Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 14, 2024

CRE concerns drive shorts higher.

DOWNLOAD PDF VERSION HERE

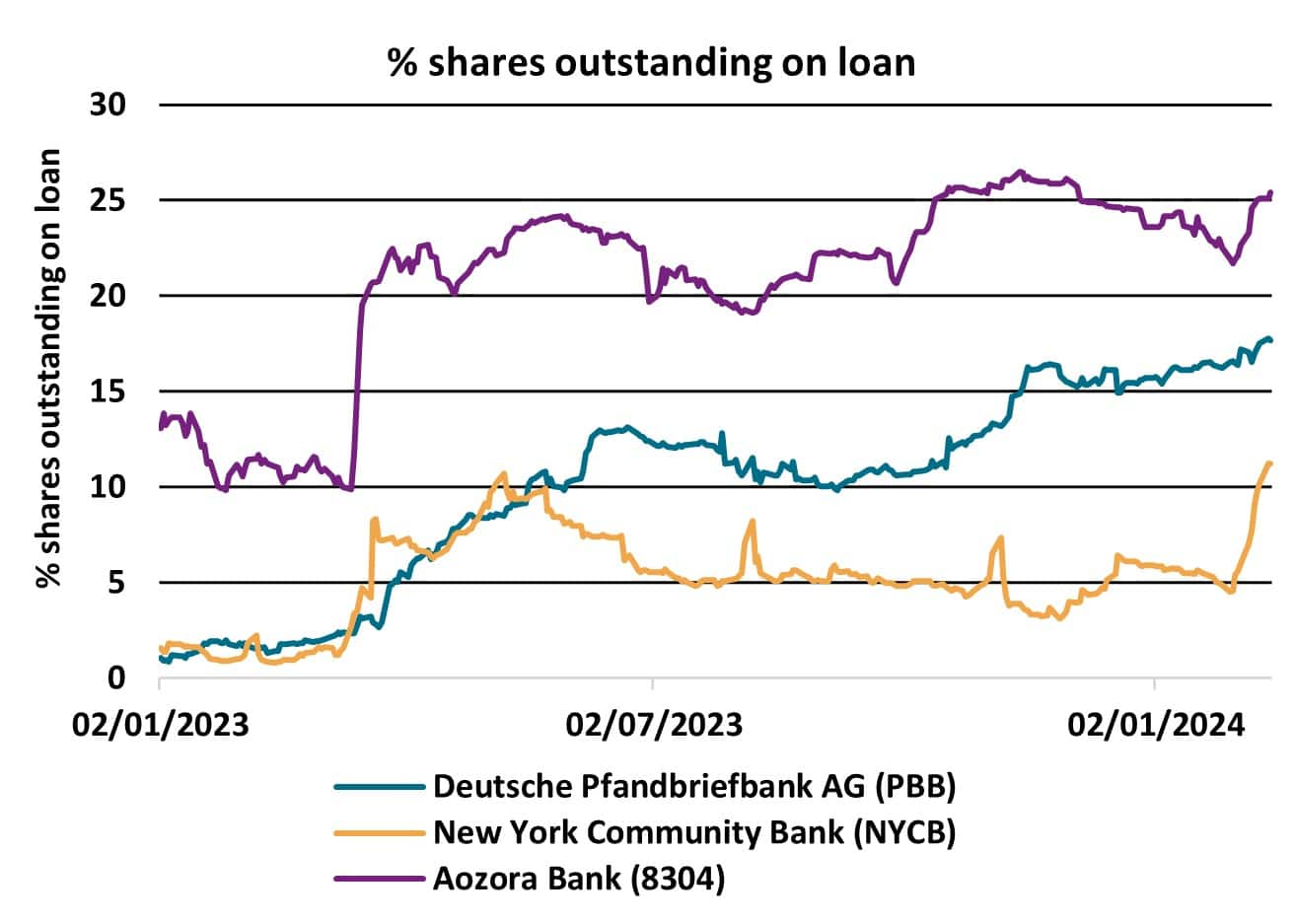

Over the last few months short interest has continued to climb in banks exposed to the commercial real estate sector (CRE).

Since the beginning of 2023, short interest has been rising across global banks with strong links to the commercial real estate (CRE) sector. Over the past weeks, a number of these banks have come under increasing pressure as they look to strengthen their balance sheets following weakness seen across their property loan books.

New York Community Bank (NYCB) has recently considered raising additional funds whilst contemplating asset sales after its stock price plunged. The bank pointed to its property loan book as the reason behind its desire to sure up its balance sheet. The institution reportedly has assets surpassing $100B, 60% of which are tied to commercial properties in Manhattan.

Across Europe and Asia, a similar picture is unfolding as Deutsche Pfandbriefbank AG (PBB), a Bavarian landesbank, has seen its share price fall after making substantial risk provisions as a result of the "persistent weakness of the real estate markets". Likewise, in Japan, Aozora bank (8304) recently recorded its first loss in 15 years due to bad loans in US commercial property investments.

Short interest has been growing significantly across all three banks since the beginning of 2023, with the percentage of shares outstanding on loan in Aozora Bank recently surpassing twenty five percent.

At a time when interest rates stand at multi-year highs, real estate will have to be refinanced at higher prices when existing debt matures. Coupled with falling asset prices, those banks exposed to commercial real estate will continue to come under pressure. Investors may wish to keep one eye on the short interest metrics across this sector as negative sentiment has been building and providing signals of stress for some time. Without any imminent reduction in interest rates, pressure is likely to continue to grow on these institutions as servicing their loan books becomes increasingly challenging.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcre-concerns-drive-shorts-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcre-concerns-drive-shorts-higher.html&text=CRE+concerns+drive+shorts+higher.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcre-concerns-drive-shorts-higher.html","enabled":true},{"name":"email","url":"?subject=CRE concerns drive shorts higher. | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcre-concerns-drive-shorts-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CRE+concerns+drive+shorts+higher.+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcre-concerns-drive-shorts-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}