Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 24, 2014

UK growth spurt continues in third quarter as GDP rises 0.7%

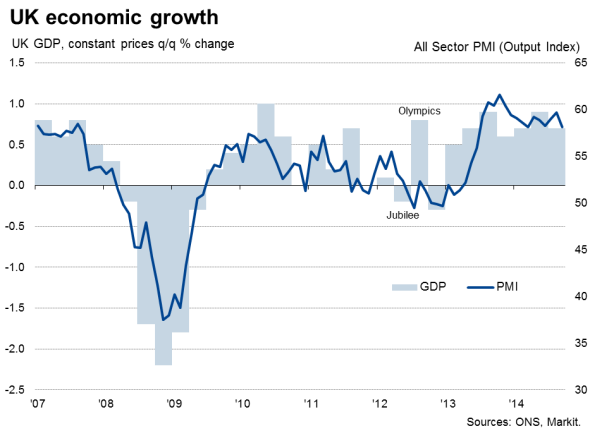

The UK's impressive economic growth spurt continued into the third quarter, according to official data. The first estimate of gross domestic product from the Office for National Statistics showed the economy expanding at an above-trend 0.7% in the three months to September. The latest expansion follows a 0.9% rise in the second quarter and 0.7% growth in the first three months of the year.

The ongoing upturn means the economy is now 3.0% bigger than a year ago and 3.4% larger than its pre-recession peak.

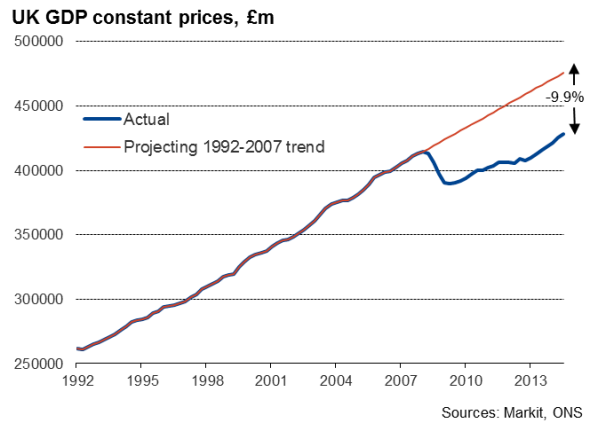

However, the economy remains almost 10% smaller than it would have been had it followed its pre-crisis growth trend, highlighting the long-term damage inflicted by the global financial crisis. Manufacturing and construction are also still 4.1% and 8.2% smaller their pre-crisis levels respectively.

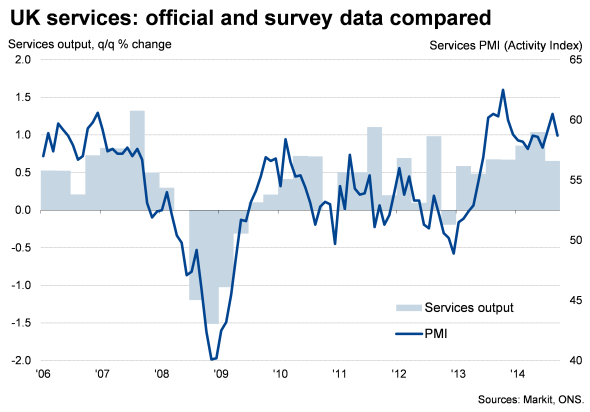

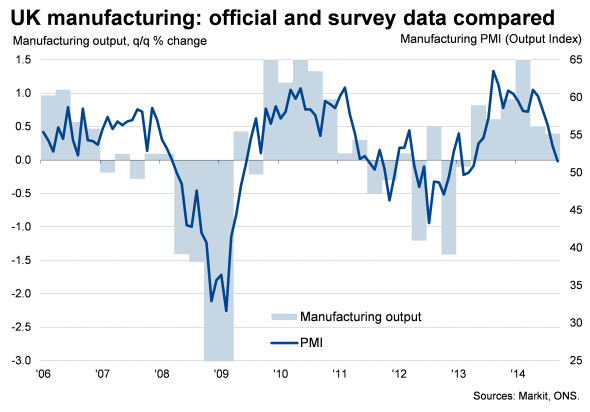

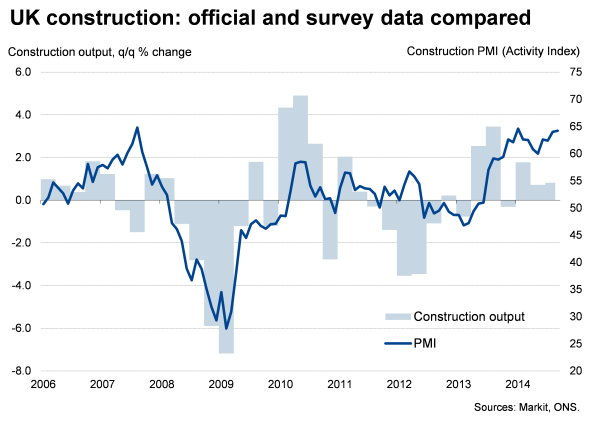

The expansion compared to the second quarter was broad-based across the economy. The largest contribution once again came from the vast service sector, where output rose 0.7% after a 1.0% gain in the second quarter. Manufacturing output meanwhile rose 0.4%, slightly slower than the 0.5% gain in Q2, while construction output grew by 0.8%, up from 0.7% in the second quarter.

This provisional estimate of third quarter growth is likely to be revised higher in coming months, possibly to 0.9%, which is in line with the calculations from the Bank of England and reflects upbeat business survey data. The GDP estimate only uses hard data for the first two months of the quarter and relies on modelled estimates for the final month.

The latest estimate of the health of the economy will do little to change the outlook for interest rates. Policymakers were expecting growth to have remained robust in the third quarter but to have also started to slow as we move toward the end of the year.

Growth slowdown

More important will be the extent to which growth slows in the fourth quarter. The UK remains vulnerable to weaker global economic growth, and sterling's appreciation since the start of the year poses a threat to export performance.

An easing in growth has been highlighted by the PMI surveys, which collectively showed the weakest pace of expansion for six months in September. The slowdown was especially marked in manufacturing, where goods producers have been struggling against the headwinds of a stronger exchange rate, worries about a renewed recession in the eurozone and subdued economic growth in key emerging markets such as China.

Policymakers eyeing global economy

Worries about global economic weakness may be somewhat exaggerated, however. A small rise in the flash PMI surveys for the eurozone and China in October suggest that fears of recession in the eurozone and a hard landing for the Chinese economy look overplayed. At the same time, the US PMI shows ongoing strong expansion and Japan's economy appears to be reviving after being hit by its sales tax rise earlier in the year.

The pushing back of interest rate hike expectations in the UK has also led to some downward pressure on sterling, which will benefit exporters.

At home, wage growth appears to be picking up gradually, and the domestically-focused services economy is faring well still.

While UK economic growth is therefore likely to weaken in the fourth quarter, it will probably do so only moderately. Such a scenario would mean that the Bank of England would be happy to keep interest rates at their record low for the foreseeable future, barring any sudden spike in wage growth, adding to the view that the first rate rise is unlikely to take place this side of the General Election.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-Economics-UK-growth-spurt-continues-in-third-quarter-as-GDP-rises-0-7.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-Economics-UK-growth-spurt-continues-in-third-quarter-as-GDP-rises-0-7.html&text=UK+growth+spurt+continues+in+third+quarter+as+GDP+rises+0.7%25","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-Economics-UK-growth-spurt-continues-in-third-quarter-as-GDP-rises-0-7.html","enabled":true},{"name":"email","url":"?subject=UK growth spurt continues in third quarter as GDP rises 0.7%&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-Economics-UK-growth-spurt-continues-in-third-quarter-as-GDP-rises-0-7.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+growth+spurt+continues+in+third+quarter+as+GDP+rises+0.7%25 http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f24102014-Economics-UK-growth-spurt-continues-in-third-quarter-as-GDP-rises-0-7.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}