BLOG

Oct 02, 2019

Belarusian external finances highlight vulnerability and dependency on Russia

Current account in surplus – for now

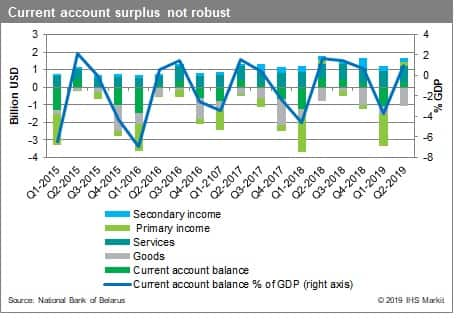

- According to the National Bank of Belarus (NBB), the current account in the second quarter produced a surplus of USD297 million, narrowing around 40% year-on-year (y/y). Combined with the deep deficit catalogued in the first quarter, the January–June balance showed a shortfall of USD771 million, which marks widening of 6% (y/y).

- The goods trade deficit in the second quarter deepened by one-third y/y, as import growth exceeded the gain in exports. For the whole of the first half, the trade gap widened by nearly 20% y/y, as exports contracted.

- The second-quarter primary income surplus narrowed, but so did the first-half deficit. Meanwhile, the service surplus managed to strengthen, as income inflows increased faster than outflows in the second quarter, while the secondary income surplus narrowed y/y in the second quarter, but narrowed significantly in the first half, as credit inflows contracted.

- FDI inflows to Belarus in the second quarter turned modestly negative. For the first half, net inflows amounted to USD1.1 billion, thus being more than enough to cover the first-half deficit.

- The annual weakening in the Belarusian current-account position was expected; the upward impact on Belarusian export values from the increase in world market oil prices is counteracted by regulatory actions and softer external demand. The price of imported crude oil is increasing by a lifting of the mineral extraction tax and, as well as decreasing export duties on exported oil products that Belarus refines.

- The current account is likely so swing back into a deficit now, given that oil prices weakened in the third quarter again, with the price of Brent crude is estimated to clearly fall from its second-quarter average of USD68.88 per barrel (pb). In addition, exports will also suffer from the further weakening of external demand.

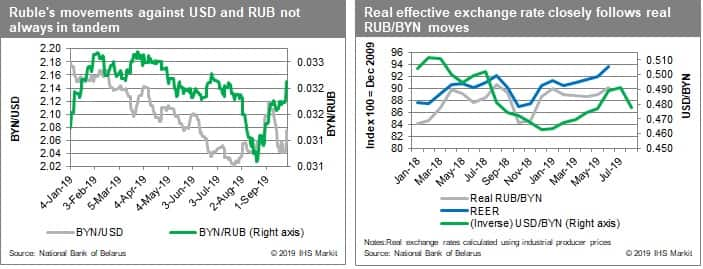

- The weakness of Belarusian economic momentum will restrict imports as well, and this will constrain the overall deterioration of the current-account deficit, together with the expected continued relative strength of transportation service export inflows. On the other hand, the support from the recent weakening of the Belarusian ruble against the US dollar will not directly translate into competitiveness gains, taking into account of the importance of the Russian ruble in determining developments in the effective exchange rate. Against the Russian ruble, the Belarusian ruble significantly appreciated from late June to late August.

Belarus turned to Russia for a bond issue, but it still needs additional financing to cover its near-term financing needs

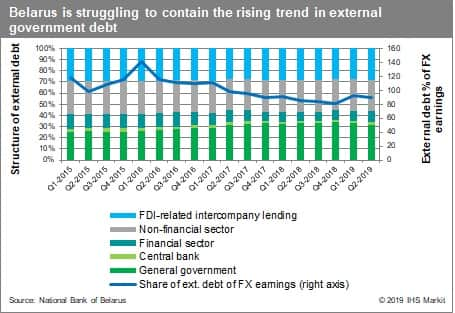

- Gross external debt during the first half of the year increased by 2.0%, standing at USD40.1 billion at the end of June. Nearly 42% of this consisted of general government debt, while the share of the banking sector was 12.8%.

- However, the latest official external debt data do not give a complete current picture of Belarusian indebtedness: Belarus in late July tapped the Russian bond markets for RUB10 billion (USD156 million), in two issues of RUB5 billion, with a maturity of three years. The debt float was a success, considering that offers totaled around RUB45 billion, and that the coupon rate was set at 8.65%, while the initial target range had been set at 9.10–9.35%.

- Belarus’s first Russian bond issue since 2010 comes after Russia has delayed the payment of its already approved USD600-million loan to Belarus, and after the Russian-controlled Eurasian Fund for Stabilization and Development (EFSD) is doing the same for the last tranche of USD200 million of its USD2-billion loan to Belarus.

- New Belarusian bond sales in Russian markets are likely to follow, while Belarus has also expressed interest in issuing debt in the Chinese markets. Although the need to set a benchmark for future corporate issuers was one key reason for the debt float, the sovereign is likely to remain in need of financing in the future.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbelarusian-external-finances-highlight-vulnerability-dependency-on-russia.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbelarusian-external-finances-highlight-vulnerability-dependency-on-russia.html&text=Belarusian+external+finances+highlight+vulnerability+and+dependency+on+Russia+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbelarusian-external-finances-highlight-vulnerability-dependency-on-russia.html","enabled":true},{"name":"email","url":"?subject=Belarusian external finances highlight vulnerability and dependency on Russia | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbelarusian-external-finances-highlight-vulnerability-dependency-on-russia.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Belarusian+external+finances+highlight+vulnerability+and+dependency+on+Russia+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbelarusian-external-finances-highlight-vulnerability-dependency-on-russia.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}