Virtual real estate attracts short interest

After yet another damning report from Citron Research, we see continued high demand to borrow shares in Zillow, although the recent share spike looks to have discouraged some short sellers

- Demand to borrow Zillow shares stands at nearly 10% of shares outstanding

- Fellow real estate website operator Trulia also sees heavy demand to borrow

- UK investors seem more bullish about local site Rightmove, which sees little demand to borrow

After looking at possible disruption in the taxi and broadcasting markets, our latest research on the subject investigates property, and the firms looking to disrupt the established market for selling real estate in North America.

Zillow Bear Case

By far the most established player in that space is web portal Zillow, which aims to feature real estate agent listings in its popular estimation platform. While the company has become ubiquitous amongst homeowners looking for the daily changing “Zestimate”, its inability to penetrate wholesale listing markets in many key markets has made it the target of short selling research house Citron Research. Chief among the activist investors’ claims is Zillow’s management inability to gain traction with real estate agents who often operate their own web portals.

While Zillow has been able to reach the top spot of the real estate portal ladder, the US real estate market, which dislocates selling and buying agents and where inventory is listed on Multiple Listing Systems (MLS) is such that agents do not see sites like Zillow as one of their top routes to market. To this end, Citron cited a recent survey by a recent industry technology firm in which real estate agents ranked third party listing portals Zillow and Trulia as the sixth and seventh source of web leads behind Facebook. Established industry owned MLS driven sites were cited as the top source of lead generation by just under half of survey respondents. With such poor performance, one has to wonder what the prospects are of Zillow ever being able to capitalise on its large casual user base and live up to its $5.3bn market cap.

Zeroing in on Zillow

Faced with the inability to impact the industry in a meaningful way, Citron has urged short sellers on, especially given the fact that the company trades on a forward PE multiple of 228. While the firm is no stranger to short sellers, the Z’s recent 40% run over the last three months has seen short sellers halve their positions over the last three months. Despite the recent bout of covering, Zillow’s short interest is still very high with 10% of shares out on loan.

Trulia also targeted

Fellow real estate portal firms Trulia also sees itself targeted by short sellers with 15% of shares out on loan. Trulia’s elevated short interest comes as no surprise as it has failed to live up to earnings expectations in its last two quarterly results. Interestingly, short sellers have stayed the course in Trulia despite the fact that its shares have also surged over the last couple of months.

UK investors more receptive

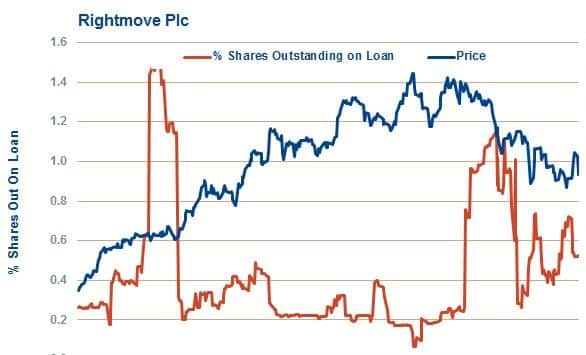

While the US market has proved tough for web disruption, the UK market looks more promising for web based third party platforms if short interest is anything to go by. UK based Rightmove sees less than one per cent of its shares out on loan currently, after having seen its short interest fall by two thirds over the last three years.