Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 06, 2022

Bearing down on high-risk shares

Research Signals - June 2022

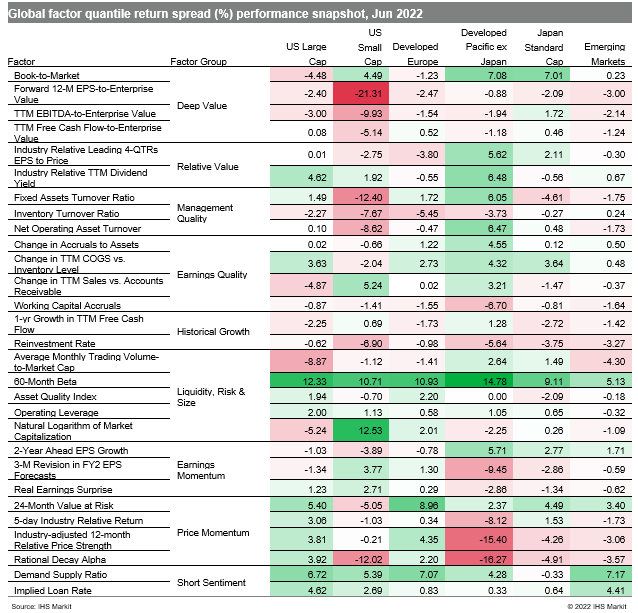

Investors continue to grapple with an elevated level of macro risks, fearing that central bank efforts to control inflation may trigger a recession if interest rates are raised too far too fast. In turn, a heightened level of risk aversion swept across global equity markets (Table 1), as sentiment remained negative in many regions, including the US where stocks officially entered bear market territory.

- US: Low risk shares were highly favored last month, as demonstrated by double-digit spreads awarded to 60-Month Beta

- Developed Europe: The risk-off trade was further accompanied by avoidance of the most highly shorted shares based on Demand Supply Ratio scores

- Developed Pacific: High momentum shares struggled in June, dragging down performance of Industry-adjusted 12-month Relative Price Strength

- Emerging markets: Investors turned to low-risk shares and away from momentum, as gauged respectively by 24-Month Value at Risk and Rational Decay Alpha

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbearing-down-on-high-risk-shares.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbearing-down-on-high-risk-shares.html&text=Bearing+down+on+high-risk+shares+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbearing-down-on-high-risk-shares.html","enabled":true},{"name":"email","url":"?subject=Bearing down on high-risk shares | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbearing-down-on-high-risk-shares.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bearing+down+on+high-risk+shares+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbearing-down-on-high-risk-shares.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}