Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2017

Japan's manufacturers end second quarter on softer note

Signs of slower growth appeared in Japan's manufacturing sector in June, suggesting some waning of the upturn seen earlier in the year.

The flash reading of the Nikkei Manufacturing PMI came in at 52.0 in June, down from 53.1 in May and its lowest since last November. The index nevertheless remains in expansion territory, and June's reading rounded off the second-best quarter for over three years. Order book growth was again principally driven by rising exports, albeit with the rate of order book wins moderating slightly in June.

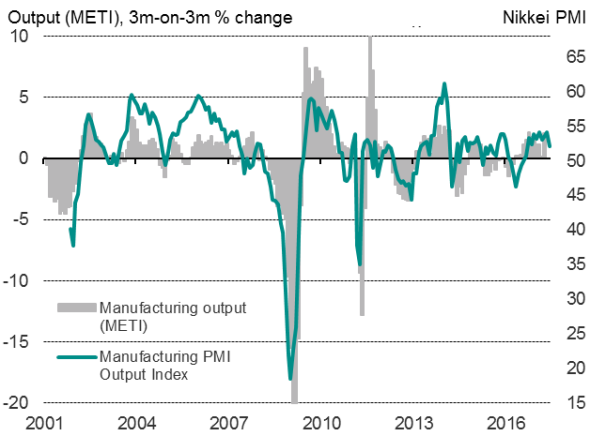

Manufacturing output

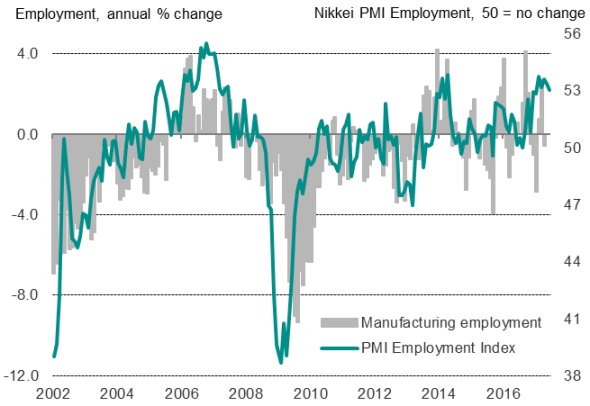

Employment continued to rise at a strong pace as business confidence about the year ahead remained elevated, suggesting companies generally expect the recent slowing to be temporary.

The survey also found further signs of moderate inflationary pressures.

Manufacturing Employment

Clearer survey signals

While official data on manufacturing output have been volatile in recent months, the signal from the PMI has been clear: the sector has enjoyed a strong start to the year. Despite the dip in the PMI in June, the first half of the year has seen the strongest upturn for three years, with the index signalling steady growth in each month.

By contrast, the official data have been harder to read, with output falling in as many months as it has risen. A 2.1% decline in January was followed by a 3.1% upturn in February. A subsequent 1.8% drop in production in March was then followed by a 4.0% surge in April (the latest month for which official data are available).

However, cut through this noise and the official data also seem to be signalling a strong year so far on average: the annual rate of increase has accelerated to 7.1%. As such, like the PMI, the official manufacturing data are now also painting the brightest picture for around three years.

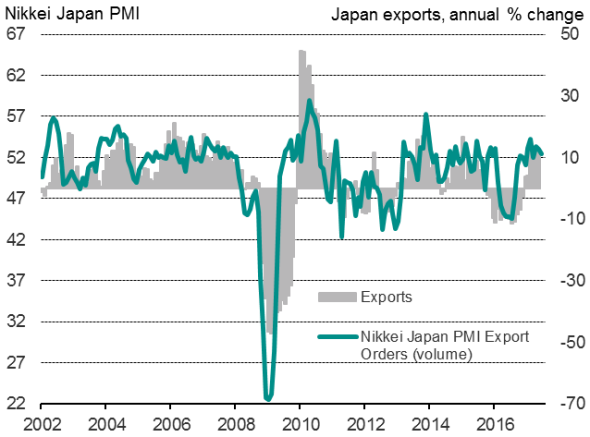

Exports drive upturn

While there were signs of an easing in the order book growth in June, with inflows of new business increasing at the slowest pace since last November, rising exports continued to underpin the current upturn. Despite export orders showing the smallest rise for three months during June, the rate of growth remained historically consistent with near double-digit annual expansion in exports.

Goods exports

Sources: IHS Markit, Datastream

Expansion plans

Firms remained optimistic about the year ahead. Expectations about future production continued to run well above the survey's historical average despite the degree of optimism softening slightly compared with May.

Buoyant business confidence meanwhile encouraged firms to keep a solid pace of hiring even though backlogs fell for the first time in five months, which suggests that Japanese manufacturers expect the recent slowing to be transient.

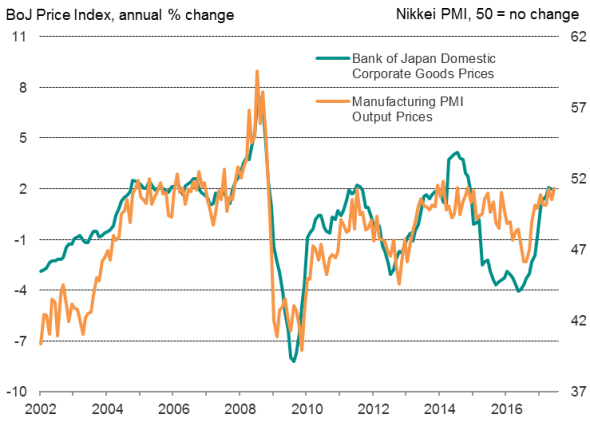

Price gauge hits 2" year high

Finally, factory gate price pressures reached the highest in over two-and-a-half years in June. Average prices charged for Japan's manufactured goods increased at a rate not seen since November 2014. Furthermore, input cost inflation picked up from May, reflecting greater strains on supply chains, which could result in faster growth of selling prices in coming months.

Such signs of gathering price pressures will be welcomed by the Bank of Japan, as rising industrial prices tend to feed through to higher consumer prices.

Official and survey price comparisons

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-Japan-s-manufacturers-end-second-quarter-on-softer-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-Japan-s-manufacturers-end-second-quarter-on-softer-note.html&text=Japan%27s+manufacturers+end+second+quarter+on+softer+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-Japan-s-manufacturers-end-second-quarter-on-softer-note.html","enabled":true},{"name":"email","url":"?subject=Japan's manufacturers end second quarter on softer note&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-Japan-s-manufacturers-end-second-quarter-on-softer-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan%27s+manufacturers+end+second+quarter+on+softer+note http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23062017-Economics-Japan-s-manufacturers-end-second-quarter-on-softer-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}