Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 10, 2014

UK export downturn adds to growth worries

More signs of the UK's economic performance being hampered by weak growth in the eurozone and sterling's appreciation are provided by an accelerating downturn in exports.

Trade deficit narrows, but exports fall

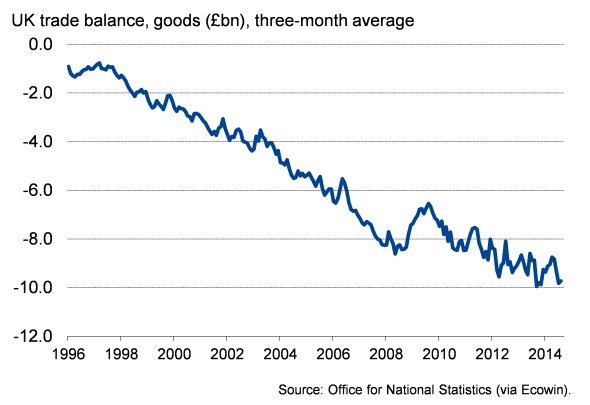

The UK's trade deficit in goods and services narrowed to "1.9 billion in August, down from "3.1 billion in July and its lowest since March. A deficit of "9.1 billion in goods (the lowest since April) was offset to a large extent by a "7.2 billion surplus in services.

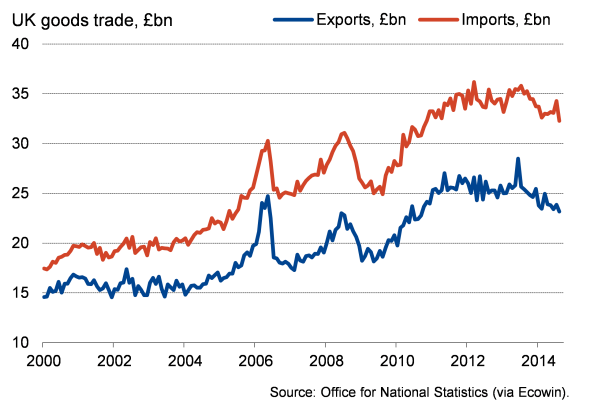

The goods deficit was "1.3 billion smaller than July, but this improvement was due to lower imports rather than any upturn in exports. Goods exports in fact fell "0.7 billion, or 2.8%, though excluding oil the fall was a more modest 0.4%.

The accelerating downturn in goods exports is a major concern, and one that is likely to encourage policymakers to hold off from raising interest rates. Goods exports were down 3.1% in the three months to August, or 2.3% if oil is excluded. These were the largest such declines seen since March. Goods exports are down some 8.8% on a year ago.

Growth slowdown

The weak export data follow news from the PMI surveys that manufacturing growth has slowed sharply in recent months, and is acting as an increasing drag on the economy in the second half of the year.

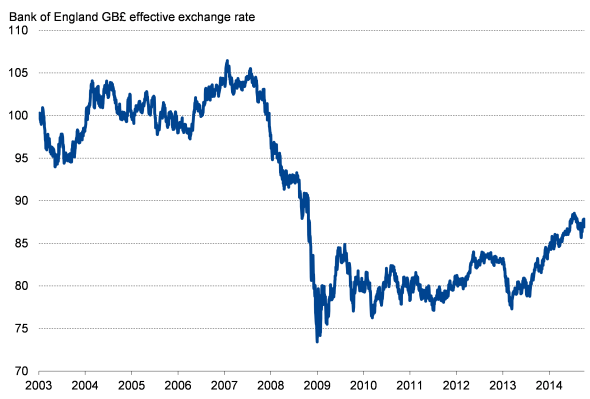

It's easy to see why exports are declining. Growth has slowed sharply in the eurozone, with even Germany facing the possibility of a renewed recession. Sanctions with Russia are clearly hurting European trade while domestic demand in many euro countries remains in the doldrums, reflecting weak business confidence and high unemployment. In addition, just as demand is slumping, sterling's appreciation is making UK goods less competitively priced overseas.

The PMI survey and British Chambers of Commerce survey both paint a less downbeat picture of the UK's export performance compared to the official data so far this year, but nevertheless even these surveys are now pointing down. The PMI survey's new export orders index fell to a 18-month low in September, having peaked back in January, while the BCC's measure fell sharply in the third quarter to its lowest since the fourth quarter of 2012.

Efforts by the European Central Bank to stimulate the eurozone economy will hopefully translate into faster growth in the region in coming months, which will benefit UK exporters. At the same time, strong growth in the US and signs of renewed life in China should help boost trade. However, with the UK facing the prospect of higher interest rates next year at the same time that the ECB will continue with ultra-loose policy, the sterling-euro exchange rate is likely to remain unfavourable to exporters and limit export growth.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-economics-uk-export-downturn-adds-to-growth-worries.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-economics-uk-export-downturn-adds-to-growth-worries.html&text=UK+export+downturn+adds+to+growth+worries","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-economics-uk-export-downturn-adds-to-growth-worries.html","enabled":true},{"name":"email","url":"?subject=UK export downturn adds to growth worries&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-economics-uk-export-downturn-adds-to-growth-worries.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+export+downturn+adds+to+growth+worries http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-economics-uk-export-downturn-adds-to-growth-worries.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}