Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 06, 2023

Banking risk monthly outlook: July 2023

Our banking risk experts provide insight into events impacting the financial sector in emerging markets:

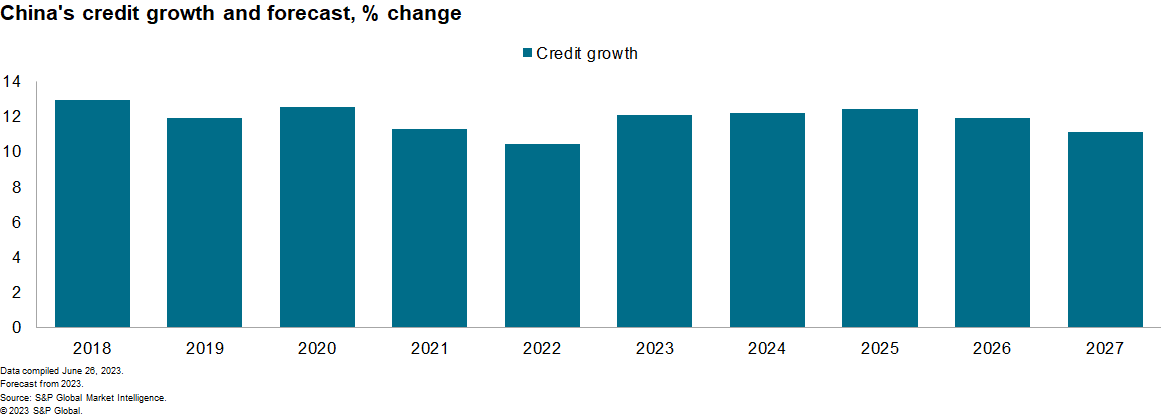

Easing monetary policy will likely lead to broad-based loan growth in mainland China. Chinese banks lowered deposit interest rates and the central bank reduced the medium-term lending facilities rate in July 2023, signaling further monetary policy easing in the coming quarter, including both a cut in the reserve requirement ratio (RRR) and a loan prime rate (LPR) reduction. Unlike previous RRR cuts that targeted micro, small and medium-sized enterprises (MSMEs), it is likely that the RRR cut will be broad based. The LPR reduction will potentially be accompanied by a more flexible interest rate reduction for existing mortgage borrowers, to reduce their incentives to redeem their mortgages early.

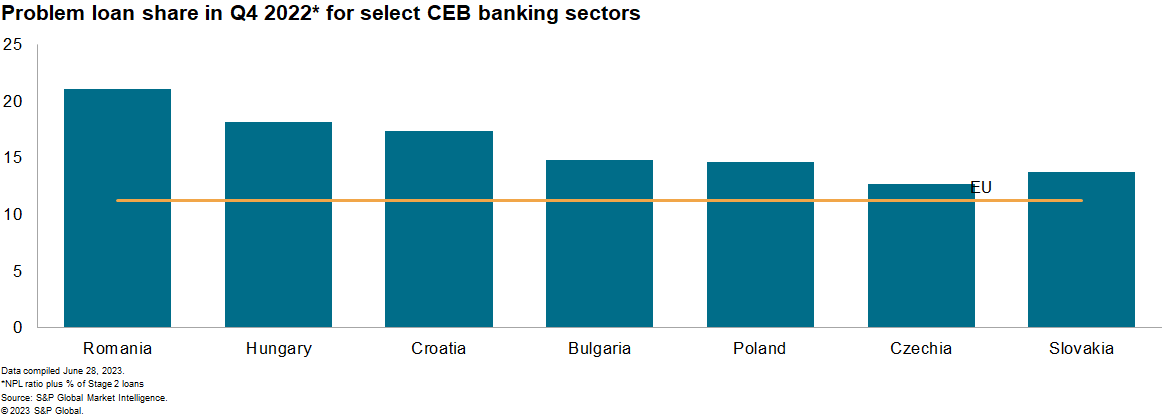

Financial soundness indicators will worsen in Central Europe and the Balkans (CEB) in the coming quarters. Non-performing loan (NPL) ratios have so far experienced limited, if any, deterioration since the start of monetary tightening in 2021 and through 2022, with most countries seeing a decrease in the ratio. However, Stage 2 loan ratios — representing loans with heightened credit risks — remain stubbornly high in Emerging European countries, including Croatia and Romania. NPL ratios for the first quarter showed a slight worsening in asset quality in these countries. Increased cost pressures for borrowers and a tightening in bank lending conditions, which is limiting their access to credit, are issues that will persist throughout 2023. Owing to continued economic headwinds and the lack of movement in Stage 2 loans, we anticipate that second-quarter data will show continued weakening in capital ratios and higher NPL ratios in banking sectors across CEB, including Croatia, Hungary and Romania.

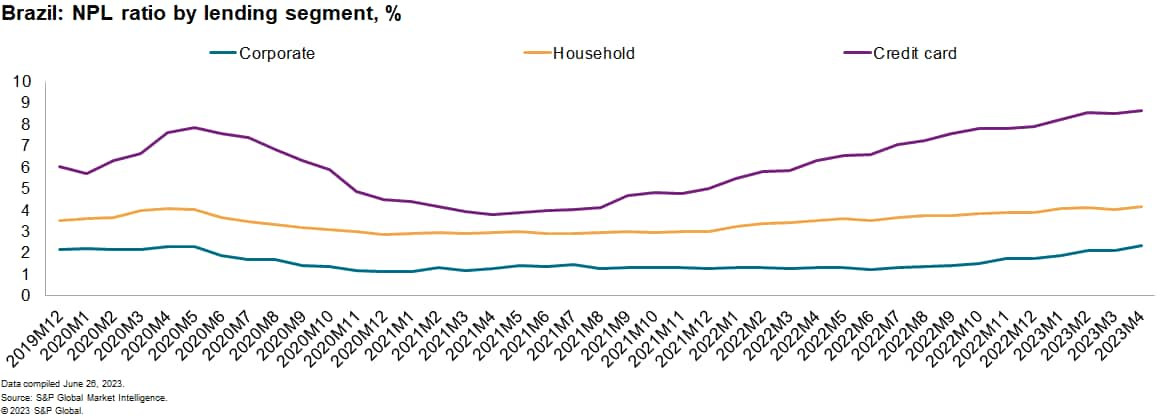

Brazilian impaired loans are increasing as interest rates stress consumers. There have been reports of increasing impairment in the Brazilian banking sector. Most stem from the consumer segment, particularly credit cards, but NPLs from corporations are also increasing. This is likely a result of the heightened stress caused by a combination of higher levels of indebtedness together with higher financial costs from higher interest rates. So far, the bankruptcy of Americanas SA has not impacted the sector severely, although it is one of the contributing factors to rising NPLs, which are likely to continue edging up if interest rates remain high.

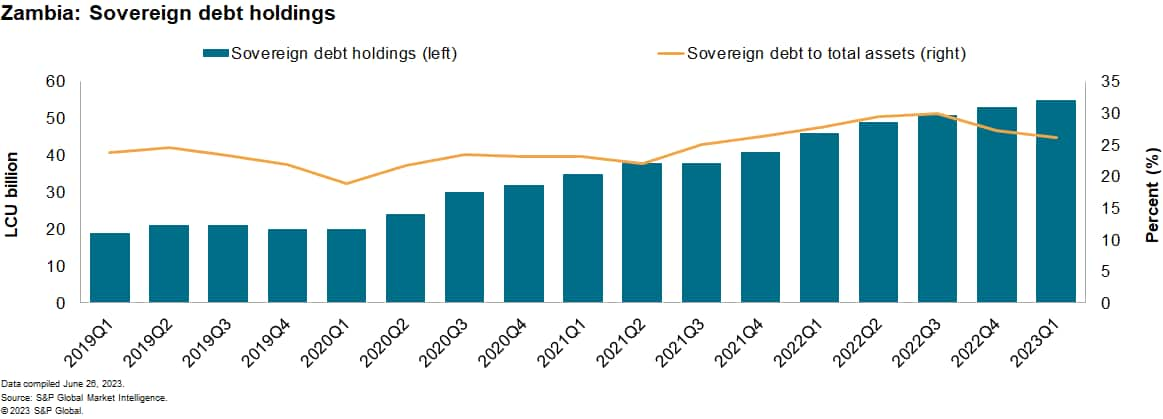

Zambia's debt restructuring agreement will prompt IMF funding, likely reducing reliance on commercial banks' funding. The Zambian government secured a memorandum of understanding (MoU) on a US$6.3 billion debt restructuring plan with its official creditors under the Group of 20 Common (G20) Framework. The debt restructuring agreement is a necessary step to unlock a US$1.3 billion credit facility with the International Monetary Fund (IMF), with the first disbursement expected in the second half of 2023. Access to the IMF credit facility is expected to improve Zambia's debt sustainability and reduce pressure on commercial banks to take on additional government debt, which crowds out private-sector lending. Zambian banks hold the bulk of domestic debt, and about 26.0% of banks' total assets was in sovereign debt holdings as of March 2023.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-july-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-july-2023.html&text=Banking+risk+monthly+outlook%3a+July+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-july-2023.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: July 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-july-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+July+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-july-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}