Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Sep 24, 2021

Asian USD Credit Primer

More bang for your buck?

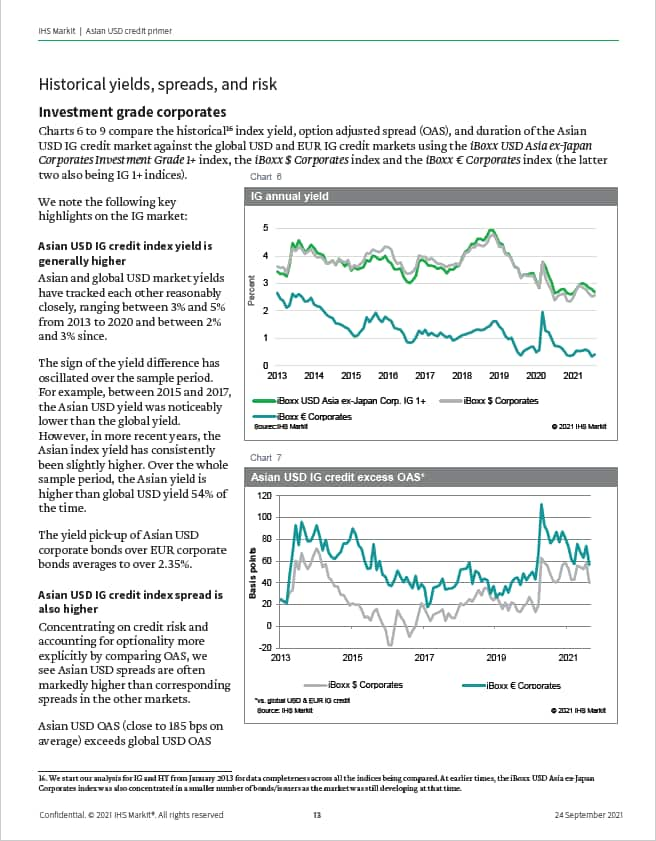

Following the recent Asian economic rebound from COVID-19 lows, the global fixed income investment community has shown increased interest in Asian (ex-Japan) USD corporate credit. Supportive spread differentials and other risk-return attributes may make this hard currency asset class an attractive potential addition to fixed income and multi-asset portfolios.

This article profiles the iBoxx USD Asia ex-Japan Corporates index to explore the Asian (ex-Japan) US dollar credit market's:

- Historical development

- Composition across geographies, maturity, sector, and rating

- Yields, spreads, and durations

- Historical returns, volatility, and other performance metrics

- Potential diversification benefits for global investors

Throughout, comparisons are made versus the global USD and EUR corporate credit markets to provide context for both global and regional investors.

Key observations indicate that the market can offer:

- Generally higher comparative yields and spreads

- Shorter relative duration

- Some portfolio diversification

- Significant exposure to China and EM risk

We also glance at the wider iBoxx/iTraxx credit ecosystem in Asia that includes a nascent ETF market and a developing derivatives landscape.

|  |

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAsian-USD-credit-primer.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAsian-USD-credit-primer.html&text=Asian+USD+Credit+Primer+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAsian-USD-credit-primer.html","enabled":true},{"name":"email","url":"?subject=Asian USD Credit Primer | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAsian-USD-credit-primer.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+USD+Credit+Primer+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fAsian-USD-credit-primer.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}