Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 15, 2014

US economy set for strong growth despite surprise fall in factory output

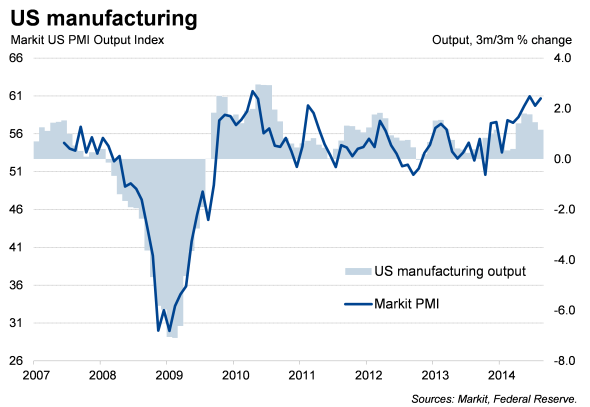

A drop in factory output in August looks to be merely a blip in a solid underlying trend. GDP in fact looks to be on course to rise strongly again in the third quarter (our model points to a 3.6% annualised rate of increase), which would heat up the discussions among policymakers about whether interest rates need to start rising earlier than currently foreseen.

Output falls in August

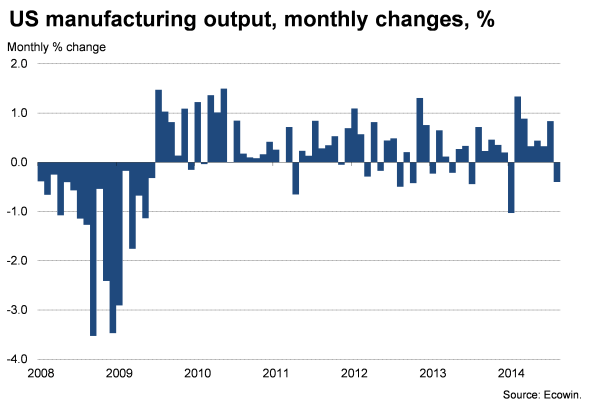

Factory output fell in August for the first time in seven months, according to official data compiled by the Federal Reserve.

Manufacturing production was 0.4% lower than in July, led down by a 7.6% drop in the autos sector. However, the data are extremely volatile and tell us little about the underlying trend. Factory output had jumped 0.7% in July with auto makers reporting a whopping 9.3% gain.

The wider measure of industrial production has shown some volatility as a result, rising 0.2% in July before falling 0.1% in August.

Positive third quarter so far

Despite the drop in August, industrial production is running 0.5% higher so far in the third quarter compared to the second quarter, while factory output is running 1.0% higher.

The data follow upbeat retail sales numbers last week. Sales rose 0.6% in August, the largest monthly gain since April, to put retail sales on course for a 1.0% rise in the third quarter.

These improving trends in sales and production add further evidence that the strength seen in the economy during the second quarter was more than just a

rebound from the weather-affected weak economic data seen earlier in the year.

Survey data are also sending positive signals for third quarter growth. Markit's PMI surveys of manufacturing and services point to GDP rising at an annualised rate of 4%, based on data available for July and August, which is broadly consistent with the signals coming from the official retail sales and factory output data. Separate data from the University of Michigan meanwhile showed consumer confidence rising in September to one of the highest levels seen since 2007. Altogether, the survey and official data available for the third quarter so far point to a 3.6% annualised rate of economic growth.

Policy focus on rate rise

If we can be persuaded to look though the volatility of the official data, it's evident that the US economy has continued to grow strongly in the third quarter. The slowing in non-farm payroll growth seen in August is therefore likely to prove temporary, putting the focus of policymaking firmly on whether the economy is resilient enough to withstand a hike in interest rates earlier than the current guidance of mid-2015.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-US-economy-set-for-strong-growth-despite-surprise-fall-in-factory-output-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-US-economy-set-for-strong-growth-despite-surprise-fall-in-factory-output-.html&text=US+economy+set+for+strong+growth+despite+surprise+fall+in+factory+output","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-US-economy-set-for-strong-growth-despite-surprise-fall-in-factory-output-.html","enabled":true},{"name":"email","url":"?subject=US economy set for strong growth despite surprise fall in factory output&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-US-economy-set-for-strong-growth-despite-surprise-fall-in-factory-output-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economy+set+for+strong+growth+despite+surprise+fall+in+factory+output http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f15092014-US-economy-set-for-strong-growth-despite-surprise-fall-in-factory-output-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}