Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 04, 2021

Banking risk monthly outlook November 2021

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in November.

- Looser mortgage lending by banks to improve liquidity of real estate companies

- Asset-quality improvements in Thailand after tourism sector opens up

- Policy rate cuts in Turkey to increase bank funding costs, challenge debt-servicing capacity amongst corporate borrowers and re-ignite credit risks

- Higher taxes for banks after the extension of COVID-19 emergency aid through 2022 in Brazil

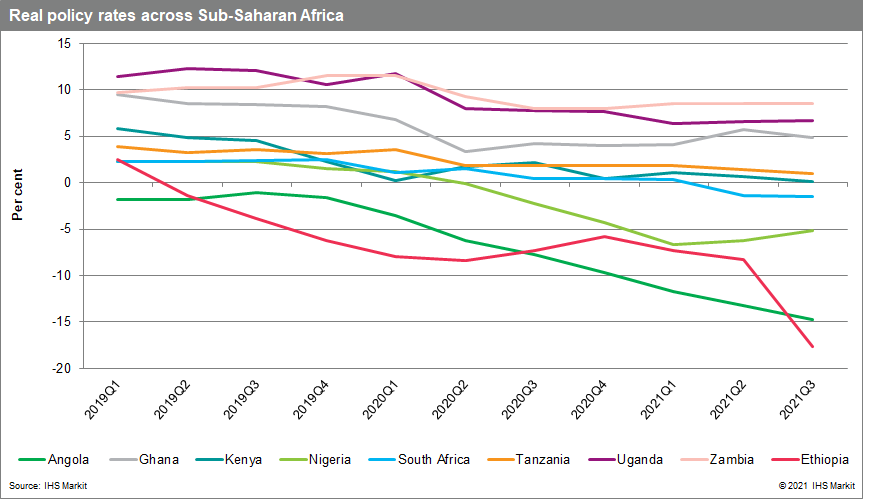

- Declining real policy rates in Sub-Saharan Africa economies signalling upside risks to the interest-rate outlook in 2022

Looser mortgage lending likely reduces the chance of hard landing for real estate companies.

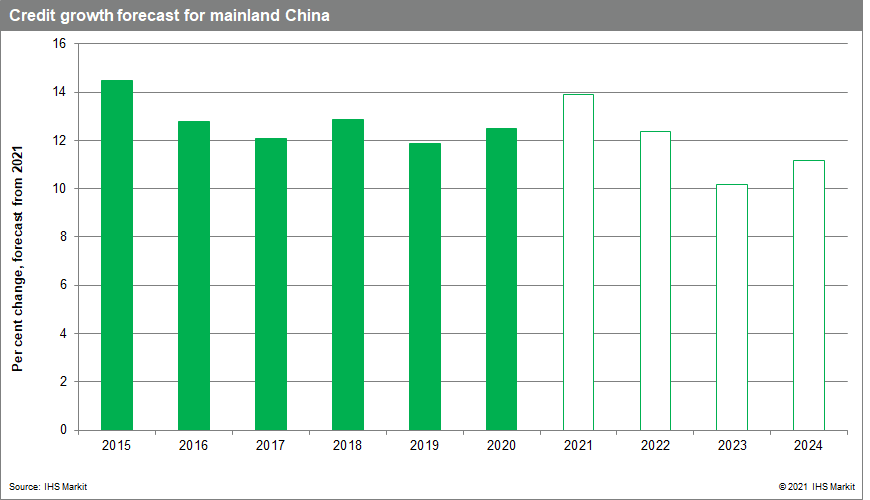

Mainland Chinese authorities have asked banks to speed up mortgage approval in the fourth quarter of 2021. IHS Markit experts believe that combined with the discounts introduced by developers, this will likely boost sales of new properties in mainland China. Despite the price falls recorded by some major cities in recent months, this will likely support the liquidity of developers in the short term and potentially improve their ability to repay their debt.

Thailand's asset quality improvement is due to the opening up of the tourism sector.

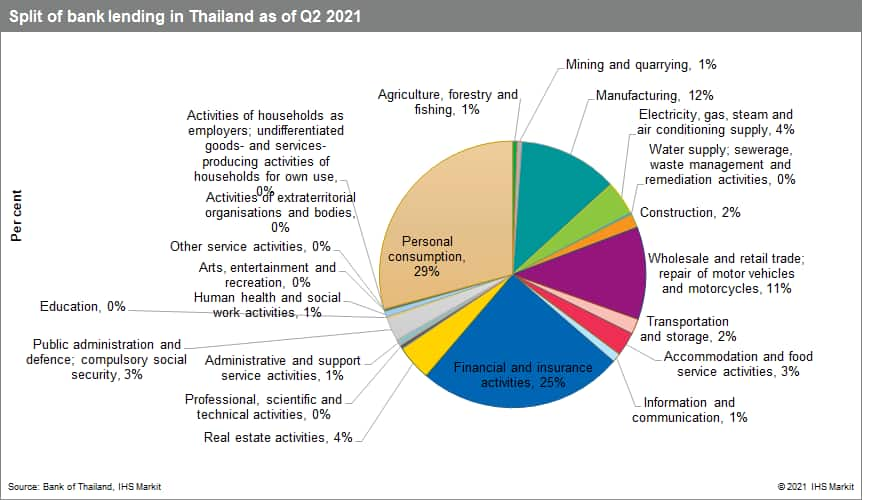

The Thai government announced that it will open up the tourism sector starting in November. Although accommodation and food service activities - a good proxy of the tourism sector - account for around only 2.5% of total lending, IHS Markit experts judge that because the tourism sector accounts for around 8.0% of total employment, the opening-up of the tourism sector will also benefit the overall personal lending portfolio, which accounts for nearly 30.0% of total loans.

Policy rate cuts in Turkey to increase bank funding costs, challenge debt-servicing capacity amongst corporate borrowers, and re-ignite credit risks.

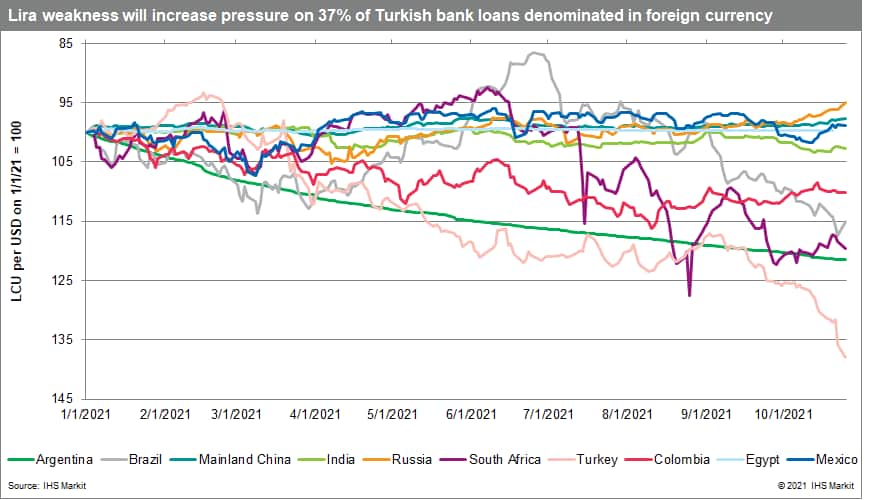

The Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB)'s decision to cut its main policy rate, the one-week repo rate, by 200 basis points, to 16.0% on 21 October, on the same day the Financial Action Task Force (FATF) added Turkey to its "grey list" is likely to yield portfolio investment outflows, trigger more substantial depreciation of the lira in both late 2021 and throughout 2022, and increase inflationary pressure. For banks, the timing of the rate cut yet again comes during the rollover of banks' annual syndicated loans. Although not as important as the spring roll-over period, the FATF designation and weaker lira are likely to increase costs and reduce appetite for this debt. The policy rate cut is furthermore likely to push lending rates back into negative territory, putting pressure on profitability even as credit growth is likely to re-accelerate from a recent dip. The strong lira depreciation meanwhile will put downward pressure on capital buffers and force banks to source more expensive swaps and derivatives to close their own on-balance sheet exposure to the weaker lira.

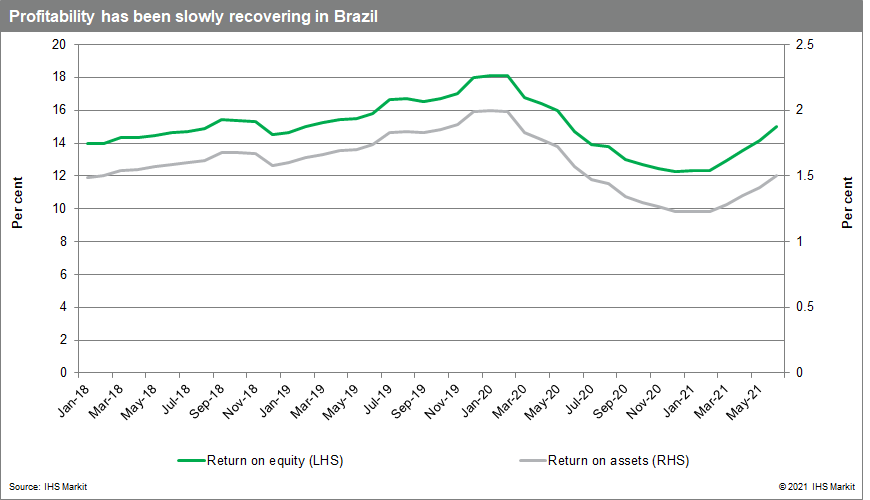

Banks in Brazil are likely to experience increased taxes after the extension of COVID-19 emergency aid through 2022.

COVID-19-related aid targeted to low-income sectors was initially due to end in October, but President Jair Bolsonaro's government indicated repeatedly that the measures would be extended. This aid was extended despite warnings from the Ministry of Economy that such spending would breach a constitutionally mandated budget cap. In turn, the government will likely aim to speed up an increase in levies for banks that is currently being discussed in Congress, likely leading to a decrease in profitability in the sector.

Declining real policy rates in Sub-Saharan Africa economies signal upside risks to the interest-rate outlook in 2022.

The COVID-19 pandemic has prompted various central banks across the Sub-Saharan Africa region to cut policy rates in many cases to historical lows. In many Sub-Saharan Africa economies, inflation is rising despite negative risks to aggregate demand amidst the ongoing pandemic and slow vaccine rates. Food prices are pressured by local shortages and the rise in global food prices. Core inflation, impacted by pandemic-induced supply-demand mismatches, rising commodity prices, adverse exchange-rate developments, transportation costs, and policy-related developments, has also increased in many economies, albeit to a lesser extent. Nevertheless, real policy interest rates have declined in Angola, Ghana, Kenya, South Africa, Tanzania, Zambia, and Ethiopia in the third quarter of 2021. IHS Markit experts expect central banks in these countries to be very conscious of their economies' fragile recovery. However, if the upward pressure on prices turns out to be more than transitionary, the risks to the interest-rate outlook will be tilted towards the upside. Price developments in these countries that could trigger a rise in interest rates in 2022 will thus be closely monitored. Increased interest rates are likely to adversely affect borrowers' debt-servicing capacity and the demand for new loans while providing some uplift to profit forecasts.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-november-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-november-2021.html&text=Banking+risk+monthly+outlook+November+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-november-2021.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook November 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-november-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook+November+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-november-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}