Stronger than previously thought UK recovery pushes GDP 2.7% above pre-crisis peak

The UK economy grew faster than previously estimated in the second quarter, according to revised official data, bringing the pace of expansion more into line with that signalled by the business surveys.

Gross domestic product increased by 0.9% in the three months to June, up from a prior estimate of 0.8%. Compared to a year ago, GDP was 3.2% higher in the second quarter, the fastest annual rate of growth for eight years.

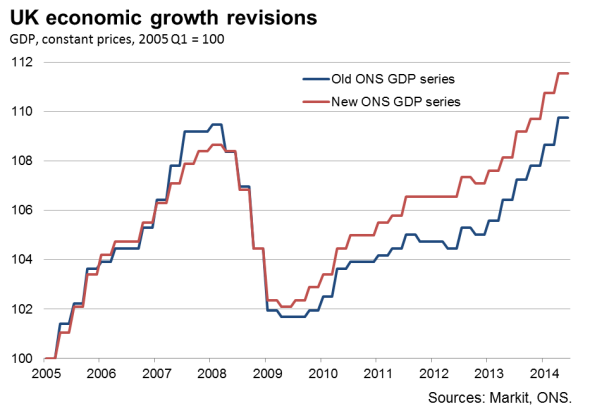

Revisions to back data as part of the Office for National Statistics' methodological changes mean the economy is now 2.7% larger than its pre-crisis peak. Previous data had shown GDP edging just 0.2% above its prior peak in the second quarter. It is now thought this pre-recession peak was in fact passed back in the third quarter of last year.

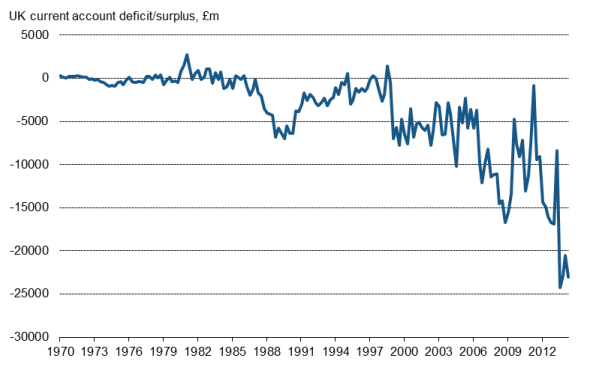

However, the good news on the upward revisions to GDP was marred somewhat by data showing the current account widening in the second quarter, and government debt now accounting for a larger share of GDP than suggested by earlier estimates.

Current account

GDP per capita also remains below its pre-crisis peak, albeit to a considerably lesser degree than previously thought.

Changes may do little to affect policy

All in all, the data paint a far brighter picture of the UK's economic recovery than previously thought, but the revisions will probably do little to change the official economic outlook at the Bank of England. The Bank had already pencilled-in faster growth in the second quarter, and also uses the business surveys to 'back-cast' GDP over recent years, so the upward revisions to the official data were already baked into the policy cake to a large degree.

However, while the Bank's official outlook is likely to be little changed following these revisions, it's hard to see that the brighter picture will not add strength to the voices and conviction of those members of the Monetary Policy Committee who have already voted to hike interest rates.

Broad-based upturn

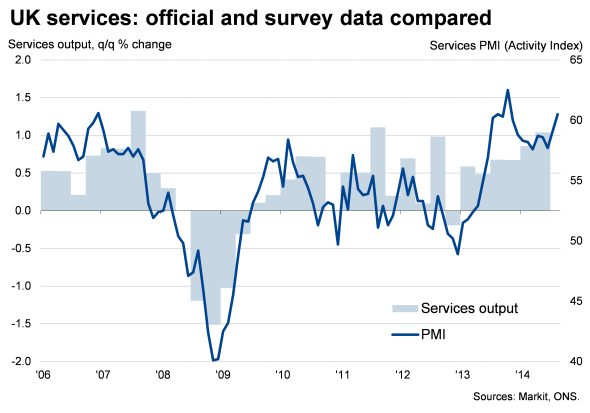

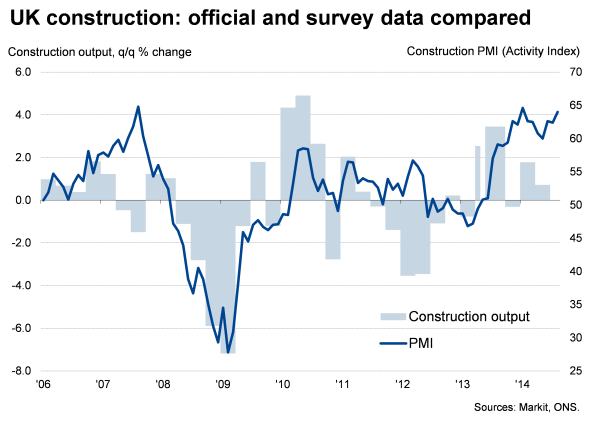

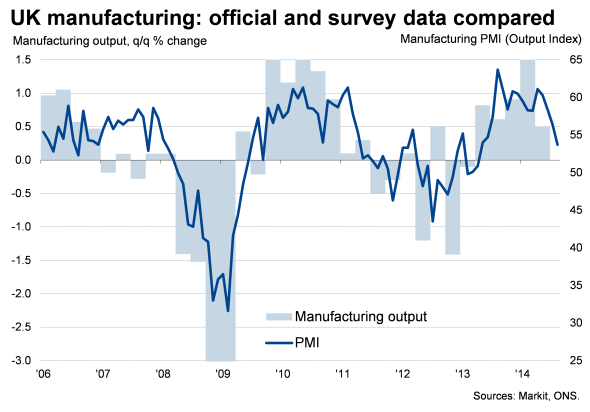

There were some major revisions in the detail of the second quarter GDP estimates, which highlight the broad-based nature of the upturn. Manufacturing is now estimated to have grown by 0.5% against a prior estimate of 0.2%, services growth was revised up by 0.1% to 1.1% and construction is now thought to have grown 0.7% instead of stagnating.

This is also by no means a recovery being driven solely by the consumer. Household spending grew 0.6% but business investment was also up by 3.3% (surging 11% on last year).

However, imports and exports both fell, 0.3% and 0.4% respectively, and revised data showed the UK's deficit with the rest of the world now standing at 5.2% of GDP, up from 4.7% in the first quarter, a total of "23.1 billion.

The revisions to the national accounts methodology also mean public sector debt (excluding the banks) as a proportion of GDP has risen from 76.5% to 79.1% in the second quarter.

There was better news on pay, with compensation of employees rising 1.5% in the second quarter and real disposable incomes up 2.2% on the year. Company profits meanwhile rose 3.2%.

Mixed outlook

The economy also looks to have been enjoying further robust growth in the third quarter, with separate data from the ONS showing services output growing 0.3% in July, up 3.4% on a year ago. This tallies with upbeat PMI survey data, showing strong services growth. However, the PMI also indicated a slowing in manufacturing, which has worried policymakers. This week's PMI data will be scoured for whether the slowdown in the goods-producing sector may have spread to other sectors.

The upward revision to second quarter GDP to 0.9% may well therefore represent a high point in the pace of economic growth, especially as the prospect of higher interest rates cools the economy as we move into 2015.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com