Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 11, 2014

Week Ahead Economic Overview

A vast amount of economic data are released during the week, including updates on inflation and the labour market in the UK and minutes from the latest Bank of England meeting. In the US, the Federal Reserve Bank announces their latest monetary policy decision, while industrial production and inflation data are also out. Meanwhile, data releases in the euro area include consumer price numbers and sentiment data.

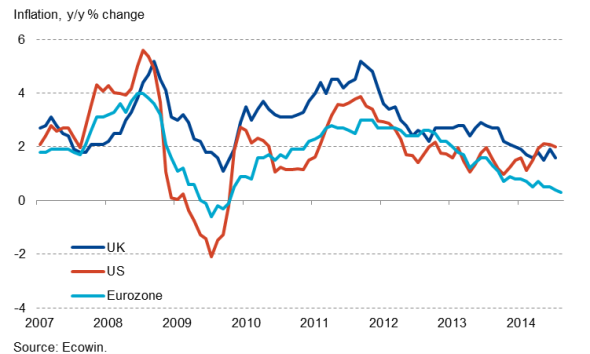

Inflation in Eurozone, UK and US

In the UK, markets will be dominated by the referendum on Scottish independence, but there are also some key economic releases. The Bank of England issues minutes from its September Monetary Policy Committee meeting while the ONS publishes latest inflation numbers. The Bank of England kept rates on hold at 0.5%, but the possibility of the Bank of England being the first major central bank to hike rates has increased after minutes from the previous meeting revealed two members had voted for a quarter point rate rise.

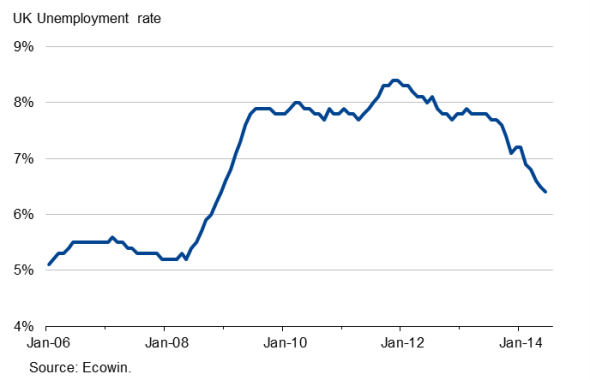

UK policymakers will also keep their eyes on the latest labour market update. Recent data have been confusing, with unemployment dropping but pay growth slowing. Survey data suggest that unemployment should continue to fall from the 6.4% rate recorded for the three months to June. A jobless rate below 6% is achievable by the end of the year if anything like the current pace of job creation is sustained in coming months. However, weak pay growth remains the Achilles Heel of the economic recovery and policymakers have made it clear they want to be sure that pay growth is picking up substantially from the current record low before making the first move in tightening policy.

UK unemployment rate

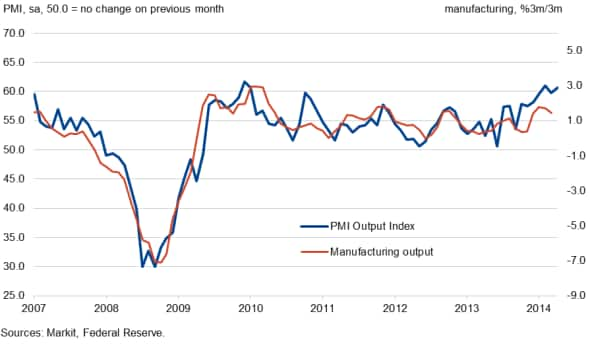

Industrial production numbers and inflation data are meanwhile released in the US. Analysts will be looking for confirmation that the underlying trend production remains healthy, after August's PMI results showed business conditions in the US goods-producing sector improving to the greatest extent in four years. The survey data bode well for another quarter of solid GDP growth after GDP rose at an annualised rate of 4.2% in the second quarter.

US manufacturing production and the PMI

Such economic strength adds to the case for the FOMC to start raising interest rates earlier than the current expectation of a first rate rise in the middle of next year. However, no change in monetary policy is the most likely outcome at Wednesday's Fed meeting.

Inflation numbers and sentiment data are the key highlights in the eurozone. A 'flash' estimate from Eurostat showed that consumer price inflation fell to 0.3% in August, the lowest in nearly five years, encouraging the European Central Bank to take further steps to bolster the faltering eurozone economic recovery. The ECB is especially concerned that inflation expectations in the euro area are turning down alongside the surprising weakness of the economy so far this year.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11092014-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}