Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 12, 2021

China Cotton Imports Analysis

With increased current focus in the global news market regarding domestic cotton production in mainland China's Xinjiang territory, as well as prior and continuing trade issues with foreign trade partners, it is expected that mainland China will look to increase cotton sourcing internationally to ensure production of cotton-based goods. (1)(2) Below, we look at trends in mainland China's cotton imports.

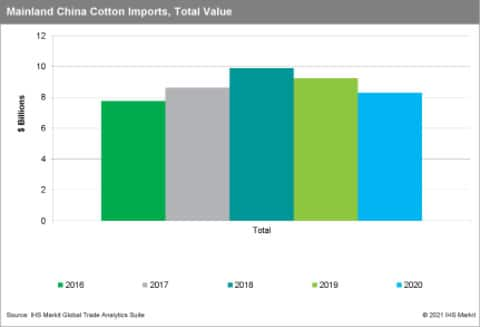

Taking a high-level view for the past five years for cotton imported into mainland China, we see values peak with 2018 imports at nearly $10 billion before tapering down in pandemic-era 2020 to $8.3 billion.

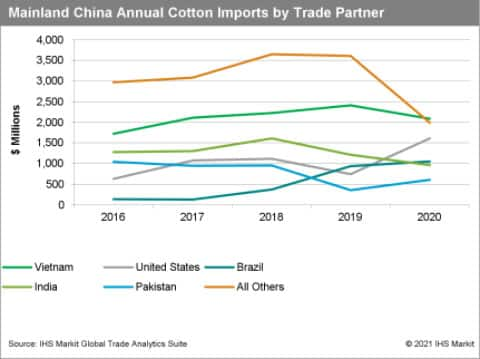

Looking deeper into the composition of the top trading partner countries over the past five years, there is a strong trend toward concentration. In 2020, the top five accounted for 76% of mainland China's imports versus only 62% in 2016.

Also of note is the dramatic increase in cotton sourced from the United States and Brazil. In 2020, cotton imports from the United States accounted for 20% of mainland China's imports. On a year-over-year basis, the United States increased 118% in 2020 versus 2019. Brazil was also a significant beneficiary of mainland Chinese purchases, providing 13% of cotton to mainland China in 2020, a significant increase from its 2016 and 2017 levels.

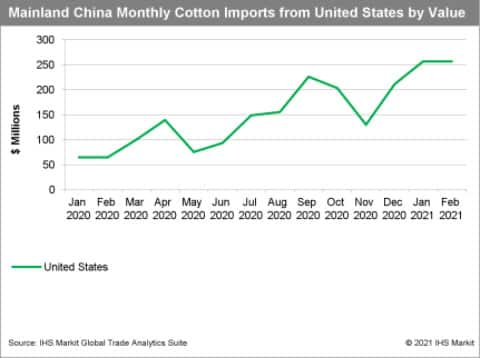

U.S.-sourced cotton increased dramatically beginning in July 2020, continued throughout the year and into the early months of 2021. The initial increase is attributable to mainland China's commitment to purchase more U.S. goods under the Phase 1 trade agreement. The subsequent COVID-19 pandemic and related shutdowns in production and retail sectors made the purchases seem excessive at the time. However, despite that initial assessment, imports from the United States continue strong growth into the early months of 2021 as mainland China looks to increase international sourcing given current concerns of domestic sourcing practices in the Xinjiang region.

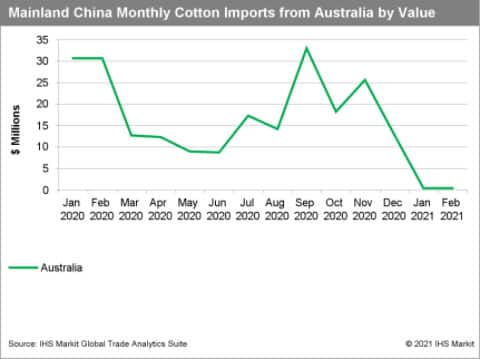

While countries such as the United States and Brazil have seen increased purchasing of their domestic cotton, others have seen theirs decrease. Australia, once a top-five sourcing partner of cotton for mainland China, has now fallen significantly over the past two months as the countries engage in trade sanctions with each other.

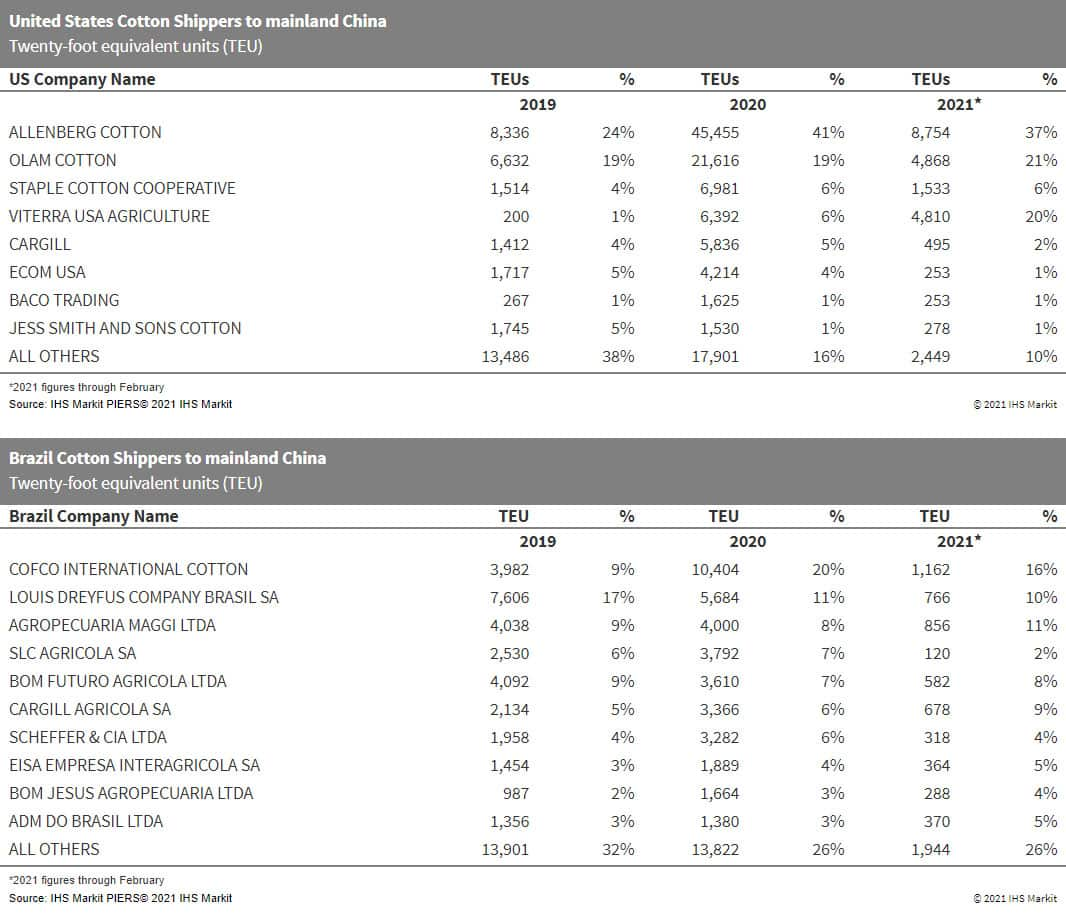

Taking a deeper dive into transactional trade data sets available from IHS Markit analyzing top shippers of cotton from strong growth source countries such as the United States and Brazil, shows a concentrated group of companies within each respective country providing cotton:

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-cotton-imports-analysis.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-cotton-imports-analysis.html&text=China+Cotton+Imports+Analysis+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-cotton-imports-analysis.html","enabled":true},{"name":"email","url":"?subject=China Cotton Imports Analysis | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-cotton-imports-analysis.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+Cotton+Imports+Analysis+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fchina-cotton-imports-analysis.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}