Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 15, 2014

Vietnamese inflation eases to five-year low

Consumer prices in Vietnam rose by 3.6% in the year to September, the weakest rate of inflation seen in five years. The pace at which prices have increased has now slowed for three successive months. Weaker inflationary pressure has also been signalled by HSBC PMI" data for Vietnam, compiled by Markit.

Among the factors contributing to slower price rises have been falling fuel costs and an easing of the disruption to supply chains seen earlier in the year.

Back in June we noted that the enforcement of truck weight restrictions had led to lengthening delivery times and increased transportation costs as suppliers were forced to make more journeys than previously to deliver items. This was a feature of the PMI survey during the second quarter of 2014, but latest data suggest that the effects of this change of policy are beginning to wear off. Suppliers' delivery times were largely unchanged in September, with input cost inflation slowing to the weakest since June 2013.

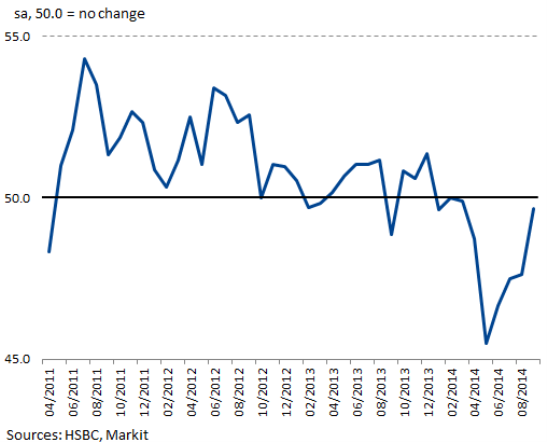

HSBC Vietnam Manufacturing PMI Suppliers' Delivery Times Index

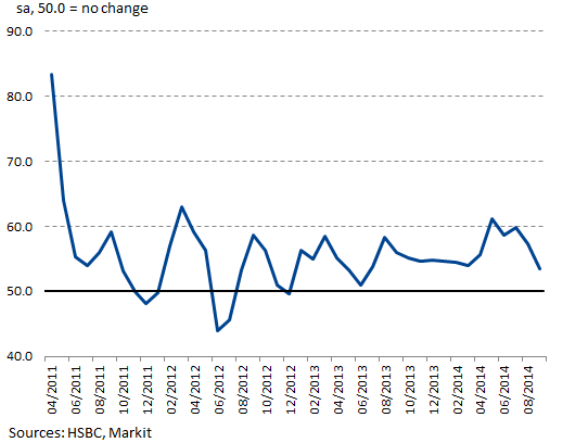

HSBC Vietnam Manufacturing PMI Input Prices

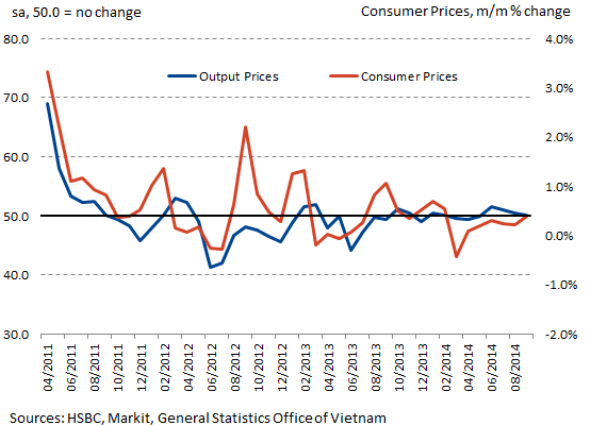

Weaker cost pressures enabled manufacturers to leave their output prices broadly unchanged in September. The rate of output price inflation has now eased for three successive months.

PMI Output Prices v Consumer Price Inflation

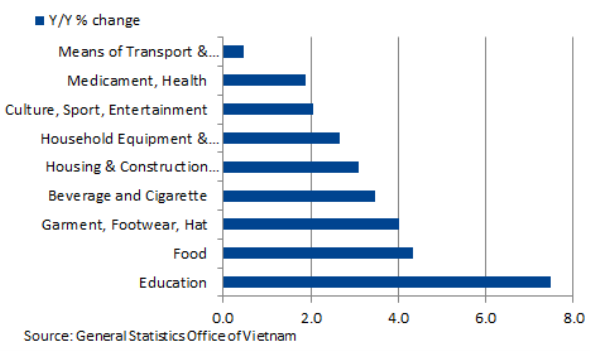

Lower fuel costs have contributed to weaker price pressures. The Vietnam National Petroleum Group (Petrolimex) recently lowered the price of diesel, attributing the reduction to falling prices in world markets. The Brent Crude oil price is currently trading at around a four-year low. Looking at the official inflation data in more detail shows that the 'Means of Transportation and Communication' sector saw just a 0.5% year-on-year rise in consumer prices in September, the slowest increase of the monitored sectors.

Vietnamese Consumer Prices by sector

Aside from prices, the PMI data for September signalled rebounds in both new orders and new export business at Vietnamese manufacturers following reductions in August. This helped lead to a twelfth successive monthly increase in production in the sector, although growth has eased from the solid pace seen earlier in the year.

The next PMI release (covering data for October) will be on 3 November.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-economics-vietnamese-inflation-eases-to-five-year-low.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-economics-vietnamese-inflation-eases-to-five-year-low.html&text=Vietnamese+inflation+eases+to+five-year+low","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-economics-vietnamese-inflation-eases-to-five-year-low.html","enabled":true},{"name":"email","url":"?subject=Vietnamese inflation eases to five-year low&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-economics-vietnamese-inflation-eases-to-five-year-low.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnamese+inflation+eases+to+five-year+low http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15102014-economics-vietnamese-inflation-eases-to-five-year-low.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}