Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 28, 2017

Official data confirm slowing of UK economy at start of year

Official data showed that the UK economy slowed more than expected in the first quarter of 2017, with growth slipping to the weakest for a year. A further lacklustre pace of growth is widely expected for the second quarter as political uncertainty and rising prices subdue demand, although an improvement in recent survey data suggests that a further slowdown is by no means a sure thing.

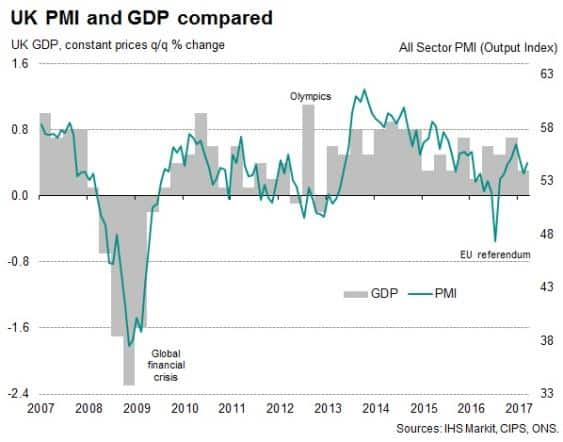

The first estimate of gross domestic product from the Office for National Statistics showed the economy growing 0.3% in the first three months of the year, just below the PMI's signal (and the average analyst's estimate) of a 0.4% decline. This represents a marked slowing from the 0.7% rate seen at the end of last year.

We expect this initial estimate to be revised higher to 0.4% as the 0.3% figure is based mainly on data for the first two months of the quarter. In particular, service sector survey data for March have strengthened, but the ONS has forecast no service sector expansion at all.

However, the message is clear: the start of the year saw the weakest pace of growth for a year as rising prices have started to hit household spending.

The consumer-led deterioration had been widely expected. Official data had already shown retail sales falling to the greatest extent for seven years in the first quarter amid signs of spending being curbed by rising prices. PMI survey data for the first three months of the year had meanwhile indicated weakness being largely confined to consumer sectors, and household finance surveys have deteriorated. Official data, such as industrial production and construction industry output, had also weakened in the early months of the year.

The detail of the official data showed the vast services economy expanding by just 0.3%, compared to 0.8% in the fourth quarter. That was the weakest increase for two years. Industrial production growth of 0.3% compared to 0.4% late last year, of which manufacturing output showed a modest 0.5% rise after a 1.2% expansion at the end of last year. Construction growth meanwhile slowed to just 0.2% after 1.0% growth in the fourth quarter.

What happens next in the second quarter remains uncertain. On balance, the risks appear skewed to the downside. There's a widespread expectation that growth will remain subdued and could even slow further as price rises and weak wage growth continue to curb consumer spending. The run-up to the general election is also likely to be a period in which existing Brexit-related uncertainty is exacerbated, leading companies and households to defer spending and investment decisions.

On the other hand, a further slowdown is by no means a sure thing. Business surveys showed a surprise upturn in March, making up for some of the weakness seen earlier in the quarter. The all-sector PMI rallied to a level consistent with a quarterly GDP growth rate of 0.5% on the back of higher service sector business activity. Furthermore, inflows of new business across the three PMI surveys showed the second-strongest rise for over a year, suggesting that business activity growth may have picked up further in April.

Furthermore, the euro area PMI surveys showed growth accelerating to a six-year high in April, suggesting demand is reviving in the UK's main trading partners.

More data are therefore needed before firm judgements can be made as to what economic growth will look like in the second quarter. In that respect, more insight will be revealed by the April PMI surveys released next week.

Any relapse in the PMI will push the surveys back into territory consistent with the Bank of England highlighting the need for policy to remain accommodative amid rising political uncertainty and signs of consumers being squeezed by higher prices. Any further improvement in the PMI data will no doubt add to the more hawkish rhetoric that has begun to appear.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-Economics-Official-data-confirm-slowing-of-UK-economy-at-start-of-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-Economics-Official-data-confirm-slowing-of-UK-economy-at-start-of-year.html&text=Official+data+confirm+slowing+of+UK+economy+at+start+of+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-Economics-Official-data-confirm-slowing-of-UK-economy-at-start-of-year.html","enabled":true},{"name":"email","url":"?subject=Official data confirm slowing of UK economy at start of year&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-Economics-Official-data-confirm-slowing-of-UK-economy-at-start-of-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Official+data+confirm+slowing+of+UK+economy+at+start+of+year http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f28042017-Economics-Official-data-confirm-slowing-of-UK-economy-at-start-of-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}