Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 15, 2024

Container shipping still has an overcapacity problem, but it’s far from insurmountable

Global container capacity is set to expand by 10% this year over 2023 despite expectations that vessel recycling will hit records levels. Meanwhile, container volume growth will be just 3% to 4%, according to shipowner association BIMCO.

The Red Sea disruption soaked up an estimated 6% to 7% of global capacity as a result of carriers extending their transits by 10 to 14 days around southern Africa rather than risking attacks from Houthi militants operating in Yemen.

"The crisis is a blessing in disguise, because the amount of ships you need to go around Africa is enormous," Lars Jensen, CEO and partner at Vespucci Maritime, said during a Feb. 8 webinar hosted by the Journal of Commerce.

That capacity suck won't last forever. When carriers, and more importantly their insurers, regain confidence in transiting the Suez Canal via the Red Sea, that oversupply will await them. Still, carriers aren't without options to put a dent in the oversupply: They can idle or recycle existing ships, or delay or outright cancel orders for new vessels.

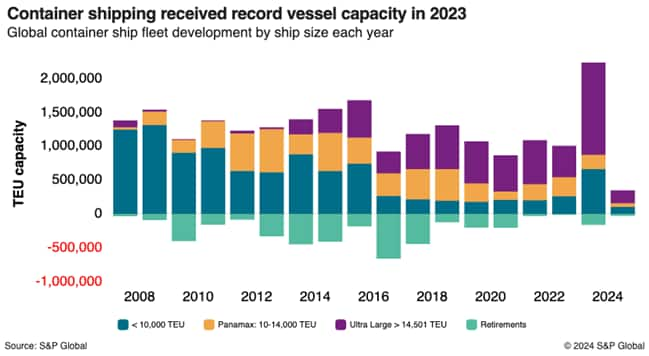

The amount of capacity delivered last year is staggering — some 2.2 million TEUs of vessel capacity came out of shipyards in 2023. Just over 60% of the capacity came from ultra-large container ships, as measured by those having capacities of more than 14,501 TEUs. By comparison, between 2019 and 2022, no more than 1.1 million TEUs of total capacity, including post-Panamax and smaller classes, were delivered in any one of those four years.

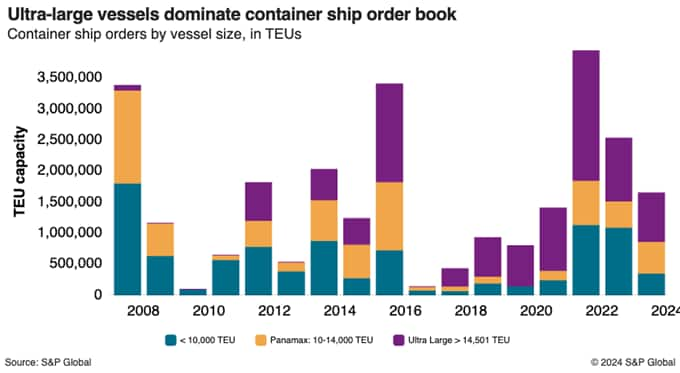

And there's plenty more on the way, with 1.6 million TEUs of capacity still on order. Container lines have pulled back on the ultra-large container ships that fit through the Suez Canal, with ships of that class accounting for slightly less than half of all capacity on order. Last year, the order book showed that vessel orders equaled 24% of the existing fleet, a mild comedown from the shares of 26% and 27% in 2021 and 2022, respectively.

Carriers have options

The pandemic-driven North American import boom in 2021 and 2022 spurred major container lines, smaller players and even some shippers to charter capacity and deploy seemingly whatever vessel could float. That prolonged scrapping plans, with a combined total of less than 30,000 TEUs retired in 2021 and 2022. But more vessels are heading to the shipbreaking yard, with about 155,000 TEUs in capacity retired last year.

To mitigate overcapacity, carriers can fall back on idling ships. Although not without additional maintenance and storage costs, there's plenty of potential to idle more of the fleet. Just 0.8% of the fleet is currently idled, according to Alphaliner. As of Jan. 29, there were no idle ships with a capacity of more than 12,500 TEUs in the global fleet due to carriers needing more vessels for the now-longer Asia-Europe transits and to accommodate the China export rush before Lunar New Year began Feb. 10, according to the analyst.

Because carriers are speeding up vessels on the longer transits to meet schedules, Jensen said they can gradually return to so-called slow steaming while popping newly received vessels into slower sailing services. The longer transits add some 3,000 nautical miles to westbound services from Asia to Europe and the East Coast of North America.

The incoming capacity won't hit all container trades equally, with the ultra-large containerships only deployable on transits through the Suez Canal or those sailing around Africa. As Asia import demand settles, carriers have upgraded some services with larger ships on the trans-Pacific but held off on launching new services; Zim's late-January announcement of a new Asia-Western Canada express service is an exception. Carriers are also loath to swamp the Asia-North America trade with capacity, which could easily reverse any of the recent spot rate gains.

To whatever degree container lines, either individually or as an industry, handle overcapacity, the delivered capacity in the next few years will overwhelmingly have engine rooms capable of being powered by liquefied natural gas (LNG), methanol or hydrogen, or to be capable of being converted later. Eighty-five percent of ordered vessel capacity will be able to run on not just traditional bunker fuel, but also on an alternative meant to significantly reduce carbon emissions, albeit with some methane leak via LNG propulsion. But whether those ships have the needed alternative fuels and a distribution system to supply is another matter.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainer-shipping-still-has-an-overcapacity-problem-but-its-f.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainer-shipping-still-has-an-overcapacity-problem-but-its-f.html&text=Container+shipping+still+has+an+overcapacity+problem%2c+but+it%e2%80%99s+far+from+insurmountable+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainer-shipping-still-has-an-overcapacity-problem-but-its-f.html","enabled":true},{"name":"email","url":"?subject=Container shipping still has an overcapacity problem, but it’s far from insurmountable | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainer-shipping-still-has-an-overcapacity-problem-but-its-f.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Container+shipping+still+has+an+overcapacity+problem%2c+but+it%e2%80%99s+far+from+insurmountable+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcontainer-shipping-still-has-an-overcapacity-problem-but-its-f.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}