Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 18, 2021

Algeria's banking risk rating: Very High Risk

IHS Markit has released a new banking risk report for Algeria, with a final risk rating indicative of Very High Risk. Regional peer Tunisia is also in this rating category. Oman is rated more favourably than Algeria in the Significant Risk category, while Lebanon has an Extreme Risk rating. Algeria's indicative banking risk rating is generated by elevated credit risk primarily driven by related-party lending risks from the sovereign, medium liquidity risk because of reliance on government and state-owned enterprise (SOE) funding and low deposit mobilisation, and moderate capital buffer risk driven by the sector's shareholders' equity's extreme exposure to non-performing loan (NPL) write-downs in the short term. Additional risks stem from weak regulatory environment, and an elevated stock of pre-existing NPLs along with low levels of provisioning going into the dual coronavirus disease 2019 (COVID-19)-virus pandemic and low oil-price shocks in 2020.

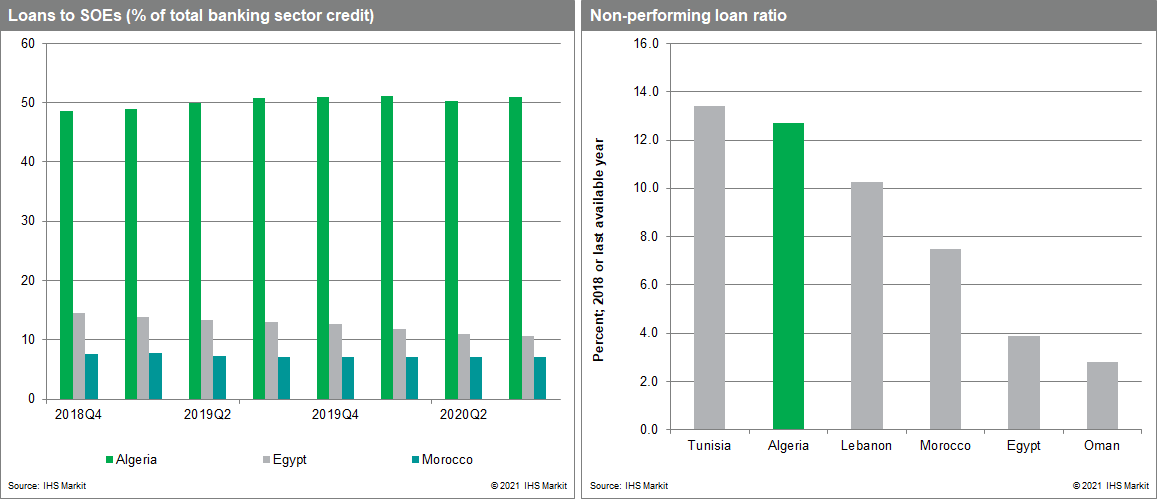

Despite government support measures, Algerian banks are extremely exposed to risk from the COVID-19 pandemic and moderately low oil price environment. In March, the Bank of Algeria announced several measures to mitigate the impact of the COVID-19 pandemic on businesses and the banking sector. The measures include a loan moratorium which is in place through end-March 2021, a reduction in capital adequacy requirements, and lowering reserve requirements. While these measures will serve to delay the impact of COVID-19 on the Algerian banking sector, banks will see a large uptick in NPLs when measures expire due to severe credit risk from exposure to SOEs. Algerian bank lending is highly concentrated in lending to SOEs, at 51% of total banking-sector loans. This share is substantially higher than other peer banking sectors in North Africa. Lending to SOEs is highest at state-owned banks, which account for 99.8% of loans to the public sector, yielding related-party lending risks. Some of this risk to banks is mitigated by government guarantees on bank loans to SOEs that exceed 25% of a bank's capital base and are used for project financing, as well as repeat historical carve-outs of SOE NPLs, but this process also creates moral hazard and crowds out private-sector lending. According to the International Monetary Fund (IMF), SOEs are concentrated in the oil and gas, construction, and tourism sectors. Although the more optimistic oil-price outlook as of mid-March 2021 signals improvement in the oil and gas sector, construction and tourism are likely to be slow to recover from the global COVID-19-virus pandemic, driving increased credit risk for public banks. Additionally, despite NPL carve-outs, Algerian banks still maintain a higher NPL ratio than most regional peers. Notably, however, direct lending to COVID-vulnerable sectors such as services (including tourism and transportation) and is expected to be much lower in Algeria than other regional peers such as Egypt, where services lending represents 24% of banking sector total loans.

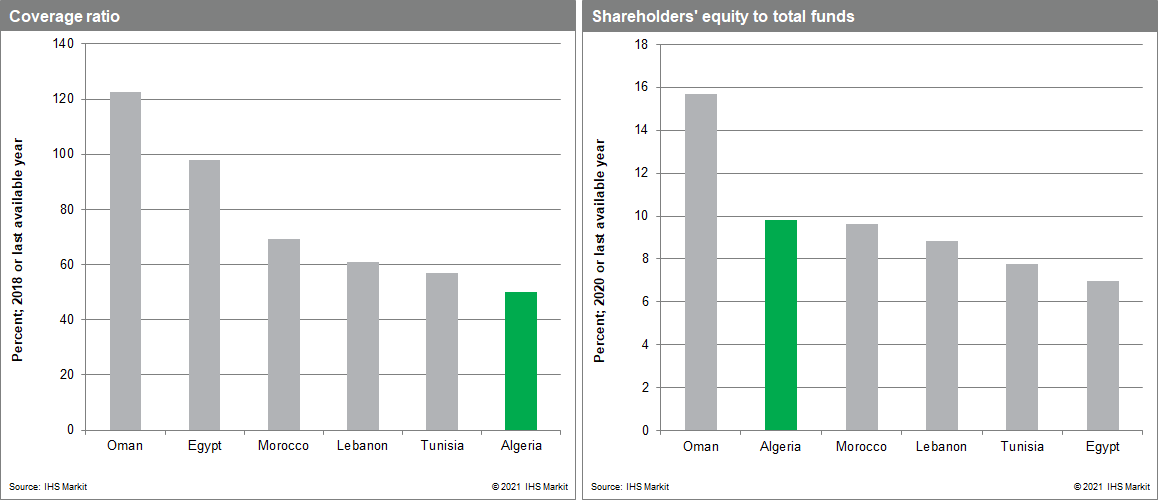

Banks will require recapitalisation in the near term. With a tier-1 capital adequacy ratio (CAR) of 15% and a 9.7% ratio of shareholders' equity to total assets, the Algerian banking sector maintains an ample capital buffer. However, despite strong capital adequacy indicators, the ratio of net NPLs to shareholders' equity is nearly 43%, signalling that a concerning share of banks' capital is exposed to NPL write-downs. We expect that capital buffers will deteriorate in the short term, given the anticipated increase in NPLs and the fact that Algeria's banks maintain the lowest level of provisioning in the region (loan-loss reserves are just 50% of total NPLs), necessitating recapitalisation.

Government deposit drawdown is the biggest liquidity risk to Algerian banks. With deposits from SOEs and the government representing 43% of total deposits, banks are heavily reliant on the government for funding. Government deposit data are released at a lag, but we believe that a drawdown of government deposits in 2020 contributed to headline deposit growth slowing slightly to 1.1% from 2.1% in 2019. In 2021, we expect that deposits will contract as government deposit drawdowns outpace deposit mobilisation in other areas. However, this will be met with a contraction in lending and we expect that the loan-to-deposit ratio (LDR) will remain constant around 92%. Additionally, the domestic deposit insurance scheme does not provide reliable insurance against depositor losses, with the IMF reporting that customers have not been repaid following bank closures in 2003. As such, IHS Markit assesses that Algeria would be at a higher risk of sudden deposit withdrawals if a loss of confidence in the banking sector were to occur.

Going forward, government NPL purchases and increased provisioning costs are key indicators to watch. As COVID-19-related support measures expire at the end of March, a positive indicator for the Algerian banking sector would be government NPL purchases, reducing asset quality risks while allowing banks' capital buffers to remain intact. Conversely, a negative indicator would be NPL write-downs and increased provisioning costs, causing capital buffer deterioration. This risk could be mitigated by large-scale government recapitalization, as has occurred repeatedly in Algeria.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falgerias-banking-risk-rating-very-high-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falgerias-banking-risk-rating-very-high-risk.html&text=Algeria%27s+banking+risk+rating%3a+Very+High+Risk+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falgerias-banking-risk-rating-very-high-risk.html","enabled":true},{"name":"email","url":"?subject=Algeria's banking risk rating: Very High Risk | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falgerias-banking-risk-rating-very-high-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Algeria%27s+banking+risk+rating%3a+Very+High+Risk+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2falgerias-banking-risk-rating-very-high-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}