Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 25, 2015

China Flash PMI edges above 50 but continues to signal stagnant manufacturing

The output of China's factories barely grew again in February, limited by a steep drop in export orders. The data suggest that recent efforts by the authorities to stimulate the economy have done little to boost growth.

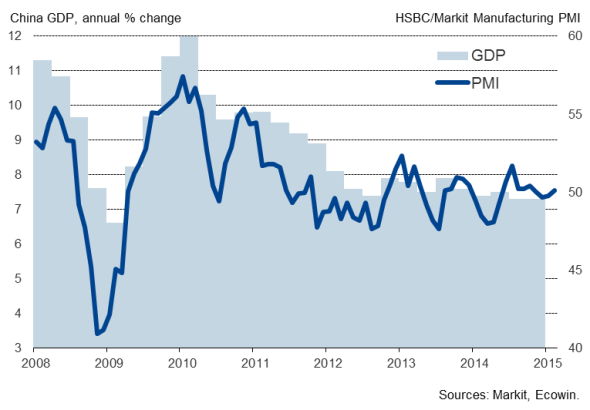

PMI and GDP compared

At 50.1, the HSBC Manufacturing PMI edged above 50 for the first time in four months, but continued to signal a continuation to the trend of stagnating business conditions seen since last August.

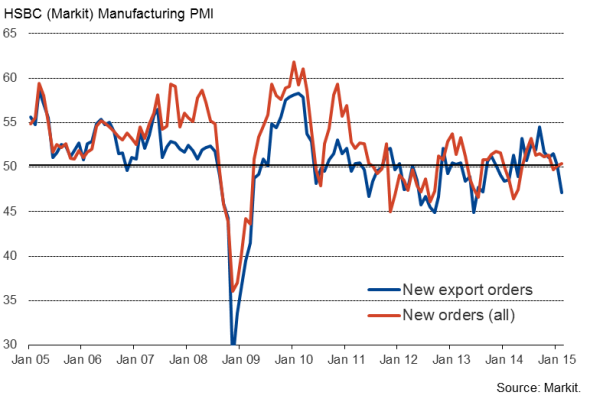

Small gains in output and domestic orders were offset by yet another downturn in employment and falling exports.

Although factory production showed the largest monthly improvement since September, up for a second successive month, the increase was only modest as companies once again reported limited order book growth.

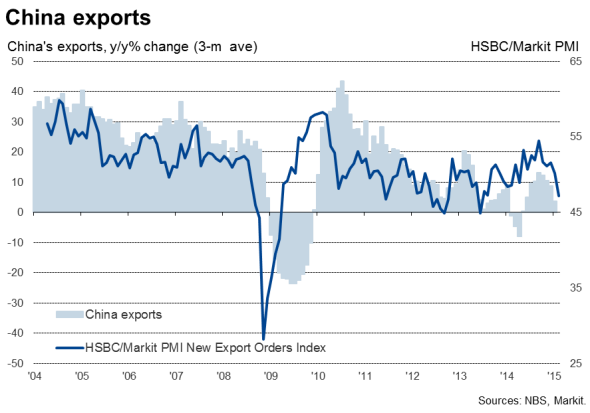

Exports and order books

Inflows of new orders ticked higher for a second month running, but the upturn was only marginal as an increase in domestic demand was countered by falling exports. New export orders suffered the largest monthly fall since June 2013, dropping for the first time in ten months.

Companies responded to the sluggish growth of demand by cutting headcounts, seeking to reduce capacity and boost productivity. Although the latest drop in employment was again only modest, the survey has recorded an almost continuous fall in payroll numbers for close to two years.

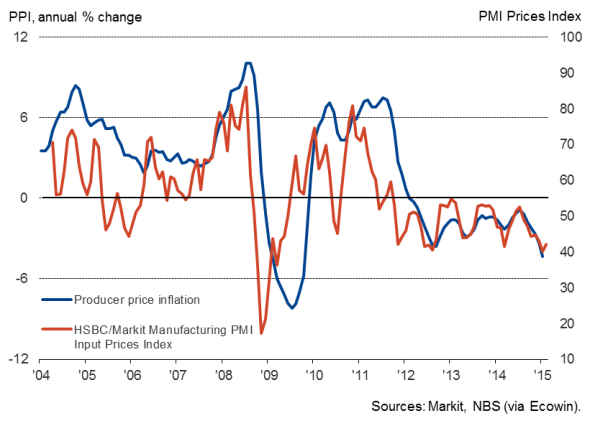

Prices fall sharply

Factory input costs fell sharply again. Although not as steep as the decline seen in January, the monthly fall in costs was one of the largest seen over the past six years as companies enjoyed the feed through of lower prices for fuel and other commodities.

Prices charged by manufacturers for their goods fell on average for the seventh consecutive month lower costs were passed onto customers. The latest decline was the smallest for three months though still steep by historical standards, suggesting falling factory gate prices will continue to feed through to lower consumer price inflation, already down to a five-year low of 0.8% in January.

Producer input prices

Limited signs of stimulus working

The ongoing weakness of the survey data in February adds to the likelihood of economic growth slowing further in 2015, after the weakest expansion for 24 years was recorded in 2014, when GDP rose by 7.4%. Markit's dividend forecasting team already sees the dividend outlook having deteriorated in 2015 compared to last year alongside the wider economic slowdown. Aggregate dividends of FTSE China A50 constituents are expected to have grown by 7.1% in 2014 but to increase by just 3.1% in 2015.

The IMF has meanwhile downgraded its growth forecast for 2015 from 7.1% to 6.8% and the authorities seem to be on course to set a target for the year of 7.0%, with slower growth widely seen as a necessary consequence of managing the transition away from an economy overly dependent on investment, construction and exports.

However, although appearing happy to countenance slower growth, the authorities are unlikely to allow unemployment to rise significantly, hence Beijing's recent efforts to reinvigorate the economy. These included a cut to interest rates in November for the first time since 2012 and a trimming of banks' reserve ratio requirements in early February. But, with the exception of the modest upturn in domestic demand signalled in February, the survey data suggest that these measures have done little to support the manufacturing sector, and that more measures may therefore be required to have a material effect on the economy.

Fortunately, the lack of any inflationary pressures recorded by the survey provides leeway for policy to be loosened further if needed.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-economics-china-flash-pmi-edges-above-50-but-continues-to-signal-stagnant-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-economics-china-flash-pmi-edges-above-50-but-continues-to-signal-stagnant-manufacturing.html&text=China+Flash+PMI+edges+above+50+but+continues+to+signal+stagnant+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-economics-china-flash-pmi-edges-above-50-but-continues-to-signal-stagnant-manufacturing.html","enabled":true},{"name":"email","url":"?subject=China Flash PMI edges above 50 but continues to signal stagnant manufacturing&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-economics-china-flash-pmi-edges-above-50-but-continues-to-signal-stagnant-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+Flash+PMI+edges+above+50+but+continues+to+signal+stagnant+manufacturing http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f25022015-economics-china-flash-pmi-edges-above-50-but-continues-to-signal-stagnant-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}