Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 13, 2021

Black Sea 3Q21 agribulk exports forecast 7% higher on Russian wheat

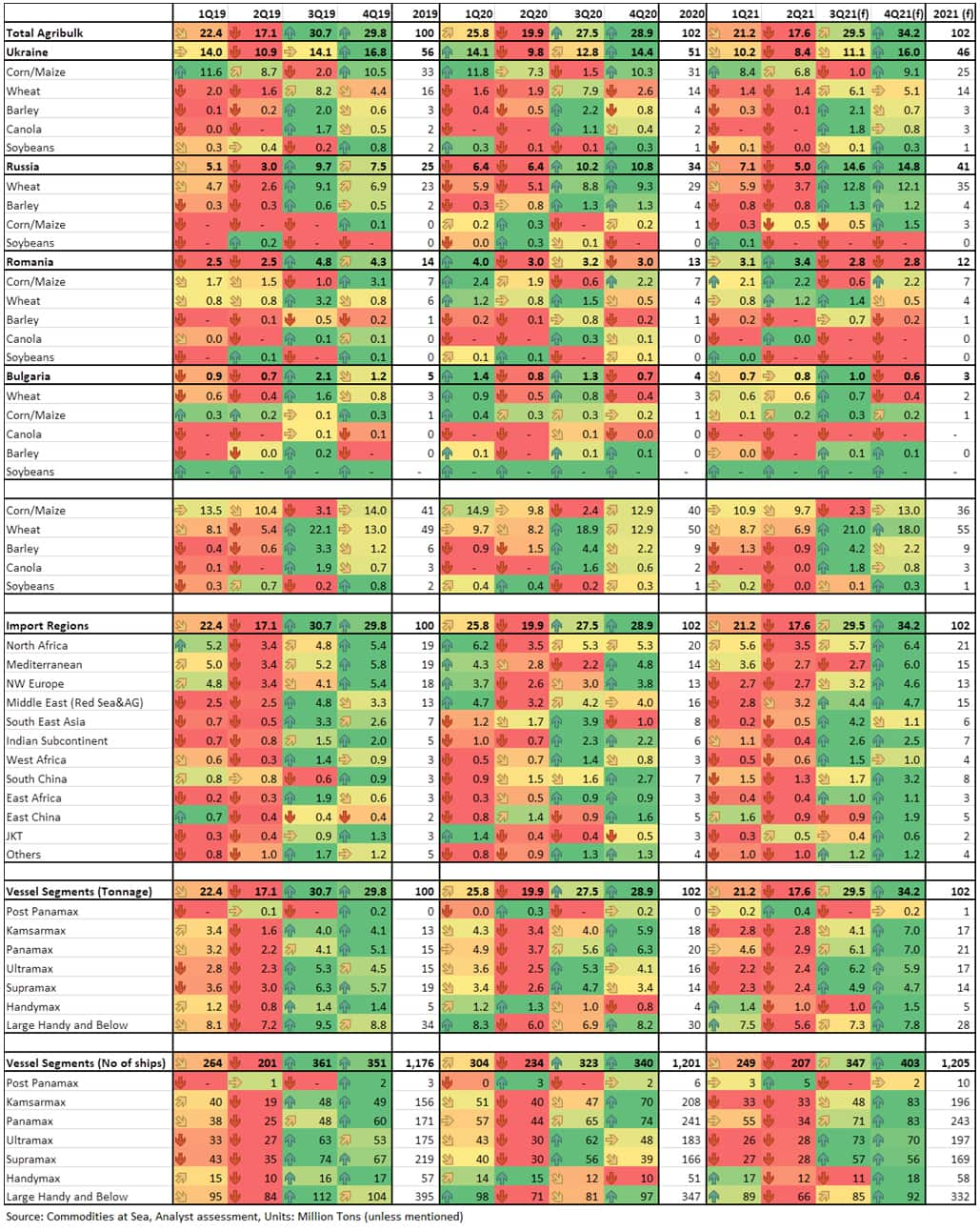

As per the IHS Markit's Commodities at Sea, total agribulk shipments from the Black Sea region during June 2021 stood at 5.5mt (up 45 percent y/y) with wheat, corn, and barley at 2.8mt (up 180 percent y/y), 2.6mt (up 5 percent) and 0.1mt (down 45 percent), respectively.

In terms of export countries, during the reported month, agribulk shipments from Ukraine, Russia, Romania, and Bulgaria stood at 2.2mt (down 1 percent y/y), 2.2mt (up 208 percent), 0.9mt (up 17 percent), and 0.3mt (up 146 percent y/y), respectively. The slowdown from Ukraine is due to a lower harvest in the 2020/21 season.

In terms of import regions, Black Sea agribulk shipments for the reported month to North Africa, Mediterranean, NW Europe, and the Middle East stood at 1.0mt (up 82 percent y/y), 0.8mt (up 138 percent), 1.0mt (up 40 percent), and 1.2mt (up 251 percent), respectively.

In terms of vessel segments, shipments increased on Panamax (0.9mt, up 3 percent y/y), Ultramax (0.9mt, up 137 percent), Supramax (0.7mt, up 30 percent), and Large Handies (1.8mt, up 92 percent); while declined on Kamsaramax vessels (0.7mt, down 11 percent y/y).

As per IHS Markit's Commodities at Sea, Ukraine has shipped 45.8mt of agribulk commodities until end-June 2021 in the 2020/21 July-June season (versus 54.7mt in the same period a season earlier). The decline was due to a smaller harvest. In January 2021, Ukraine decided to limit corn exports for the current crop year at 24mt, following proposals from various domestic agricultural as feed associations in the country.

Overall in the first half of 2021, total agribulk shipments from the Black Sea region stood at 38.6mt (down 15 percent y/y), with shipments for wheat, corn, and barley at 15.6mt (down 11 percent), 20.7mt (down 16 percent), and 2.2mt (down 8 percent), respectively.

In terms of export countries, during 1H21, shipments from Ukraine, Russia, Romania, and Bulgaria stood at 18.6mt (down 22 percent), 12.1mt (down 6 percent), 6.5mt (down 6 percent), and 1.6mt (down 28 percent). In terms of import regions, during 1H21, shipments to North Africa, Mediterranean, NW Europe, and the Middle East stood at 9.1mt (down 7 percent), 6.3mt (down 12 percent), 5.4mt (down 15 percent), and 6mt (down 25 percent).

Short-Medium term outlook

Russia had implemented a new floating duty on agribulk exports from 02 June 2021, which is changed every week, and was set for wheat, barley, and corn for the period 07-13 July 2021 at $41.2/t, $37/t, and $50.6/t, respectively. Despite uncertainties created by its new moving export levy system, Russia agribulk shipments are expected to witness an annual increase as harvest starts in addition to larger carryover stocks (12mt versus last year's 7mt, according to the USDA).

Black Sea agribulk shipments for 3Q21 and full 2021 are forecast at 29.5mt (up 7 percent y/y) and 102mt (at almost previous year levels). Agribulk shipments from Ukraine, Russia, Romania, and Bulgaria during 3Q21 and full 2021 are forecast at 11.1mt/46mt, 14.6mt/41mt, 2.8mt/12mt, and 1.0mt/3mt, respectively. In terms of grades, for 3Q21 and 2021, total Black Sea exports of corn, wheat, and barley forecast at 2.3mt/36mt, 21mt/55mt, and 4.2mt/9mt, respectively.

Black Sea agribulk shipments - Quarterly forecast

For more insight subscribe to our complimentary commodity analytics newsletter

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fblack-sea-3q21-agribulk-exports-forecast-higher-russian-wheat.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fblack-sea-3q21-agribulk-exports-forecast-higher-russian-wheat.html&text=Black+Sea+3Q21+agribulk+exports+forecast+7%25+higher+on+Russian+wheat+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fblack-sea-3q21-agribulk-exports-forecast-higher-russian-wheat.html","enabled":true},{"name":"email","url":"?subject=Black Sea 3Q21 agribulk exports forecast 7% higher on Russian wheat | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fblack-sea-3q21-agribulk-exports-forecast-higher-russian-wheat.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Black+Sea+3Q21+agribulk+exports+forecast+7%25+higher+on+Russian+wheat+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fblack-sea-3q21-agribulk-exports-forecast-higher-russian-wheat.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}