UK output up in July but weakening trend evident

UK factory output rose for a second successive month in July, but the rate underlying rate of growth appears to have eased from the strong pace of expansion seen earlier in the year. The slowing may temper calls for higher rates to cool the economy, after two members of the Bank of England's Monetary Policy Committee voted to hike rates at the August meeting.

Production rises, but trend remains weak

Data from the Office for National Statistics showed industrial production rising 0.5% in July, which included a 0.3% increase in manufacturing output. The latter was in line with market expectations.

Factory production was 2.2% higher than a year ago but, although it has risen 7.9% from the trough seen during the recession, it remains 7.2% smaller than prior to the financial crisis, according to these data (though we note that revisions to be published by the ONS on 30 September may tell a very different story, with a strong possibility that the recovery has been stronger than previously stated).

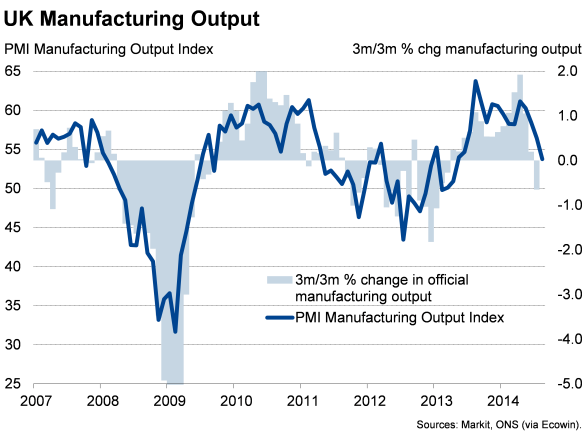

While the July upturn builds further on the rise in production seen in June, it only partially makes up for the steep drop recorded back in May. Production is consequently 0.1% lower in the latest three months compared to the prior three month period, while manufacturing is down 0.6%. On this basis, the underlying trend in factory output is the weakest since the start of 2013.

Trade deficit rises despite export gain

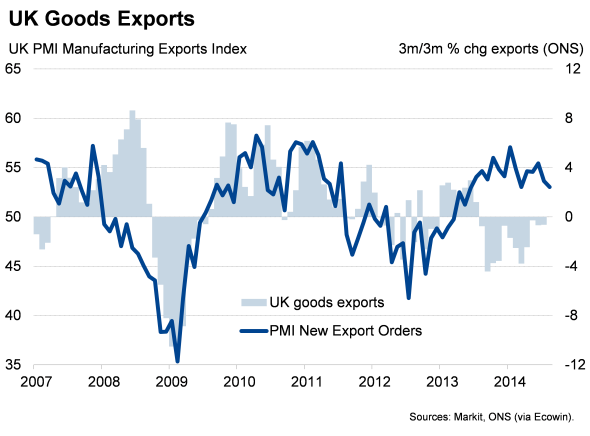

Other data from the ONS meanwhile showed the UK's deficit in trade in goods and services rising from "2.5 billion in June to "3.3 billion in July. The deficit in goods widened by "0.8 billion to "10.2 billion, its highest since April 2012 and one of the largest on record. Even excluding oil and erratics, the trade deficit hit a near record "8.5 billion.

However, there was some comfort in the detail of the trade data, with exports rising 2.1%, registering the first increase since March. Imports were up a larger 3.9%, however, hence the deterioration in the overall trade balance.

Geopolitical worries

The weaker official production data correspond with a similar picture from the business surveys, which suggest that factories have struggled over the summer compared to the strong growth enjoyed earlier in the year. The Markit/CIPS manufacturing PMI signalled a marked easing in the rate of growth of factory activity in August, suggesting jitters about the Ukraine had begun to hit trade flows and business confidence.

The survey data also showed export growth slowing to the weakest since April, contributing to the smallest monthly expansion of activity in the sector for just over a year (though we note that the survey data paint a remarkably more buoyant picture of the UK's trade performance over the past year than the official data - see chart).

Although the three PMI surveys collectively indicated that the economy is still on course to have grown by 0.8% again in third quarter, buoyed by faster growth in services and construction, the slowdown in manufacturing raises concerns that the wider economy may also weaken in coming months.

Policymakers will be keeping a keen eye on the health of the goods producing sector. Although only accounting for just over one-tenth of the economy, factory production is a still good barometer of the overall health of the wider economy. Any signs of sustained weakness will no doubt encourage policy to be kept on hold for longer, adding to the likelihood of the first rate rise being delayed until next year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com