Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 07, 2023

Argentina: Investors remain cautious despite recent IMF bailout

DOWNLOAD PDF VERSION HERE

Despite the recent disbursement of $7.5B to the Argentinian government by the IMF, S&P Global Market intelligence data* shows that investors are becoming increasingly cautious.

Argentina recently came close to defaulting on its debts following a disagreement with the IMF over the implementation of unpopular reforms in the run up to the country's upcoming election. A delayed IMF payment of $4B from June meant that the country could no longer afford to service its interest payments on a previous loan taken from the IMF last year. Despite a request by the Argentinian government to bring forward all remaining disbursements for 2023, a total of $10.6B, the IMF only released the $4B disbursement that was previously planned for June and an additional $3.5B that was previously subjected to a September assessment. The country continues to struggle with an inflation rate of 115% and a plunging currency, with the Peso declining roughly 30% against the dollar so far this year.

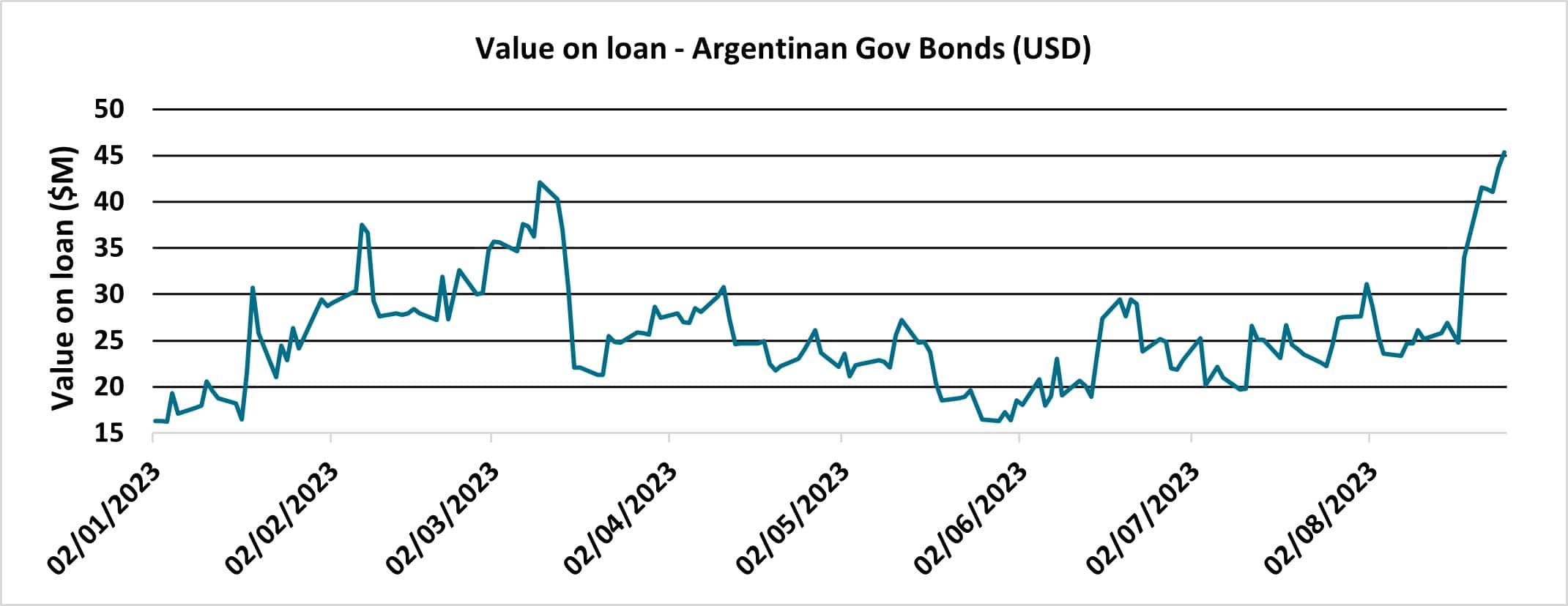

Data from S&P Global Market Intelligence Securities Finance

Despite the news that the IMF would be paying the most recent disbursements, borrowing activity in the securities lending markets in Argentinian government bonds has recently spiked as political and economic uncertainty remains high.

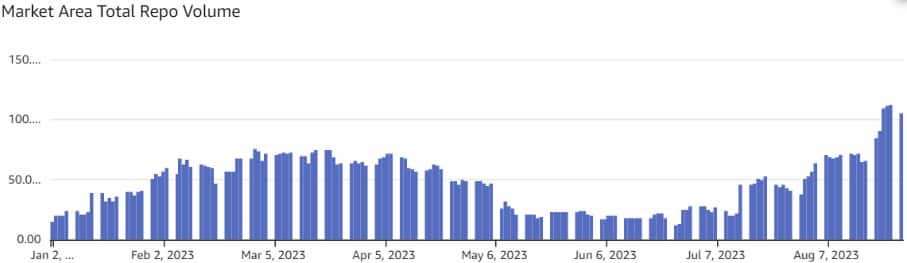

In the repo markets active volumes have also hit recent highs with 111.69M USD of Argentinian government bond repo being shown on August 25th. Indicative repo spreads have been trending increasingly negative throughout the year, trading close to 85bps below benchmark on July 31st.

Data from S&P Global Market Intelligence Repo Data Analytics

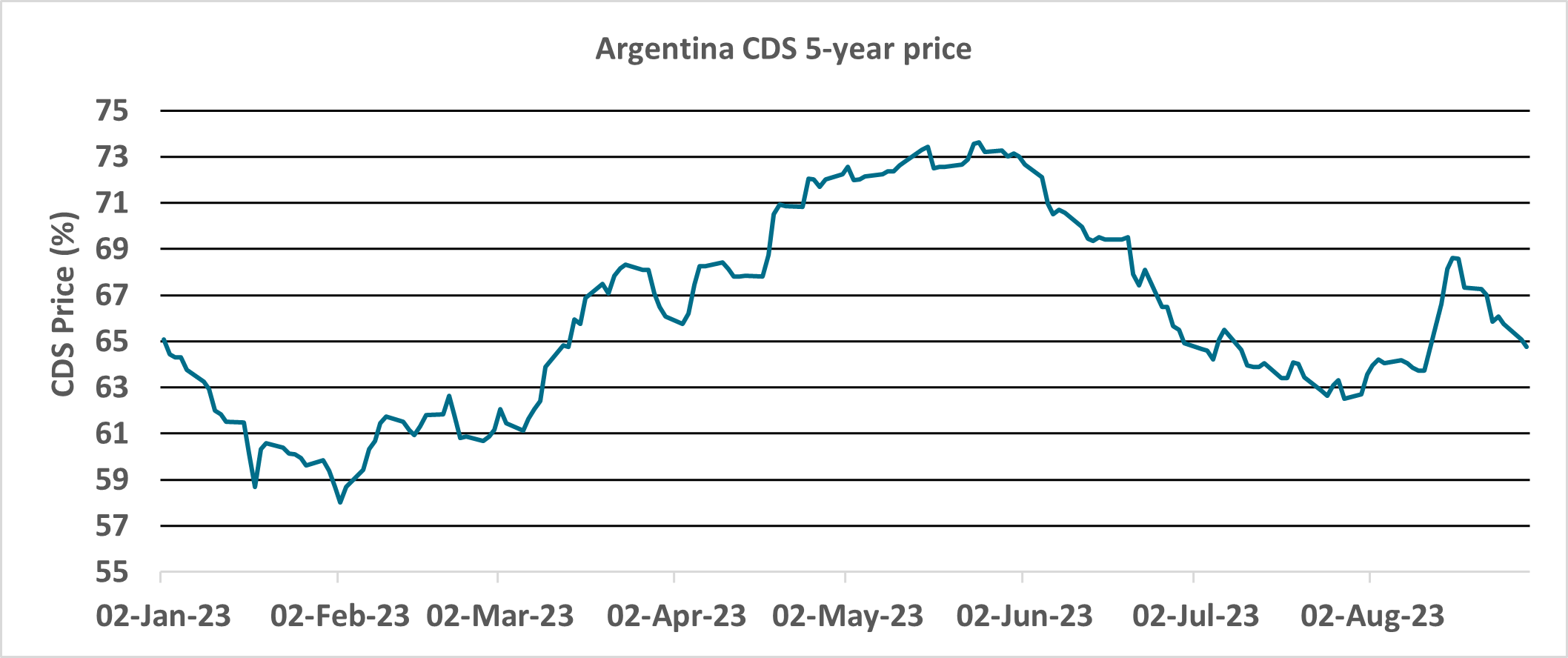

In the CDS markets the price of protection against the potential default of Argentinian government bonds has also shown an increasing trend building up to the most recent payment. A modest recovery can be seen since the IMF disbursement was made but CDS still remains wider than before the recent primary election result.

Data from S&P Global Market Intelligence CDS

Debt difficulties are not only related to Argentina's foreign currency liabilities: the Treasury's Peso-issued debt faces short-term refinancing challenges too. In addition to public institutions, banks and financial institutions have been key players for guaranteeing the Treasury's short-term debt rollover. During debt swap negotiations that took place in March, the Central Bank relaxed a previous restriction on dividend distributions for local banks and allowed them to distribute a maximum of 40% of its utilities (up from the former 20% limit).

Even though this sweetener (among others) helped the Government to rely on banks' participation in debt swaps and rollovers throughout the year, systemic risks arise when considering the overall financial sector's exposure to public debt (Treasury and Central Bank). Whereas economics reforms will be needed after the elections, consequences on the financial sector balance sheets cannot be overlooked.

As the election in October approaches, bearish sentiment towards Argentinian government bonds is expected to grow. Whoever wins the election will face a difficult economic landscape and is likely to have to initiate some far-reaching economic reforms to win back the confidence of investors.

For more information on how to access this data set, please contact the sales team at: Global-EquitySalesSpecialists@spglobal.com

*S&P Global Market Intelligence, Data Valuation and Analytics data sets used: Securities Finance, Repo Data Analytics, Credit Default Swap and Dividend Forecasting data

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fargentina-investors-remain-cautious-despite-recent-imf-bailout-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fargentina-investors-remain-cautious-despite-recent-imf-bailout-.html&text=Argentina%3a+Investors+remain+cautious+despite+recent+IMF+bailout++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fargentina-investors-remain-cautious-despite-recent-imf-bailout-.html","enabled":true},{"name":"email","url":"?subject=Argentina: Investors remain cautious despite recent IMF bailout | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fargentina-investors-remain-cautious-despite-recent-imf-bailout-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Argentina%3a+Investors+remain+cautious+despite+recent+IMF+bailout++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fargentina-investors-remain-cautious-despite-recent-imf-bailout-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}