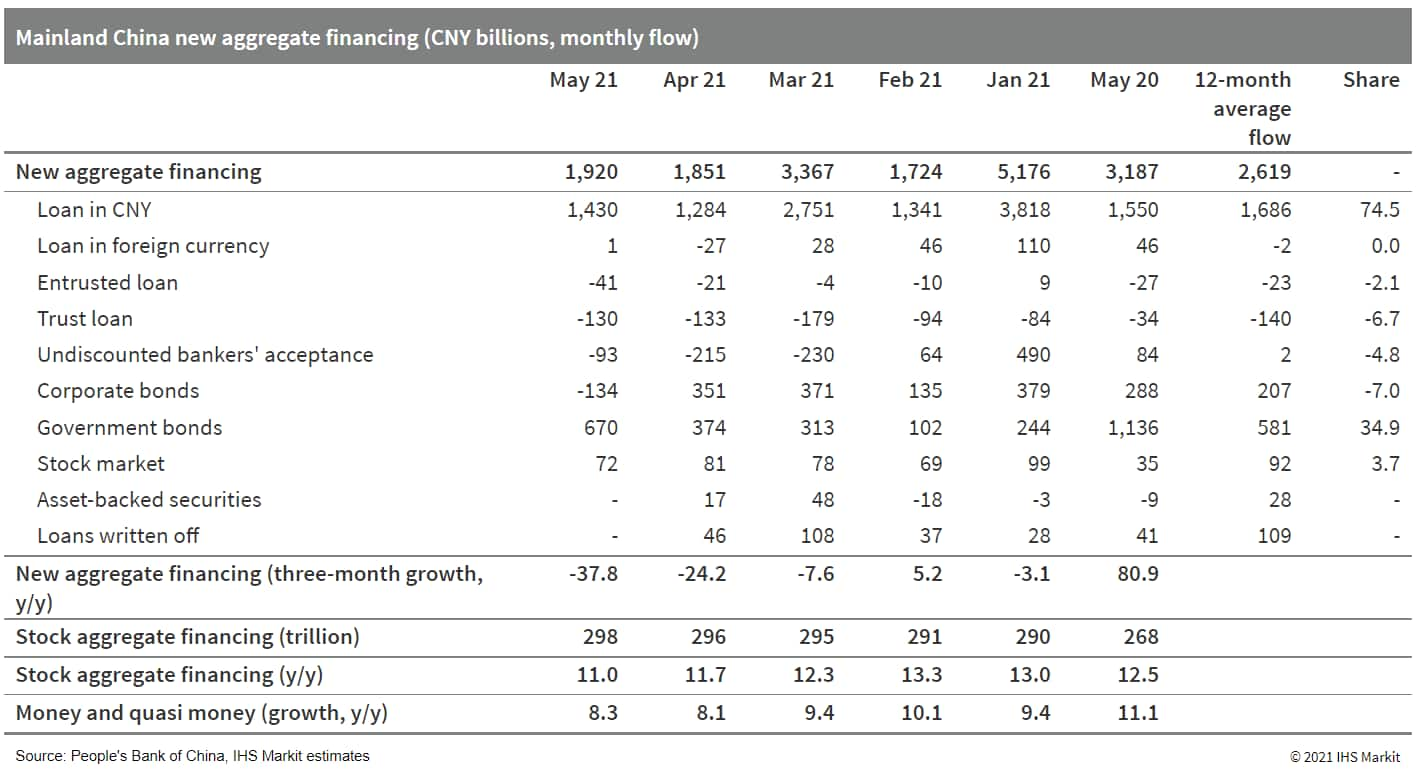

2. Mainland China's total social financing (TSF) - the broadest

measure of net new financing to the real economy - amounted to

CNY1.92 trillion (USD298 billion) in May, according to the People's

Bank of China (PBOC). Owing to the relatively high baseline, the

May TSF reading marks a year-on-year (y/y) decline of CNY1.27

trillion, although it remains higher than the comparable 2019 level

by CNY208.1 billion. Stock TSF reached CNY298 trillion in May, up

by 11.0% y/y -marking the third consecutive month of stock TSF

growth rate decline. (IHS Markit Economist Lei Yi)

a. The year-on-year new TSF decline in May was broad across

sub-categories, led by government and corporate bonds. Fiscal

spending has stayed on the lower end so far this year, and notably

the pace of special-purpose bond issuance has remained

sluggish.

b. However, government bond issuance did post a significant

month-on-month (m/m) increase in May, which may suggest a pickup in

momentum in the second half of the year. On the corporate front,

net new TSF from corporate bonds registered a negative reading in

May, the lowest reading since mid-2017; this may be the result of

the financial de-risking campaign weighing on leverage buildup,

with debt expansion of property developers and implicit local

government debt being major targets.

c. Broad money supply (M2) expanded 8.3% y/y in May, up by 0.2

percentage point from the prior month. M1 grew by 6.1% y/y, down

0.1 percentage point from April.

3. Chinese telecoms equipment giant Huawei Technologies aims to

offer driverless passenger car solutions by 2025, reports China

Daily. Wang Jun, senior executive at Huawei's smart vehicle unit,

said, "Driverless vehicles are the ultimate goal of autonomous

driving, and we are working to make passenger vehicles driverless

in 2025". (IHS Markit Automotive Mobility's Surabhi Rajpal)

4. China's ride-hailing giant Didi Chuxing (DiDi) made public its

filing for US stock market listing. According to a report by

Reuters, DiDi could raise around USD10 billion and seek a valuation

of close to USD10 billion for its initial public offering (IPO). In

its filing, DiDi revealed slower revenue growth between 2019 and

2020 due to COVID-19 pandemic-related lockdowns imposed all over

the globe. In 2020, DiDi reported revenue of CNY141.7 billion

(USD22.2 billion), down from CNY154.8 billion (USD24.2 billion) a

year earlier. Net loss in 2020 amounted to CNY10.6 billion (USD1.6

billion), compared with CNY9.7 billion (USD1.5 billion) in 2019.

However, DiDi made a solid start in 2021, as business reopened in

China. Revenue more than doubled to CNY42.2 billion (USD6.6

billion) for the quarter ending 31 March, from CNY20.5 billion

(USD3.2 billion) a year earlier. (IHS Markit Automotive Mobility's

Surabhi Rajpal)

5. Chinese electric vehicle (EV) startup AIWAYS is preparing to

enter the Italian market with local partner Koelliker Group and

plans to introduce its electric sport utility vehicle (SUV), the

U5, in the country later this year, reports electrive.com. The

automaker is said to have shipped around 2,500 vehicles to Europe

since May 2020. Alex Klose, executive vice-president of overseas

operations at AIWAYS, said, "Our exciting product and their

[Koelliker's] proven track record in sales and marketing of foreign

cars will give us the best chance of attracting Italian electric

car buyers to the Aiways brand." (IHS Markit AutoIntelligence's

Nitin Budhiraja)

6. Japan's current Business Survey Index (BSI) for large

enterprises fell by 0.2 point to -4.7 in the Business Outlook

Survey for the second quarter of 2021. The BSI for large

manufacturing declined to -1.4, marking the first negative figure

in four quarters, largely reflecting the negative effects of

semiconductor shortages on auto manufacturers. (IHS Markit

Economist Harumi

Taguchi)

a. The contractions in BSIs for manufacturing and non-manufacturing groupings narrowed for all sized enterprises, except for large manufacturing. However, the resurgence of COVID-19 and the negative impacts of the state of emergency continued to dampen business conditions for a broad range of industries, particularly for small-sized enterprises.

b. Projected sales and ordinary profits for all industries in

fiscal year (FY) 2021/22 (ending in March 2022) were revised down

to a 2.8% year-on-year (y/y) rise from a 3.2% y/y increase and to a

6.8% y/y rise from an 8.8% y/y increase, respectively, reflecting

the negative effects of supply-chain disruptions and prolonged

containment measures.

c. Fixed investment plans in FY 2021/22 for manufacturing were

revised up to a 10.7% y/y rise from a 7.9% y/y increase thanks

largely to robust plans of chemical, non-ferrous metal, production

machinery, and some other groupings. A downward revision for fixed

investment plans for non-manufacturing largely reflected weaker

plans in retail sales, real estate, and services (such as amusement

and life-related services).

7. South Korea's 'hangover-release' drinks market was worth KRW250

billion (USD225 million) in 2019, up 60% from 2016 as the previous

customer base of 30-40 year-olds has now extended to people in

their 20s. Currently, HK inno.N leads the market with its Hutgae

Condition, which has a 44% market share, followed by Grammy's Dawn

808 with 32%, and Dong-A Pharmaceutical's Morning Power with 14%.

After selling three million cans in just half a year after the

introduction of carbonated 'Kaesugang', Lotte Chilsung Beverage has

recently launched its 'Kesu Kwang Phan'. The drink contains seven

types of Jeju-derived ingredients, which are claimed to be

excellent in hangover relief, such as green tea leaves, five types

of seaweed, mandarin peel and patented hangover relief ingredients.

The company plans to establish a 'Big 5' system for these drinks.

(IHS Markit Food and Agricultural Commodities' Mainbayar

Badarch)

8. India is set to install nearly 20.2 GW of wind power capacity

through 2025, raising capacity in the world's fourth-largest wind

power market by more than 50% from the 39.2 GW currently up and

running, according to a study released 10 June. The study,

published by the Global Wind Energy Council (GWEC), and titled

India Wind Energy Market Outlook 2025, found a 10.3-GW pipeline of

projects in federal (or central) and state markets is expected to

drive installations until 2023. After 2023 though, growth is likely

be pushed forward by almost 10 GW of capacity awarded to wind

projects through mainly hybrid tenders, it said. Hybrid tenders

combine wind and solar in an effort produce a higher capacity

utilization factor. Through 2025, 90% of new installed wind

capacity will come from federal government tenders, GWEC said.

While GWEC expects installed Indian wind capacity to total 59.4 GW

at the end of 2025, it said there is a chance under an "ambitious

case projection" model that as much as 62.9 GW of capacity could be

up and running by that point. (IHS Markit Climate and

Sustainability News' Keiron Greenhalgh)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-june-2021.html&text=Daily+Global+Market+Summary+-+11+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-june-2021.html","enabled":true},{"name":"email","url":"?subject=Daily Global Market Summary - 11 June 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Daily+Global+Market+Summary+-+11+June+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fdaily-global-market-summary--11-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}