Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 13, 2023

Assessing a potential United Auto Workers strike

The four-year contract between the United Auto Workers (UAW) union, representing over 140,000 workers, and three major auto manufacturers will expire on Sept. 14.

Currently, negotiations are ongoing, with pay, benefits and union representation all areas left to be concluded. While recent reports suggest movement in the talks, unless the companies or the union offer major concessions, a strike lasting several weeks appears probable. The current political and economic conditions increase the odds of a longer strike, and any strike is likely to affect all three companies.

Potential economic impact

The economic impact of a strike will depend on which manufacturers are struck, for what length of time and how their competitors and suppliers react.

Any agreement will raise costs, but a rise in productivity over the past 20 years provides a buffer against the need to increase vehicle prices. Labor costs are also just 5% of manufacturing expenses, so a 46% settlement would only increase costs by 2% over four years. That may be enough, though, to provide a price disadvantage for US-made vehicles.

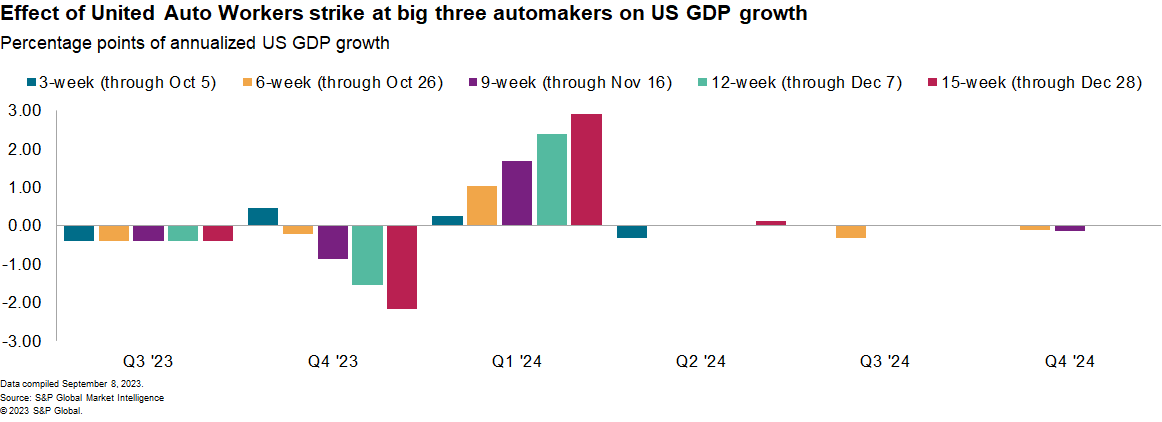

In our simulation work, we calculate the US economic impact of strikes against each individual auto manufacturer and all three combined, and we simulate strikes of five different durations: 3, 6, 9, 12 and 15 weeks. In each simulation, the effects on third-quarter US GDP growth are relatively small. For the fourth quarter, the effects range from small positive contributions to GDP growth to large negative contributions, depending on the duration of the strike.

These are static calculations in that we do not allow the impact of reduced activity in the auto sector to spill out into the broader economy. A full dynamic simulation would show somewhat larger effects.

Potential supply chain impact

Zooming into corporate supply chain activity, a prior 40-day strike against GM in 2019 provides some indication of the impact of a multi-week strike on supply chains.

The strike at GM in September 2019 had a delayed knock-on effect to supply chains. Imports of parts from Mexico only started to fall in October, while those shipped by sea did not decline until November. The impact will be most keenly felt by auto-parts exporters in Mexico (80% of whose auto-parts exports go to the US), Canada (90%) and Taiwan (50%).

S&P Global Mobility data show vehicle manufacturing by GM fell by 50% in September 2019 versus the prior three months, before falling to 17% of the three-month average in October. Production by all other manufacturers rose by 6% in September and by 21% in October versus the June to August period. That improvement may have mitigated the impact on parts suppliers serving firms outside GM.

Looking ahead in 2023, the US strikes would reverberate through upstream automotive supply chains around the world.

Political implications

The Biden administration's response to any strike will likely be limited initially but will increase the longer the work stoppage endures. The US Treasury Department has released a report that largely espoused a pro-union position.

The UAW has expressed concerns over the staffing levels, wages and benefits that will be offered at EV and battery manufacturing facilities that receive government subsidies.

Learn more about our data and insights

Subscribe to our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-a-potential-united-auto-workers-strike.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-a-potential-united-auto-workers-strike.html&text=Assessing+a+potential+United+Auto+Workers+strike+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-a-potential-united-auto-workers-strike.html","enabled":true},{"name":"email","url":"?subject=Assessing a potential United Auto Workers strike | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-a-potential-united-auto-workers-strike.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Assessing+a+potential+United+Auto+Workers+strike+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fassessing-a-potential-united-auto-workers-strike.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}