Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 20, 2014

Japan flash PMI signals ongoing expansion as exports help lift manufacturing sector

Japan's manufacturing sector continued its steady recovery in November.

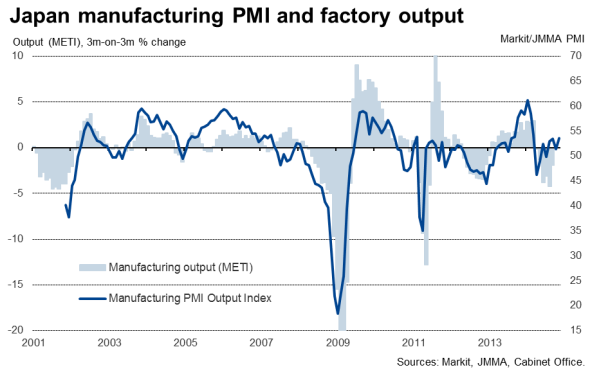

At 52.1 in November, down from 52.4 in October, the flash Markit/JMMA Japan Manufacturing PMI signalled a slight moderation in the rate of growth of business activity in the goods-producing sector.

However, the PMI remains above 50.0 to therefore signal an ongoing expansion of activity, with the average seen for the fourth quarter so far up to 52.3 compared to 51.5 in the third quarter. That puts the sector on course for its best performance since the first quarter, pointing to an ongoing recovery from the weakness seen in the second quarter, when activity was hit by the sales tax rise.

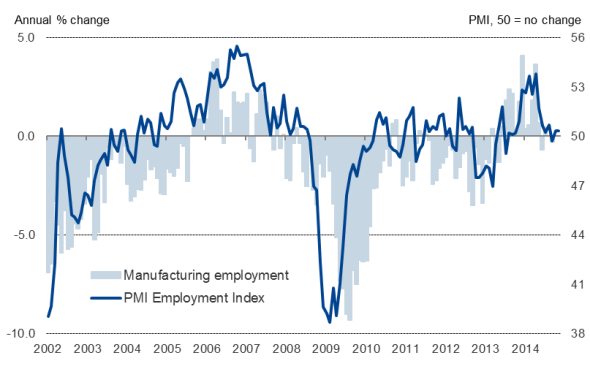

Manufacturing employment

Upturn fuelled by exports

The PMI is a weighted average of several survey variables, of which the Output Index was especially notable in registering the largest increase in factory production since March. New orders continued to rise, buoyed partly by a further increase in exports, although the rate of increase slowed compared to October.

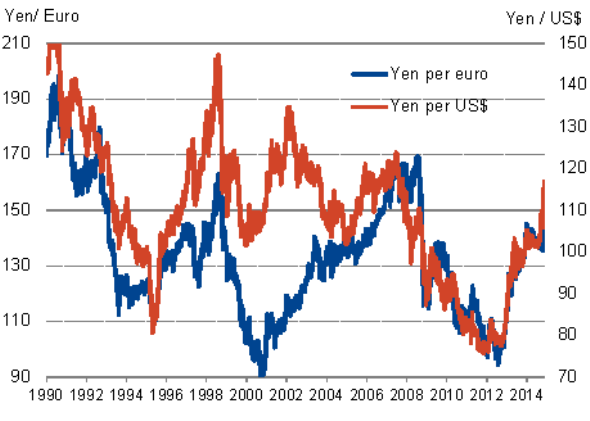

Export growth has in turn been helped by the yen's depreciation since Abenomics was introduced, with an especially marked depreciation in recent days following the central bank's announcement that its quantitative easing purchases will be raised from "60-70 trillion to "80 trillion per annum. The yen is trading against the US dollar at levels not seen since 2007, having slumped by around 15% since July.

Exports rose 9.6% on a year ago in October, according to official data, in line with the PMI signal. Although the PMI suggests some easing in this rate in November, the pace of export growth clearly remains strong and a key driver of the manufacturing economy.

Goods exports

Welcome news after recession

Even the modest growth signalled by the PMI comes as welcome news after official data showed the economy sliding back into recession. GDP fell 0.4% in the third quarter after a 1.9% decline in the second quarter.

The downturn has been blamed on consumption falling after the country's sales tax was hiked from 5% to 8% in April. Prime Minister Shinzo Abe followed the news with an announcement that the planned further hike in the sales tax next October will be delayed by 18 months, assuming the government's mandate is renewed at a snap election called next month.

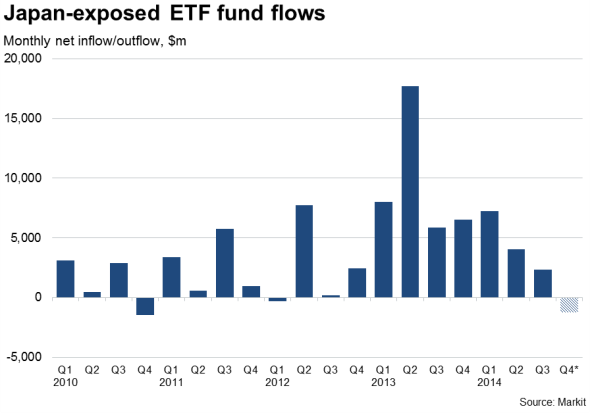

The election seeks to reassert public approval for the government policies and boost confidence among investors. Money has also been flowing out of exchange traded funds exposed to Japan in the fourth quarter to the greatest extent seen for four years.

Exchange rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-japan-flash-pmi-signals-ongoing-expansion-as-exports-help-lift-manufacturing-sector.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-japan-flash-pmi-signals-ongoing-expansion-as-exports-help-lift-manufacturing-sector.html&text=Japan+flash+PMI+signals+ongoing+expansion+as+exports+help+lift+manufacturing+sector","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-japan-flash-pmi-signals-ongoing-expansion-as-exports-help-lift-manufacturing-sector.html","enabled":true},{"name":"email","url":"?subject=Japan flash PMI signals ongoing expansion as exports help lift manufacturing sector&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-japan-flash-pmi-signals-ongoing-expansion-as-exports-help-lift-manufacturing-sector.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+PMI+signals+ongoing+expansion+as+exports+help+lift+manufacturing+sector http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f20112014-economics-japan-flash-pmi-signals-ongoing-expansion-as-exports-help-lift-manufacturing-sector.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}