Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 14, 2014

German economy suffers surprise contraction in second quarter

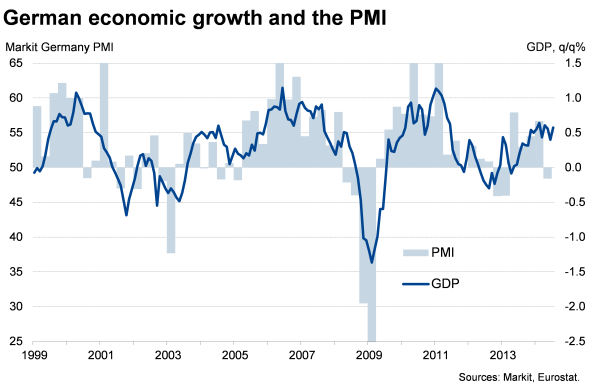

The German economy contracted in the second quarter of 2014, raising worries that the eurozone's largest member state could be facing a triple-dip recession. However, survey data suggest the economy is in better health than the official data imply and that economic growth should rebound in the third quarter as the recovery builds.

Economy contracts in second quarter

Gross domestic product fell 0.2% in the three months to June, representing a marked deterioration in economic performance compared to the 0.7% increase seen in the first quarter. The drop in GDP was the first since early last year. The statistics body Destatis attributed the decline to particular weakness of trade and capital formation (i.e. investment).

Data for recent years were also revised, in particular showing a deeper downturn in early 2013.

If sustained into the third quarter, the GDP data would point to Germany having slipped into its third recession since the financial crisis struck in 2008.

Mixed signals for third quarter, but current data point to rebound

However, PMI surveys suggest a low risk of the downturn being sustained into the second half of the year, although there are some worrying signs of manufacturing being hit by the escalation of the crisis in Ukraine.

The PMI usually provides an accurate indication of the underlying GDP growth trend, cutting through some of the volatility in the official data (see chart). Recently, the PMI accurately anticipated the robust 0.7% expansion of GDP in the first quarter of 2014, but continued to signal a similar robust pace of expansion

in the second quarter. The drop in GDP therefore comes as a surprise, but could be explained by the official data being distorted by seasonal influences.

In particular, it is likely that the second quarter GDP were affected by the data not accurately accounting for a lower than usual number of working days, as workers bridged public holidays that fell on a Thursday over to the weekend (note that one working day lost out of a quarterly total of 60 would represent a 1.7% cut to working hours, so it's easy to see how GDP could be greatly understated).

It is also encouraging to note that the PMI remained in robust growth territory in July, signalling a good start to the third quarter. The all-sector PMI Output Index picked up after sliding to an eight-month low in June, running at a level consistent with GDP growth of 0.7% (unchanged from the pace signalled by the PMI for the first two quarters of the year.

Ukraine crisis poses key risk

However, the July PMI survey also revealed some growing concerns among companies about the potential impact of the crisis in Ukraine. Worries centred on the possible rise in energy prices, sales sliding due to heightened risk aversion and the potential impact of sanctions.

Manufacturers appear most concerned, as reflected in a trimming of workforce numbers for a second successive month. In contrast, however, an upturn in hiring in the domestically-focused service sector implies that any concerns about the future remain focused on the external economy and trade, rather than domestic demand.

As yet, therefore, there are minimal signs of the Ukraine crisis hitting the real economy in Germany, although it is too early to tell for sure. August's flash PMI data, released on 21 August, should provide further important insights in this respect.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014german-economy-suffers-surprise-contraction-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014german-economy-suffers-surprise-contraction-in-second-quarter.html&text=German+economy+suffers+surprise+contraction+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014german-economy-suffers-surprise-contraction-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=German economy suffers surprise contraction in second quarter&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014german-economy-suffers-surprise-contraction-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+economy+suffers+surprise+contraction+in+second+quarter http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f14082014german-economy-suffers-surprise-contraction-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}