Most shorted ahead of earnings

With the earning season in full swing we highlight the most borrowed stocked in the run up to next week’s earnings announcements.

- The US sees over 15 heavily shorted companies announcing results which have demand to borrow at twice the market average, led by retailers Radioshack and Wet Seal

- Nine heavily borrowed European companies will announce results, led by Elekta

- Asia sees 11 companies with short interest over 2% announcing earnings, led by Kingsoft

US

Speciality retailers account for a quarter of the 17 most heavily shorted companies with over 6% of their shares on loan – a figure that is almost three times the average for the S&P500 index. Radioshack Corp and Wet Seal take the top two positions.

However, in the run up to results, short sellers have covered their position in struggling electrical retailer, Radioshack despite the share price having fallen to fresh lows throughout 2014. Short interest has fallen by a third from the record high of 30% in March to its current level of 21.5% of the total shares on loan.

By contrast, demand to borrow Wet Seal stands at a record high ahead of results. Short interest has risen from a market average of around 2% of the total shares on loan in mid March to almost 19% as the shares have fallen to a new annual low.

The company recently announced that it will wind down its Arden B retail store business and will close 31 locations by the end of fiscal 2015.

Abercombie & Fitch has also seen a sharp increase in demand to borrow ahead of results with short interest having increased a quarter over the past month to 14.5% of the total shares.

Outside of the retail sector, Arca Biopharma (which specialises in developing genetically targeted therapies for cardiovascular diseases) has seen a resurgence of short interest ahead of results. Short interest has risen to an annual high of just under 15%, excluding the spike in March.

Europe

There are nine heavily borrowed European companies announcing results next week in which short interest above the market average of 2%. Topping the list is Elekta which has almost a quarter of its total shares on loan, though short interest has remained stable in the run up to earnings.

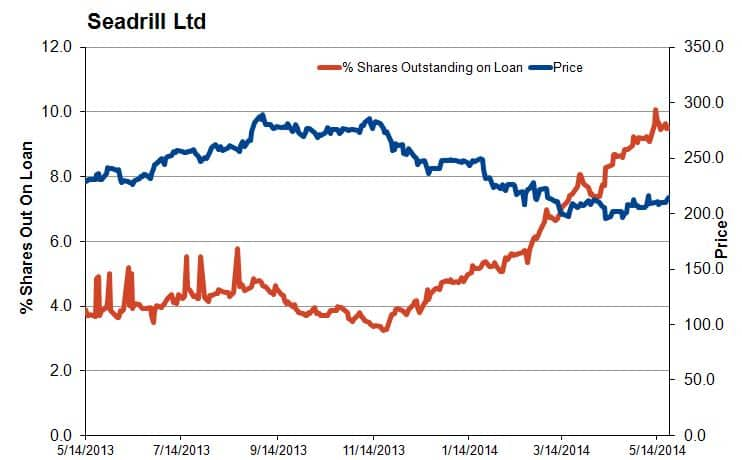

Demand to borrow Seadrill has risen to just off the annual high at 9.5%, while the share price has flat lined over the past couple of months to hover close to the annual low. The offshore drilling company managed to post solid earnings last time round, but was still subject to analyst downgrades driven by concerns over the fall in the oil price.

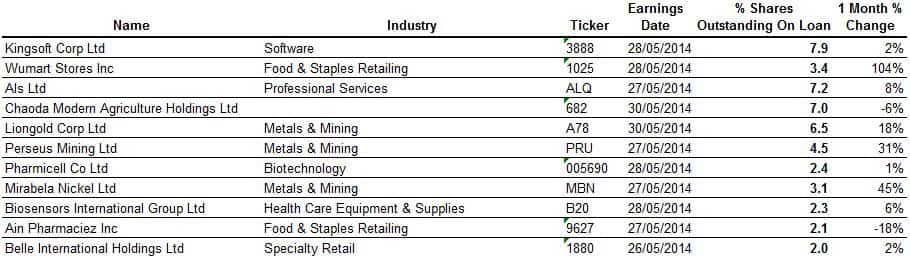

Asia

Asia sees 11 companies with short interest over 2% announcing earnings. This is led by Kingsoft Corp which has 8% of its shares on loan. This represents an annual high for the software company, a level that has held flat over the past month while the shares have tumbled from their annual high.

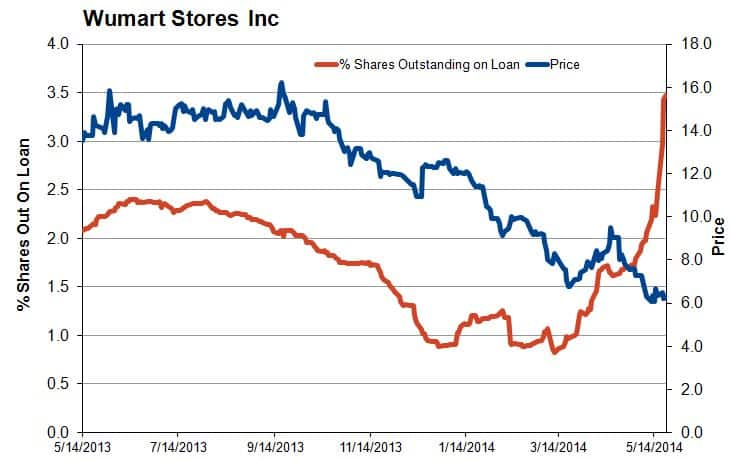

Demand to borrow Chinese retailer Wumart Stores has soared to an annual high of 3.4% as the share price has fallen to a record low. In December 2013, shares of Wumart dropped sharply when the proposed acquisition of the Thai based company CP Lotus fell through.