Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 12, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Retailers heavily represented among firms seeing high short interest leading up to earnings

- WireCard sees heavy covering as its shares recover from recent activist short campaign

- Hotel Shilla continues to see high short interest as it struggles with its duty free business

North America

Retailers are a main theme across the heavily shorted firms announcing results this week with eight firms seeing more than nine percent of their shares shorted in the run-up to earnings. While overall US retail spending has proved relatively buoyant in recent months, the hypercompetitive nature of the sector has seen several of the sector's stalwarts, most notably specialized retailers, come under increased pressure from short sellers as they struggle to address online competition and shifting consumer tastes.

This week's heavily shorted retailer pack is led by Hibbett Sports which has over a quarter of its shares shorted. Hibbett's and its bricks and mortars sporting goods peers have suffered from a fall in footfall as consumers and sports brands shift operations online. This has led to a slew of closing and bankruptcies in the sector with Sports Authority being the highest profile casualty. These bankruptcies do offer a bit of a silver lining however, as surviving firms stand to benefit from a narrowed field of competitors. These dynamics have seen shares in Hibbett rebound from their earlier lows but short sellers seem happy to ride the recent rebound as demand to short its shares has only gone down by a tenth from the recent yearly high.

The ever hypercompetitive clothing and fashion world also features heavily in the most shorted ahead of earnings and Stage Stores sees itself as the second most firm announcing earnings this week.

Other fashion players include American Eagle which has 14.4% of its shares shorted, Children's Place with 9% and perhaps most notably Gap which also has 9% of its shares shorted. The latter of the three already show a lacklustre sales guidance which revealed a 2% like for like sales decline which sent its shares down sharply.

Another key focus of this week's most shorted ahead of earnings are solar firms with three firms making the heavily shorted screen. Solar short sellers were vindicated last week when fellow solar firm Sunpower announced that business had weakened after an extension of solar subsidies reduced the urgency to complete solar projects which in turn sent its shares down by a third.

The solar shares to watch this week will by Jinkosolar, Canadian Solar and Trina Solar. Trina is the only one of the three to have seen covering in the lead-up to earnings as its current short interest stands a fifth lower than a month ago.

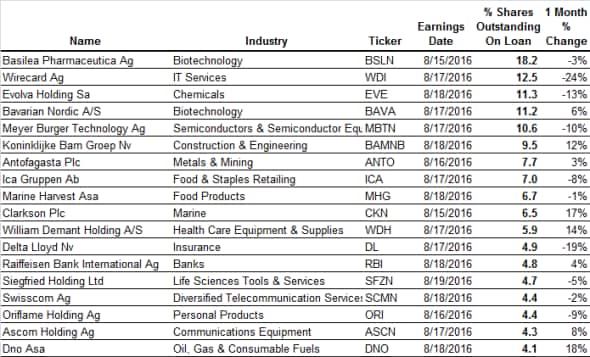

Europe

Bailea Pharmaceutica is the most shorted European company announcing earnings this week with 18.2% of its shares shorted.

The most notable change in shorting activity in the lead-up to earnings was seen in German payment processor Wirecard which has seen its short interest shrink by a quarter in the month leading up to earnings. Wirecard was the target of an activist short Zatarra Research which accused the firm of engaging fraudulent practices as well as money laundering. Short sellers initially benefited as Wirecard shares slid by a third, but they have since gone on to recover most of their lost ground which has seen a growing number of bearish investors capitulate as their once winning trade turned sour. The most recent bout of short covering means that the current 12.5% of Wirecard shares shorted is roughly half that of its recent yearly highs.

Antofagasta sees the most demand from short sellers out of any UK firms announcing earnings this week with 7.7% of its shares now out on loan. Copper, which is the miner's main commodity has not proved to be as resilient as other industrial metals since the start of the year as it has largely failed to recover from last year's 25% fall. This has in turn emboldened short sellers as Antofagasta short interest now stands at the highest in three years.

Another developing short position off the back of slowing global trade is shipping firm Clarkson. The firm announced that its 2016 profits would be "materially lower" due to uncertainty in freight rates and depressed offshore oil volumes. This has led to a surge in short interest with current demand to borrow now at an all-time high.

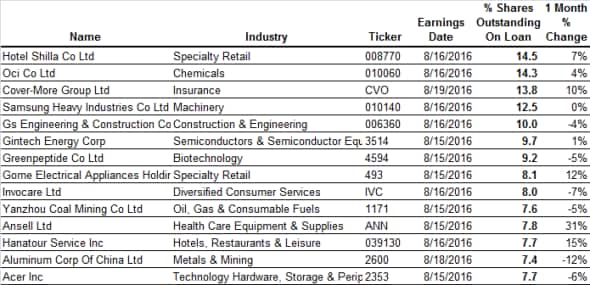

Apac

Short interest among Asian firms announcing earnings this week is led by Hotel Shilla which operates hotels and duty free outlets in South Korea. The latter of the two businesses seems to be the main catalyst for bearish investor sentiment as Hotell Shilla is facing stiff competition from a slew of upstarts as the Korean government opened up the sector. This competition has led to a shrinking of margins in the sector as the competitors battle for business which has led Shilla to issue its seventh straight quarterly earnings miss.

Hanatour, another duty free operator also makes the list as 8% of its shares are currently shorted.

Asian short sellers are also playing the solar trade as Gintech Energy has seen its short interest more than double in recent weeks to just under 10% of shares outstanding.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12082016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}