Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 22, 2023

Asset vs. non-asset debate in logistics services is sharpening post-Covid

The COVID-19 pandemic and the disruption it wrought on containerized supply chains brought new relevance to an age-old question facing shippers: Is greater reliability, consistency, and the ability to de-risk in a volatile world achieved by using a provider that controls its own ships, trucks, warehouses or other assets?

Or despite an elevated perception of supply chain risk, are intermediaries equally able to provide quality service with their technology and service culture, and by leveraging relationships and volumes with asset owners?

Given that it's their own business on the line, shippers for their part have long been adept at uncovering the right solutions for their needs. "It's more about the end service and our expectations for providers," the logistics director for a large retailer told the Journal of Commerce this month. "I don't go into a meeting saying, 'do you have assets or not have assets?'"

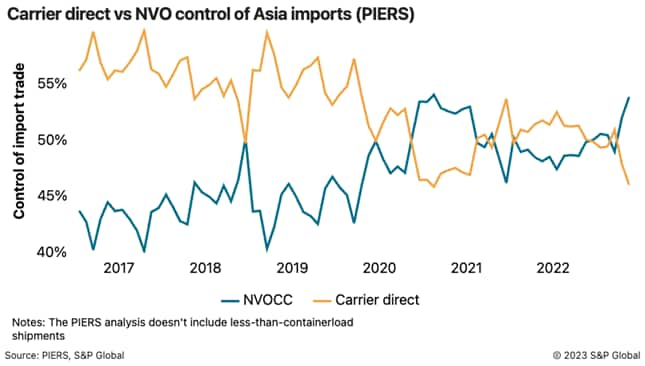

In the U.S. ocean space, that is borne out by the data. There is a growing percentage of Asia import trade handled by non-vessel-operating common carriers (NVOs) versus moved under direct shipper-carrier contracts. And other sectors such as air freight have long been dominated by forwarders. In May, NVOs handled 53.9% of U.S. imports from Asia, excluding less-than-containerload volume, according to PIERS, a sister company of the Journal of Commerce within S&P Global. The NVO share was 46.2% in late 2021.

But that hasn't stopped traditional asset-owning companies from attempting to leverage core assets in a bid to differentiate themselves. Indeed, the history of freight transport is replete with examples of asset owners that sought to build broader franchisees off a core asset-based position.

In the 1980s, the railroad CSX acquired ocean carrier Sea-Land and a barge line, American Commercial Lines, with the idea of creating an integrated offering for shippers, although it never produced the envisioned synergies.

Early on in containerization, with visions of end-to-end dominance, Sea-Land (as its name implied) as well as APL started origin consolidation businesses that, as it turned out, required a high degree of independence from the carrier in order to meet the needs of shippers. Those businesses were eventually detached completely through M&A deals.

But that is not to say some asset plays in freight transportation haven't proved successful. There are several examples of viable models, although they tend to be concentrated in specific or closed-loop scenarios.

Matson Navigation, owning its own Long Beach marine terminal and offering a tightly integrated downstream logistics business including chassis, has worked. As has the approach of the Port of Virginia, which integrates automated terminal and gate operations with a chassis pool; indeed, the port largely stayed out of the news in 2021 and 2022 because its cargo, for the most part, kept flowing. Canadian National Railway has built a successful retail intermodal service directly serving shippers.

There are other examples. The no-margin-for-error requirement of expedited freight and parcels gave rise to "integrated" carriers UPS, FedEx and DHL that maintain end-to-end control over shipments via a network of planes, trucks and warehouses, and has led Amazon to exert growing control over last-mile deliveries.

Doubling down on asset-based strategies

If anything, there seems to be a doubling down on asset-based strategies. From its core competency in marine terminals, DP World has made several recent acquisitions in logistics and shipping, including Imperial, a logistics provider serving Africa, and Unifeeder, a feeder container line, all in a bid to become a "leading end-to-end supply chain solutions provider." Singapore-based terminal operator PSA International's 2022 acquisition of forwarder BDP International was seen as "an opportunity to offer shippers a greater degree of control of their goods amid elevated geopolitical uncertainty and regulatory restrictions," as the Journal of Commerce wrote at the time. Oman-based logistics group Asyad emphasizes its control over ships, terminals, distribution center and other assets in being able to provide integrated solutions.

Ocean carriers, meanwhile, are doubling down on assets, reinvesting windfall profits earned during the pandemic in assets, including marine terminals where they are seeking to build synergies with their vessel operations. CMA CGM acquiring the Fenix (former APL) terminal at Los Angeles and the Global Container Terminal facilities at New York-New Jersey are examples, as is Hapag-Lloyd's recent acquisitions of marine terminal stakes in Italy and India. In December, Ocean Network Express (ONE) agreed to acquire majority stakes in the Los Angeles terminals TraPac and Yusen Terminals from its Japanese shareholders.

Arguably, the biggest asset play is that of Maersk, which through a string of acquisitions in warehousing and distribution, customs brokerage and air freight is redefining itself from a traditional container line into a self-described global integrator of container logistics. "Integrator" is key as that is the term used to describe UPS and FedEx. Maersk's strategy, which relies heavily on direct shipper relationships, is a retort to those who cite the Sea-Land and APL experience as evidence that independence and assets are incompatible in the ocean space.

Many shippers are listening. The large percentage of U.S. ocean import freight still moving under direct carrier contracts is evidence of a bias toward assets by shippers, especially large shippers. "We would like to have a smaller set of asset-based partners that we invest in, and they invest in us," said the logistics director for a large furniture company.

Greater control over assets was cited by Maersk CEO Vincent Clerc as a justification for the impending breakup of its 2M Alliance with Mediterranean Shipping Co. "What is really key now is that we regain the operational control so that we can turn assets into choice for our customers and make a play for quality," Clerc said in the company's May 4 earnings call.

Smaller shippers, which often don't have the scale to make themselves appealing to asset-owning carriers, have long relied on intermediaries. That helps explain why Flexport sees an opening to build an end-to-end non-asset logistics network, recently announcing plans to build a truck brokerage as part of its vision.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Insights Newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasset-vs-nonasset-debate-in-logistics-services-is-sharpening-p.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasset-vs-nonasset-debate-in-logistics-services-is-sharpening-p.html&text=Asset+vs.+non-asset+debate+in+logistics+services+is+sharpening+post-Covid+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasset-vs-nonasset-debate-in-logistics-services-is-sharpening-p.html","enabled":true},{"name":"email","url":"?subject=Asset vs. non-asset debate in logistics services is sharpening post-Covid | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasset-vs-nonasset-debate-in-logistics-services-is-sharpening-p.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asset+vs.+non-asset+debate+in+logistics+services+is+sharpening+post-Covid+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fasset-vs-nonasset-debate-in-logistics-services-is-sharpening-p.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}