Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 22, 2021

Banking sectors in Cote d'Ivoire, Ethiopia, Senegal: Significant to High Risk

Our Banking Risk Service has expanded its coverage of Sub-Saharan Africa (SSA), launching risk ratings forCôte d'Ivoire, Ethiopia, and Senegal.

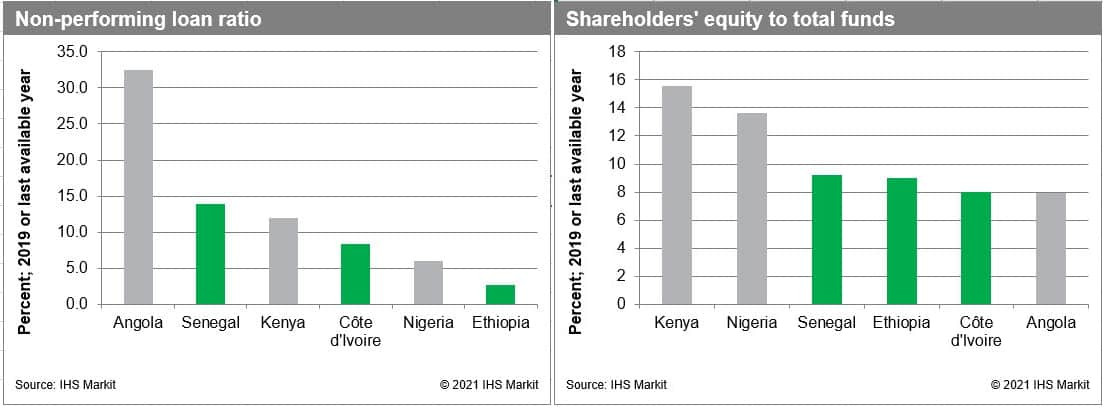

Côte d'Ivoire and Senegal are each rated as Significant Risk, while Ethiopia is rated as High Risk. Regional peer Mozambique is rated less favorably than Ethiopia in the Very High Risk Category, while Tanzania and Kenya are rated more favorably than Ethiopia in the Significant Risk category. In the region, only South Africa is rated more favorably than Côte d'Ivoire and Senegal, in the Medium Risk category. Côte d'Ivoire and Senegal's banking risk ratings are both driven by large lending concentration, a large stock of unprovisioned for non-performing loans relative to capital, and the regulator's lack of enforcement and transparency. Ethiopia's indicative banking risk rating is generated by low credit risk owing to rapid nominal credit growth, moderate liquidity risk primarily driven by maturity mismatch and bank funding of SOEs, medium solvency risk, and moderate qualitative risk factors including an outdated regulatory environment. The overall banking risk rating for Ethiopia is constrained by risks to the sovereign's creditworthiness.

Banking sectors in Côte d'Ivoire, Ethiopia, and Senegal face similar challenges as the rest of SSA.

Overall banking performance in the SSA countries has been mixed. Countries such as Nigeria, which are dependent on oil exports, for instance, have seen short-term liquidity constraints and foreign currency risks. Nevertheless, most banks across the region are adequately capitalized and limited earnings deterioration through the retainment of dividends and good management practices. The most pertinent risk across all SSA countries has been the deterioration of asset quality and credit risks. These risk factors are intertwined with the ongoing Covid-19 pandemic and resultant modest economic growth outlook.

Overall for SSA banks, NPLs have been structurally high, primarily due to macroeconomic volatility, a legacy of problem loans that are not written off, government arrears, and poor credit risk management practices.

The ongoing COVID-19 crisis is likely to aggravate the NPL problem even further, even though the effect may be delayed due to regulatory forbearance measures in most SSA countries. Another concern centers around the level of restructured loans that are past due, of which figures are sparse at this stage that is likely to progress to NPLs. Therefore, asset quality is expected to deteriorate over the near to medium term as borrowers' debt servicing capacity stays strained, given a modest economic recovery expected in most SSA countries. The SSA-economic growth outlook is primarily driven by the slow vaccine rollout across the region and supply-side constraints despite a rebound in world growth. Economic recovery will not only be impacted upon by the ongoing pandemic but also by the diminished multiplier effect that lower credit growth has on economic activity. The elevated level of NPLs is likely to slow credit growth through banks' risk-averse stance.

Despite strong credit growth in the wake of the coronavirus disease 2019 (COVID-19)-virus pandemic, related-party lending represents a significant risk to Ethiopian banks.

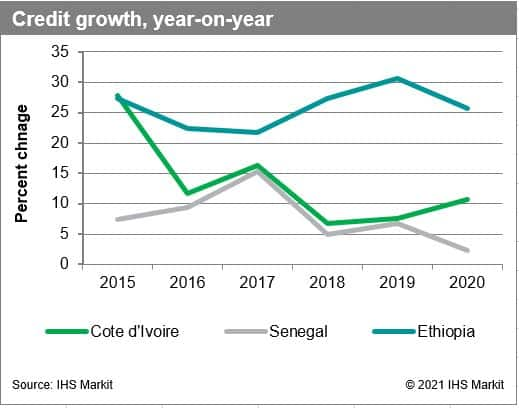

Credit growth in Ethiopia held relatively constant in 2020, at 29% year on year (y/y) despite the negative macroeconomic outlook in the wake of the COVID-19 virus pandemic. IHS Markit anticipates that credit growth will slow to 16% in 2021, as loan provisions to SOEs slow and the government refocuses on fiscal consolidation efforts. Lending to SOEs represents 30% of total banking-sector loans in Ethiopia. Although the Ethiopian government is currently in the process of reforming and privatizing SOEs, these corporations are historically underperforming and are not held to a consistent standard of financial reporting. This is particularly a concern at the sector's largest bank - the Commercial Bank of Ethiopia (CBE) - which has 40% of assets tied up in energy-sector SOEs, according to the International Monetary Fund (IMF), a significant related-party lending risk. It is believed that some of these financing arrangements are unsustainable and will thus become non-performing. In fact, the CBE is reportedly undergoing an asset-quality review to determine the scale of these vulnerabilities.

Credit riskin Côte d'Ivoire and Senegal is driven by lending concentration and significant exposure to government securities.

Côte d'Ivoire and Senegal are members of the West African Economic and Monetary Union (WAEMU) and have the largest and the second largest banking sectors in the WAEMU, respectively. In Senegal, lending concentration is the major vulnerability to the banking system as bank portfolios are concentrated among a handful of borrowers, including SOEs. Concentration of lending also remains elevated in Côte d'Ivoire. The large exposure limit was tightened in both countries from 75% to 25% as of 2018 by WAEMU's regional regulator, the Central Bank of West African States, but risks will remain elevated in the medium term as existing loans mature. Furthermore, Ivorian and Senegalese banks are likely to continue increasing their exposure to government securities, which was further exacerbated by the COVID-19-virus-related economic slowdown. We forecast that credit extension will slow marginally in Côte d'Ivoire in 2021 as the real GDP growth outlook is favorable but contingent upon the global economic outlook, while we expect Senegal's credit growth to pick up slightly given fiscal and monetary policy support that improved the health system and cushioned the pandemic's economic shock.

All three countries have capital ratios above the regulatory minimum; however, inferior regulatory standards blur underlying weaknesses in Ethiopia, while asset quality deterioration will weigh on capital buffers inCôte d'Ivoire and Senegal.

With a sector-level Tier-1 capital adequacy ratio (CAR) of 17.2% when last reported in December 2019, the Ethiopian banking sector appears well capitalized. However, given that the National Bank of Ethiopia's regulatory framework uses Basel I standards, it is likely that the regulatory CARs overstate the sector's buffer against insolvency. This is underscored by the sector level leverage ratio of 7.9% in December 2020, indicative of moderate solvency risk. The capital adequacy ratio stood at 10.5% in Côte d'Ivoire at the end of 2019, while in Senegal the ratio was 13.9% at the end of 2020. While Senegal's CAR ratio is higher than Côte d'Ivoire's, so are non-performing loans (NPLs), and a sharp asset-quality deterioration could quickly diminish capital buffers given low provisioning. In Côte d'Ivoire, particularly weak capitalization of small state-owned banks also presents vulnerabilities to the banking system and diminishes confidence in the banking sector overall.

Outlook

- The largest risks to Ethiopia's banking sector stem from the sovereign because of related party lending risks. These risks are likely to materialize if there is a large deterioration in the sovereign's external position including additional short-term debt restructuring or currency devaluation. Additionally, a deterioration in the sovereign's financial position will impact the sovereign's ability to repay SOE debt owed to the banking sector.

- In Côte d'Ivoire and Senegal, the greatest near-term risk stems from likely asset quality deterioration, although the favorable economic outlook and anticipated robust recovery will sustain credit growth in 2021, supporting profitability and provisioning against new loan losses.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sectors-cote-divoire-ethiopia-senegal-significant-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sectors-cote-divoire-ethiopia-senegal-significant-risk.html&text=Banking+sectors+in+Cote+d%27Ivoire%2c+Ethiopia%2c+Senegal%3a+Significant+to+High+Risk++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sectors-cote-divoire-ethiopia-senegal-significant-risk.html","enabled":true},{"name":"email","url":"?subject=Banking sectors in Cote d'Ivoire, Ethiopia, Senegal: Significant to High Risk | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sectors-cote-divoire-ethiopia-senegal-significant-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+sectors+in+Cote+d%27Ivoire%2c+Ethiopia%2c+Senegal%3a+Significant+to+High+Risk++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-sectors-cote-divoire-ethiopia-senegal-significant-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}