Asia PMI indicates region slipping further into contraction ahead of 2023 arrival

The Asia region as a whole had seen a shallower decline in the early months of the COVID-19 pandemic but consequently found the recovery pace paling in comparison to the rest of the world in 2021 and 2022, according to PMI data. Moreover, latest indications suggest that, alongside the global picture, a deterioration in business conditions had set in in the final months of 2022, although there are notable and wide variations in performance within Asia.

We review the performances of major Asia economies covered by the S&P Global PMI, examining the sub-indices to shed light on key issues of concern for the respective economies and gain insights into the outlook for 2023.

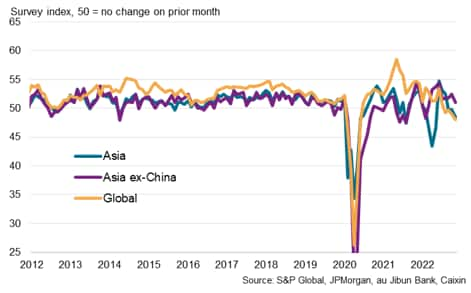

Asia region joins the global economy in contraction

The latest S&P Global Asia Composite PMI indicated a third consecutive month of contraction for the region in the penultimate month of 2022. The pace of contraction further sharpened to the quickest since May to outline a steepening deterioration in conditions, but remained at a slower pace compared to the global situation, according to the JPMorgan Global Composite PMI.

Global and Asia composite PMI output

Excluding mainland China, however, private sector output remained in growth territory in November, albeit seeing the pace of expansion slowing from the start of the fourth quarter. COVID-19 disruptions continued to affect Asia's largest economy in November, hampering both manufacturing production and services activity, though this was before an easing of restrictions into December which may suggest that we could see better numbers in the months ahead.

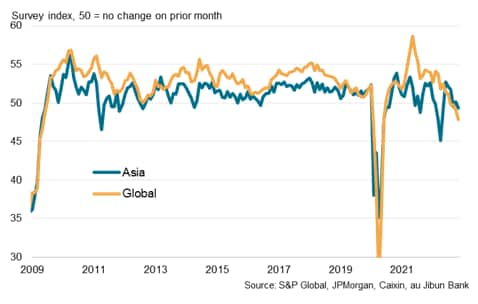

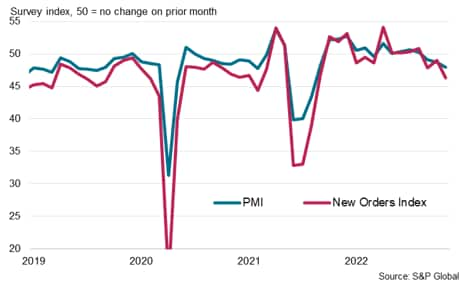

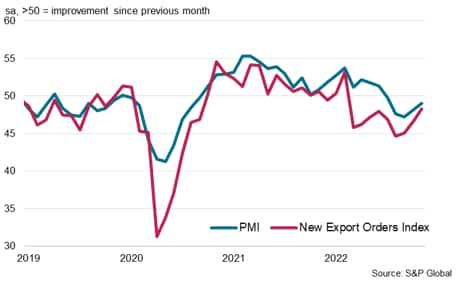

Falling demand

That said, the overall picture for Asia as a whole remains a worrying one, especially as the world economy faces an extended cooling off period on the back of persistent inflation and expectations of further monetary tightening, which are likely to result in a further slowdown in household and business spending.

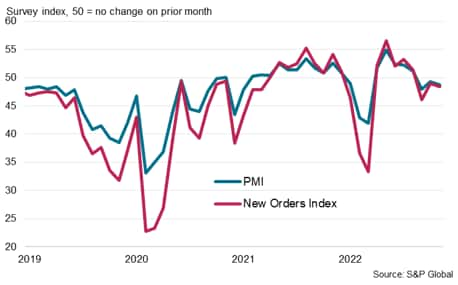

Global demand has in fact already contracted for four straight month, according to the JPMorgan Global Composite PMI new orders data, falling in November at the sharpest pace since the financial crisis in 2009, excluding pandemic lockdown months. While the sharp downturn in new orders appears to be concentrated in Europe and North America, Asia likewise saw demand contract in six of the first 11 months of 2022 to reflect sluggish demand conditions. The drying up of demand in Western economies is also expected to affect Asia through trade and capital flows going into 2023.

Global and Asia composite PMI new orders

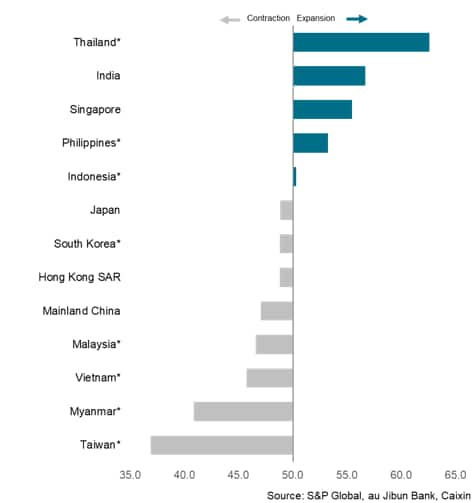

Comparing the output performance across major Asian economies in the penultimate month of 2022, more than half of which tracked can be seen in contraction. While Taiwan is experiencing the sharpest slowdown within its manufacturing sector, Thailand, India, Singapore and the Philippines continue to see output improve at solid rates, outlining the mixed picture across the Asia region towards the end of 2022.

Asia PMI output, November 2022

*Manufacturing output used in place of composite / whole economy output

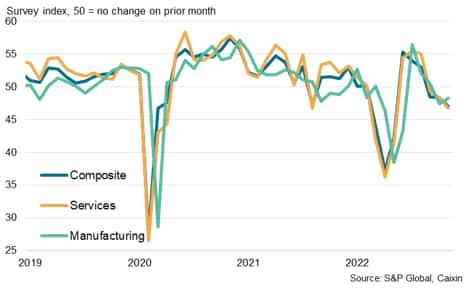

Mainland China to see reopening boom and renewal of price pressures?

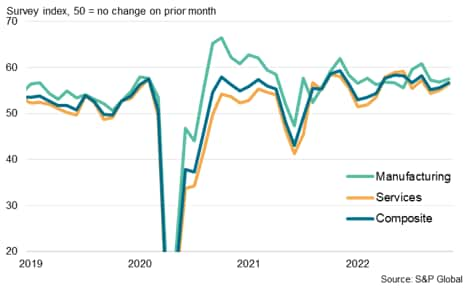

Relative to the rest of Asia, mainland China's economic conditions remained negatively affected by COVID-19 restrictions in November. This was as containment measures implemented to suppress the rise in virus cases dampened economic activity, especially services activity, according to the latest available data. China's services activity can be seen falling at a faster pace compared to manufacturing output, the latter seeing only a modest decline in November.

Caixin China General PMI output

That said, recent COVID-19 guidance has been revised to promote a lowering of restrictions (See " Chinese government revises COVID-19 guidance, promoting lower restrictions, reducing scope of policy divergence between localities"), although some degree of "dynamic zero-COVID" control measures are expected to remain through the first quarter of 2023. As such, further improvements in business activity may be expected in the coming months, barring any surprises, and we will be observing closely via the PMI new orders and output indicators, in addition to other subindices that could highlight capacity conditions.

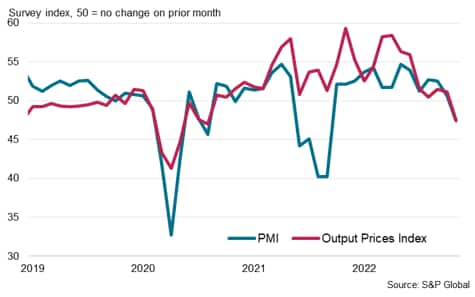

More crucially, however, the question will be on whether concerns over a revival in demand from mainland China will lead to resurgent price growth. Selling prices amongst goods producers in mainland China can frequently be seen rising at rates quicker than upturns in new orders in the survey's history. Renewed demand may therefore have its effect on inflationary pressures, which does not bode well for the world economy grappling with recession risks and further tightening of monetary conditions. These will be the indicators to track as we head into 2023.

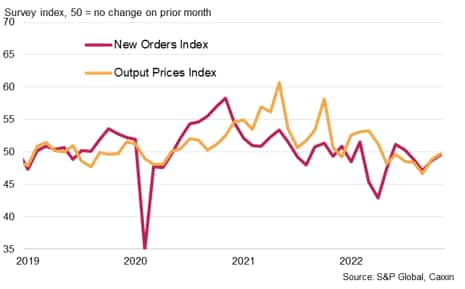

Caixin China General Manufacturing PMI new orders and prices

Read the accompanying press release here.

Hong Kong SAR's demand woes

S&P Global Hong Kong SAR PMI

Hong Kong SAR had meanwhile seen overall business conditions and output fall for a third straight month in November according to PMI data. While the rate of decline was not as severe as that seen at the start of 2022, the general trend remained one of deteriorating conditions midway into the final quarter of the year. Worsening external conditions and falling domestic demand led to a persistent contraction, according to survey participants.

With an expected improvement in mainland China's economic conditions amid the lowering of COVID-19 restrictions, it will be of interest to observe if the S&P Global Hong Kong SAR PMI will likewise indicate better business conditions into 2023. Weaker Western markets are none the less expected to remain a drag on international demand.

Read the accompanying press release here.

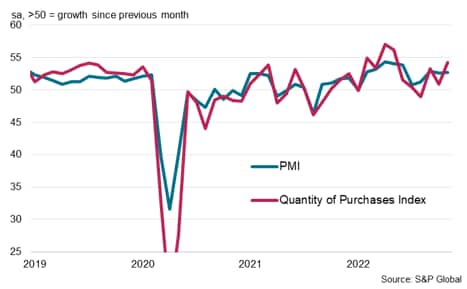

India output receives demand boost

S&P Global India PMI output

India had seen resilient economic performance into the second half of 2022 even as the broader Asian economy slowed. Central to the relative outperformance had been strong domestic demand which supported a further impressive expansion of both the manufacturing and service sectors in November. Private sector firms were also generally confident that business conditions will continue to improve in the months ahead, with goods producers remaining committed to building inventory, as seen via the Quantity of Purchases Index, for the fulfilment of current orders and in anticipation of incoming demand.

With the above said, the corresponding impact on prices had been considerable, with services selling prices in particular rising at the fastest rate in over five years according to PMI data. The shift in pricing power to firms amid the expansion of new orders could mean persistent price hikes and monetary policy tightening that may negatively impact India's growth.

Read the accompanying press release here.

Indonesia manufacturing sector faces weak external demand

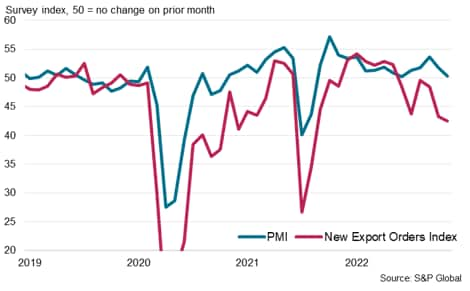

Indonesia's manufacturing sector meanwhile remained in expansion through the first 11 months of 2022, even though the latest November reading suggested that only mild growth was recorded. This was as demand growth slowed sharply in November, led by external demand falling for a sixth straight month (and at the fastest pace since August 2021).

The weak external demand picture may well persist into the start of 2023 amid soft Western economic growth. Domestic demand in Indonesia meanwhile faces headwinds from monetary and fiscal tightening. Altogether, this outlines the likelihood for Indonesia's economy to slow in the coming quarters (See " Indonesian economic growth accelerates in Q3, but building headwinds weigh on short-term growth outlook"). This is, however, barring any surprises in external conditions especially with the easing of restrictions in mainland China, which clearly poses some upside risks. We will be watching the New Export Orders Index, in particular, for signs of a turnaround going into the new year.

S&P Global Indonesia Manufacturing PMI

Read the accompanying press release here.

Japan's economic conditions deteriorate again before yearend

au Jibun Bank Japan PMI output

While the National Travel Discount Programme and the easing of border restrictions supported the expansion of Japan's economic activity, particularly services activity, at the start of the fourth quarter, overall conditions worsened once again in November as the effects waned.

This was notably taking place amid persistently elevated inflationary pressures, especially for firms. Companies; input price inflation continued to rise at a much faster pace compared to output prices, hinting at squeezed margins and outlining the double whammy for Japan's private sector firms. The au Jibun Bank Japan Composite PMI, compiled by S&P Global, fell at the sharpest pace since February, alluding to the slowdown in growth conditions. With prices and external demand remaining key areas of concern (See " Larger inventories drive upward revision to Japan's Q3 real GDP, but higher prices and weak external demand remain concerns"), prices and export orders sub-indices will be ones to track going into 2023.

Read the accompanying press release here.

Malaysian manufacturing firms see a drying demand well

The latest S&P Global Malaysia Manufacturing PMI indicated a third straight month of worsening business conditions, mirroring the broad Asia trend. Output shrank for a fourth consecutive month in November. Core to the slump in output had been the worsening in demand, according to PMI indications. New orders fell at the fastest rate in over a year as the external environment grew more hostile. Falling backlogs of work and a stalling of employment growth in November also outlined growing spare capacity.

With expectations of growing headwinds to global growth in 2023, conditions at the goods producing sector in Malaysia may remain hampered and we will be tracking the PMI for any indications of a turnaround.

S&P Global Malaysia Manufacturing PMI

Read the accompanying press release here.

Myanmar's manufacturing contraction deepens into end 2022

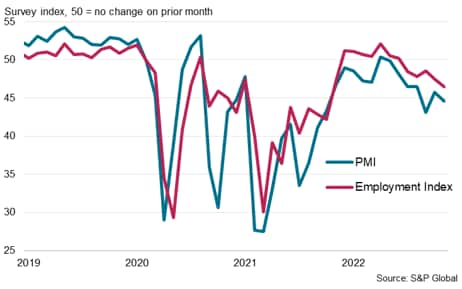

Myanmar's manufacturing sector fared amongst the worst in Asia in the latest November PMI tally, affected by weak demand, supply challenges and power outages, among other headwinds. As a result of the deterioration in operating conditions, employment in the manufacturing sector declined for a fifth straight month in November, declining at the fastest pace since November 2021. Job shedding on account of lower production requirements and resignations - as workers sought better employment prospects elsewhere - meant poor job market conditions within the sector. Amid expectations of persistent supply and demand side constraints for the manufacturing sector, business conditions may be at risk of further worsening, which does not bode well for the employment picture going into 2023, especially against the current strained political backdrop.

S&P Global Myanmar Manufacturing PMI

Read the accompanying press release here.

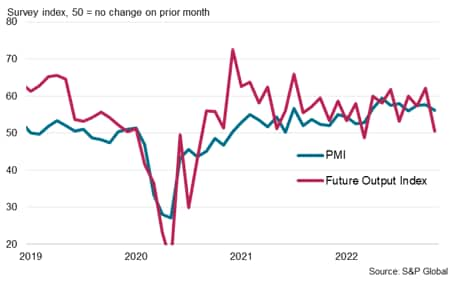

Philippines manufacturing sector remains one of the bright spots in Asia

S&P Global Philippines Manufacturing PMI

The latest signals from S&P Global PMI data indicated that the Philippines' manufacturing sector remained in solid expansion midway into the final quarter of 2022. The uptick in output had been backed by solid demand growth, particularly from domestic customers, as export sales continued to shrink in November.

With the sentiment-based Future Output Index pointing to optimism about the year ahead, it was no surprise to Philippines-based manufacturing firms ramping up their input purchasing at the fastest rate in six months. Whether headwinds from a softening global picture will affect the Philippines' manufacturing sector will be watched intently with PMI releases in the coming months.

Read the accompanying press release here.

Singapore economy's strong performance to continue?

Relative to the rest of Asia, Singapore had also seen economic growth remain strong in November. Furthermore, relative to the historical series, the November seasonally adjusted whole economy PMI remained amongst the highest on record to indicate robust growth. Positive demand, including external demand, had been a key driver for the growth in activity, although lingering COVID-19 effects did cause the private sector expansion to slow in November.

That said, the only sentiment-based sub-index, the Future Output Index, fell sharply to the lowest reading since March and hence signalled somewhat subdued optimism regarding output in the next 12 months. An amalgamation of external concerns, such as concerns over a deterioration in foreign economic conditions, and domestic worries, including the pending GST hike's effect on sales and recession risks, were listed as reasons for the fall in business confidence, foreshadowing the potential for actual slowdown in growth. The pace and depth of any declines, however, remains in question as we watch the PMI figures.

S&P Global Singapore PMI

Read the accompanying press release here.

South Korea manufacturing sector sees easing of contraction into the end of year

South Korea's manufacturing sector remained in decline in November but registered a shallower contraction than October, according to the S&P Global South Korea Manufacturing PMI, picking up further from the recent September low. The pace of contraction was mild overall. Faltering overseas demand and a downturn of the global electronics cycle had been at the core of the latest deterioration in conditions, which were also key concerns for South Korea manufacturing firms according to panel comments in the PMI survey.

Indications of a slower foreign demand contraction in November had been a positive sign to note in the penultimate survey of 2022. The still-elevated price indices meanwhile will be another issue to contend with going into the new year, with potential for inflation to further corrode demand.

S&P Global South Korea Manufacturing PMI

Read the accompanying press release here.

Taiwan's manufacturing sector exposed to the elements

S&P Global Taiwan Manufacturing PMI

Of the major Asian economies tracked, Taiwan's manufacturing sector saw the sharpest contraction in output in November and this was also the case when compared with the rest of the world. Weak global trade demand led to the rapid fall in production according to PMI indications, with the New Export Orders Index showing readings among the lowest in the survey's history.

Expectations for a persistent deterioration in global economic conditions into the start of 2023 meant that Taiwan's manufacturing sector may experience persistent headwinds. That said, with the easing of restrictions in mainland China, it will be of interest to find out if foreign demand for Taiwanese manufactured goods may be supported through any improvements in conditions in China.

Read the accompanying press release here.

Thailand's manufacturing sector moderates with weak external demand

Likewise for Thailand, poor demand, including external demand, weighed on manufacturing performance into the end of 2022. In turn, this led to firms working through pre-existing work with backlogs falling at a record rate. Furthermore, lower employment levels were noted in November, outlining the degree to which excess capacity has built.

Global headwinds remain key issues for Thailand's export-oriented manufacturing sector, though tightening liquidity conditions also bode ill for the sector. In line with other export-oriented manufacturing economies, data such as the New Export Orders Index will be closely watched for indications of any turnaround in worldwide trade during 2023.

S&P Global Thailand Manufacturing PMI

Read the accompanying press release here.

Vietnam's manufacturers lose pricing power amid slowdown

S&P Global Vietnam Manufacturing PMI

Vietnamese manufacturers experienced a renewed deterioration in production, demand, employment and purchasing conditions in November, with the seasonally adjusted S&P Global Vietnam Manufacturing PMI in contraction for the first in 14 months. Global demand weakness affected manufacturing output in November, driving the downturn.

Notably, given the decline in demand, pricing power has shifted away from firms which led to the first fall in selling prices since August 2020. This was while input costs increased at a faster pace, albeit at a muted pace. In other words, Vietnam manufacturing firms simultaneously saw a rise in costs and a decline in output prices, indicating pressure on their margins.

Further headwinds for Vietnam manufacturing firms should not be ruled out in 2023, with price pressures likely to provide clues as to the extent of further demand weakness.

Read the accompanying press release here.

Outlook

Given the abovementioned developments in 2022, we will be looking towards the new year, tracking both the headline PMI and the PMI subindices to better understand the underlying conditions of the region and to compare intra-regional variations in performance.

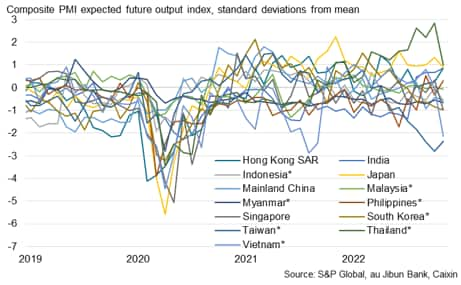

As far as the future output indices have indicated, sentiment has remained positive in all but one of the abovementioned sectors, Taiwan's manufacturing sector, to indicate continued positivity in Asia output in 2023.

That said, the level of business confidence can be seen varying greatly when standardised across the respective histories. Of which, Thailand and Japan have exhibited the strongest level of confidence while Taiwan and Vietnam lead on the other end of the spectrum. Evidently differentials in current output played a part to influence sentiment, but whether this deviation persists will be watched with the earliest economic signals generated through our PMI surveys.

Future output indices

*Manufacturing future output is used in the absence of composite future output figures

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2022, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.