Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 06, 2024

Bitcoin and Ether ETFs entice short sellers.

DOWNLOAD PDF VERSION

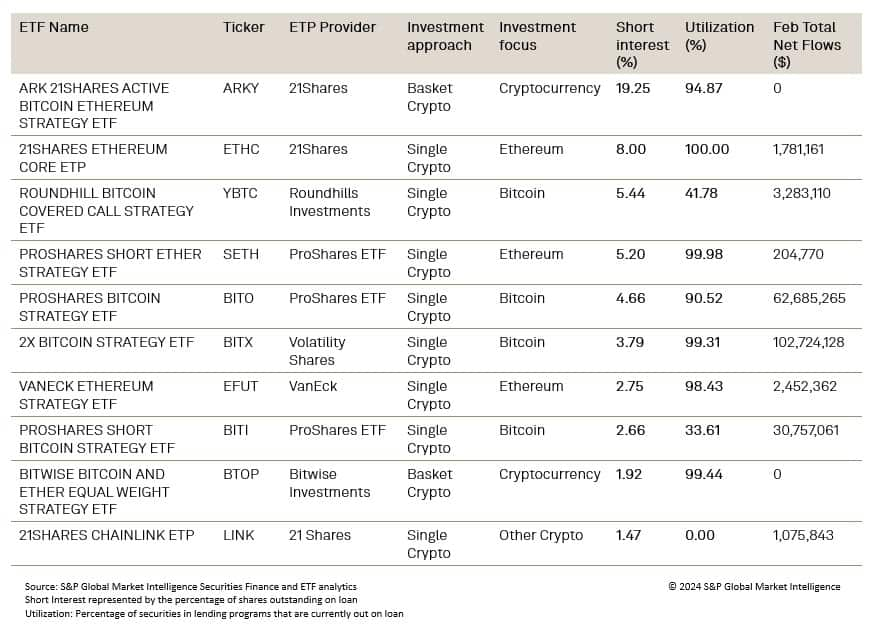

The top ten most shorted Crypto ETFs indicate Ether, Bitcoin, or a combination of both are primary targets for short sellers.

As Bitcoin tops $69,000 and physical Ether ETFs await the green light from US regulators, both cryptocurrencies top the table for the most popular crypto ETF shorts.

Seven ETF issuers are presently awaiting approval from US regulators to introduce physical Ether ETF products, capitalizing on its status as the world's second-largest cryptocurrency. Despite these submissions, uncertainty exists as to whether the SEC will approve these applications, given the ambiguous legal status of Ether. The regulatory classification of Ether is pending, with questions remaining about whether the SEC will designate it as a security or a commodity. If classified as a security, approval for ETFs based on current filings will be withheld.

The value of Ether continues to climb following the relatively swift approval granted to ten physical Bitcoin ETFs earlier on this year. Investors continue to predict a similar approval process taking place for physical Ether ETFs following recent filings. The increase in value of both Ether and Bitcoin presents an opportunity for short sellers who believe that the price of Bitcoin will soon fall, as profit taking from its new investor base picks up pace. The potential for a slower approval process for Ether ETFs than originally expected may lead to a decrease in both the price and demand of the cryptocurrency.

When looking at the short interest across these exchange traded funds, whilst the percentage of shares outstanding on loan remains relatively modest, the utilization, which reflects how many of those shares available in lending pools are currently being borrowed, remains high and, in some cases, very close to 100%. This suggests that there is strong appetite to borrow these shares, but the supply is curtailing the ability of short sellers to execute trades.

Following the approval of Bitcoin ETFs, short interest in Coinbase, the Crypto exchange, has started to decline. As can be seen in the graph, short Interest, measured as a percentage of outstanding shares on loan, increased rapidly in 2022. This followed a statement by well-known fund manager, Jeff Chanos, announcing that he was shorting the company, believing that it represented a "bubble stock"[1]. Short interest in Coinbase, the largest crypto exchange in the US, is often regarded as a key indicator of sentiment in the broader crypto market, and it's currently at its lowest level since 2021. As Bitcoin ETF flows reach record levels for newly created assets, Coinbase continues to benefit from both greater interest across the asset class and greater flows in the crypto market. This has been positive for the sector as a whole, bringing the asset class into the mainstream investment arena. Investors are likely to keep one eye on the short Interest in this stock as the SEC moves closer to a decision on physical Ether ETFs to monitor sentiment across the sector.

As the value of Cryptocurrencies continues to rise but uncertainty regarding the future approval of forthcoming spot crypto ETFs remains, the asset class in all of its forms, is likely to remain both volatile and fascinating for all market participants in the coming months.

For more information on how to access this data set, please contact the sales team at:

h-ihsm-global-equitysalesspecialists@spglobal.com

[1] Fund Manager Jim Chanos Says He's Shorting Coinbase (coindesk.com)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbitcoin-and-ether-etfs-entice-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbitcoin-and-ether-etfs-entice-short-sellers.html&text=Bitcoin+and+Ether+ETFs+entice+short+sellers.+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbitcoin-and-ether-etfs-entice-short-sellers.html","enabled":true},{"name":"email","url":"?subject=Bitcoin and Ether ETFs entice short sellers. | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbitcoin-and-ether-etfs-entice-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bitcoin+and+Ether+ETFs+entice+short+sellers.+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbitcoin-and-ether-etfs-entice-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}