Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 02, 2021

China’s consumer market recovery under the Covid-19 pandemic

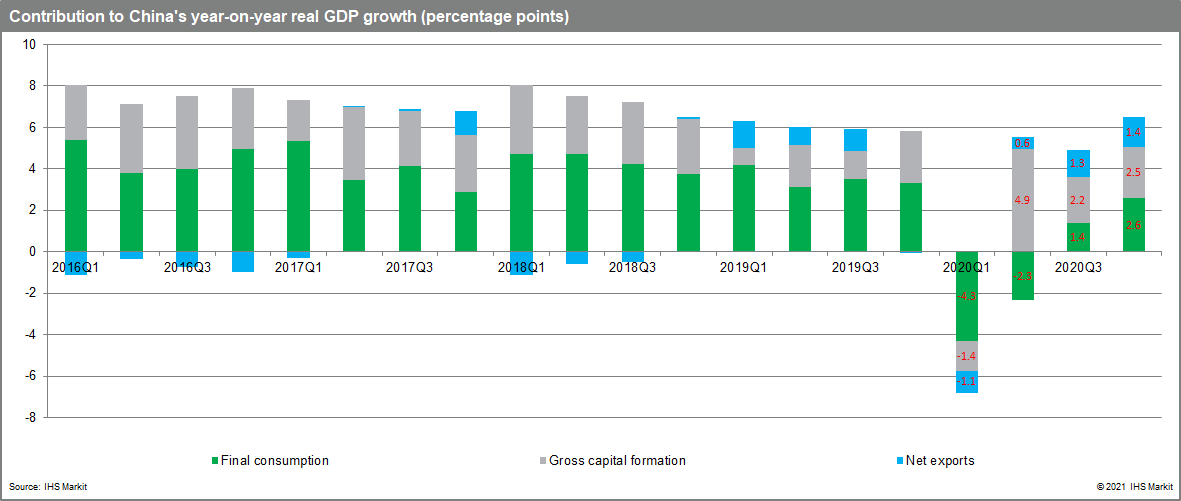

China's consumer market has staged a remarkable recovery from the coronavirus downturn. Of the Chinese economy's 6.5% year-on-year (y/y) growth in the fourth quarter of 2020, nearly 40% came from final consumption. While this remains well below consumption's 60% average growth contribution in the three years prior to the COVID-19 pandemic during which quarterly GDP averaged 6.6% y/y, it marks an exceptional comeback considering the depth of consumer market crash in the first half of 2020 (consumption pulled down real GDP by 4.3 percentage points in the first quarter and 2.3 percentage points in the second), and the fact that the COVID-19 virus has not been stamped out.

What made this turnaround possible is the Chinese government's effective pandemic containment. Since the COVID-19 pandemic was contained in China in early April 2020 (marked by the reopening of Wuhan city), sporadic COVID-19 outbreaks surfaced across the country, including the current outbreaks in northern China. For each local outbreak, the government has been able to execute rapid COVID-19 testing for the entire local population. The test results enabled local authorities to implement targeted lockdowns to minimize the negative impact on the economy. Such effective pandemic containment measures have greatly reduced public fears of new COVID-19 outbreak quickly spreading and hence allowed greater restoration of normalcy in economic activities.

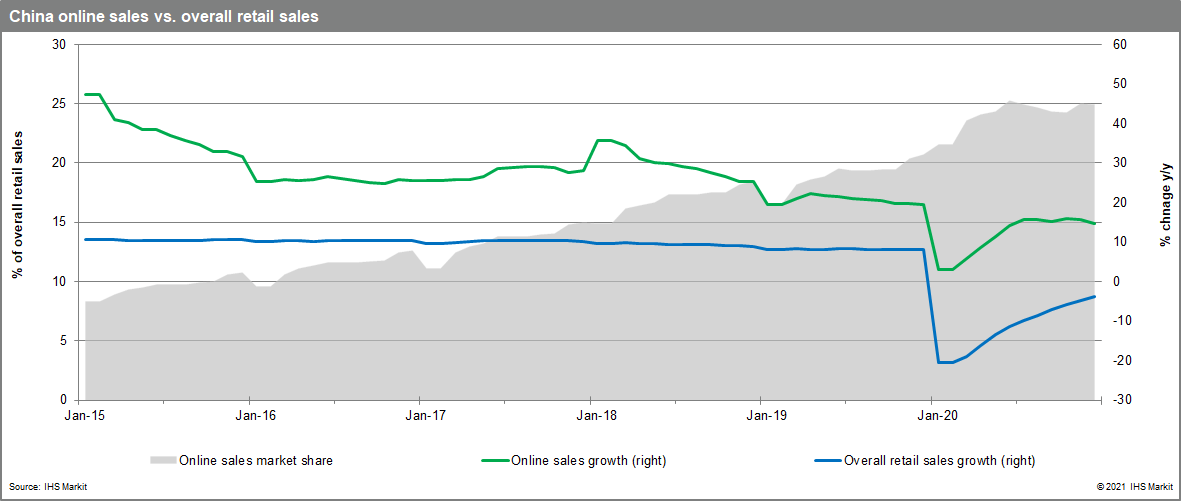

Still, China's consumer market has not quite returned to the pre-pandemic "normal" conditions. Moreover, consumer market's recovery under the threat of pandemic differs from the usual business cycle recoveries in several respects. The most obvious is the dominance of online sales. Online sales were also hit hard by the pandemic in early 2020 due to lockdown—online sales growth fell to 3.0% y/y in the first two months of the year, from nearly 20% growth in 2019. As lockdown eased, online sales quickly rebounded, driven by Chinese consumers switching purchases from physical stores to online merchants. By the end of 2020, year-to-date online sales growth rose to nearly 15% y/y, while retail sales in brick-and-mortar stores were still down by nearly 10% from a year earlier level. As a result of online sales' surge and physical stores sales' contraction, online sales' share of overall retail sales jumped from 20.7% at the end of 2019 to 24.9% at the end of 2020.

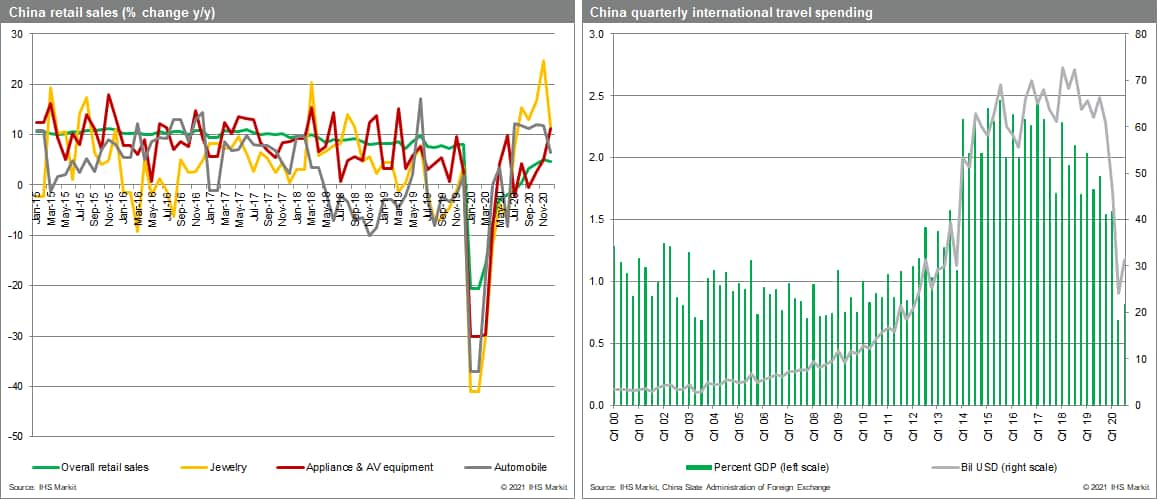

Another feature of the current consumer market recovery is the uneven recovery across spending of different income groups. The pandemic-induced severe economic downturn has disproportionately affected lower-skill, lower-income workers, as reflected in the uneven rebound in retail sales across product categories. Although monthly overall retail sales did not return to growth until August 2020, sales of luxury goods and big-ticket items resumed growth more quickly. Appliance and audio-video equipment sales and automobile sales expanded again in May, and jewelry sales began to grow in July. Moreover, after returning to growth, sales of these products soon rebounded to high single-digit or double-digit growth rates.

The unevenness in the consumer spending rebound has been heightened by the restrictions on outbound tourism due to pandemic controls. Chinese residents' spending on international travel has surged in recent years, averaging more than USD250 billion per year from 2014 to 2019 (about 2% of China's GDP). Given their costliness, international trips are generally afforded by higher-income households. As outbound tourism remains restricted, effective pandemic containment in mainland China has redirected higher-income households' planned spending on overseas trips to domestic spending instead, especially on luxury goods and big-ticket items.

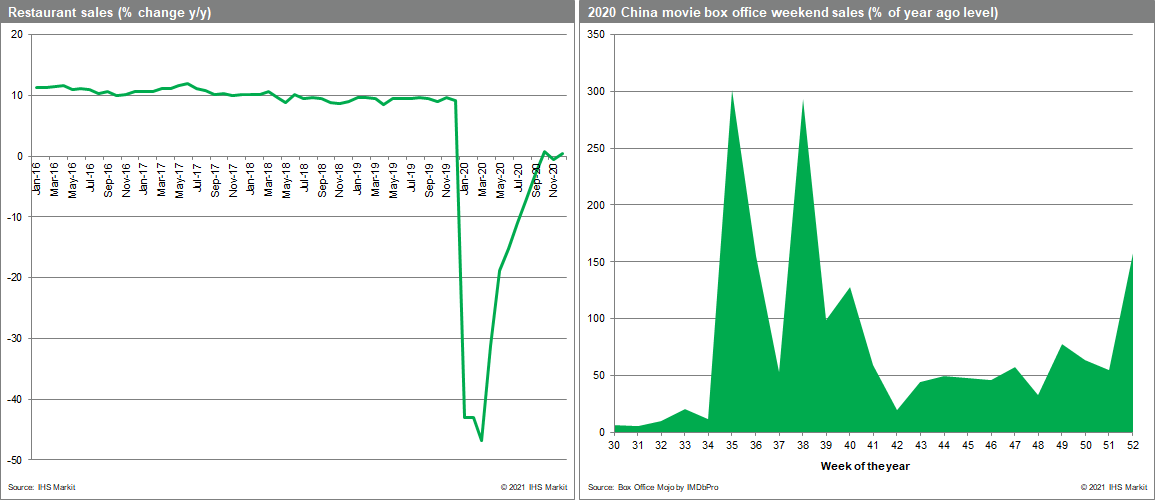

Besides uneven recovery, there is a ceiling to consumer market's rebound under the threat of pandemic. Restaurants were one the most severely affected businesses by COVID-19, with sales plummeting by more than 40% in the first quarter of 2020. After the Chinese government began reopening the economy in March 2020, restaurant sales slowly clawed back to a year earlier level in October. But sales since then has stuck at flat growth, far from the relatively consistent monthly 10% y/y sales growth that restaurants in China posted from 2015 to 2019.

China's box office performance underwent a similar, but more drastic swing. Cinemas in mainland China reopened in late July 2020 after shutting down for nearly six months due to COVID-19. In the first five weeks of the reopening, the weekend box office revenue amounted to only 10% of the ticket sales recorded one year previously. In the subsequent six weekends, as the government relaxed the capacity restrictions from 30% to 50% of available seats, and public confidence in the pandemic containment measures mounted, pent-up demand led to ticket sales surging to 136% of their level one year ago. In the twelve weeks since, however, weekend box office retrenched to 56% of a year ago sales, despite the authorities further relaxed the capacity restriction from 50% to 75%.

These "bounce and fade" rebounds exemplify the limits on the consumer market rebound with Covid-19 contained but not eradicated, regardless of the effectiveness of the pandemic containment measures.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-consumer-market-recovery-under-covid19-pandemic.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-consumer-market-recovery-under-covid19-pandemic.html&text=China%e2%80%99s+consumer+market+recovery+under+the+Covid-19+pandemic+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-consumer-market-recovery-under-covid19-pandemic.html","enabled":true},{"name":"email","url":"?subject=China’s consumer market recovery under the Covid-19 pandemic | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-consumer-market-recovery-under-covid19-pandemic.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+consumer+market+recovery+under+the+Covid-19+pandemic+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchinas-consumer-market-recovery-under-covid19-pandemic.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}