Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Apr 25, 2017

CDS Data for Prudent Valuation

Introduction

Pricing and risk management are two of the most established and durable uses of CDS data. After all, market practitioners with CDS exposure need to mark-to-market their positions and assess fair value. They are also required to calculate market and credit risk, and often need CDS data regardless of whether they have CDS positions (using CDS data for CVA calculation being the most obvious example).

But in this era of stringent regulatory oversight new rules have created new requirements for data. One notable example is Prudent Valuation (PruVal), a regulation that came into force in the EU in February 2016. PruVal acts as a bridge between the two traditional use cases of pricing and risk management. Banks are required to apply prudent valuation to all fair value positions, and the prudent valuation is reached by taking an Additional Valuation Adjustment to the fair value. The AVA is deducted from Core Equity Tier One (CET1) capital.

PruVal applies to a range of asset classes and there are various types of AVAs under the Core Approach (threshold of "15bn in fair value assets and liabilities), but for the purposes of this paper we will focus on CDS Market Price Uncertainty (MPU) and Close-Out Cost (CC). IHS Markit's new CDS Premium end-of-day report can make AVA calculation easier and more accurate, helping to optimize deductions to precious CET1 capital.

Data Sources

The EBA (RTS, Article 3) specifies a hierarchy of pricing sources when calculating AVAs:

- Exchange prices in a liquid market

- Trades in the exact same or very similar instrument, either from internal records or from the market

- Tradable quotes from brokers and other market participants

- Consensus service data

- Indicative broker quotes

- Counterparty collateral valuations

The CDS market is an OTC market (though some indices trade on SEFs), so the first three sources can be difficult to acquire. That means consensus service data, such as CDS pricing provided by IHS Markit, is typically the best source for calculating MPU and CC AVAs.

Market Price Uncertainty AVA

Market Price Uncertainty refers to the valuation uncertainty of a valuation exposure arising from uncertainty of a valuation input. In practice, the valuation input is the mid-level used to fair-value the position, adjusted for independent price verification.

As noted above, CDS levels provided by IHS Markit are often used to independently verify positions in the IPV process, so it follows that this would be the starting point for the MPU AVA.

So, if a bank wanted to calculate Market Price Uncertainty for a CDS position, they would need dispersion data on the Markit CDS mid-level (the composite spread). Markit now provides this in the new CDS premium end-of-day report. As well as standard deviations on spreads, upfronts and bid-ask spreads, the report also includes 10th and 90th percentiles.

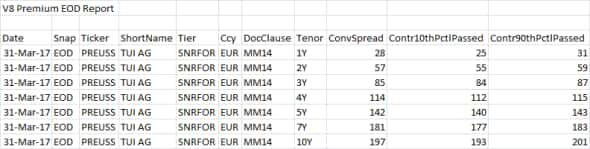

Figure 1 TUI CDS curve in premium end-of-day report

Figure 1 shows conventional spread composites for TUI AG, along with 10th and 90th percentiles for each tenor. The EBA specifies that a 90% confidence interval should be applied to calculate the MPU AVA. If we assume a sensitivity based approach to risk measurement, the uncertainty on a long delta position can be calculated by subtracting the 90th percentile from the mid-level and multiplying the result by the delta. A short position would be measured by subtracting the 10th percentile from the mid-level. Note that CDS is different from most asset classes as a long delta position is short CDS (selling protection). An example is shown in figure 2.

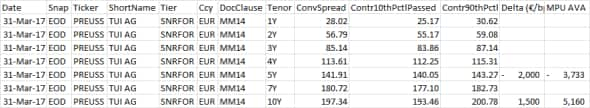

Figure 2 TUI CDS curve with AVA calculation

This shows a curve position on Tui AG, where there is short risk on the 5-year tenor and long risk on the 10-year tenor (a curve flattening strategy). In practice, the risk may be re-bucketed across the curve.

The above approach is not the only way to calculate the MPU AVA. A standard deviation on the Markit composite spread (included in the premium end-of-day report) can also be applied. Standard deviations, as well as 10th and 90th percentiles, are also available for upfront levels.

Some market participants prefer to use a full revaluation, rather than sensitivities, approach to calculate AVAs. Markit provides a Contributions report, which shows all the contributed curves for each entity. The individual contributions can then be used in a full revaluation.

Close-Out Cost AVA

Close-Out Cost (CC) refers to the valuation uncertainty of a valuation exposure arising from uncertainty in the exit price of the valuation position. This can effectively be interpreted as uncertainty around the closeout reserve levels taken to achieve an exit cost. The closeout reserve is typically half the bid-ask spread (bid-to-mid).

So, it follows that the CC AVA calculation requires dispersion data around the bid-ask spread. The premium end-of-day report provides standard deviations around the bid-ask spread, as well as 10th and 90th percentiles. In conjunction with the mid-level (composite spread), these fields can be used to calculate the CC AVA.

Unearned Credit Spread AVA

Unearned credit spread (UCS) refers to the valuation uncertainty in the credit valuation adjustment (CVA) to include, according to the applicable accounting framework, the current value of expected losses due to counterparty default on derivative positions.

The "valuation uncertainty" encompasses MPU, CC and also Model Risk. CDS data is used in CVA calculations to estimate default probabilities (PD), and the UCS AVA requires institutions to calculate the MPU and CC for PDs. Hence the metrics included in the new CDS premium end-of-day report - 10th and 90th percentiles, standard deviations - can be used in calculating the UCS AVA. Note that the UCS AVA also requires calculating uncertainty around the exposure, as well as model risk uncertainty.

The bank's exposure can relate to a variety of OTC derivatives - for example, an uncollateralized interest rate swap. CDS data is not only useful for banks with CDS trading desks.

Capital Optimization

Banks required to use the core approach to PruVal need data to calculate MPU, CC UCS AVAs. IHS Markit's new CDS premium end-of day report contains a number of fields that will make AVA calculation easier and ensure capital is optimized as efficiently as possible.

For information on this report and other IHS Markit CDS services, please contact the author.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042017-Credit-CDS-Data-for-Prudent-Valuation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042017-Credit-CDS-Data-for-Prudent-Valuation.html&text=CDS+Data+for+Prudent+Valuation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042017-Credit-CDS-Data-for-Prudent-Valuation.html","enabled":true},{"name":"email","url":"?subject=CDS Data for Prudent Valuation&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042017-Credit-CDS-Data-for-Prudent-Valuation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=CDS+Data+for+Prudent+Valuation http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25042017-Credit-CDS-Data-for-Prudent-Valuation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}