Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 03, 2021

Bank of Russia delivers hefty but expected rate increase in October

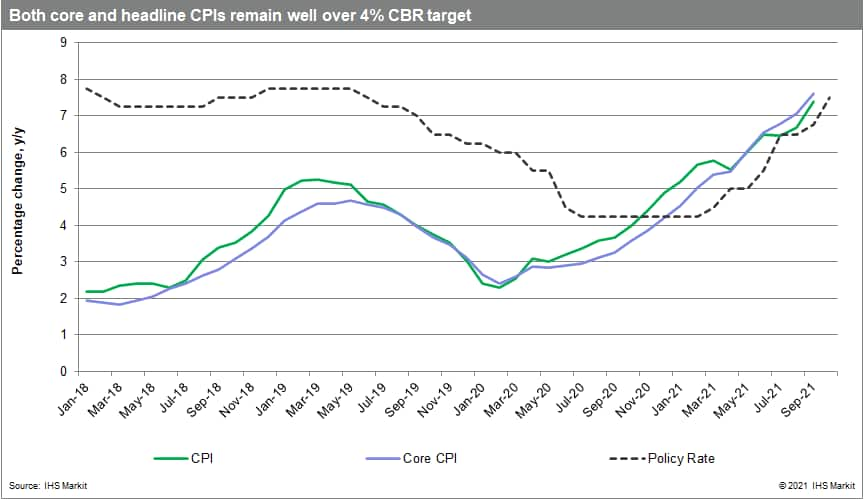

- The unabating headline and core inflation forced the Central Bank of Russia (CBR) to take a firm step by raising its key rate to 7.5%.

- By frontloading the monetary tightening CBR aims to anchor consumer and business inflation expectations, as the headline annual inflation surged to 7.4% in September, the highest reading since June 2016.

- Both demand- and supply-side inflationary pressures keep the headline and core inflation well above the central bank's 4% inflation target.

- Bank of Russia could opt for a smaller rate rise should the inflation rates remain above the current key interest rate in the coming months.

On 22 October, the CBR's Board of Directors lifted its key rate by 75 basis points (bp) from 6.75%. The move followed a 25-bp increase in September and marked the sixth rate tightening since the start of the year. The accompanying press note by the Board of Directors after the rate-setting meeting was not dissimilar to those issued in the past months. The bank reiterated that inflationary pressures are rising.

Demand continues to outstrip output expansion capacity. The deviation of the headline inflation from the CBR's target of 4.0% will persist. The only difference was the CBR's decision to increase its annual inflation forecast to 7.4-7.9% by end-2021. The bank kept annual average inflation at 4.0-4.5% in 2022.

This compares to IHS Markit's projections of 7.2% annual inflation by end-2021. Annual average inflation will stand at 6.4% in 2021, easing to 4.8% in 2022, under our current assumptions.

The surge in consumer prices through September and the first half of October was a key trigger for CBR's decisive move to anchor consumer inflation expectations. Specifically, detailed monthly inflation data released by the Russian Federal State Statistical Service (RosStat) showed a jump in the headline inflation to 7.4% year on year (y/y) in September from 6.7% in August, and 6.5% in June-July.

Highest inflation since 2016

Food prices were the main driver of the September inflation increase. Services sub-index also rose. The least inflationary impulse came from the non-food price sub-index.

For the fourth consecutive month, the core inflation increased faster than the headline CPI. In y/y terms, the underlying inflation increased to 7.6% in September from 7.1% in the previous month and 6.8% in July.

Despite the tightening cycle, monetary conditions showed no notable changes since the previous meeting, according to the CBR. Lending remained largely unaffected. Short-term OFZ's (Obligatsyi Federal'novo Zaima) yields increased in anticipation of a further key rate hike.

Both commercial and consumer borrowing remained significant. Still, there were also small inflows of funds into fixed-term rouble deposits, a trend that the bank expects to solidify in the coming months due to its monetary policy.

Cash to spend

- Inflationary pressures from economic activity remain a concern for the Russian central bank.

- Household incomes benefited from one-off budgetary payments and rising real wages. Ahead of the Duma elections in September, the government made USD9.5-billion payments to nearly 40% of the country's population, including economically vulnerable groups and military personnel.

- High inflation expectations also contribute to increased white goods and other purchases.

Producer prices bite

- Apart from the demand-linked inflationary pressure, CBR sees inflationary pressures rising from supply side constraints, and high input costs, which producers transfer to consumers.

- Increased labor demand and the fall of the unemployment rate close to its record lows signal rising labor costs.

Outlook

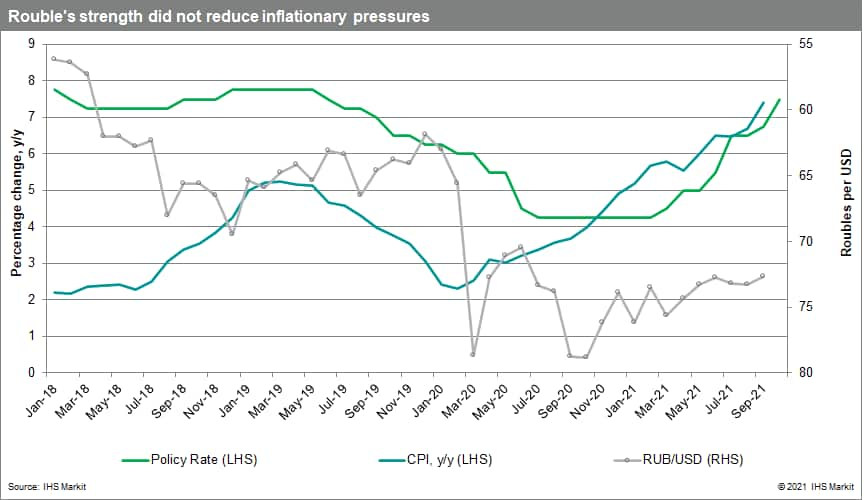

As expected, after a substantial rate hike the Bank of Russia took a break until 17 December. Currently, the disinflationary risks appear on the rise, giving the bank some breathing space. Specifically, the inflationary impact of the one-off social payments is fading. The rouble's stability limits import price inflation risks.

More importantly, economic activity, especially client-facing businesses, once again face the drag from the pandemic. To combat the third wave of the coronavirus disease 2019 (COVID-19) virus, Russia entered a week-long strict lockdown on 28 October.

On the flipside, worsening pandemic and the lockdown could trigger yet another round of domestic supply disruptions and related price increases. Therefore, further policy tightening is still on cards but should they happen, the rate hikes will be smaller and wider paced.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbank-russia-delivers-hefty-expected-rate-increase-october.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbank-russia-delivers-hefty-expected-rate-increase-october.html&text=Bank+of+Russia+delivers+hefty+but+expected+rate+increase+in+October+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbank-russia-delivers-hefty-expected-rate-increase-october.html","enabled":true},{"name":"email","url":"?subject=Bank of Russia delivers hefty but expected rate increase in October | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbank-russia-delivers-hefty-expected-rate-increase-october.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bank+of+Russia+delivers+hefty+but+expected+rate+increase+in+October+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbank-russia-delivers-hefty-expected-rate-increase-october.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}