Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 03, 2021

Banking risk monthly outlook: August 2021

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in August

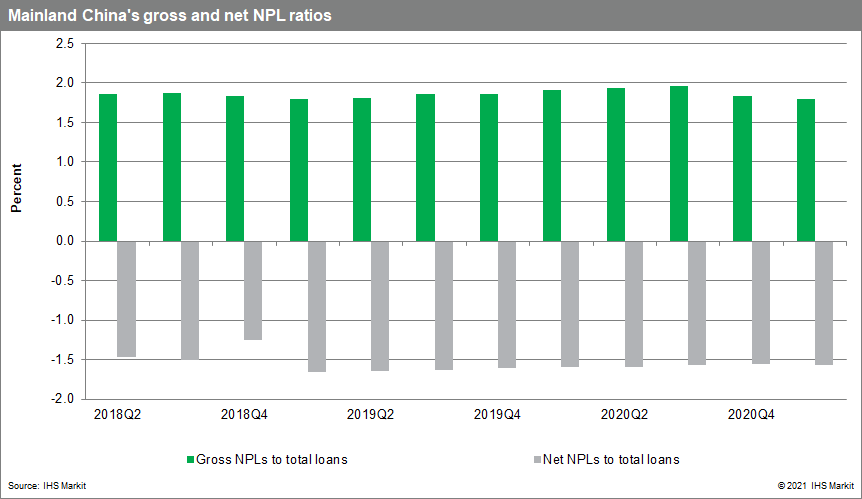

- Bad-loan write-offs and use of debt-to-equity swaps to contain worsening on-paper asset quality in mainland China

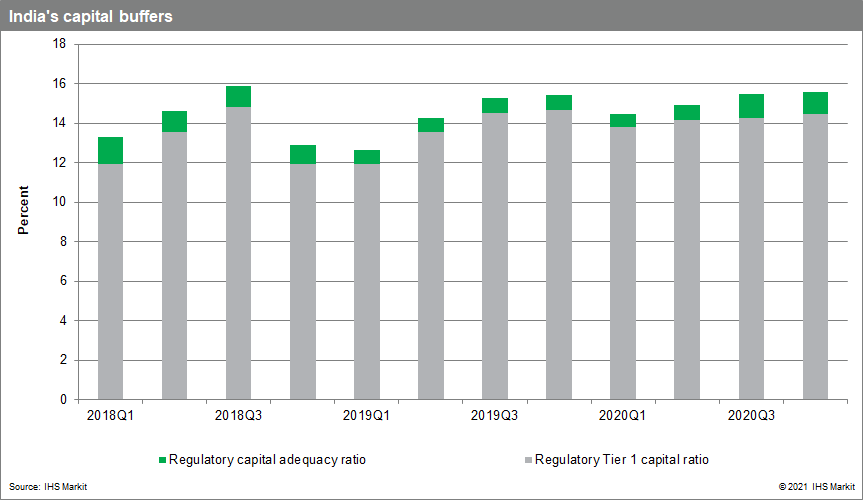

- Key focus in state-directed bad bank likely supporting higher NPL purchases in India

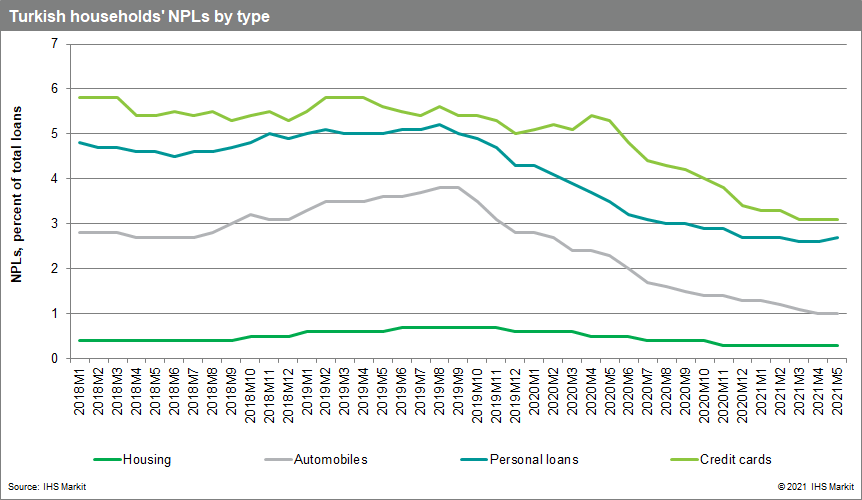

- The end of Turkey's COVID-19 employment-protection scheme likely yielding a small bump in household NPLs, reversing recent trends

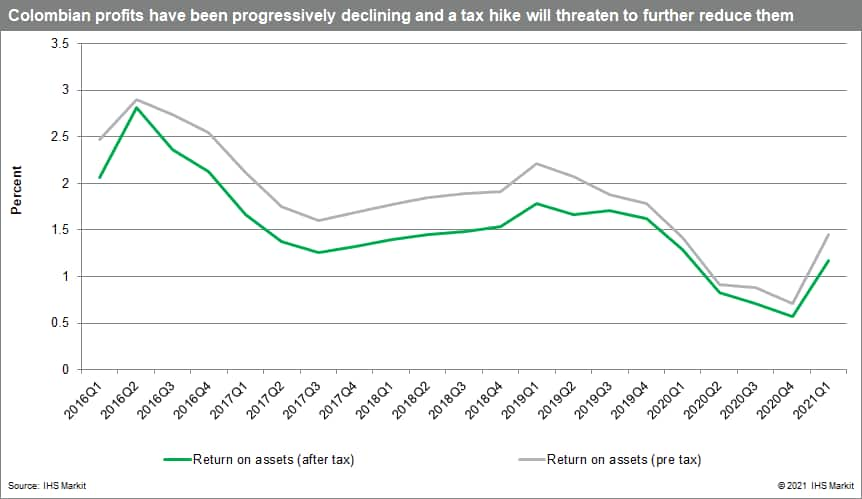

- Discussions on the new Colombian tax bill's targeted tax for banks

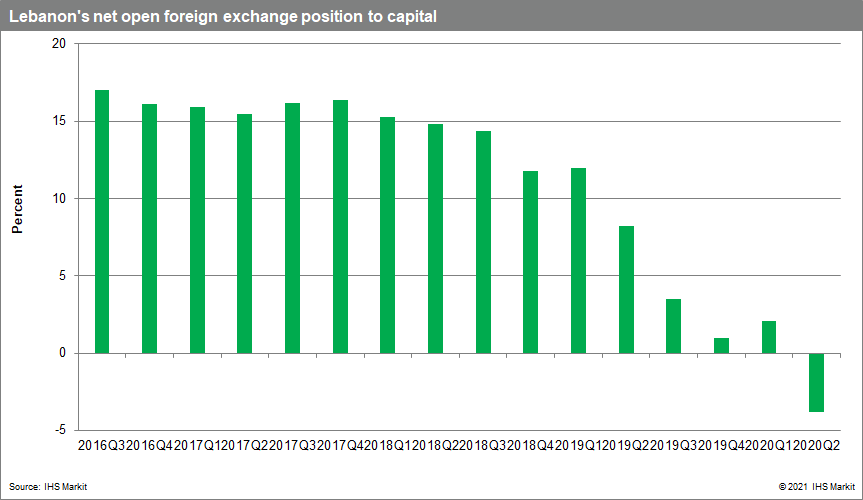

- Official currency devaluation driving recapitalization needs in Lebanon

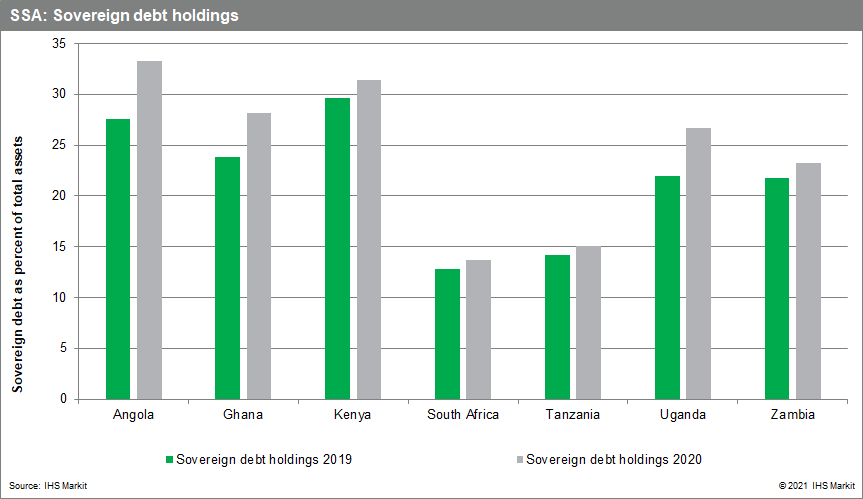

- Private-sector credit recovery and increased bank-sovereign linkages in Sub-Saharan Africa

Bad-loan write-offs and use of debt-to-equity swaps to contain worsening on-paper asset quality.

Many announcements have been made over the past few months indicating that banks should expect a build-up in bad loans because of higher lending to micro, small, and medium-sized enterprises (MSMEs). Considering the recent market turbulence and increased regulations in the financial market, IHS Markit experts judge that bad-loan write-offs will be more prominent. Furthermore, debt-to-equity swaps will likely be used more extensively to ensure the control and shareholding of businesses remain in mainland China.

Key focus in state-directed bad bank likely to aid NPL purchases in India.

The state-directed bad bank will be functional in the next few months, as state-owned banks have been busy selling down their stakes in smaller, part-owned asset reconstruction companies (ARCs). This will likely attract more foreign investment in these ARCs; at the same time, it will likely increase the firepower of the main bad bank. More loans will likely be removed from banks, especially when the loan-restructuring scheme expires.

End of Turkey's COVID-19 employment-protection scheme is likely to yield a small bump in household NPLs.

First introduced in April 2020, Turkey's pandemic prohibition on terminating employees and instituting furloughs expired at the end of June, raising the possibility that unemployment numbers will increase over the coming months. This would put added pressure on debt-servicing capacity amongst households employed in sectors that remain subject to periodic COVID-19 restrictions and that are experiencing a slower recovery, like tourism and other service sectors in particular, reversing what has been a declining trend in household-sector NPLs during the pandemic. All categories of household loans stood at less than half their long-run average as of May, and overall NPLs on banks' household loan portfolios are half that of corporates, 2% versus 4%.

Discussions on the new Colombian tax bill's targeted tax for banks.

President Iván Duque's government submitted a tax bill on 20 July. This comes after the public rejection of the original bill, which was not sanctioned by the president after it triggered protests and riots. The new proposal targets wealthier individuals, higher corporate taxes, and a special tax on banks. Although the proposal is likely to be passed, it will probably be watered down by lobbying business groups. However, it is likely that banks will end up paying the special tax, which would hurt already depressed profitability in the Colombian sector.

Official currency devaluation driving recapitalization needs in Lebanon.

The selection of Najib Mikati as prime minister designate in Lebanon is expected to spur a more rapid government formation and energy for banking sector reform, in particular given Mikati's domestic consensus and external support. On top of the agenda is taming the rapid depreciation of the local currency, which has lost more than 90% of its value since October 2019. However, the banking sector is extremely exposed to direct foreign exchange-rate risks, as foreign currency liabilities outweigh foreign currency assets. As such, it is expected that an official devaluation of the Lebanese pound will lead to significant recapitalization needs in the banking sector in the near term. In fact, IHS Markit calculates that a devaluation of the pound to just LBP15,000 per US dollar - well below the black-market rate of LBP18,050 per US dollar - will lead to an increase in the net open position amounting to 700% of shareholders' equity.

Post-pandemic delays in fiscal consolidation on overall lackluster economic recoveries across the Sub-Saharan Africa (SSA) region raising concerns for private-sector credit recovery and increasing bank-sovereign linkages.

Across the region, countries tabled budgets for 2021/22 reflecting fiscal consolidation from the previous year's boost to government spending amidst the COVID-19 pandemic. However, the ongoing pandemic and slow vaccine rollouts across the region lead IHS Markit analysts to expect a slower rate of fiscal consolidation across our rated SSA banking sectors. The increasing trend in banks' sovereign debt holdings observed in 2020 is thus set to continue and crowd out private-sector loans. Governments in countries like Ghana, Angola, Kenya, Uganda, Zambia, and South Africa in particular utilize the domestic markets extensively to help finance public debt. Further deterioration in asset quality as forbearance measures end will also keep banks' risk appetite muted and drive them to divert their portfolios towards safer and more liquid public assets.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2021.html&text=Banking+risk+monthly+outlook%3a+August+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2021.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: August 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+August+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-august-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}