Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 25, 2015

Convertible bonds outperform in volatility

Convertible bonds have proven more resilient than conventional bonds in the current volatile market, encouraging strong inflows into convertible bond tracking ETFs.

- Largest convertible bond ETF outperformed investment grade bonds by over 6.5% in Q2

- Convertible bond ETFs' AUM at an all-time high after strong performance and inflows

- Long dated Intel convertible bonds up in Q2; similar conventional bonds fallen by over 10%

Bonds have borne the brunt of the market volatility seen in the second quarter as investors brace for the possibility of an imminent rate rise. This environment has seen many dollar denominated bonds, especially government and investment grade corporates, head into negative territory for the year.

This negative slide contrasts with equity markets which have proven relatively more resilient, demonstrated by the fact that the S&P 500 index is up by 2.4% year to date; only 0.5% off its all-time high seen in mid-May.

This phenomenon has seen convertible bonds, which offer investors equity-like upside along with bond-like downside protection, outperform the rest of the bond market.

Convertible bonds outperform

The largest convertible bond ETF, the SPDR Barclays Convertible Bond ETF (CWB), has outperformed both high yield and investment grade corporate bonds over the quarter. The fund has delivered total returns of about 3% for Q2 with less than one trading week to go. This positive performance is 2.4% and 6.6% more than the total returns delivered by the largest high yield and investment grade corporate bond ETFs respectively; the iShares iBoxx $ High Yield Corporate Bond ETF and iShares iBoxx $ Investment Grade Bond ETF.

This strong performance of the convertible bond ETF is driven by the fact that many of these bonds will covert to equities upon maturation, which have enjoyed a strong run in recent months.

Convertible bond issuers also tend to include many small high growth companies, which has helped boost the CWB's returns as small cap equities have outperformed their larger peers since the start of the year. This means that the CWB is now 1.05% ahead of the SPDR S&P 500 ETF year to date.

ETF investors pile in

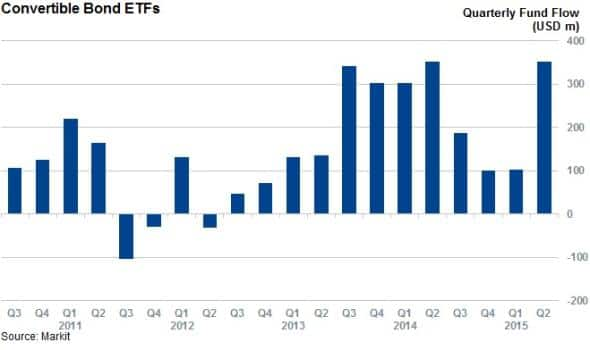

The strong run delivered by convertible bonds over the last few months has not gone unnoticed by investors as the eight listed convertible bond ETFs are on track for their largest quarterly inflows this quarter. These funds have managed to attract $352m of new funds, putting them on track for their twelfth successive quarterly inflows.

These strong inflows contrast with the rest of the bond ETF universe, which has seen outflows over the last three months.

Example Intel

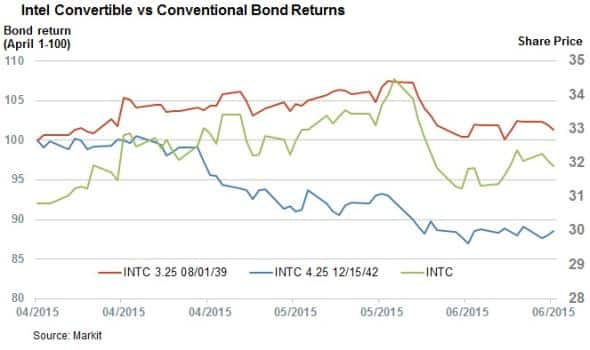

These returns are not driven by any borrower mismatch, as seen in the case of chipmaker Intel which has seen its convertible bonds race ahead of its outstanding conventional bonds in recent months. The firm's A- rated 2039 convertible bonds have traded 1.3% higher for this quarter while its conventional 4.25% bonds which mature in 2042 are down by 11.4% over the same period of time.

This return differential is driven by the fact that long term interest rates have surged in the last three months, dragging down conventional investment grade bonds. In addition, Intel's equity which the bonds will ultimately covert into has managed to notch up a 3.6% gain since the close of April.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Credit-Convertible-bonds-outperform-in-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Credit-Convertible-bonds-outperform-in-volatility.html&text=Convertible+bonds+outperform+in+volatility","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Credit-Convertible-bonds-outperform-in-volatility.html","enabled":true},{"name":"email","url":"?subject=Convertible bonds outperform in volatility&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Credit-Convertible-bonds-outperform-in-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Convertible+bonds+outperform+in+volatility http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25062015-Credit-Convertible-bonds-outperform-in-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}