Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 06, 2021

Banking risk monthly outlook: Regional risks in 2021

Our banking risk experts provide insight into the regional events impacting the financial sector in emerging markets in 2021.

- Increased provisioning following expiration of mainland China's micro, small, and medium-sized enterprise loan moratorium in March 2021

- Higher lending to mortgage segment and stock investment in India

- Resumed efforts by European regulators to upgrade local bank recovery and resolution regimes

- Rising impairments across Latin America accompanied by provisions and reduced profits

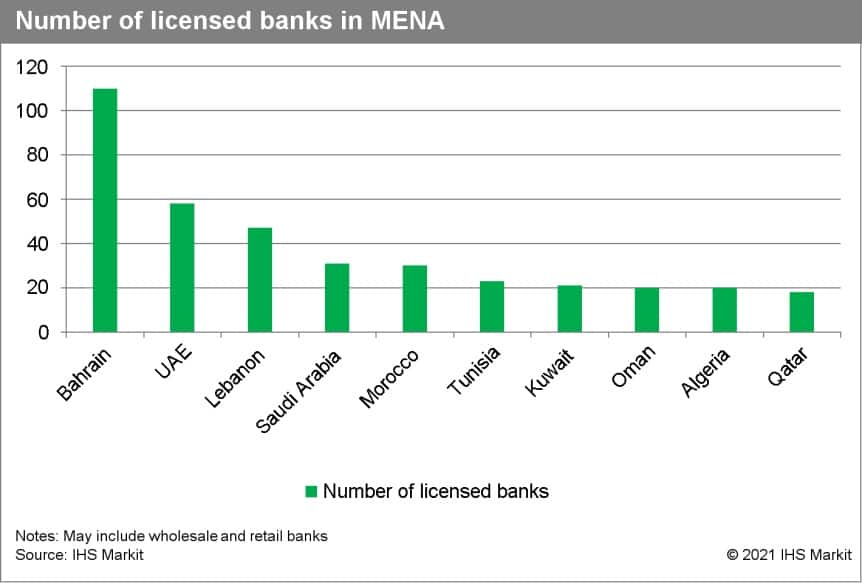

- Banking sector consolidation in the Middle East and North Africa

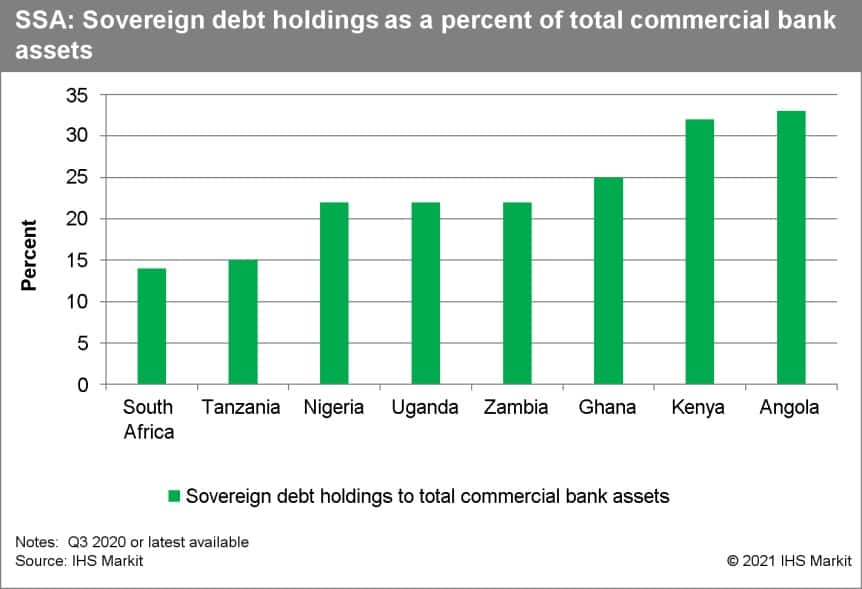

- High and rising sovereign debt exposure for Sub-Saharan African banks

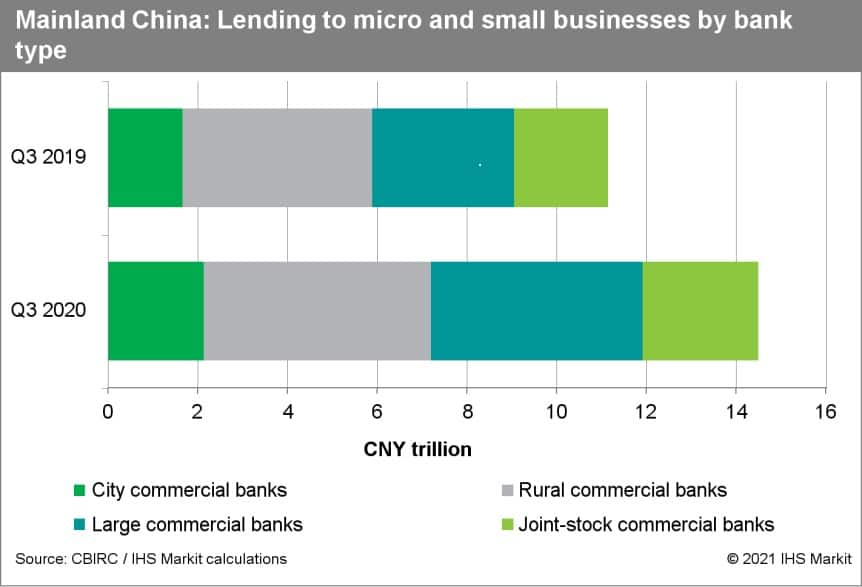

Rising micro, small, and medium-sized enterprise (MSME) lending and moratorium expiration likely to lead to rising bad loans in Mainland China.

Lending to micro and small enterprises has increased by close to 30% in 2020 on an annual basis, higher than headline credit growth. Because the loan moratorium for MSMEs will expire in March 2021, this will likely lead to an increase of bad loans in 2021 and beyond, especially considering the additional lending to the sector. It is likely that banks will need to have additional provisioning for bad loans and expect some effect on profits.

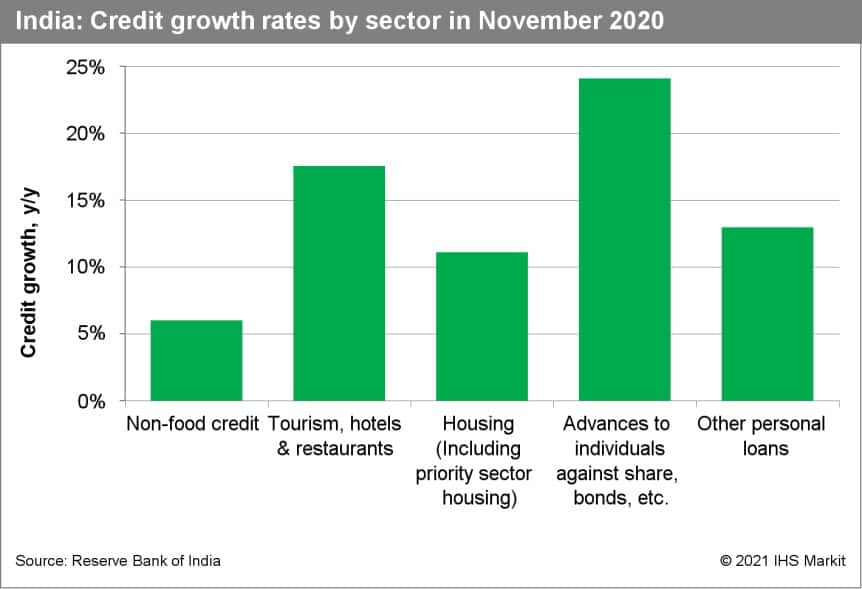

Rising lending for mortgages and investments likely to increase credit risk in India's banking sector.

In India, consumer housing loans rose as a result of a combination of lower mortgage interest rates and various offers made by developers facing liquidity issues in order to offload properties. At the same time, investments for purchasing securities and bonds had also increased substantially. Increased lending to the real estate sector while the economy is facing headwinds and higher lending for speculative investments increase the risks of turning sour in the next 12-18 months.

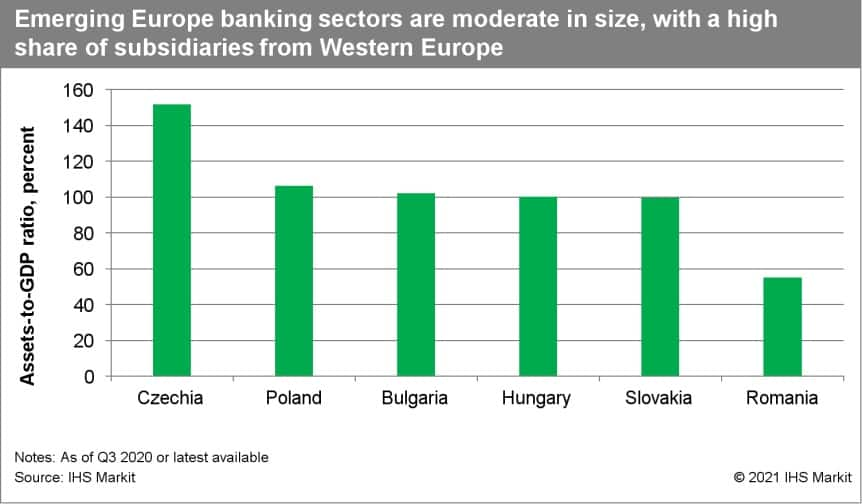

European regulators to restart efforts to upgrade local bank recovery and resolution regimes.

The EU restarted discussions on reforming the bank resolution framework in late 2020 and is seeking full harmonisation of its framework across member states by 2024 as one of the key steps towards eventual banking union. Several proposals on how to deal with potential bank failures and recapitalisation needs are under discussion. The European Commission is also considering making a new proposal for the European deposit insurance scheme, another pillar of banking union, after national governments have failed to agree on a common scheme since 2015.

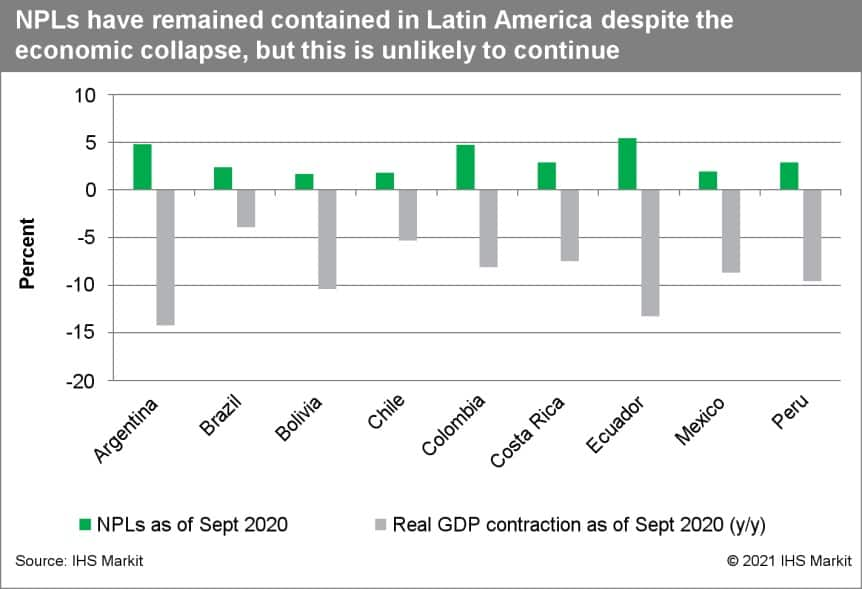

Rising loan impairment throughout 2021 in Latin America accompanied by higher provisioning and reduced profits.

As is the case in most regions, the severe recession witnessed in Latin American economies during 2020 has not yet translated into a rise in NPLs. Unlike other regions, however, the percentage of loans that have been restructured or have benefited from payment delays is very high, suggesting that there has been a de facto deterioration in borrowers' debt-servicing capacity. The percentage of borrowers who have embraced the forbearance measures through either payment delays or loan renegotiations stands at 33% in Peru, 25% in Mexico, and 35% in Ecuador. However, most of the region has demonstrated a willingness to increase provisions as needed. We expect this to continue in 2021 at the expense of profits.

Banking sector consolidation in the Middle East and North Africa, especially in the Gulf.

After some stalling in 2020, 2021 is expected to be a much bigger year for mergers and acquisitions (M&A) in the MENA region as economies begin to recover from the COVID-19 and low-oil-price shocks and banks refocus their growth strategies. Additionally, COVID-19 may serve as a catalyst for M&A in some MENA banking sectors in 2021, as credit growth is expected to contract on average across the region and profitability will be affected by the materialisation of loan losses. Consolidation will be most notable in Gulf countries with a large number of smaller banks. There should also be further consolidation in Lebanon in 2021, where a central bank circular requires banking sector recapitalisation by end-February to avoid takeover by the central bank. Consolidation is a likely survival strategy for the sector's 47 commercial banks.

High and rising sovereign debt exposure to present challenges for Sub-Saharan African banks.

COVID-19 has led banks in Sub-Saharan Africa to increase further their holdings of domestic sovereign debt given the credit deterioration of good-quality corporate borrowers in the market and higher government funding needs, a trend we expect to persist in 2021. Of the eight banking sectors in the region rated by IHS Markit, six hold more than one-fifth of total sector assets in sovereign debt. Given the severe fiscal constraints facing local SSA governments, the likelihood of debt renegotiations and possible defaults will remain a key risk for banks' liquidity and profitability in 2021.

You can read more about our 2021 banking risk analysis in a post from the end of the year on themes and trends we see coming.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-regional-risks-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-regional-risks-2021.html&text=Banking+risk+monthly+outlook%3a+Regional+risks+in+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-regional-risks-2021.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: Regional risks in 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-regional-risks-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+Regional+risks+in+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-regional-risks-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}