Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

SPECIAL REPORTS

May 21, 2024

Anglo American: how dividends will be impacted by the breakup plan?

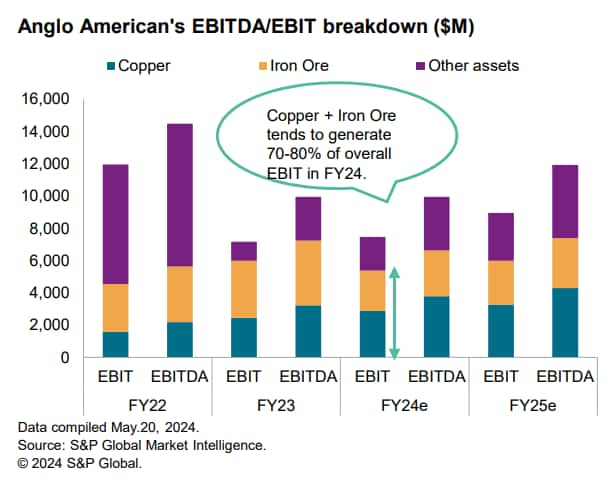

Anglo American is considering streamlining its asset portfolio to only include copper, premium iron ore, and crop nutrients. Considering the cyclical nature of the mining industry and based on the Q1 production report, copper and iron ore will continue to see strong production momentum and drive the underlying EBITDA growth. For FY23, copper and iron ore generated 73% of the overall portfolio's underlying EBITDA and 84% of the underlying EBIT. According to Anglo's pro-forma financials, 2023 EBITDA was estimated to be $7.5bn (vs.$10.0bn for the overall portfolio), including $0.8bn cost savings and excluding corporate cost allocations for businesses that are not retained. Over the past two years, copper's depreciation and amortization made up 24% of its EBITDA, and iron ore's was around 12%. As a result, we forecast that the retained three assets will contribute 70-80% of the Group's EBIT in FY24.

A new stand-alone business unit is expected to have 54% (up from 30% in FY23) copper production and a high-quality EBITDA margin. The capital allocation policy will be maintained, with the goal of achieving a net debt-to-EBITDA ratio below 1.5x and a 40% payout ratio. It is envisaged that any proceeds from business divestments would be used to repay debt, which tends to reduce interest costs and further improve the bottom line.

We forecast an interim DPS (dividend per share) of $0.46 and a final DPS of $0.38 for FY24, resulting in a 40% payout ratio of the H1/H2 underlying EPS (earnings per share) consensus. The wide range of EPS consensus signals a volatile outlook against the backdrop of Anglo being eyed by its rivals. Since the first proposal made by BHP, we've spotted a slight upward movement in Anglo's EPS forecasts. Over the past three years, the annual earnings generation has been slightly weighted to H1, averaged at c.60% of annual profits. Following the upper EPS consensus for FY24, we predict a best-case annual DPS of $1.10. Likewise, the lower EPS consensus leads to our bear-case forecast of $0.74.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fanglo-american-how-dividends-will-be-impacted-by-the-breakup-p.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fanglo-american-how-dividends-will-be-impacted-by-the-breakup-p.html&text=Anglo+American%3a+how+dividends+will+be+impacted+by+the+breakup+plan%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fanglo-american-how-dividends-will-be-impacted-by-the-breakup-p.html","enabled":true},{"name":"email","url":"?subject=Anglo American: how dividends will be impacted by the breakup plan? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fanglo-american-how-dividends-will-be-impacted-by-the-breakup-p.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Anglo+American%3a+how+dividends+will+be+impacted+by+the+breakup+plan%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fanglo-american-how-dividends-will-be-impacted-by-the-breakup-p.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}